by Calculated Risk on 9/30/2021 08:34:00 AM

Thursday, September 30, 2021

Q2 GDP Growth Revised up to 6.7% Annual Rate

From the BEA: Gross Domestic Product, (Third Estimate), GDP by Industry, and Corporate Profits (Revised), 2nd Quarter 2021

Real gross domestic product (GDP) increased at an annual rate of 6.7 percent in the second quarter of 2021, according to the "third" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 6.3 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised up from 11.9% to 12.0%. Residential investment was revised down from -11.5% to -11.7%. This was at the consensus forecast.

The "third" estimate of GDP released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 6.6 percent. Upward revisions to personal consumption expenditures (PCE), exports, and private inventory investment were partly offset by an upward revision to imports, which are a subtraction in the calculation of GDP

emphasis added

Wednesday, September 29, 2021

Thursday: GDP, Unemployment Claims, Chicago PMI

by Calculated Risk on 9/29/2021 09:04:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 335 thousand initial claims, down from 351 thousand last week.

• Also at 8:30 AM, Gross Domestic Product, 2nd quarter 2021 (Third estimate). The consensus is that real GDP increased 6.7% annualized in Q2, revised up from the second estimate of 6.6%.

• At 9:45 AM, Chicago Purchasing Managers Index for September. The consensus is for a reading of 65.0, down from 66.8 in August.

September 29th COVID-19: 7-Day Average Cases Off 30% from Recent Peak

by Calculated Risk on 9/29/2021 06:31:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 55.9% | 54.9% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 185.5 | 182.4 | ≥2321 | |

| New Cases per Day3 | 110,232 | 131,736 | ≤5,0002 | |

| Hospitalized3 | 74,923 | 83,786 | ≤3,0002 | |

| Deaths per Day3 | 1,487 | 1,508 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 21 states have between 50% and 59.9% fully vaccinated: Colorado at 59.3%, California, Minnesota, Hawaii, Pennsylvania, Delaware, Florida, Wisconsin, Texas, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Arizona, Kansas, Nevada, Alaska, Utah and Ohio at 50.2%.

Next up (total population, fully vaccinated according to CDC) are North Carolina 49.7%, Montana at 48.4%, and Indiana at 48.3% .

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Real House Prices, Price-to-Rent Ratio and Price-to-Median Income in July

by Calculated Risk on 9/29/2021 12:19:00 PM

Today, in the Newsletter: Real House Prices, Price-to-Rent Ratio and Price-to-Median Income in July

Excerpt:

This graph uses the year end Case-Shiller house price index - and the nominal median household income through 2020 (from the Census Bureau). 2021 median income is estimated at a 5% annual gain.

By all of the above measures, house prices appear elevated.

NAR: Pending Home Sales Increased 8.1% in August

by Calculated Risk on 9/29/2021 10:03:00 AM

From the NAR: Pending Home Sales Recover 8.1% in August

Pending home sales rebounded in August, recording significant gains after two prior months of declines, according to the National Association of Realtors®. Each of the four major U.S. regions mounted month-over-month growth in contract activity. However, those same territories reported decreases in transactions year-over-year, with the Northeast being hit hardest, enduring a double-digit drop.This was well above expectations of a 1.3% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in September and October.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, increased 8.1% to 119.5 in August. Year-over-year, signings dipped 8.3%. An index of 100 is equal to the level of contract activity in 2001.

...

Month-over-month, the Northeast PHSI rose 4.6% to 96.2 in August, a 15.8% drop from a year ago. In the Midwest, the index climbed 10.4% to 115.4 last month, down 5.9% from August 2020.

Pending home sales transactions in the South increased 8.6% to an index of 141.8 in August, down 6.3% from August 2020. The index in the West grew 7.2% in August to 107.0, however still down 9.2% from a year prior.

emphasis added

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 9/29/2021 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 24, 2021.

... The Refinance Index decreased 1 percent from the previous week and was 0.4 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 12 percent lower than the same week one year ago.

“Increased optimism about the strength of the economy pushed Treasury yields higher following last week’s FOMC meeting. Mortgage rates in response rose across all loan types, with the benchmark 30- year fixed rate reaching its highest level since early July 2021,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The increase in rates – mostly later in the week – led to a decrease in both purchase and refinance applications, with a prominent decline in government loan applications. Conventional loan applications increased, driven by a rise in conventional refinances. This was perhaps a sign that some borrowers reacted to higher rates and decided to refinance.”

Added Kan, “With home-price appreciation continuing to run hot, increasing more than 19 percent annually in July, applications for larger loan amounts continue to outpace lower-balance loans. The average loan size for a purchase application reached $410,000, its highest level since May 2021.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) increased to 3.10 percent from 3.03 percent, with points increasing to 0.34 from 0.30 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With low rates, the index remains elevated.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 12% year-over-year unadjusted.

According to the MBA, purchase activity is down 12% year-over-year unadjusted.Note: The year ago comparisons for the unadjusted purchase index are now difficult since purchase activity picked up in late May 2020.

Note: Red is a four-week average (blue is weekly).

Tuesday, September 28, 2021

September 28th COVID-19

by Calculated Risk on 9/28/2021 09:27:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 55.8% | 54.8% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 185.3 | 182.0 | ≥2321 | |

| New Cases per Day3 | 95,228 | 134,500 | ≤5,0002 | |

| Hospitalized3 | 76,251 | 84,925 | ≤3,0002 | |

| Deaths per Day3 | 1,332 | 1,508 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 21 states have between 50% and 59.9% fully vaccinated: Colorado at 59.2%, California, Minnesota, Hawaii, Pennsylvania, Delaware, Florida, Wisconsin, Texas, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Arizona, Kansas, Nevada, Alaska, Utah and Ohio at 50.1%.

Next up (total population, fully vaccinated according to CDC) are North Carolina 49.6%, Indiana at 48.3% and Montana at 48.3%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Wednesday: Pending Home Sales, Fed Chair Powell

by Calculated Risk on 9/28/2021 09:00:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Pending Home Sales Index for August. The consensus is 1.3% increase in the index.

• At 11:45 AM, Discussion, Fed Chair Powell, Policy Panel Discussion, At the European Central Bank Forum on Central Banking

Zillow Case-Shiller House Price Forecast: National Index Growth to Increase Slightly to 20.0% in August

by Calculated Risk on 9/28/2021 07:57:00 PM

The Case-Shiller house price indexes for July were released this morning. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: July 2021 Case-Shiller Results & Forecast: Scorching Hot

The slow rise in inventory that marked the beginning of summer wasn’t enough to cool the sizzling market, with the already rapidly rising Case-Shiller indices hitting the gas accelerating into the middle of the year instead of tapping the brakes.

...

Home price growth remained scorching hot as the housing market entered the dog days of summer, but data released in the weeks since indicate cooler days in the months to come. With mortgage rates still near historic lows, competition for the relatively few for-sale homes remain very stiff and home prices continue to rise sharply as a result. But the tight market conditions that have fueled the skyrocketing prices are finally showing signs of loosening. For-sale inventory levels charted their fourth consecutive monthly increase in August, and sellers appear to be taking a less aggressive approach when putting their homes on the market. Annual growth in list prices peaked in the spring and price cuts are becoming more common. And while still-strong price growth continues to present challenging conditions for many would-be buyers, the softening market conditions do appear to be offering some home shoppers a reprieve. Home sales volumes improved in August and applications for home purchase mortgages – a leading indicator of sales activity – has risen in four of the last five week to reach its highest level since April. Price growth remains about as hot as ever, but the housing market is gradually retreating towards a more balanced state.

Monthly and annual growth in August as reported by Case-Shiller is expected to accelerate from July in all three main indices. S&P Dow Jones Indices is expected to release data for the June S&P CoreLogic Case-Shiller Indices on Tuesday, October 26.

emphasis added

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 20.0% in August, from 19.7% in July.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 20.0% in August, from 19.7% in July.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 9/28/2021 04:18:00 PM

A few key points:

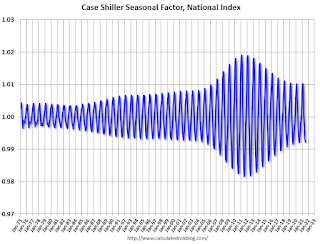

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now closer to normal (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Jed Kolko's article from 2014 (currently Chief Economist at Indeed) "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through July 2021). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings declined following the bubble, however the recent price surge changed the month-over-month pattern.

The swings in the seasonal factors have decreased, and the seasonal factors has been moving back towards more normal levels.