by Calculated Risk on 7/30/2021 04:10:00 PM

Friday, July 30, 2021

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in June

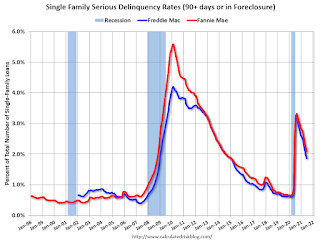

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 2.08% in June, from 2.24% in May. The serious delinquency rate is down from 2.65% in June 2020.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble, and peaked at 3.32% in August 2020 during the pandemic.

By vintage, for loans made in 2004 or earlier (1% of portfolio), 5.04% are seriously delinquent (down from 5.27% in May). For loans made in 2005 through 2008 (2% of portfolio), 8.75% are seriously delinquent (down from 9.09%), For recent loans, originated in 2009 through 2021 (97% of portfolio), 1.69% are seriously delinquent (down from 1.82%). So Fannie is still working through a few poor performing loans from the bubble years.

Mortgages in forbearance are counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once they are employed.

Note: Freddie Mac reported earlier.

July 30th COVID-19, New Cases, Hospitalizations, Vaccinations

by Calculated Risk on 7/30/2021 03:36:00 PM

According to the CDC, on Vaccinations.

Total doses administered: 344,928,514, as of a week ago 340,363,922. Average doses last week: 0.65 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 69.6% | 69.4% | 68.7% | ≥70.0%1,2 |

| Fully Vaccinated✅ (millions) | 164.2 | 163.9 | 162.4 | ≥1601 |

| New Cases per Day3🚩 | 67,080 | 65,476 | 46,828 | ≤5,0002 |

| Hospitalized3🚩 | 32,876 | 31,245 | 22,602 | ≤3,0002 |

| Deaths per Day3🚩 | 275 | 277 | 248 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met (even if late). | ||||

KUDOS to the residents of the 20 states and D.C. that have achieved the 70% goal (percent over 18 with at least one dose): Vermont, Hawaii, Massachusetts and Connecticut are at 80%+, and Maine, New Mexico, New Jersey, Rhode Island, Pennsylvania, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Oregon, Colorado and D.C. are all over 70%.

Next up are Florida at 68.5%, Utah at 67.7%, Wisconsin at 67.2%, Nebraska at 67.2%, South Dakota at 66.2%, Kansas at 66.2%, Iowa at 65.6%, and Nevada at 65.4%.

Click on graph for larger image.

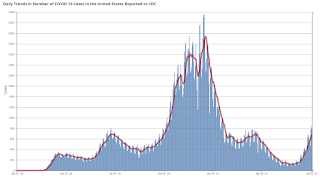

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Initial Q3 GDP Forecasts: 6% to 9% Range

by Calculated Risk on 7/30/2021 01:28:00 PM

From BofA:

We maintain our 2H forecast but adjust the composition, taking up inventories but taking down consumption (reflecting virus headwinds) and residential investment. (7.0% in Q3 qoq ar and 6.0% in Q4) [July 30 estimate]From Goldman Sachs:

emphasis added

Following today’s data and yesterday’s GDP report, we are launching our Q3 GDP tracking estimate at +9.0% (qoq ar), 0.5pp above our previous forecast, and are also boosting our Q4 forecast by 0.5pp to +5.5%. [July 30 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 4.2% for 2021:Q3. [July 30 estimate]And from the Altanta Fed: GDPNow

The initial GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2021 is 6.1 percent on July 30. [July 30 estimate]

Q2 2021 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 7/30/2021 11:41:00 AM

The BEA released the underlying details for the Q2 advance GDP report today.

The BEA reported that investment in non-residential structures decreased at a 7.0% annual pace in Q2. Note that weakness in non-residential structures started in 2019, before the pandemic.

Investment in petroleum and natural gas structures increased sharply in Q2 compared to Q1, and was up 46% year-over-year. However, investment in petroleum and natural gas structures is still down over 60% from the peak in 2014.

The first graph shows investment in offices, malls and lodging as a percent of GDP.

Investment in offices (blue) decreased in Q2, and was down 9.0% year-over-year.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was down about 19% year-over-year in Q2 - and at a record low as a percent of GDP. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment increased slightly in Q2 compared to Q1, but lodging investment was down 19% year-over-year.

The second graph is for Residential investment components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).

The second graph is for Residential investment components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).Even though investment in single family structures has increased from the bottom, single family investment is just approaching normal levels as a percent of GDP.

Investment in single family structures was $405 billion (SAAR) (about 1.8% of GDP), and up 45% year-over-year.

Investment in multi-family structures increased in Q2.

Investment in home improvement was at a $331 billion Seasonally Adjusted Annual Rate (SAAR) in Q2 (about 1.5% of GDP). Home improvement spending has been strong during the pandemic.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Increased Slightly

by Calculated Risk on 7/30/2021 10:07:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of July 27th.

From Andy Walden at Black Knight: Forbearances See Weekly Rise

After the last couple of weeks of volumes remaining flat, we did see some movement in the number of active forbearance plans this past week. According to our McDash Flash daily Forbearance Tracker data, the total number of active plans is up by 31,000 since last Tuesday.

Such upward movement late in the month has been relatively common in the recovery to date. Plan removals are clustered early in the month, which tends to lead to some degree of restart activity as the month progresses.

Despite this increase, there are still 163,000 (-7.9%) fewer plans than at the same time last month. As of July 27, 1.9 million borrowers remain in COVID-19 forbearance plans, making up 3.6% of all active mortgages and 2.0% of GSE, 6.3% of FHA/VA and 4.4% of Portfolio/PLS loans.

Click on graph for larger image.

Forbearances rose most significantly among loans held in bank portfolios or private label securities – which were up 35,000 for the week – with FHA/VA mortgages seeing a slight uptick in plans as well (+1,000). The 5,000-plan decline among GSE loans offset just a small share of the total weekly rise.

There are still some 179,000 plans are still scheduled to be reviewed for extension/removal in July, which provides some substantial opportunity for improvement next week.

While still low, new forbearance plan starts hit their highest weekly level since late March, with restart activity also remaining elevated. Roughly 2/3 of all starts over the past week were restarts. Removal volumes were the lowest since late May given the low volume of review activity at this time of month.

emphasis added

Personal Income increased 0.1% in June, Spending increased 1.0%

by Calculated Risk on 7/30/2021 08:37:00 AM

The BEA released the Personal Income and Outlays, June 2021 and Annual Update report:

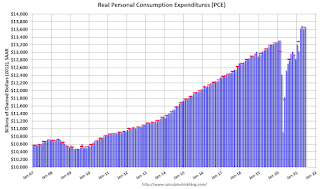

Personal income increased $26.1 billion (0.1 percent) in June according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) decreased $2.6 billion (less than 0.1 percent) and personal consumption expenditures (PCE) increased $155.4 billion (1.0 percent).The June PCE price index increased 4.0 percent year-over-year and the June PCE price index, excluding food and energy, increased 3.5 percent year-over-year.

Real DPI decreased 0.5 percent in June and Real PCE increased 0.5 percent; goods decreased 0.2 percent and services increased 0.8 percent. The PCE price index increased 0.5 percent. Excluding food and energy, the PCE price index increased 0.4 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through June 2021 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income and personal spending were above expectations, and the increase in PCE was slightly below expectations.

Thursday, July 29, 2021

Friday: Personal Income and Outlays

by Calculated Risk on 7/29/2021 09:00:00 PM

Friday:

• At 8:30 AM ET,: Personal Income and Outlays, June 2020. The consensus is for a 0.3% decrease in personal income, and for a 0.7% increase in personal spending. And for the Core PCE price index to increase 0.6%.

• At 9:45 AM, Chicago Purchasing Managers Index for July.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for July). The consensus is for a reading of 80.8.

July 29th COVID-19, New Cases, Hospitalizations, Vaccinations

by Calculated Risk on 7/29/2021 03:49:00 PM

According to the CDC, on Vaccinations.

Total doses administered: 344,071,595, as of a week ago 339,763,765. Average doses last week: 0.62 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 69.4% | 69.3% | 68.6% | ≥70.0%1,2 |

| Fully Vaccinated✅ (millions) | 163.9 | 163.6 | 162.2 | ≥1601 |

| New Cases per Day3🚩 | 66,606 | 62,231 | 40,596 | ≤5,0002 |

| Hospitalized3🚩 | 31,148 | 29,541 | 21,464 | ≤3,0002 |

| Deaths per Day3🚩 | 296 | 296 | 222 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met (even if late). | ||||

KUDOS to the residents of the 20 states and D.C. that have achieved the 70% goal (percent over 18 with at least one dose): Vermont, Hawaii, Massachusetts and Connecticut are at 80%+, and Maine, New Mexico, New Jersey, Rhode Island, Pennsylvania, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Oregon, Colorado and D.C. are all over 70%.

Next up are Florida at 68.2%, Utah at 67.7%, Wisconsin at 67.1%, Nebraska at 67.1%, South Dakota at 66.1%, Kansas at 66.0%, Iowa at 65.5%, and Nevada at 65.2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Las Vegas Visitor Authority for June: Convention Attendance N/A, Visitor Traffic Down 18% Compared to 2019

by Calculated Risk on 7/29/2021 02:44:00 PM

From the Las Vegas Visitor Authority: June 2021 Las Vegas Visitor Statistics

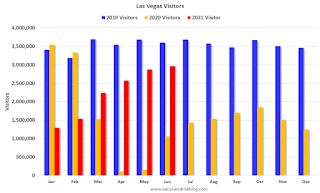

Marking the sixth consecutive month of MoM gains, June saw the destination host more than 2.9 million visitors, +3.2% MoM and down ‐17.6% vs. June 2019.

While convention and group data continue to be gathered, the return of several conventions including World of Concrete, Surfaces, Nightclub & Bar and the Int'l Esthetics, Cosmetics & Spa Conference helped support midweek business.

Hotel occupancy continued to improve, reaching 75.9% (up 5.0 pts MoM, down ‐15.8 pts vs. June 2019), as Weekend occupancy neared 90% (89.4%) and Midweek occupancy reached 70.9% (up 8.1 pts MoM, down ‐18.8 pts vs. June 2019.)

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (blue), 2020 (orange) and 2021 (red).

Visitor traffic was down 17.6% compared to the same month in 2019.

Note: Conventions started again in June, but the data isn't available yet.

Hotels: Occupancy Rate Down 8% Compared to Same Week in 2019

by Calculated Risk on 7/29/2021 11:44:00 AM

Note: The year-over-year occupancy comparisons are easy, since occupancy declined sharply at the onset of the pandemic. So STR is comparing to the same week in 2019.

The occupancy rate is down 7.8% compared to the same week in 2019.

U.S. weekly hotel occupancy reached its highest level since October 2019, while room rates hit an all-time high, according to STR‘s latest data through July 24.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

July 18-24, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 71.4% (-7.8%)

• Average daily rate (ADR): $141.75 (+4.0%)

• Revenue per available room (RevPAR): $101.24 (-4.2%)

Historically, the middle weeks of July are the country’s highest occupancy weeks each year, and 2021 has been no different even as demand slows week to week.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Note: Y-axis doesn't start at zero to better show the seasonal change.