by Calculated Risk on 7/14/2021 10:12:00 AM

Wednesday, July 14, 2021

First Look at 2022 Cost-Of-Living Adjustments and Maximum Contribution Base

The BLS reported yesterday morning:

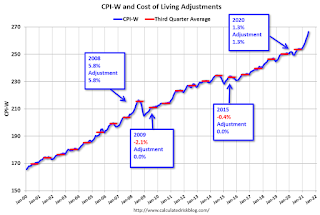

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 6.1 percent over the last 12 months to an index level of 266.412 (1982-84=100). For the month, the index rose 1.1 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

• In 2020, the Q3 average of CPI-W was 253.412.

The 2020 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 6.1% year-over-year in June, and although this is very early - we need the data for July, August and September - my current guess is COLA will probably be around 5.5% this year, the largest increase since 5.8% in 2008 - and it is possible this will be the largest increase since 1982 (7.4%).

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2020 yet, but wages probably increased again in 2020. If wages increased the same as in 2019, then the contribution base next year will increase to around $148,200 in 2022, from the current $142,800.

Remember - this is an early look. What matters is average CPI-W, NSA, for all three months in Q3 (July, August and September).

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 7/14/2021 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 16.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 9, 2021. This week’s results include an adjustment for the Fourth of July holiday.

... The Refinance Index increased 20 percent from the previous week and was 29 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 8 percent from one week earlier. The unadjusted Purchase Index decreased 13 percent compared with the previous week and was 29 percent lower than the same week one year ago.

“Overall applications climbed last week, driven heavily by increased refinancing as rates dipped again. Treasury yields have trended lower over the past month as investors remained concerned about the COVID-19 variant and slowing economic growth,” said Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting. “Mortgage rates fell for the second consecutive week as a result, with the 30-year fixed rate hitting 3.09 percent, its lowest level since February 2021. Refinance applications increased over 20 percent last week after adjusting for the July 4th holiday, aided by a 23 percent increase in conventional refinance applications. Also, there may have been a delayed spillover of applications from the previous week, when rates also decreased but there was not much of response in terms of refinance applications.”

Added Kan: “Purchase applications increased last week, but average loan sizes decreased to their lowest level since January 2021. We continue to see ebbs and flows as housing demand remains strong but for-sale inventory remains low. However, lower rates may be helping some home buyers close on their purchases, especially first-time home buyers. The year-over-year comparisons were down significantly for both purchase and refinance applications, as they were relative to a non-holiday week in 2020.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) decreased to 3.09 percent from 3.15 percent, with points decreasing to 0.37 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With low rates, the index remains elevated, and increased last week as rates declined.

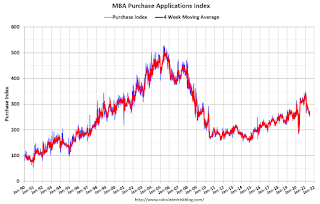

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 29% year-over-year unadjusted.

According to the MBA, purchase activity is down 29% year-over-year unadjusted.Note: The year ago comparisons for the unadjusted purchase index are now difficult since purchase activity picked up in late May 2020.

Note: Red is a four-week average (blue is weekly).

Tuesday, July 13, 2021

Wednesday: PPI, Fed Chair Powell Testimony, Beige Book

by Calculated Risk on 7/13/2021 09:00:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Producer Price Index for June from the BLS. The consensus is for a 0.5% increase in PPI, and a 0.5% increase in core PPI.

• At 12:00 PM, Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the U.S. House Committee on Financial Services

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

A Few Excerpts from a Local Commercial Real Estate Report: "Good news is construction activity has all but stopped"

by Calculated Risk on 7/13/2021 04:54:00 PM

Voit Real Estate Services released their Q2 reports on Commercial Real Estate (CRE) in SoCal. Here are a few excerpts from the Orange County Office report:

"The Orange County office market struggled again in 2Q. It had already been slowing before the pandemic hit, and by virtue of the higher employee density and multi-tenant configuration of office product, the office sector was hit harder by COVID than other sectors. Vacancy and availability both moved higher, and net absorption remained in negative territory. Average asking lease rates were relatively flat, but they alone do not tell the full story, as landlord concessions have risen sharply and are not reflected in market metrics. Office tenants are still trying to sort out how to fold their workforces back into the office, and that has delayed decision-making regarding relocations and renewals.

...

The vacancy rate in Orange County rose to 13.76%, up 61 basis points in 2Q. That came on top of a 116-basis-point spike in 1Q. The increase was expected given how many moves have been put on hold to re-evaluate space utilization. Class A product is under the most stress. Vacancy in those buildings rose to 18.28% in 2Q, compared with 10.96% for Class B and just 8.75% for Class C.

...

Fewer relocations and an increase in short-term renewals significantly impacted net absorption in 1Q, and the same held true in 2Q. Net absorption was in negative territory again in 2Q, posting a net loss of 512,502 SF, after recording a loss of more than 1.2 MSF in the opening quarter. Consistent negative absorption points to a future increase in vacancy.

...

The good news is that construction activity has all but stopped for the moment, which gives the market a chance to reabsorb existing unoccupied space and clear off some of the lower-priced sublease space. Just 439,206 SF of office space was in the construction queue as 2Q ended, all of it in one project in Costa Mesa, The Press. Another 1.7 MSF of space is in the planning stage but is not expected to get underway until market conditions improve."

emphasis added

July 13th COVID-19, New Cases, Hospitalizations, Vaccinations

by Calculated Risk on 7/13/2021 03:38:00 PM

According to the CDC, on Vaccinations.

Total doses administered: 334,942,236, as of a week ago 331,214,347. Average doses last week: 0.53 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 67.7% | 67.7% | 67.1% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 159.7 | 159.5 | 157.6 | ≥1601 |

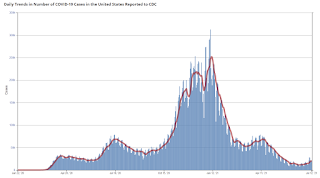

| New Cases per Day3🚩 | 21,420 | 20,100 | 14,981 | ≤5,0002 |

| Hospitalized3🚩 | 14,308 | 12,831 | 11,418 | ≤3,0002 |

| Deaths per Day3🚩 | 194 | 176 | 163 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths | ||||

KUDOS to the residents of the 20 states and D.C. that have already achieved the 70% goal (percent over 18 with at least one dose): Vermont, Hawaii, Massachusetts and Connecticut are at 80%+, and Maine, New Mexico, New Jersey, Rhode Island, Pennsylvania, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Oregon, Colorado and D.C. are all over 70%.

Next up are Wisconsin at 66.1%, Florida at 65.9%, Nebraska at 65.9%, Utah at 65.2%, South Dakota at 64.8%, and Iowa at 64.4%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.

Minnesota Real Estate in June: Sales Up 13% YoY, Inventory Down 41% YoY

by Calculated Risk on 7/13/2021 01:49:00 PM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

From the Minnesota Realtors®:

Total Residential Units Sold in June 2021 were 10,386, up 12.9% from 9,203 in June 2020.

Active Residential Listings in June 2021 were 10,227, down 40.8% from 17,285 in June 2020.

Months of Supply was 1.2 Months in June 2021, compared to 2.4 Months in June 2020.

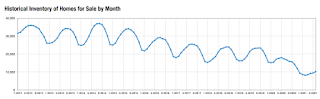

This graph from the Minnesota Realtors® shows inventory in Minnesota since 2012. Inventory had been trending down, and then was somewhat flat for a few years, and then declined significantly during the pandemic.

Active inventory was up 14.2% from the previous month, and up 24.6% seasonally from the all time low in February 2021. Usually, at this time of the year, we'd expect active inventory of around 23,000 in Minnesota, so current inventory is still extremely low.

Colorado Real Estate in June: Sales Up 9% YoY, Inventory Down 59% YoY

by Calculated Risk on 7/13/2021 01:01:00 PM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

From the Colorado Association of REALTORS® for the entire state:

Closed sales for Single Family and Townhouse-Condo in June 2021 were 13,014, up 8.9% from 11,952 in June 2020.

Active Listings for Single Family and Townhouse-Condo in June 2021 were 9,191, down 58.7% from 22,230 in June 2020.

Inventory in June was up 7.7% from last month.

Months of Supply was 0.8 Months in June 2021, compared to 2.4 Months in June 2020.

Cleveland Fed: Key Measures Show Inflation Increased in June

by Calculated Risk on 7/13/2021 11:08:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

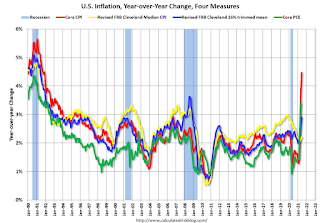

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% June. The 16% trimmed-mean Consumer Price Index rose 0.5% in June. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details for June here. Used cars and trucks were up 231% annualized.

This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 2.9%, and the CPI less food and energy rose 4.5%. Core PCE is for May and increased 3.4% year-over-year.

Second Home Market: South Lake Tahoe in June

by Calculated Risk on 7/13/2021 10:12:00 AM

Four months ago, from Jann Swanson at MortgageNewsDaily: Fannie Warns Lenders on Investment Properties and 2nd Homes.

I'm looking at data for some second home markets - and will track those markets to see if there is an impact from the lending changes.

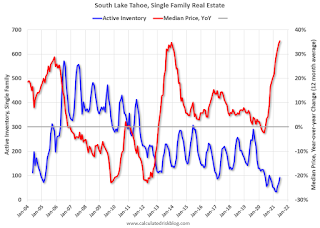

This graph is for South Lake Tahoe since 2004 through June 2021, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12 month average).

Note: The median price is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Note that inventory was high while prices were declining - and significantly lower inventory in 2012 suggested the bust was over. (Tracking inventory helped me call the bottom for housing way back in February 2012, see:The Housing Bottom is Here)

Currently inventory is still very low, but solidly above the record low set three months ago, and prices are up sharply YoY. This will be interesting to watch.

BLS: CPI increased 0.9% in June, Core CPI increased 0.9%

by Calculated Risk on 7/13/2021 08:31:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.9 percent in June on a seasonally adjusted basis after rising 0.6 percent in May, the U.S. Bureau of Labor Statistics reported today. This was the largest 1-month change since June 2008 when the index rose 1.0 percent. Over the last 12 months, the all items index increased 5.4 percent before seasonal adjustment; this was the largest 12-month increase since a 5.4-percent increase for the period ending August 2008.CPI and core CPI were well above expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The index for used cars and trucks continued to rise sharply, increasing 10.5 percent in June. This increase accounted for more than one-third of the seasonally adjusted all items increase. The food index increased 0.8 percent in June, a larger increase than the 0.4-percent increase reported for May. The energy index increased 1.5 percent in June, with the gasoline index rising 2.5 percent over the month.

The index for all items less food and energy rose 0.9 percent in June after increasing 0.7 percent in May. Many of the same indexes continued to increase, including used cars and trucks, new vehicles, airline fares, and apparel. The index for medical care and the index for household furnishings and operations were among the few major component indexes which decreased in June.

The all items index rose 5.4 percent for the 12 months ending June; it has been trending up every month since January, when the 12-month change was 1.4 percent. The index for all items less food and energy rose 4.5 percent over the last 12-months, the largest 12-month increase since the period ending November 1991. The energy index rose 24.5 percent over the last 12-months, and the food index increased 2.4 percent.

emphasis added