by Calculated Risk on 7/07/2021 11:25:00 AM

Wednesday, July 07, 2021

Las Vegas Real Estate in June: Sales up 53% YoY, Inventory down 46% YoY

Note: Sales slumped in April and May 2020 everywhere due to the pandemic, and were still low in June 2020 in Las Vegas - although sales picked up in July last year.

The Las Vegas Realtors reported Southern Nevada home prices inch closer to $400,000 mark; LVR housing statistics for June 2021

A report released Wednesday by Las Vegas REALTORS® (LVR) shows local home prices continuing to set records while sales rise and the local housing supply remains tight.1) Overall sales (single family and condos) were up 52.8% year-over-year from 2,934 in June 2020 to 4,486 in June 2021.

...

LVR reported a total of 4,486 existing local homes, condos and townhomes sold during June. Compared to one year ago, June sales were up 43.8% for homes and up 100.6% for condos and townhomes. So far this year, local home sales are on pace to exceed last year’s total.

…

By the end of June, LVR reported 2,454 single-family homes listed for sale without any sort of offer. Although down 51.7% from the same time last year, Martinez noted the number of homes listed without offers actually increased for the fourth straight month. For condos and townhomes, the 575 properties listed without offers in June were more than were listed during the previous month, though that inventory is still down 64.4% from the same time last year.

...

With eviction and foreclosure bans still in place, the number of so-called distressed sales remains near historically low levels. LVR reported that short sales and foreclosures combined accounted for just 0.7% of all existing local property sales in June. That compares to 2.2% of all sales one year ago, 2.2% of all sales two years ago, 2.6% three years ago and 6.3% four years ago. Martinez added that these percentages may increase once government moratoriums are lifted.

emphasis added

2) Active inventory (single-family and condos) is down 45.7% from a year ago, from a total of 6,695 in June 2020 to 3,029 in June 2021. And months of inventory is extremely low.

3) Active inventory is up 18.3% from the previous month (May 2021).

BLS: Job Openings "Little Changed" at 9.2 Million in May

by Calculated Risk on 7/07/2021 10:06:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 9.2 million on the last business day of May, the U.S. Bureau of Labor Statistics reported today. Hires were little changed at 5.9 million. Total separations decreased to 5.3 million. Within separations, the quits rate decreased to 2.5 percent. The layoffs and discharges rate, while little changed over the month, hit a series low of 0.9 percent.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for May, the most recent employment report was for June.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The huge spikes in layoffs and discharges in March and April 2020 are labeled, but off the chart to better show the usual data.

Jobs openings increased in May to 9.209 million from 9.193 million in April. This is a new record high for this series.

The number of job openings (yellow) were up 69% year-over-year.

Quits were up 63% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 7/07/2021 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 2, 2021.

... The Refinance Index decreased 2 percent from the previous week and was 8 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 14 percent lower than the same week one year ago.

“Mortgage application activity fell for the second week in a row, reaching the lowest level since the beginning of 2020. Even as mortgage rates declined, with the 30-year fixed rate dropping 5 basis points to 3.15 percent, both purchase and refinance applications decreased,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Treasury yields have been volatile despite mostly positive economic news, including last week’s June jobs report, which showed ongoing improvements in the labor market. However, rates continued to move lower – especially late in the week. The 30-year fixed rate was 11 basis points lower than the same week a year ago, but many borrowers previously refinanced at even lower rates. Refinance applications have trended lower than 2020 levels for the past four months.”

Added Kan, “Swift home-price growth across much of the country, driven by insufficient housing supply, is weighing on the purchase market and is pushing average loan amounts higher.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) decreased to 3.15 percent from 3.20 percent, with points decreasing to 0.38 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With low rates, the index remains elevated, but has been declining recently.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 14% year-over-year unadjusted.

According to the MBA, purchase activity is down 14% year-over-year unadjusted.Note: The year ago comparisons for the unadjusted purchase index are now difficult since purchase activity picked up in late May 2020.

Note: Red is a four-week average (blue is weekly).

Tuesday, July 06, 2021

Wednesday: Job Openings, FOMC Minutes

by Calculated Risk on 7/06/2021 09:00:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Job Openings and Labor Turnover Survey for May from the BLS.

• At 2:00 PM, FOMC Minutes, Meeting of June 15-16, 2021

July 6th COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 7/06/2021 05:02:00 PM

According to the CDC, on Vaccinations.

Total doses administered: 331,214,347, as of a week ago 323,327,328. Average doses last week: 1.13 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 67.1% | 67.1% | 66.2% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 157.6 | 157.3 | 154.2 | ≥1601 |

| New Cases per Day3 | 10,789 | 11,521 | 12,305 | ≤5,0002 |

| Hospitalized3 | 11,418 | 11,322 | 11,837 | ≤3,0002 |

| Deaths per Day3 | 163 | 182 | 212 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing week-over-week | ||||

KUDOS to the residents of the 20 states and D.C. that have already achieved the 70% goal: Vermont, Hawaii and Massachusetts are at 80%+, and Connecticut, Maine, New Jersey, Rhode Island, Pennsylvania, New Mexico, Maryland, California, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Colorado, Oregon and D.C. are all over 70%.

Next up are Wisconsin at 65.7%, Nebraska at 65.5%, Florida at 65.2%, Utah at 64.4%, South Dakota at 64.4%, and Iowa at 64.1%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 3.87%"

by Calculated Risk on 7/06/2021 04:00:00 PM

Note: This is as of June 27th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 3.87%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 4 basis points from 3.91% of servicers’ portfolio volume in the prior week to 3.87% as of June 27, 2021. According to MBA’s estimate, 1.9 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 3 basis points to 1.99%. Ginnie Mae loans in forbearance decreased 3 basis points to 5.10%, while the forbearance share for portfolio loans and private-label securities (PLS) decreased 5 basis points to 7.92%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers decreased 3 basis points to 4.00%, and the percentage of loans in forbearance for depository servicers declined 3 basis points to 4.11%.

“For the first time since last March, the share of Fannie Mae and Freddie Mac loans in forbearance dropped below 2 percent. The share in every investor type and almost every loan category dropped as well, bringing the number of homeowners in forbearance below 2 million,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “The rate of forbearance exits and new forbearance requests remained at low levels, but we expect the pace of exits to increase with reporting next week for the beginning of July.”

Added Fratantoni, “Strong job growth in June should provide a springboard for further improvements in the forbearance numbers over the next month.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April 2020, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) remained the same relative to the prior week at 0.04%".

Note: Deferral plans are very popular. Basically when the homeowner exits forbearance, they just go back to making their regular monthly payments, they are not charged interest on the missed payments, and the unpaid balanced is deferred until the end of the mortgage.

Denver Real Estate in June: Sales Down 1% YoY, Active Inventory Down 51% YoY

by Calculated Risk on 7/06/2021 01:13:00 PM

In June 2021, the report shows that what goes down must come up. Overall, month-end active inventory increased 50.46 percent compared to May 2021, which is the highest percentage of month-over-month increase in DMAR records. The number of new listings was up 23.89 percent month-over-month. Likewise, the number of closed properties increased 9.29 percent. More houses hit the market in June and therefore more people had the opportunity to buy, which is reflected in the month of inventory increasing to 0.50. While historically this still remains incredibly low, it does show a slight shift from the previous month which was 0.39.

“Big percentage changes happen when the market starts with the low inventory that Denver has recently seen,” said Andrew Abrams, Chair of the DMAR Market Trends Committee and Metro Denver REALTOR®. “For the first time in what feels like a long time, buyers have to compete with less competition, and therefore, the extreme bidding wars have drastically decreased. Sellers are now adjusting their listing strategy to what the comps suggest. However, while inventory did drastically increase from the previous month, we are still at less than one-third of the total inventory compared to 2019 at this time."

emphasis added

Seven High Frequency Indicators for the Economy

by Calculated Risk on 7/06/2021 11:06:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of July 5th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 18.9% from the same day in 2019 (81.1% of 2019). (Dashed line)

There was a slow increase from the bottom - and TSA data has picked up in 2021.

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through July 4th, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays, then slumped with the huge winter surge in cases. Dining is generally picking up, but was down 13% in the US (7-day average compared to 2019). Florida and Texas are above 2019 levels.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $140 million last week, down about 54% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Occupancy is now above the horrible 2009 levels and weekend occupancy (leisure) has been solid.

This data is through June 26th. Hotel occupancy is currently down 7% compared to same week in 2019). Note: Occupancy was up year-over-year, since occupancy declined sharply at the onset of the pandemic. However, the 4-week average occupancy is still down from normal levels.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

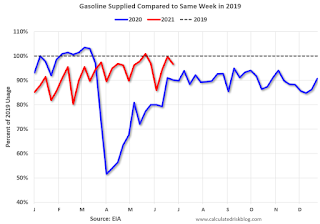

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of June 25th, gasoline supplied was down 3.4% compared to the same week in 2019 (about 96.6% of the same week in 2019).

Five weeks ago was the only week this year when gasoline supplied was up compared to the same week in 2019.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through July 4th for the United States and several selected cities.

This data is through July 4th for the United States and several selected cities.The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 94% of the January 2020 level and moving up.

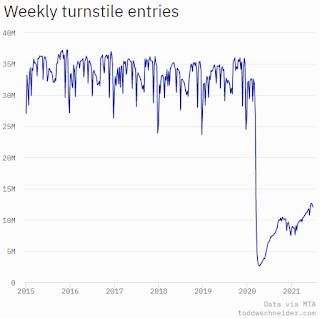

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, July 2nd.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

ISM® Services Index Decreased to 60.1% in June

by Calculated Risk on 7/06/2021 10:06:00 AM

(Posted with permission). The June ISM® Services index was at 60.1%, up from 64.0% last month. The employment index decreased to 49.3%, from 55.3%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: June 2021 Services ISM® Report On Business®

Economic activity in the services sector grew in June for the 13th month in a row, say the nation’s purchasing and supply executives in the latest Services ISM® Report On Business®.The employment index decreased to 49.3%, from 55.3% in May.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “The Services PMI registered 60.1 percent, which is 3.9 percentage points lower than May’s all-time high reading of 64 percent. The June reading indicates the 13th straight month of growth for the services sector, which has expanded for all but two of the last 137 months.

“The Supplier Deliveries Index registered 68.5 percent, down 1.9 percentage points from May’s reading of 70.4 percent. (Supplier Deliveries is the only ISM® Report On Business® index that is inversed; a reading of above 50 percent indicates slower deliveries, which is typical as the economy improves and customer demand increases.) The Prices Index registered 79.5 percent, 1.1 percentage points lower than the May reading of 80.6 percent, indicating that prices increased in June, and at a slightly slower rate.

“According to the Services PMI®, 16 services industries reported growth. The composite index indicated growth for the 13th consecutive month after a two-month contraction in April and May 2020. The rate of expansion in the services sector remains strong, despite the slight pullback in the rate of growth from the previous month’s all-time high. Challenges with materials shortages, inflation, logistics and employment resources continue to be an impediment to business conditions,” says Nieves.

emphasis added

CoreLogic: House Prices up 15.4% Year-over-year in May

by Calculated Risk on 7/06/2021 08:00:00 AM

Notes: This CoreLogic House Price Index report is for May. The recent Case-Shiller index release was for April. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: Torrid Demand and Scarce Inventory Fuels Double-Digit Home Price Growth in May, CoreLogic Reports

CoreLogic® ... released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for May 2021.

Converging pressures of severe inventory shortages and sustained demand pushed home prices to record highs in May, with the year-over-year increase in home prices at its highest level since 2005. While many millennials and Gen Z home buyers continue to move into the hot market thanks to low borrowing rates, high prices are likely deterring increasing numbers of prospective buyers — especially first-time and low-income families. Currently, 82% of consumers note housing affordability as a key problem, according to a recent CoreLogic survey. Additionally, 33% of respondents noted they would wait to buy or not buy at all rather than make sacrifices on their purchase.

“First-time buyers are hitting a wall in many places around the country as the pace of home price rises outpace the benefits of lower borrowing costs. Younger and first-time buyers, including younger millennials, are faced with the challenge of having sufficient savings for a down payment, closing costs and cash reserves,” said Frank Martell, president and CEO of CoreLogic. “As we look to the balance of 2021, we expect price rises to continue which could very well push prospective buyers out of the market in many areas and slow home price growth over the next year.”

“There are marked differences in today’s run up in prices compared to 2005, which was a bubble fueled by risky loans and lenient underwriting,” said Dr. Frank Nothaft, chief economist at CoreLogic. “Today, loans with high-risk features are absent and mortgage underwriting is prudent. However, demand and supply imbalances — fueled by a drop in mortgage rates to less than one-half what they were in 2005 and a scarcity of for-sale homes — has fed the latest run up in sales prices.”

...

Nationally, home prices increased 15.4% in May 2021, compared with May 2020. On a month-over-month basis, home prices increased by 2.3% compared to April 2021.

At the state level, Idaho and Arizona continued to have the strongest price growth at 30.3% and 23.4%, respectively. Utah also had a 20.4% year-over-year increase as home buyers seek out more affordable locations with lower population density and attractive outdoor amenities.

emphasis added