by Calculated Risk on 5/19/2021 07:00:00 AM

Wednesday, May 19, 2021

MBA: Mortgage Applications Increase in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 14, 2021.

... The Refinance Index increased 4 percent from the previous week and was 2 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. The unadjusted Purchase Index decreased 4 percent compared with the previous week and was 2 percent higher than the same week one year ago.

“Mortgage rates increased last week, with all loan types hitting their highest levels in two weeks. Rates were still lower than levels reported in late March and early April, providing additional opportunity for borrowers to refinance. Despite the 30-year fixed rate rising to 3.15 percent, applications for conventional and VA refinances increased. Ongoing volatility in refinance applications is likely if rates continue to oscillate around current levels,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “A decline in purchase applications was seen for both conventional and government loans. There continues to be strong demand for buying a home, but persistent supply shortages are constraining purchase activity, and building material shortages and higher costs are making it more difficult to increase supply. As a result, home prices and average purchase loan balances continue to rise, with the average purchase application reaching $411,400 – the highest since February.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) increased to 3.15 percent from 3.11 percent, with points increasing to 0.36 from 0.32 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. T

emphasis added

Click on graph for larger image.

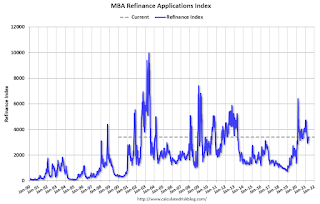

Click on graph for larger image.The first graph shows the refinance index since 1990.

With low rates, the index remains elevated, but below recent levels since mortgage rates have moved up from the record lows.

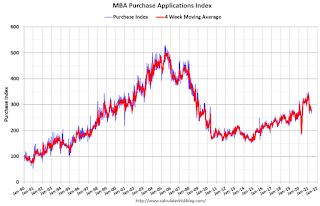

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is up 2% year-over-year unadjusted.

According to the MBA, purchase activity is up 2% year-over-year unadjusted.Note: The year ago comparisons for the unadjusted purchase index will be more difficult going forward since purchase activity picked up in late May 2020.

Note: Red is a four-week average (blue is weekly).

Tuesday, May 18, 2021

Wednesday: FOMC Minutes

by Calculated Risk on 5/18/2021 09:11:00 PM

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day, the AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Minutes, Meeting of April 27-28, 2021

May 18th COVID-19 New Cases, Hospitalizations, Vaccinations

by Calculated Risk on 5/18/2021 04:10:00 PM

1) 60.0% of the population over 18 has had at least one dose (70% goal by July 4th).

2) 124.5 million Americans are fully vaccinated (160 million goal by July 4th)

Note: I'll stop posting this daily once all four of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine, and

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000, and

4) average daily deaths under 50 (currently 558 per day).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

The current 7-day average is 27,027, up from 26,726 reported yesterday, and still above the post-summer surge low of 23,000.

Alabama Real Estate in April: Sales Up 33% YoY, Inventory Down 46% YoY

by Calculated Risk on 5/18/2021 01:04:00 PM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year. Remember sales were weak in April 2020 due to the pandemic, so the YoY sales comparison is easy.

For the entire state of Alabama:

Closed sales in April 2021 were 7,068, up 33.4% from 5,300 in April 2020.

Active Listings in April 2021 were 9,582, down 46.6% from 17,956 in April 2020.

Months of Supply was 1.4 Months in April 2021, compared to 3.4 Months in April 2020.

Inventory in April was down 1.4% from last month.

Rhode Island Real Estate in April: Sales Up 27% YoY, Inventory Down 48% YoY

by Calculated Risk on 5/18/2021 12:01:00 PM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year. Remember sales were weak in April 2020 due to the pandemic, so the YoY sales comparison is easy.

For for the entire state Rhode Island:

Closed sales (single family and condos) in April 2021 were 1,080, up 26.6% from 853 in April 2020.

Active Listings (single family and condos) in April 2021 were 1,520, down 48.0% from 2,922 in April 2020.

Inventory in April was down 7.1% from last month.

Comments on April Housing Starts

by Calculated Risk on 5/18/2021 10:39:00 AM

Earlier: Housing Starts decreased to 1.569 Million Annual Rate in April

It is possible that supply constraints held back housing starts in April. Here is a comment from MBA SVP and Chief Economist Mike Fratantoni:

“Single-family starts in April dropped more than 13% compared to last month, but permits to build single-family homes saw a smaller decline. This is consistent with reports that builders are delaying starting new construction because of the marked increase in costs for lumber and other inputs. Moreover, builders are also reporting difficulty obtaining other inputs like appliances."

The housing starts report showed total starts were down 9.5% in April compared to March, and total starts were up 67.3% year-over-year compared to April 2020.

The first graph shows the month to month comparison for total starts between 2020 (blue) and 2021 (red).

Click on graph for larger image.

Click on graph for larger image.Starts were up 67.3% in April compared to April 2020. The year-over-year comparison will be easy again in May and June.

2020 was off to a strong start before the pandemic, and with low interest rates and little competing existing home inventory, starts finished 2020 strong. Starts have started 2021 strong (February was impacted by the harsh weather).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions. The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - then mostly moved sideways. Completions (red line) had lagged behind - then completions caught up with starts- then starts picked up a little again late last year, but have fallen off with the pandemic.

The last graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The last graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Single family starts are getting back to more normal levels, but I still expect some further increases in single family starts and completions on a rolling 12 month basis - especially given the low level of existing home inventory.

Housing Starts decreased to 1.569 Million Annual Rate in April

by Calculated Risk on 5/18/2021 08:39:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in April were at a seasonally adjusted annual rate of 1,569,000. This is 9.5 percent below the revised March estimate of 1,733,000, but is 67.3 percent above the April 2020 rate of 938,000. Single‐family housing starts in April were at a rate of 1,087,000; this is 13.4 percent below the revised March figure of 1,255,000. The April rate for units in buildings with five units or more was 470,000.

Building Permits:

Privately‐owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,760,000. This is 0.3 percent above the revised March rate of 1,755,000 and is 60.9 percent above the April 2020 rate of 1,094,000. Single‐family authorizations in April were at a rate of 1,149,000; this is 3.8 percent below the revised March figure of 1,194,000. Authorizations of units in buildings with five units or more were at a rate of 559,000 in April

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased slightly in April compared to March. Multi-family starts were up 91% year-over-year in April.

Single-family starts (blue) decreased in April, and were up 59% year-over-year (starts slumped at the beginning of the pandemic).

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then the eventual recovery (but still not historically high).

Total housing starts in April were below expectations, and starts in February and March were revised down.

I'll have more later …

Monday, May 17, 2021

May 17th COVID-19 New Cases, Hospitalizations, Vaccinations

by Calculated Risk on 5/17/2021 11:16:00 PM

1) 59.8% of the population over 18 has had at least one dose (70% goal by July 4th).

2) 123.8 million Americans are fully vaccinated (160 million goal by July 4th)

Note: I'll stop posting this daily once all four of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine, and

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000, and

4) average daily deaths under 50 (currently 545 per day).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

The current 7-day average is 26,726, down from 27,992 reported yesterday, but still above the post-summer surge low of 23,000.

Tuesday: Housing Starts

by Calculated Risk on 5/17/2021 09:00:00 PM

From Matthew Graham at Mortgage News Daily: MBS RECAP: Super Slow Day; Still Waiting For Breakout

Whether it's the narrow range between 1.62 and 1.68% in 10yr yields or the wider 1.53-1.75%, bond watchers continue waiting for evidence of a breakout. It certainly didn't arrive today, and even if it did, the ultra low volume profile would argue against reading too much into it. [30 year fixed 3.14%]Tuesday:

emphasis added

• At 8:30 AM ET: Housing Starts for April. The consensus is for 1.710 million SAAR, down from 1.739 million SAAR in March.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 4.22%"

by Calculated Risk on 5/17/2021 04:00:00 PM

Note: This is as of May 9th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 4.22%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 14 basis points from 4.36% of servicers’ portfolio volume in the prior week to 4.22% as of May 9, 2021. According to MBA’s estimate, 2.1 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 8 basis points to 2.24%. Ginnie Mae loans in forbearance decreased 21 basis points to 5.61%, while the forbearance share for portfolio loans and private-label securities (PLS) decreased by 29 basis points to 8.26%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers decreased 16 basis points to 4.42%, and the percentage of loans in forbearance for depository servicers declined 12 basis points to 4.35%.

“More homeowners exited forbearance in the first full week of May, leading to a 14-basis-point decrease in the forbearance share – the 11th straight week of declines. The rate of new requests dropped to 4 basis points, which is the lowest level since last March,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Of those in forbearance extensions, more than half have been in forbearance for more than 12 months.”

Added Fratantoni, “The opening of the economy, as the successful vaccination effort continues, should lead to further reductions in the forbearance share. However, many homeowners continue to struggle. Borrowers who are reaching the end of their forbearance term should reach out to their servicer to review their options.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week: from 0.05% to 0.04%"