by Calculated Risk on 4/01/2021 10:20:00 AM

Thursday, April 01, 2021

Construction Spending decreased 0.8% in February

From the Census Bureau reported that overall construction spending decreased:

Construction spending during February 2021 was estimated at a seasonally adjusted annual rate of $1,516.9 billion, 0.8 percent below the revised January estimate of $1,529.0 billion.Both private and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,165.7 billion, 0.5 percent below the revised January estimate of $1,171.6 billion. ...

In February, the estimated seasonally adjusted annual rate of public construction spending was $351.2 billion, 1.7 percent below the revised January estimate of $357.4 billion.

Click on graph for larger image.

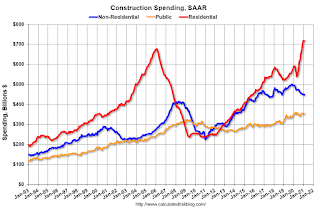

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 6% above the bubble peak (in nominal terms - not adjusted for inflation).

Non-residential spending is 8% above the previous peak in January 2008 (nominal dollars), but has been weak recently.

Public construction spending is 8% above the previous peak in March 2009, and 34% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 21.1%. Non-residential spending is down 9.7% year-over-year. Public spending is down slightly year-over-year.

Construction was considered an essential service in most areas and did not decline sharply like many other sectors, but it seems likely that non-residential will be under pressure. For example, lodging is down 24% YoY, multi-retail down 33% YoY, and office down 5% YoY.

ISM® Manufacturing index Increased to 64.7% in March

by Calculated Risk on 4/01/2021 10:17:00 AM

(Posted with permission). The ISM manufacturing index indicated expansion in March. The PMI® was at 64.7% in March, up from 60.8% in February. The employment index was at 59.6%, up from 54.4% last month, and the new orders index was at 68.0%, up from 63.2%.

From ISM: Manufacturing PMI® at 64.7%; March 2021 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector grew in March, with the overall economy notching a 10th consecutive month of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This was above expectations.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The March Manufacturing PMI® registered 64.7 percent, an increase of 3.9 percentage points from the February reading of 60.8 percent. This figure indicates expansion in the overall economy for the 10th month in a row after contraction in April. The New Orders Index registered 68 percent, up 3.2 percentage points from the February reading of 64.8 percent. The Production Index registered 68.1 percent, an increase of 4.9 percentage points compared to the February reading of 63.2 percent. The Backlog of Orders Index registered 67.5 percent, 3.5 percentage points above the February reading of 64 percent. The Employment Index registered 59.6 percent, 5.2 percentage points higher than the February reading of 54.4 percent. The Supplier Deliveries Index registered 76.6 percent, up 4.6 percentage points from the February figure of 72 percent. The Inventories Index registered 50.8 percent, 1.1 percentage points higher than the February reading of 49.7 percent. The Prices Index registered 85.6 percent, down 0.4 percentage point compared to the February reading of 86 percent. The New Export Orders Index registered 54.5 percent, a decrease of 2.7 percentage points compared to the February reading of 57.2 percent. The Imports Index registered 56.7 percent, a 0.6-percentage point increase from the February reading of 56.1 percent.”

emphasis added

This suggests manufacturing expanded at a faster pace in March than in February.

Weekly Initial Unemployment Claims increased to 719,000

by Calculated Risk on 4/01/2021 08:37:00 AM

The DOL reported:

In the week ending March 27, the advance figure for seasonally adjusted initial claims was 719,000, an increase of 61,000 from the previous week's revised level. The previous week's level was revised down by 26,000 from 684,000 to 658,000. The 4-week moving average was 719,000, a decrease of 10,500 from the previous week's revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500. The previous week's average was revised down by 6,500 from 736,000 to 729,500.This does not include the 237,025 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 241,137 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 719,000.

The previous week was revised down.

Regular state continued claims decreased to 3,794,000 (SA) from 3,840,000 (SA) the previous week.

Note: There are an additional 7,349,663 receiving Pandemic Unemployment Assistance (PUA) that increased from 7,844,867 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 5,515,355 receiving Pandemic Emergency Unemployment Compensation (PEUC) down from 6,220,492.

Weekly claims were higher than the consensus forecast.

Wednesday, March 31, 2021

Thursday: Unemployment Claims, ISM Mfg, Construction Spending, Vehicle Sales

by Calculated Risk on 3/31/2021 09:00:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 650 thousand from 684 thousand last week.

• At 10:00 AM, ISM Manufacturing Index for March. The consensus is for the ISM to be at 61.2, up from 60.8 in February.

• Also at 10:00 AM, Construction Spending for February. The consensus is for a 0.9% decrease in construction spending.

• At All Day, Light vehicle sales for March. The consensus is for light vehicle sales to be 16.5 million SAAR in March, up from 15.7 million in February (Seasonally Adjusted Annual Rate).

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in February

by Calculated Risk on 3/31/2021 04:10:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 2.76% in February, from 2.80% in January. The serious delinquency rate is up from 0.65% in February 2020.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble, and peaked at 3.32% in August 2020 during the pandemic.

By vintage, for loans made in 2004 or earlier (2% of portfolio), 5.90% are seriously delinquent (up from 5.87% in January). For loans made in 2005 through 2008 (2% of portfolio), 10.01% are seriously delinquent (up from 9.98%), For recent loans, originated in 2009 through 2021 (96% of portfolio), 2.29% are seriously delinquent (down from 2.32%). So Fannie is still working through a few poor performing loans from the bubble years.

Mortgages in forbearance are counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once they are employed.

Note: Freddie Mac reported earlier.

March 31 COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 3/31/2021 03:48:00 PM

Note: I've been posting this data daily for over a year. I'll stop once 70% of the population over 18 has had at least one dose of vaccine, new cases are under 5,000 per day, and hospitalizations below 3,000.

According to the CDC, 150.3 million doses have been administered. 21.1% of the population over 18 is fully vaccinated, and 37.7% of the population over 18 has had at least one dose (97.2 million people have had at least one dose).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

CDC: "Age-adjusted death rate increased by 15.9% in 2020"; COVID Third Leading Cause of Death

by Calculated Risk on 3/31/2021 12:33:00 PM

The CDC released the Provisional Mortality Data — United States, 2020 today:

During January–December 2020, the estimated 2020 age-adjusted death rate increased for the first time since 2017, with an increase of 15.9% compared with 2019, from 715.2 to 828.7 deaths per 100,000 population. COVID-19 was the underlying or a contributing cause of 377,883 deaths (91.5 deaths per 100,000). COVID-19 death rates were highest among males, older adults, and AI/AN and Hispanic persons. The highest numbers of overall deaths and COVID-19 deaths occurred during April and December. COVID-19 was the third leading underlying cause of death in 2020, replacing suicide as one of the top 10 leading causes of deathThis is very close to economist Tom Lawler's estimates, see: Lawler: Update on the Dismal Demographics of 2020; "Smallest Population increase since 1918"

emphasis added

NAR: Pending Home Sales Decrease 10.6% in February

by Calculated Risk on 3/31/2021 10:02:00 AM

From the NAR: Pending Home Sales Slip 10.6% in February

Pending home sales dipped for a second straight month in February, according to the National Association of Realtors®. Each of the four major U.S. regions witnessed month-over-month declines in February, while results were mixed in the four regions year-over-year.This was well below expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in March and April.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, dropped 10.6% to 110.3 in February. Year-over-year, contract signings fell 0.5%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI fell 9.2% to 92.3 in February, a 3.9% dip from a year ago. In the Midwest, the index dropped 9.5% to 102.4 last month, down 6.1% from February 2020.

Pending home sales transactions in the South declined 13.0% to an index of 133.2 in February, up 2.9% from February 2020. The index in the West fell 7.4% in February to 96.9, up 1.9% from a year prior.

emphasis added

ADP: Private Employment increased 517,000 in March

by Calculated Risk on 3/31/2021 08:19:00 AM

Private sector employment increased by 517,000 jobs from February to March according to the March ADP® National Employment ReportTM. Broadly distributed to the public each month, free of charge, the ADP National Employment Report is produced by the ADP Research Institute® in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basisThis was below the consensus forecast of 550,000 for this report.

“We saw marked improvement in March’s labor market data, reporting the strongest gain since September 2020,” said Nela Richardson, chief economist, ADP. “Job growth in the service sector significantly outpaced its recent monthly average, led with notable increase by the leisure and hospitality industry. This sector has the most opportunity to improve as the economy continues to gradually reopen and the vaccine is made more widely available. We are continuing to keep a close watch on the hardest hit sectors but the groundwork is being laid for a further boost in the monthly pace of hiring in the months ahead.”

emphasis added

The BLS report will be released Friday, and the consensus is for 565 thousand non-farm payroll jobs added in March. The ADP report has not been very useful in predicting the BLS report.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 3/31/2021 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 26, 2021.

... The Refinance Index decreased 3 percent from the previous week and was 32 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 39 percent higher than the same week one year ago.

“After seven consecutive weeks of increasing mortgage rates, the 30-year fixed rate declined 3 basis points to 3.33 percent, which is still almost half a percentage point higher than the start of this year. Mortgage applications for refinances and home purchases both declined, but purchase activity was still convincingly higher than the pandemic-induced drop seen a year ago, as well as up 6 percent from the same week in March 2019,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Many prospective homebuyers this spring are feeling the effects of higher rates and rapidly accelerating home prices. Record-low inventory is pushing home-price growth at double the rate from a year ago, and even above the 10 percent growth rates seen in 2005. The housing market is in desperate need of more inventory to cool price growth and preserve affordability.”

Added Kan, “Higher mortgage rates continue to shut down refinance activity, as the pool of borrowers who can benefit from a refinance further shrinks.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) decreased to 3.33 percent from 3.36 percent, with points decreasing to 0.39 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

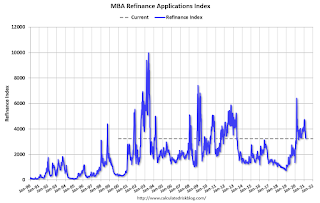

Click on graph for larger image.The first graph shows the refinance index since 1990.

With low rates, the index remains elevated, but falling as rates rise.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is up 38% year-over-year unadjusted.

According to the MBA, purchase activity is up 38% year-over-year unadjusted.Note: Until the 2nd half of May, the MBA index will be up sharply year-over-year since purchase activity collapsed in late March 2020 in the early weeks of the pandemic.

Note: Red is a four-week average (blue is weekly).