by Calculated Risk on 3/09/2021 08:55:00 PM

Tuesday, March 09, 2021

Wednesday: CPI

From Matthew Graham at MortgageNewsDaily: Mortgage Rates Modestly Lower, But Hoping For More

At this point, no one should be surprised to hear that mortgage rates have moved significantly higher in 2021--especially in the past few weeks. ... Taking the big, scary rate spike as read, let's move on to wondering about what happens next. All too often in the past 2-3 weeks, there's been a glimmer of hope in the bond market (which dictates day-to-day mortgage rate changes) only for things to get even worse in short order. We've reached another one of those "glimmer of hope" moments now as rates have managed to avoid slipping above their highest levels in more than a year seen last Friday.Wednesday:

With only 2 days of ground-holding, we obviously can't declare victory just yet, but should we even hope for victory or just assume rates will continue higher? [30 year fixed 3.26%]

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for February from the BLS. The consensus is for a 0.4% increase in CPI, and a 0.2% increase in core CPI.

March 9 COVID-19 Test Results and Vaccinations

by Calculated Risk on 3/09/2021 04:41:00 PM

From Bloomberg on vaccinations as of Mar 9th:

"So far, 93.7 million doses have been given. In the last week, an average of 2.15 million doses per day were administered."Here is the CDC COVID Data Tracker. This site has data on vaccinations, cases and more.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

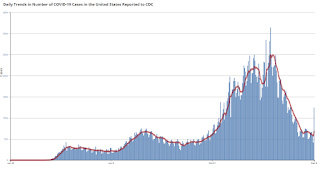

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

Note that Missouri reported 81,000 previously unreported cases - and that caused the spike in total cases today.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

NMHC: Rent Payment Tracker Shows Households Paying Rent Decreased 4.1% YoY in Early March

by Calculated Risk on 3/09/2021 01:07:00 PM

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 80.4 percent of apartment households made a full or partial rent payment by March 6 in its survey of 11.6 million units of professionally managed apartment units across the country.

This is a 4.1 percentage point, or 474,942 household decrease from the share who paid rent through March 6, 2020 and compares to 79.2 percent that had paid by February 6, 2021. This data encompasses a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

“On behalf of the multifamily industry, we are deeply appreciative of how leaders in Congress and the Biden administration worked with us to develop legislation that will deliver direct financial support to those facing distress due to the pandemic,” said Doug Bibby, NMHC President.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the NMHC Rent Payment Tracker shows the percent of household making full or partial rent payments by the 6th of the month compared to the same month the prior year.

This is mostly for large, professionally managed properties.

The second graph shows full month payments through February compared to the same month the prior year.

This shows a decline in rent payments year-over-year, and somewhat more of a decline over the last several months.

This shows a decline in rent payments year-over-year, and somewhat more of a decline over the last several months.SF Fed: Weather Reduced February Employment by About 100 Thousand

by Calculated Risk on 3/09/2021 11:56:00 AM

Every month, the San Francisco Fed estimates Weather-Adjusted Change in Total Nonfarm Employment (monthly change, seasonally adjusted). They use local area weather to estimate the impact on employment.

The BLS reported 379 thousand jobs were added in February.

The San Francisco Fed estimates that weather adjusted employment gains were 482 thousand; about 100 thousand higher than the BLS reported.

This table from Daniel Wilson at the SF Fed shows the BLS reported job gains for the last 6 months, and two estimates of the impact of weather.

North Texas Real Estate in February: Sales Down 6% YoY, Inventory Down 65% YoY

by Calculated Risk on 3/09/2021 11:41:00 AM

Closed sales in Texas might have been impacted by the severe weather in February.

Note: I'm posting data for many local markets around the U.S. The story is the same everywhere ... inventory is at record lows.

From the NTREIS for North Texas (including Dallas/Ft. Worth):

Single Family Homes sold in February 2021 were 6,958, down 8% from 7,534 in February 2020.

Combined, sales were down 5.6% year-over-year.

Single Family Active Listings in February 2021 were 6,687, down 68% from 20,723 in February 2020.

Combined, active listings declined 65% year-over-year.

Denver Real Estate in February: Sales Up 4% YoY, Active Inventory Down 58%

by Calculated Risk on 3/09/2021 09:29:00 AM

Note: I'm posting data for many local markets around the U.S. The story is the same everywhere ... inventory is at record lows.

From the DMAR: Monthly Indicators, February 2021

Total Residential Units Sold in February 2021 were 3,641, up 3.7% from 3,511 in February 2020.

Active Residential Listings in February 2021 were 2,024, down 58.1% from 4,835 in February 2020.

Inventory in Denver had been fairly steady over the last 6 or 7 years, but declined sharply in 2020.

Northwest Real Estate in February: Sales up 10% YoY, Inventory down 44% YoY

by Calculated Risk on 3/09/2021 08:11:00 AM

Note: Inventory is down sharply in the Northwest almost everywhere except Seattle. And inventory is low in Seattle too, but was even lower a year ago.

The Northwest Multiple Listing Service reported Housing market stays hot despite some “lousy” February weather

Housing activity during February remained hot around much of Washington state despite significant accumulation of lowland snow over the Valentine’s Day weekend, according to the latest statistical report from the Northwest Multiple Listing Service.The press release is for the Northwest MLS area. There were 5,812 closed sales in February 2021, up 10.4% from 5,265 sales in February 2020. Active inventory for the Northwest is down 44%.

“It’s amazing how close the February numbers are when compared to February 2020, which was, of course, right before our world changed,” said Mike Grady, president and CEO of Coldwell Banker Bain. "Despite our similarly lousy February weather, the data show that the market continues to be hot, with residential inventory very tight and median prices rising by double digits across most of our counties.”

...

Northwest MLS member-brokers reported 5,812 closed sales during February for a 10.4% increase over the year-ago total of 5,265 closings.

...

Total active listings of single family homes declined nearly 44% from a year ago. The selection of single family homes fell more than 51% while condo inventory rose 7.9%.

emphasis added

In King County, sales were up 13.5% year-over-year, and active inventory was down 18% year-over-year.

In Seattle, sales were up 19.6% year-over-year, and inventory was UP 27% year-over-year. (inventory in Seattle was extremely low last year). This puts the months-of-supply in Seattle at just 1.3 months.

Monday, March 08, 2021

March 8 COVID-19 Test Results and Vaccinations

by Calculated Risk on 3/08/2021 05:03:00 PM

From Bloomberg on vaccinations as of Mar 8th:

"So far, 92.1 million doses have been given. In the last week, an average of 2.17 million doses per day were administered."Here is the CDC COVID Data Tracker. This site has data on vaccinations, cases and more.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

Note that data for recent days will likely increase.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 5.20%"

by Calculated Risk on 3/08/2021 04:00:00 PM

Note: This is as of February 28th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 5.20%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 3 basis points from 5.23% of servicers’ portfolio volume in the prior week to 5.20% as of February 28, 2021. According to MBA’s estimate, 2.6 million homeowners are in forbearance plans.

...

There was a small decline in the total share of loans in forbearance in the last week of February, as the pace of forbearance exits increased. This continues the trend reported in prior months. Of those homeowners in forbearance, more than 12 percent were current at the end of February, down somewhat from the almost 14 percent at the end of January,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “The improving economy, the soon-to-be passed stimulus package, and the many homeowners in forbearance reaching the 12-month mark of their plan could all influence the overall forbearance share in the coming months."

Fratantoni added, “Job growth picked up sharply in February and the unemployment rate decreased, but there are still almost 10 million people unemployed, with 4.1 million among the long-term unemployed – up 125,000 from January. The passage of the American Rescue Plan provides needed support for homeowners who are continuing to struggle during these challenging times.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, then trended down - and has mostly moved slowly down recently.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) remained the same relative to the prior week at 0.07%."

Black Knight Mortgage Monitor for January

by Calculated Risk on 3/08/2021 01:44:00 PM

Black Knight released their Mortgage Monitor report for January today. According to Black Knight, 5.85% of mortgages were delinquent in January, down from 6.08% of mortgages in December, and up from 3.22% in January 2020. Black Knight also reported that 0.32% of mortgages were in the foreclosure process, down from 0.46% a year ago.

This gives a total of 6.17% delinquent or in foreclosure.

Press Release: Black Knight’s January 2021 Mortgage Monitor; Lock Activity Suggests Q1 2021 Refi Originations to Remain Near Record Highs as Rate Increases Cloud Q2 Outlook; Servicer Retention Hits New Low

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage, real estate and public records datasets. This month’s report looks back on 2020 origination volumes as well as at rate lock data from Black Knight’s Secondary Marketing Technologies division to get a sense of how the market is faring as rates begin to rise. According to Black Knight Data & Analytics President Ben Graboske, despite interest rates recently spiking to more than 3.2% according to the daily tracking data of the company’s Optimal Blue Mortgage Market Index, Q1 2021 refinance lending volumes are poised to remain near Q4 2020’s record-breaking high.

“Roughly 2.8 million homeowners refinanced their mortgages in the last quarter of 2020, which saw a record-breaking $869 billion in refinance lending,” said Graboske. “Assuming a 45-day lock-to-close timeline, daily rate lock data from Black Knight through mid-February suggests refi activity could remain steady in Q1 2021. Of course, that’s before a recent spike in 30-year rates is expected to begin impacting closed loan volumes in late Q1 or early Q2. Still, by the end of March, another 2.8 million homeowners will have taken advantage of near-record-low rates to refinance their mortgages. It’s important to remember that this would be coupled with a 25% reduction from Q4 2020 in purchase loans as well, resulting in an overall 10% quarterly decline.

“With rates on the rise, refinance incentive has been significantly curtailed. Just under 13 million high-quality refinance candidates remain in the market – a nearly 30% drop in just the past three weeks. Added to that, retention of what is now a dwindling number of refinancing borrowers remains at record lows, with just 18% being retained by their servicers. Approximately 2.3 million borrowers were not retained in Q4 2020 alone. The current rate volatility serves to underscore the critical nature of both accurate and strategic pricing and advanced retention analytics to help identify borrowers who still have incentive and are out there transacting in the market.”

emphasis added

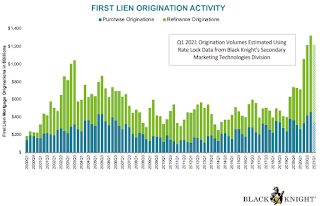

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows First Lien Origination Activity by quarter.

From Black Knight:

• All in, a record-breaking $4.3T was originated in 2020, with $2.8T in refis – also an all-time high – and $1.5T in purchase loans, the largest annual volume since 2005

• Q4 2020 set an all-time high for a single quarter across the board, with $346B in purchase lending, $869B in refinance lending and $1,322B in total lending

• By the end of March, an expected 2.8M homeowners will have taken advantage of near-record-low rates to refinance their mortgages

• It’s important to note that the same data suggests a 25% reduction from Q4 2020 in purchase loans, resulting in an overall 10% quarterly decline.

• Despite quarter-over-quarter decline, that would still put Q1 2021 purchase originations some 31% above 2020 levels

And on delinquencies from Black Knight:

And on delinquencies from Black Knight: • Early-stage delinquencies continue to stay below pre-pandemic levels, with the number of borrowers with a single missed payment down 24% and 60-day delinquencies down 6%There is much more in the mortgage monitor.

• However, despite some slight improvement in January, serious delinquencies (90+ days) remain 5X their pre-pandemic levels