by Calculated Risk on 2/09/2021 07:22:00 PM

Tuesday, February 09, 2021

February 9 COVID-19 Test Results and Vaccinations

SPECIAL NOTE: The Covid Tracking Project will end daily updates on March 7th. Heroes that filled a critical void! Quality government data will likely be available soon.

From Bloomberg on vaccinations as of Feb 9th.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 44.4 million doses have been given, according to a state-by-state tally. In the last week, an average of 1.53 million doses per day were administered."Here is the CDC COVID Data Tracker. This has data on vaccinations, cases and more.

The US is now averaging close to 2.0 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,611,368 test results reported over the last 24 hours.

There were 92,986 positive tests.

Over 26,000 US deaths have been reported in February. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.

The percent positive over the last 24 hours was 5.8%. The percent positive is calculated by dividing positive results by total tests (including pending).

Both cases and hospitalizations have peaked, but are declining from a very high level.

Denver Real Estate in January: Sales Down 10% YoY, Active Inventory Down 53%

by Calculated Risk on 2/09/2021 01:52:00 PM

From the DMAR: Monthly Indicators, January 2021

In January, the Greater Denver Metro housing market again broke an all-time record, a new inventory low with only 2,316 total properties on the market, translating into an inventory shortage and opportunity for appreciation to accelerate.The number of residential units sold in January (attached and detached) decreased to 3,015, down 10.3% from 3,361 in January 2020.

Single-family detached properties hit a record average price of $629,159, while attached properties hit a record of $397,792. Single-family home sellers saw a 101.03 percent close-to-list-price in January and a drop to five days in the MLS, down from six last month and 24 days last year. ...

“Interestingly enough, just because at the end of the month there are not many houses to choose from did not affect the amount of properties going under contract,” said Andrew Abrams, Chair of the DMAR Market Trends Committee and Metro Denver REALTOR®. “There were 4,459 pending properties in January, which is only a 1.09 percent decrease from last year at this time, and 2020 as a whole sang a similar note. There were more homes purchased throughout all of last year than any previous year, but at the end of every month towards the end of the year, there was not much inventory meaning the attrition rate was high.”

Active listings were at 2,316, down 53.1 from 4,941 in January 2020. This is a record low.

NMHC: Rent Payment Tracker Shows Households Paying Rent Decreased 1.9% YoY in Early February

by Calculated Risk on 2/09/2021 12:04:00 PM

he National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 79.2 percent of apartment households made a full or partial rent payment by February 6 in its survey of 11.6 million units of professionally managed apartment units across the country.

This is a 1.9 percentage point, or 216,479 household decrease from the share who paid rent through February 6, 2020 and compares to 76.6 percent that had paid by January 6, 2021. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

"As we approach almost a full year of navigating the pandemic and the resulting financial distress, we remain encouraged by the COVID relief package passed at the end of 2020 that included critical support for apartment residents and the nation's rental housing industry such as $25 billion in rental assistance, extended unemployment benefits and direct payments," said Doug Bibby, NMHC President.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the NMHC Rent Payment Tracker shows the percent of household making full or partial rent payments by the 6th of the month compared to the same month the prior year.

This is mostly for large, professionally managed properties.

The second graph shows full month payments through January compared to the same month the prior year.

This shows a decline in rent payments year-over-year, and somewhat more of a decline over the last several months.

This shows a decline in rent payments year-over-year, and somewhat more of a decline over the last several months.BLS: Job Openings "Little Changed" at 6.6 Million in December

by Calculated Risk on 2/09/2021 10:08:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 6.6 million on the last business day of December, the U.S. Bureau of Labor Statistics reported today. Hires decreased to 5.5 million while total separations were little changed at 5.5 million. Within separations, the quits rate and layoffs and discharges rate were little changed at 2.3 percent and 1.3 percent, respectively.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for December, the most recent employment report was for January.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The huge spikes in layoffs and discharges in March and April 2020 are labeled, but off the chart to better show the usual data.

Jobs openings increased in December to 6.646 million from 6.572 million in November.

The number of job openings (yellow) were up 1.4% year-over-year. Note that job openings were declining a year ago prior to the pandemic.

Quits were down 6.9% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

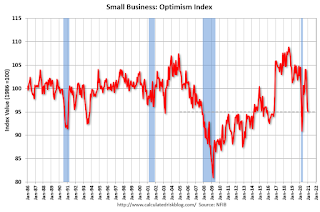

Small Business Optimism Decreased in January

by Calculated Risk on 2/09/2021 08:38:00 AM

Most of this survey is noise, but sometimes there is some information.

From the National Federation of Independent Business (NFIB): January [2021] Report

The NFIB Small Business Optimism Index declined in January to 95.0, down 0.9 from December and three points below the 47-year average of 98. ... “As Congress debates another stimulus package, small employers welcome any additional relief that will provide a powerful fiscal boost as their expectations for the future are uncertain,” said NFIB Chief Economist Bill Dunkelberg. “The COVID-19 pandemic continues to dictate how small businesses operate and owners are worried about future business conditions and sales.”

...

NFIB’s monthly jobs report showed job growth continued in January. Firms increased employment by 0.36 workers per firm on average over the past few months, up from 0.30 in December, a strong 2-month performance. However, the hiring remains uneven geographically and by industry.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index declined in January.

Monday, February 08, 2021

Tuesday: Job Openings

by Calculated Risk on 2/08/2021 09:11:00 PM

Tuesday:

• At 6:00 AM ET, NFIB Small Business Optimism Index for January.

• At 10:00 AM, Job Openings and Labor Turnover Survey for November from the BLS.

February 8 COVID-19 Test Results and Vaccinations

by Calculated Risk on 2/08/2021 07:13:00 PM

SPECIAL NOTE: The Covid Tracking Project will end daily updates on March 7th. Heroes that filled a critical void! Quality government data will likely be available soon.

From Bloomberg on vaccinations as of Feb 8th.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 43.1 million doses have been given, according to a state-by-state tally. In the last week, an average of 1.47 million doses per day were administered."Also check out the graphs at COVID-19 Vaccine Projections The site has several interactive graphs related to US COVID vaccinations including a breakdown of how many have had one shot, and how many have had both shots.

The US is now averaging close to 2.0 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,434,298 test results reported over the last 24 hours.

There were 77,737 positive tests. This is the fewest daily positive cases since October.

Over 23,000 US deaths have been reported in February. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.

The percent positive over the last 24 hours was 5.4%. The percent positive is calculated by dividing positive results by total tests (including pending).

Both cases and hospitalizations have peaked, but are declining from a very high level.

MBA Survey: "Share of Mortgage Loans in Forbearance Declines to 5.35%"

by Calculated Risk on 2/08/2021 04:00:00 PM

Note: This is as of January 31st.

From the MBA: Share of Mortgage Loans in Forbearance Declines to 5.35%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 3 basis points from 5.38% of servicers’ portfolio volume in the prior week to 5.35% as of January 31, 2021. According to MBA’s estimate, 2.7 million homeowners are in forbearance plans.

...

“The share of loans in forbearance decreased at the end of January across all investor categories. Almost 14 percent of homeowners in forbearance were reported as current on their payments at the end of last month, but the share has declined nearly every month from 28 percent in May,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “While new forbearance requests increased slightly at the end of January, the rate of exits picked up somewhat but remained much lower than in recent months. We are anticipating a sharp increase in exits in March and April as borrowers hit the 12-month expiration of their forbearance plans.”

Fratantoni added, “The job market rebounded slightly in January following a decline in December, but there are still 6.5 percent fewer jobs in the U.S. economy compared to February 2020. The proportion of long-term unemployed also remains troubling, with 4 million people who have been actively looking for work for 27 weeks or more. These are the homeowners who are likely to still be in forbearance and need additional support until the job market recovers to a greater extent.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, then trended down - and has mostly moved sideways recently.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) increased relative to the prior week: from 0.06% to 0.07%."

Housing Inventory Weekly Update: At Record Lows

by Calculated Risk on 2/08/2021 02:15:00 PM

One of the key questions for 2021 is: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

Tracking inventory will be very important this year, and I'll be using some weekly sources.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Northwest Real Estate in January: Sales up 16% YoY, Inventory down 43% YoY

by Calculated Risk on 2/08/2021 12:24:00 PM

Note: Inventory is down sharply in the Northwest almost everywhere except Seattle. And inventory is low in Seattle too, but was even lower a year ago.

The Northwest Multiple Listing Service reported Pandemic presents new option for home buyers

as market “kept foot firmly on the accelerator”

Some brokers are reporting up to 40 private showings for a single listing, according to Scott. “To compete in today’s ultra-competitive market, we’re seeing some buyers front-loading their offer above the list price,” he reported, explaining, “This is done in an attempt to ‘stop the action’ and push the sellers to accept their offer before the set review date.”The press release is for the Northwest MLS area. There were 5,896 closed sales in January 2021, up 16.2% from 5,074 sales in January 2020. Inventory for the Northwest is down 43%.

“The ongoing combination of very low mortgage rates and escalating prices has both buyers and sellers taking advantage of the market. Buyers are finding well-priced homes in good condition, and sellers are seeing many multiple offer situations,” reported Dean Rebhuhn, broker-owner at Village Homes and Properties. Lower prices near I-5 locations in Lewis, Cowlitz, and Thurston counties continue to attract buyers, observed Rebhuhn, who credited job opportunities and desirable lifestyles as market drivers.

James Young, director of the Washington Center for Real Estate Research at the University of Washington, said the search for value in outer areas has continued unabated, despite further lockdowns in January. “It is difficult to think of the last time when nearly every Western Washington county with the exception of Clallam, King and Jefferson had double-digit percentage price growth,” he remarked. This year’s “extraordinarily low inventory” (down 43% overall) suggests continued price growth into the spring as demand remains high and interest rates remain low, according to Young.

“It is somewhat of a ‘prisoner’s dilemma’ for the housing market in Western Washington,” Young commented. “Those who own do not want to sell because there is little inventory to buy. They will stay put. Those who want to buy (and get on the housing ladder) cannot get into the market because there is little available for sale.”

emphasis added

In King County, sales were up 20.5% year-over-year, and active inventory was down 12% year-over-year.

In Seattle, sales were up 28.7% year-over-year, and inventory was UP 47% year-over-year. (inventory in Seattle was extremely low last year). This puts the months-of-supply in Seattle at just 1.6 months.