by Calculated Risk on 12/22/2020 08:35:00 AM

Tuesday, December 22, 2020

Q3 GDP Growth Revised up slightly to 33.4% Annual Rate

From the BEA: Gross Domestic Product (Third Estimate), Corporate Profits (Revised), and GDP by Industry, Third Quarter 2020

Real gross domestic product (GDP) increased at an annual rate of 33.4 percent in the third quarter of 2020, according to the "third" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP decreased 31.4 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised up to 41.0% from 40.6%. Residential investment was revised up from 62.3% to 63.0%. This was at the consensus forecast.

The “third” estimate of GDP released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 33.1 percent. The upward revision primarily reflected larger increases in personal consumption expenditures (PCE) and nonresidential fixed investment

emphasis added

Monday, December 21, 2020

Tuesday: Existing Home Sales, Q3 GDP

by Calculated Risk on 12/21/2020 09:27:00 PM

Tuesday:

• At 8:30 AM ET, Gross Domestic Product, 3nd quarter 2020 (Third estimate). The consensus is that real GDP increased 33.1% annualized in Q3, unchanged from the second estimate of GDP.

• At 10:00 AM, Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 6.70 million SAAR, down from 6.85 million. Housing economist Tom Lawler expects the NAR to report sales of 6.50 million SAAR for November.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for December.

December 21 COVID-19 Test Results; Record Hospitalizations, Record 7-Day Deaths

by Calculated Risk on 12/21/2020 07:12:00 PM

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 2,076,374 test results reported over the last 24 hours.

There were 178,191 positive tests.

Over 51,000 US deaths have been reported so far in December. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.6% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

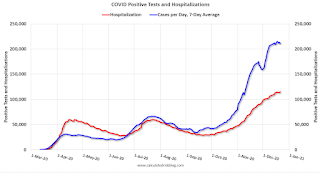

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record Hospitalizations

• Record 7 Day Average Deaths

December Vehicle Sales Forecast: "Rise Slightly from November"; Annual Sales Down 16% from 2019

by Calculated Risk on 12/21/2020 04:34:00 PM

From Wards: December U.S. Light-Vehicle Sales Forecast to Rise Slightly from November (pay content)

This graph shows actual sales from the BEA (Blue), and Wards forecast for December (Red).

Sales have bounced back from the April low, but will likely be down around 6% year-over-year in December.

The Wards forecast of 15.8 million SAAR, would be up about 2% from November.

This would put annual sales in 2020 down about 16% compared to 2019.

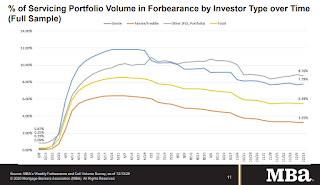

MBA Survey: "Share of Mortgage Loans in Forbearance Increases to 5.49%"

by Calculated Risk on 12/21/2020 04:00:00 PM

Note: This is as of December 13th.

From the MBA: Share of Mortgage Loans in Forbearance Increases to 5.49%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance increased slightly from 5.48% of servicers’ portfolio volume in the prior week to 5.49% as of December 13, 2020. According to MBA’s estimate, 2.7 million homeowners are in forbearance plans.

...

The share of loans in forbearance has stayed fairly level since early November, often with small decreases in the GSE loan share and increases for Ginnie Mae loans. That was the case last week. Additionally, forbearance requests from Ginnie Mae borrowers reached the highest level since the week ending June 14,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Additional restrictions on businesses and rising COVID-19 cases are causing a renewed increase in layoffs and other signs of slowing economic activity. These troubling trends will likely result in more homeowners seeking relief.”

...

By stage, 18.78% of total loans in forbearance are in the initial forbearance plan stage, while 78.54% are in a forbearance extension. The remaining 2.69% are forbearance re-entries.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has generally been trending down.

The MBA notes: "Weekly forbearance requests as a percent of servicing portfolio volume (#) remained flat from the previous week at 0.12 percent."

Chicago Fed National Activity "Index Suggests Slower, but Still Slightly Above-Average Growth in November"

by Calculated Risk on 12/21/2020 01:12:00 PM

Note: This is a composite index of other data.

From the Chicago Fed: Index Suggests Slower, but Still Slightly Above-Average Growth in November

Led by slower growth in employment- and production-related indicators, the Chicago Fed National Activity Index (CFNAI) declined to +0.27 in November from +1.01 in October. Three of the four broad categories of indicators used to construct the index made positive contributions in November, but all four categories decreased from October. The index’s three-month moving average, CFNAI-MA3, decreased to +0.56 in November from +0.85 in OctoberThis graph from the Chicago Fed shows the Chicago Fed National Activity Index by category.

emphasis added

Click on graph for larger image.

Click on graph for larger image.According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Black Knight: National Mortgage Delinquency Rate Decreased in November

by Calculated Risk on 12/21/2020 10:40:00 AM

Note: Loans in forbearance are counted as delinquent in this survey, but those loans are not reported as delinquent to the credit bureaus.

From Black Knight: Black Knight: Delinquencies Improved Again in November 2020, But Nearly 2.2 Million Seriously Past-Due Mortgages Remain

• Despite seasonal headwinds, mortgage delinquencies improved for the sixth consecutive month in November 2020, falling to 6.33% from 6.44% in the month priorAccording to Black Knight's First Look report, the percent of loans delinquent decreased 1.8% in November compared to October, and increased 79% year-over-year.

• The national delinquency rate is now down 1.5 percentage points from its peak of 7.8% in May but remains a full three percentage points (+93%) above pre-pandemic levels

• While early-stage delinquencies – borrowers one or two payments past due – have fallen back below pre-pandemic levels, seriously past-due (90+ days) mortgages remain 1.8 million above pre-pandemic levels

• Foreclosure activity remains muted as widespread moratoriums remain in place

• November’s 4,400 foreclosure starts and 176,000 loans in active foreclosure are both at their lowest levels on record since Black Knight began reporting the metrics in 2000

• Prepayments fell 11% from October’s 16-year high; however, with interest rates at record lows and refinance incentive at an all-time high, prepay activity is likely to remain elevated in the coming months

emphasis added

The percent of loans in the foreclosure process decreased 1.6% in November and were down 30% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 6.33% in November, down from 6.44% in October.

The percent of loans in the foreclosure process decreased slightly in November to 0.33%, from 0.33% in October.

The number of delinquent properties, but not in foreclosure, is up 1,513,000 properties year-over-year, and the number of properties in the foreclosure process is down 72,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Nov 2020 | Oct 2020 | Nov 2019 | Nov 2018 | |

| Delinquent | 6.33% | 6.44% | 3.53% | 3.71% |

| In Foreclosure | 0.33% | 0.33% | 0.47% | 0.52% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 3,381,000 | 3,437,000 | 1,868,000 | 1,925,000 |

| Number of properties in foreclosure pre-sale inventory: | 176,000 | 178,000 | 248,000 | 268,000 |

| Total Properties | 3,557,000 | 3,616,000 | 2,116,000 | 2,193,000 |

Seven High Frequency Indicators for the Economy

by Calculated Risk on 12/21/2020 08:23:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the vaccine is distributed.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

The dashed line is the percent of last year for the seven day average.

This data is as of December 20th.

The seven day average is down 63.8% from last year (36.2 of last year). (Dashed line)

There had been a slow increase from the bottom, but is now moving more sideways - with ups and downs due to the holidays.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through December 19, 2020.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Note that dining is generally lower in the northern states - Illinois, Pennsylvania, and New York - but declining in the southern states. Note that California dining is off sharply with the orders to close.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through December 17th.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through December 17th.Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales have picked up slightly over the last couple of months, but were down last week to $8 million (compared to usually as much as $400 million per week at this time of year).

Some movie theaters have reopened (probably with limited seating).

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels - prior to 2020).

This data is through December 12th. Hotel occupancy is currently down 37.4% year-over-year.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Since there is a seasonal pattern to the occupancy rate, we can track the year-over-year change in occupancy to look for any improvement. This table shows the year-over-year change since the week ending Sept 19, 2020:

| Week Ending | YoY Change, Occupancy Rate |

|---|---|

| 9/19 | -31.9% |

| 9/26 | -31.5% |

| 10/3 | -29.6% |

| 10/10 | -29.2% |

| 10/17 | -30.7% |

| 10/24 | -31.7% |

| 10/31 | -29.0% |

| 11/7 | -35.9% |

| 11/14 | -32.7% |

| 11/21 | -32.6% |

| 11/28 | -28.5% |

| 12/5 | -37.9% |

| 12/12 | -37.4% |

This suggests no improvement over the last few months.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week last year of .

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week last year of .At one point, gasoline supplied was off almost 50% YoY.

As of December 11th, gasoline supplied was off about 15.3% YoY (about 84.7% of last year).

Note: People driving instead of flying might have boosted gasoline consumption over the summer.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through December 19th for the United States and several selected cities.

This data is through December 19th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 45% of the January level. It is at 33% in Chicago, and 52% in Houston - and mostly trending down over the last few months.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is daily data for this year.

This graph is from Todd W Schneider. This is daily data for this year.This data is through Friday, December 18th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, December 20, 2020

Sunday Night Futures

by Calculated Risk on 12/20/2020 07:24:00 PM

Weekend:

• Schedule for Week of December 20, 2020

• Some thoughts on Housing Inventory

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for November. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 8 and DOW futures are up 100 (fair value).

Oil prices were up over the last week with WTI futures at $48.39 per barrel and Brent at $51.57 barrel. A year ago, WTI was at $60, and Brent was at $69 - so WTI oil prices are down about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.22 per gallon. A year ago prices were at $2.55 per gallon, so gasoline prices are down $0.33 per gallon year-over-year.

December 20 COVID-19 Test Results; Record 7-Day Deaths

by Calculated Risk on 12/20/2020 07:13:00 PM

The US is now averaging well over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,764,566 test results reported over the last 24 hours.

There were 194,988 positive tests.

Almost 50,000 US deaths have been reported so far in December. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 11.1% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record 7 Day Average Deaths