by Calculated Risk on 12/17/2020 03:16:00 PM

Thursday, December 17, 2020

Comments on November Housing Starts

Earlier: Housing Starts increased to 1.547 Million Annual Rate in November

Total housing starts in November were slightly above expectations, however starts in September and October were revised down, combined. The single family sectors has increased sharply, but the volatile multi-family sector is down year-over-year (apartments are under pressure from COVID).

The housing starts report showed starts were up 1.2% in November compared to October, and starts were up 12.8% year-over-year compared to November 2019.

Single family starts were up 27% year-over-year. Low mortgage rates and limited existing home inventory have given a boost to single family housing starts.

The first graph shows the month to month comparison for total starts between 2019 (blue) and 2020 (red).

Click on graph for larger image.

Click on graph for larger image.Starts were up 12.8% in November compared to November 2019.

Last year, in 2019, starts picked up at the end of the year - and were strong in early 2020 - so the comparison next month will be more difficult. Don't be surprised if starts are down year-over-year sometime over the next few months.

Starts, year-to-date, are up 7.0% compared to the same period in 2019. This is close to my forecast for 2020, although I didn't expect a pandemic!

I expect starts to remain solid, but the growth rate will slow.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions. The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - then mostly moved sideways. Completions (red line) had lagged behind - then completions caught up with starts- then starts picked up a little again late last year, but have fallen off the pandemic.

The last graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The last graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Single family starts are getting back to more normal levels, and I expect some further increases in single family starts and completions on rolling 12 month basis.

CAR on California November Housing: Sales up 26% YoY, Active Listings down 47% YoY

by Calculated Risk on 12/17/2020 01:32:00 PM

The CAR reported: Low rates, flexibility to work from home drive California home-buying interest to levels not seen since the last decade, C.A.R. reports

efying an otherwise struggling economy, California home sales remained red hot in November, breaking the 500,000 sales benchmark for the first time since January 2009 and reaching the highest level in 15 years, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.CR Note: Existing home sales are reported when the transaction closes, so this was mostly for contracts signed in September and October.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 508,820 units in November, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2020 if sales maintained the November pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

November sales rose 5.0 percent from 484,510 in October and were up 26.3 percent from a year ago, when 402,880 homes were sold on an annualized basis. The year-over-year, double-digit sales gain was the fourth consecutive and the largest yearly gain since May 2009.

...

On a year-to-date basis, sales in the Central Coast region has already surpassed 2019’s level by 4.3 percent, while Southern California (-0.7 percent), the San Francisco Bay Area (-1.2 percent), the Central Valley (-1.5 percent) and the Far North (-2.6 percent) continued to trail slightly behind last year’s level.

...

With a resurgence in COVID-19 cases in recent weeks and the market entering the traditional holiday season, active listings declined from the prior month as expected, contributing to a substantial decline in inventory. Active listings fell 46.6 percent from last year and continued to drop more than 40 percent on a year-over-year basis for the sixth straight month. The Unsold Inventory Index (UII) fell sharply from 3.1 months in November 2019 to 1.9 months this November. The index indicates the number of months it would take to sell the supply of homes on the market at the current rate of sales.

emphasis added

Hotels: Occupancy Rate Declined 37.4% Year-over-year

by Calculated Risk on 12/17/2020 11:18:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 12 December

U.S. weekly hotel occupancy remained relatively flat from the previous week, according to the latest data from STR through 12 December.Since there is a seasonal pattern to the occupancy rate - see graph below - we can track the year-over-year change in occupancy to look for any improvement. This table shows the year-over-year change since the week ending Sept 19, 2020:

6-12 December 2020 (percentage change from comparable week in 2019):

• Occupancy: 37.8% (-37.4%)

• Average daily rate (ADR): US$85.88 (-31.7%)

• Revenue per available room (RevPAR): US$32.49 (-57.3%)

emphasis added

| Week Ending | YoY Change, Occupancy Rate |

|---|---|

| 9/19 | -31.9% |

| 9/26 | -31.5% |

| 10/3 | -29.6% |

| 10/10 | -29.2% |

| 10/17 | -30.7% |

| 10/24 | -31.7% |

| 10/31 | -29.0% |

| 11/7 | -35.9% |

| 11/14 | -32.7% |

| 11/21 | -32.6% |

| 11/28 | -28.5% |

| 12/5 | -37.9% |

| 12/12 | -37.4% |

This suggests no improvement over the last 3 months.

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels - before 2020).

Seasonally we'd expect the occupancy rate to decline into the new year.

Note: Y-axis doesn't start at zero to better show the seasonal change.

Philly Fed Manufacturing "growth was less widespread" in December, Kansas City Fed "Activity Expanded Further"

by Calculated Risk on 12/17/2020 11:05:00 AM

From the Philly Fed: December 2020 Manufacturing Business Outlook Survey

Manufacturing activity in the region continued to grow, but growth was less widespread, according to firms responding to the December Manufacturing Business Outlook Survey. The survey’s current indicators for general activity, new orders, and shipments remained positive for the seventh consecutive month but fell notably from their readings in November. Some future indexes also moderated this month but continue to indicate that firms expect growth over the next six months.This was lower than the consensus forecast.

The diffusion index for current activity fell 15 points to 11.1 in December, its lowest positive reading following its fall to long-term lows in April and May... On balance, fewer firms reported increases in manufacturing employment this month. The current employment index has remained positive for six consecutive months but decreased 19 points to 8.5 in December.

emphasis added

And from the Kansas City Fed: Tenth District Manufacturing Activity Expanded Further

The Federal Reserve Bank of Kansas City released the December Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded further in December. Manufacturing activity was still below year ago levels, but expectations for future activity were positive.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

“Regional factories reported another month of solid growth, but activity continues to lag preCOVID levels,” said Wilkerson. “The recent wave of COVID-19 has negatively affected manufacturers, but many firms still indicated significant capital spending plans for the coming year.”

...

The month-over-month composite index was 14 in December, up from 11 in November and 13 in October

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (blue, through December), and five Fed surveys are averaged (yellow, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through November (right axis).

These early reports suggest the ISM manufacturing index will show expansion in December, but will likely decrease from the November level.

Weekly Initial Unemployment Claims increased to 885,000

by Calculated Risk on 12/17/2020 08:48:00 AM

The DOL reported:

In the week ending December 12, the advance figure for seasonally adjusted initial claims was 885,000, an increase of 23,000 from the previous week's revised level. The previous week's level was revised up by 9,000 from 853,000 to 862,000. The 4-week moving average was 812,500, an increase of 34,250 from the previous week's revised average. The previous week's average was revised up by 2,250 from 776,000 to 778,250.This does not include the 455,037 initial claims for Pandemic Unemployment Assistance (PUA) that was up from 415,037 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 812,500.

The previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims decreased to 5,508,000 (SA) from 5,781,000 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 9,244,556 receiving Pandemic Unemployment Assistance (PUA) that increased from 8,555,763 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

This was much higher than expected, and this was for the BLS reference week for the December employment report.

Housing Starts increased to 1.547 Million Annual Rate in November

by Calculated Risk on 12/17/2020 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in November were at a seasonally adjusted annual rate of 1,547,000. This is 1.2 percent above the revised October estimate of 1,528,000 and is 12.8 percent above the November 2019 rate of 1,371,000. Single-family housing starts in November were at a rate of 1,186,000; this is 0.4 percent above the revised October figure of 1,181,000. The November rate for units in buildings with five units or more was 352,000.

Building Permits:

Privately-owned housing units authorized by building permits in November were at a seasonally adjusted annual rate of 1,639,000. This is 6.2 percent above the revised October rate of 1,544,000 and is 8.5 percent above the November 2019 rate of 1,510,000. Single-family authorizations in November were at a rate of 1,143,000; this is 1.3 percent above the revised October figure of 1,128,000. Authorizations of units in buildings with five units or more were at a rate of 441,000 in November.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased slightly in November compared to October. Multi-family starts were down 18% year-over-year in November.

Single-family starts (blue) increased in November, and were up 27% year-over-year. This is the highest level for single family starts since 2007.

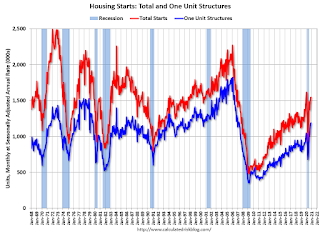

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then eventual recovery (but still historically low).

Total housing starts in November were slightly above expectations, however starts in September and October were revised down, combined.

I'll have more later …

Wednesday, December 16, 2020

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 12/16/2020 09:16:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 815,000 initial claims, down from 853,000 last week.

• Also at 8:30 AM, Housing Starts for November. The consensus is for 1.530 million SAAR, unchanged from 1.530 million SAAR.

• Also at 8:30 AM, the Philly Fed manufacturing survey for December. The consensus is for a reading of 19.0, down from 26.3.

• At 11:00 AM, the Kansas City Fed manufacturing survey for December.

December 16 COVID-19 Test Results; Record 7-Day Deaths, Hospitalizations

by Calculated Risk on 12/16/2020 07:10:00 PM

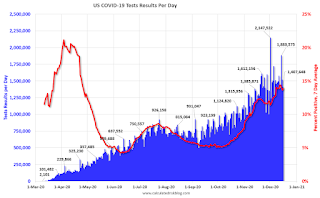

The US is now averaging well over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,407,648 test results reported over the last 24 hours.

There were 230,728 positive tests.

Over 39,000 US deaths have been reported so far in December. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 16.4% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

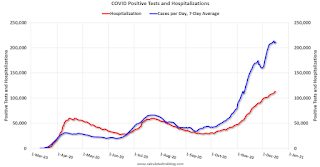

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record Hospitalizations (Over 113,000)

• Record 7 Day Average Deaths

FOMC Projections and Press Conference

by Calculated Risk on 12/16/2020 02:08:00 PM

Statement here.

Fed Chair Powell press conference video here starting at 2:30 PM ET.

Here are the projections.

Note that GDP decreased at a 5.0% annual rate in Q1, decreased at a 31.4% annual rate in Q2, and increased at 33.1% annual rate in Q3. This leaves real GDP down 3.5% from Q4 2019.

Wall Street forecasts are for GDP to increase at a 5% to 6% annual rate in Q4. These forecasts would put the economy down around 2.1% to 2.3% Q4-over-Q4. The FOMC revised up their GDP projections for 2020, 2021 and 2022.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Dec 2020 | -2.5 to -2.2 | 3.7 to 5.0 | 3.0 to 3.5 | 2.2 to 2.7 |

| Sept 2020 | -4.0 to -3.0 | 3.6 to 4.7 | 2.5 to 3.3 | 2.4 to 3.0 |

The unemployment rate was at 6.7% in November, down from 6.9% in October, and might decrease more in December. This will put the unemployment rate for Q4 below the lower end of the September projections.

The unemployment rate was revised down for all years.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Dec 2020 | 6.7 to 6.8 | 4.7 to 5.4 | 3.8 to 4.6 | 3.5 to 4.3 |

| Sept 2020 | 7.0 to 8.0 | 5.0 to 6.2 | 4.0 to 5.0 | 3.5 to 4.4 |

As of October 2020, PCE inflation was up 1.2% from October 2019. The projections for inflation were revised up slightly.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Dec 2020 | 1.2 | 1.7 to 1.9 | 1.8 to 2.0 | 1.9 to 2.1 |

| Sept 2020 | 1.1 to 1.3 | 1.6 to 1.9 | 1.7 to 1.9 | 1.9 to 2.0 |

PCE core inflation was up 1.4% in October year-over-year. Projections for core inflation were revised up slightly.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Dec 2020 | 1.4 | 1.7 to 1.8 | 1.8 to 2.0 | 1.9 to 2.1 |

| Sept 2020 | 1.3 to 1.5 | 1.6 to 1.8 | 1.7 to 1.9 | 1.9 to 2.0 |

FOMC Statement: No Change

by Calculated Risk on 12/16/2020 02:02:00 PM

Fed Chair Powell press conference video here starting at 2:30 PM ET.

FOMC Statement:

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

The COVID-19 pandemic is causing tremendous human and economic hardship across the United States and around the world. Economic activity and employment have continued to recover but remain well below their levels at the beginning of the year. Weaker demand and earlier declines in oil prices have been holding down consumer price inflation. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy will depend significantly on the course of the virus. The ongoing public health crisis will continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer-term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In addition, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee's maximum employment and price stability goals. These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Patrick Harker; Robert S. Kaplan; Neel Kashkari; Loretta J. Mester; and Randal K. Quarles.

emphasis added