by Calculated Risk on 12/16/2020 10:59:00 AM

Wednesday, December 16, 2020

AIA: "Architecture billings lose ground in November"

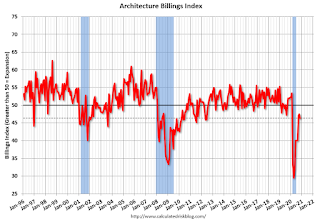

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture billings lose ground in November

Architecture firm billing activity is contracting once again after two months of a slowing decline, according to a new report from the American Institute of Architects (AIA).

The pace of decline during November accelerated from October, posting an Architecture Billings Index (ABI) score of 46.3 from 47.5 (any score below 50 indicates a decline in firm billings). The pace of inquiries into new projects slowed, but remained positive with a score of 52.0, however the value of new design contracts dipped back into negative territory with a score 48.6.

“In previous design cycles, we typically haven’t seen a straight line back to growth after a downturn hits,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “The path to recovery is shaping up to be bumpier than we hoped for. While there are pockets of optimism in design services demand, the overall construction landscape remains depressed.”

...

• Regional averages: Midwest (50.1); West (48.3); South (46.7); Northeast (38.7)

• Sector index breakdown: multi-family residential (52.2); mixed practice (49.5); commercial/industrial (47.5); institutional (41.9)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 46.3 in November, down from 47.5 in October. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index has been below 50 for nine consecutive months. This represents a significant decrease in design services, and suggests a decline in CRE investment through most of 2021 (This usually leads CRE investment by 9 to 12 months).

This weakness is not surprising since certain segments of CRE are struggling, especially offices and retail.

NAHB: Builder Confidence Decreased to 86 in December

by Calculated Risk on 12/16/2020 10:04:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 86, down from 90 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Down from Record High, Still Strong

Ending a string of three successive months of record highs, builder confidence in the market for newly built single-family homes fell four points to 86 in December, according to the latest NAHB/Wells Fargo Housing Market Index (HMI) released today. Despite the decline, this is still the second-highest reading in the history of the series after last month’s mark of 90.

“Housing demand is strong entering 2021, however the coming year will see housing affordability challenges as inventory remains low and construction costs are rising,” said NAHB Chairman Chuck Fowke. “Policymakers should take note to avoid increasing regulatory costs associated with land development and residential construction.”

“Builder confidence fell back from historic levels in December, as housing remains a bright spot for a recovering economy,” said NAHB Chief Economist Robert Dietz. “The issues that have limited housing supply in recent years, including land and material availability and a persistent skilled labor shortage, will continue to place upward pressure on construction costs. As the economy improves with the deployment of a COVID-19 vaccine, interest rates will increase in 2021, further challenging housing affordability in the face of strong demand for single-family homes.”

...

The HMI index gauging current sales conditions dropped four points to 92, the component measuring sales expectations in the next six months fell four points to 85 and the gauge charting traffic of prospective buyers also decreased four points to 73.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell one point to 82, the Midwest was up one point to 81, the South rose one point to 87 and the West increased two points to 96.

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was close to the consensus forecast.

Housing and homebuilding have been one of the best performing sectors during the pandemic.

Retail Sales decreased 1.1% in November

by Calculated Risk on 12/16/2020 08:39:00 AM

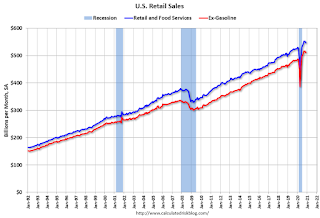

On a monthly basis, retail sales decreased 1.1 percent from October to November (seasonally adjusted), and sales were up 4.1 percent from November 2019.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for November 2020, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $546.5 billion, a decrease of 1.1 percent from the previous month, but 4.1 percent above November 2019. Total sales for the September 2020 through November 2020 period were up 5.2 percent from the same period a year ago. The September 2020 to October 2020 percent change was revised from up 0.3 percent to down 0.1 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 1.0% in November.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 5.9% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 5.9% on a YoY basis.The decrease in November was well below expectations, and sales in October were revised down (September was revised up).

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 12/16/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 11, 2020.

... The Refinance Index increased 1 percent from the previous week and was 105 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 26 percent higher than the same week one year ago.

“U.S. Treasury rates stayed low last week, in part due to uncertainty over the prospects of additional pandemic-related government stimulus, as well as concerns about the continued rise in COVID-19 cases across the country. Mortgage rates as a result fell to another survey low, with the 30-year fixed mortgage rate dropping five basis points to 2.85 percent,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Homeowners once again acted on the decline in rates, with refinance activity rising for the second straight week and up 105 percent from a year ago.”

Added Kan, “The ongoing strength in the housing market has carried into December. Applications to buy a home increased for the fourth time in five weeks, as both conventional and government segments of the market saw gains. Government purchase applications rose for the sixth straight week to the highest level since June – perhaps a sign that more first-time buyers are entering the market.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to a survey low of 2.85 percent from 2.90 percent, with points decreasing to 0.33 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index remains up significantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 26% year-over-year unadjusted.

Note: Red is a four-week average (blue is weekly).

Tuesday, December 15, 2020

Wednesday: Retail Sales, Homebuilder Confidence, FOMC Statement

by Calculated Risk on 12/15/2020 09:32:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for November will be released. The consensus is for a 0.3% decrease in retail sales.

• At 10:00 AM, The December NAHB homebuilder survey. The consensus is for a reading of 88, down from 90. Any number above 50 indicates that more builders view sales conditions as good than poor.

• During the day, The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Meeting Announcement. No change to rate policy is expected at this meeting.

• At 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

December 15 COVID-19 Test Results; Record 7-Day Deaths, Hospitalizations

by Calculated Risk on 12/15/2020 07:28:00 PM

The US is now averaging well over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,480,147 test results reported over the last 24 hours.

There were 189,783 positive tests.

Almost 36,000 US deaths have been reported so far in December. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 12.8% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record Hospitalizations (Over 112,000)

• Record 7 Day Average Deaths

LA Area Port Traffic: Strong Imports, Weak Exports in November

by Calculated Risk on 12/15/2020 01:29:00 PM

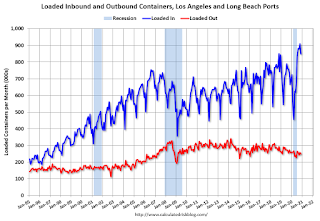

Note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 2.2% in November compared to the rolling 12 months ending in September. Outbound traffic was down 0.5% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were up 28% YoY in November, and exports were down 5% YoY.

Denver Real Estate in November: Sales Up 18% YoY, Active Inventory Down 63%

by Calculated Risk on 12/15/2020 11:37:00 AM

From the DMAR: Monthly Indicators, November 2020

The number of single family homes sold in November increased to 4,647, up 15.2% from 4,033 in November 2019.

Active listings are at 2,965, down 69.2% from 9,626 in November 2019.

Sales to date are up 7.3% compared to 2019.

For condos, 1,753 were sold in November, up 26.0% from 1,391 in November 2019.

Active listings are at 1,927, down 48.4% from 3,737 in November 2019.

Condo sales to date are up 7.1% compared to 2019.

Industrial Production Increased 0.4 Percent in November; 5% Below Pre-Crisis Level

by Calculated Risk on 12/15/2020 09:22:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production increased 0.4 percent in November. After having fallen 16.5 percent between February and April, the level of the index has risen to about 5 percent below its pre-pandemic (February) reading. In November, manufacturing output advanced 0.8 percent for its seventh consecutive monthly gain. An increase of 5.3 percent for motor vehicles and parts contributed significantly to the gain in factory production; excluding motor vehicles and parts, manufacturing output moved up 0.4 percent. The output of utilities declined 4.3 percent, as warmer-than-usual temperatures reduced the demand for heating. Mining production increased 2.3 percent after decreasing 0.7 percent in October.

At 104.0 percent of its 2012 average, total industrial production was 5.5 percent lower in November than it was a year earlier. Capacity utilization for the industrial sector increased 0.3 percentage point in November to 73.3 percent, a rate that is 6.5 percentage points below its long-run (1972–2019) average but 9.1 percentage points above its low in April.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April, but still well below the level in February 2020.

Capacity utilization at 73.3% is 6.5% below the average from 1972 to 2017.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in October to 104.0. This is 4.9% below the February 2020 level.

The change in industrial production was close to consensus expectations, and industrial production in September and October were revised up slightly.

NY Fed: Manufacturing: Business activity "edged slightly higher" in New York State in December

by Calculated Risk on 12/15/2020 08:33:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity edged slightly higher in New York State, according to firms responding to the December 2020 Empire State Manufacturing Survey. The headline general business conditions index was little changed at 4.9. New orders increased marginally, and shipments were modestly higher. Inventories continued to move lower, and delivery times edged up. Employment posted its strongest gain in months, and the average workweek lengthened somewhat. Input prices increased at the fastest pace in two years, while selling prices increased at about the same pace as last month. Looking ahead, firms remained optimistic that conditions would improve over the next six months.This was below expectations, and showed activity "edged slightly higher" in December.

...

The index for number of employees rose five points to 14.2, its highest level in over a year, pointing to ongoing significant gains in employment. The average workweek index was unchanged at 4.8, signaling a small increase in hours worked.

emphasis added