by Calculated Risk on 12/15/2020 07:28:00 PM

Tuesday, December 15, 2020

December 15 COVID-19 Test Results; Record 7-Day Deaths, Hospitalizations

The US is now averaging well over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,480,147 test results reported over the last 24 hours.

There were 189,783 positive tests.

Almost 36,000 US deaths have been reported so far in December. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 12.8% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record Hospitalizations (Over 112,000)

• Record 7 Day Average Deaths

LA Area Port Traffic: Strong Imports, Weak Exports in November

by Calculated Risk on 12/15/2020 01:29:00 PM

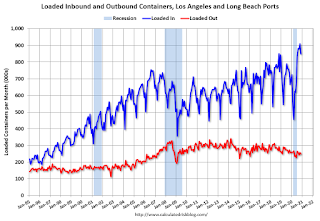

Note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 2.2% in November compared to the rolling 12 months ending in September. Outbound traffic was down 0.5% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were up 28% YoY in November, and exports were down 5% YoY.

Denver Real Estate in November: Sales Up 18% YoY, Active Inventory Down 63%

by Calculated Risk on 12/15/2020 11:37:00 AM

From the DMAR: Monthly Indicators, November 2020

The number of single family homes sold in November increased to 4,647, up 15.2% from 4,033 in November 2019.

Active listings are at 2,965, down 69.2% from 9,626 in November 2019.

Sales to date are up 7.3% compared to 2019.

For condos, 1,753 were sold in November, up 26.0% from 1,391 in November 2019.

Active listings are at 1,927, down 48.4% from 3,737 in November 2019.

Condo sales to date are up 7.1% compared to 2019.

Industrial Production Increased 0.4 Percent in November; 5% Below Pre-Crisis Level

by Calculated Risk on 12/15/2020 09:22:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production increased 0.4 percent in November. After having fallen 16.5 percent between February and April, the level of the index has risen to about 5 percent below its pre-pandemic (February) reading. In November, manufacturing output advanced 0.8 percent for its seventh consecutive monthly gain. An increase of 5.3 percent for motor vehicles and parts contributed significantly to the gain in factory production; excluding motor vehicles and parts, manufacturing output moved up 0.4 percent. The output of utilities declined 4.3 percent, as warmer-than-usual temperatures reduced the demand for heating. Mining production increased 2.3 percent after decreasing 0.7 percent in October.

At 104.0 percent of its 2012 average, total industrial production was 5.5 percent lower in November than it was a year earlier. Capacity utilization for the industrial sector increased 0.3 percentage point in November to 73.3 percent, a rate that is 6.5 percentage points below its long-run (1972–2019) average but 9.1 percentage points above its low in April.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April, but still well below the level in February 2020.

Capacity utilization at 73.3% is 6.5% below the average from 1972 to 2017.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in October to 104.0. This is 4.9% below the February 2020 level.

The change in industrial production was close to consensus expectations, and industrial production in September and October were revised up slightly.

NY Fed: Manufacturing: Business activity "edged slightly higher" in New York State in December

by Calculated Risk on 12/15/2020 08:33:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity edged slightly higher in New York State, according to firms responding to the December 2020 Empire State Manufacturing Survey. The headline general business conditions index was little changed at 4.9. New orders increased marginally, and shipments were modestly higher. Inventories continued to move lower, and delivery times edged up. Employment posted its strongest gain in months, and the average workweek lengthened somewhat. Input prices increased at the fastest pace in two years, while selling prices increased at about the same pace as last month. Looking ahead, firms remained optimistic that conditions would improve over the next six months.This was below expectations, and showed activity "edged slightly higher" in December.

...

The index for number of employees rose five points to 14.2, its highest level in over a year, pointing to ongoing significant gains in employment. The average workweek index was unchanged at 4.8, signaling a small increase in hours worked.

emphasis added

Monday, December 14, 2020

Tuesday: Industrial Production, NY Fed Mfg

by Calculated Risk on 12/14/2020 09:04:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Barely Higher For Some; Lower For Others

What do you get when you add a modest amount of cost to the average mortgage rate from last Friday? Rates that are still effectively right in line with all-time lows. ... Purchase rates (30yr fixed, conventional, top tier) are in the 2.375-2.625% range while refinance rates are another 0.25% higher for most lenders (some have even bigger gaps between purchase and refi rates).Tuesday:

emphasis added

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of 6.8, up from 6.3.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for November. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 72.9%.

December 14 COVID-19 Test Results; Record 7-Day Cases and Deaths, Record Hospitalizations

by Calculated Risk on 12/14/2020 07:32:00 PM

The US is now averaging well over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,883,575 test results reported over the last 24 hours.

There were 193,384 positive tests.

Almost 33,000 US deaths have been reported so far in December. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 10.3% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record Hospitalizations (Over 110,000)

• Record 7 Day Average Cases

• Record 7 Day Average Deaths

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 5.48%", More Borrowers Seeking Relief

by Calculated Risk on 12/14/2020 04:00:00 PM

Note: This is as of December 6th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 5.48%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased from 5.54% of servicers’ portfolio volume in the prior week to 5.48% as of December 6, 2020. According to MBA’s estimate, 2.7 million homeowners are in forbearance plans.

...

“The share of loans in forbearance decreased in the first week of December. However, more borrowers sought relief, with new forbearance requests reaching their highest level since the week ending August 2, and servicer call volume hitting its highest level since the week ending April 19,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Compared to the last two months, more homeowners exiting forbearance are using a modification – a sign that they have not been able to fully get back on their feet, even if they are working again.”

Added Fratantoni, “The latest economic data is showing a slowdown, particularly an increase in layoffs and long-term unemployment. Coupled with the latest surge in COVID-19 cases, it is not surprising to see more homeowners seeking relief.”

...

By stage, 18.72% of total loans in forbearance are in the initial forbearance plan stage, while 78.72% are in a forbearance extension. The remaining 2.56% are forbearance re-entries.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has been trending down for the last few months.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) increased relative to the prior week: from 0.08% to 0.12%. ... As a percent of servicing portfolio volume (#), calls increased from the previous week from 5.3% to 9.4%."

Phoenix Real Estate in November: Sales Up 27.4% YoY, Active Inventory Down 45% YoY

by Calculated Risk on 12/14/2020 01:37:00 PM

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales were at 8,886 in November, down from 9,690 in October, and up from 6,974 in November 2019. Sales were down 8.3% from October 2020 (last month), and up 27.4% from November 2019.

2) Active inventory was at 7,564, down from 13,675 in November 2019. That is down 45% year-over-year.

3) Months of supply decreased to 1.40 in November from 1.41 in October. This is very low.

Sales are reported at the close of escrow, so these sales were mostly signed in September and October.

The Employment Situation is Worse than the Headline Unemployment Rate Suggests

by Calculated Risk on 12/14/2020 11:33:00 AM

The headline unemployment rate has fallen to 6.7% in November, but that significantly understates the current situation. Note that the headline unemployment rate was 3.5% at the end of 2019.

Here is a table that shows the current number of unemployed and the unemployment rate. Then I calculated the unemployment rate by including the number of people that have left the labor force since early 2020, and the expected growth in the labor force.

| Number (000s) | Unemployment Rate | |

|---|---|---|

| Unemployed | 10,735 | 6.7% |

| Left Labor Force | 4,139 | 9.0% |

| Expected Labor Force Growth | 1,000 | 9.6% |

This is just the headline unemployment rate. There are also 2.3 million additional involuntary part time workers than in February (these workers are included in U-6).

Note: I'd be careful looking at the weekly initial claims report in addition to the BLS report. The weekly claims report suggests there are millions of workers receiving pandemic assistance, but this should be captured in the BLS household surveys (so I wouldn't add the numbers together).