by Calculated Risk on 12/14/2020 08:19:00 AM

Monday, December 14, 2020

Seven High Frequency Indicators for the Economy

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the vaccine is distributed.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

The dashed line is the percent of last year for the seven day average.

This data is as of December 13th.

The seven day average is down 67.9% from last year (32.1% of last year). (Dashed line)

There had been a slow increase from the bottom, but has declined since Thanksgiving.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through December 5, 2020.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Note that dining is generally lower in the northern states - Illinois, Pennsylvania, and New York - but declining in the southern states. Note that California dining is off sharply with new orders to close.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through December 10th.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through December 10th.Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales have picked up slightly over the last couple of months, but were down last week to $10 million (compared to usually around $125 million per week at this time of year).

Some movie theaters have reopened (probably with limited seating).

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels - prior to 2020).

This data is through December 5th. Hotel occupancy is currently down 37.9% year-over-year.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Since there is a seasonal pattern to the occupancy rate, we can track the year-over-year change in occupancy to look for any improvement. This table shows the year-over-year change since the week ending Sept 19, 2020:

| Week Ending | YoY Change, Occupancy Rate |

|---|---|

| 9/19 | -31.9% |

| 9/26 | -31.5% |

| 10/3 | -29.6% |

| 10/10 | -29.2% |

| 10/17 | -30.7% |

| 10/24 | -31.7% |

| 10/31 | -29.0% |

| 11/7 | -35.9% |

| 11/14 | -32.7% |

| 11/21 | -32.6% |

| 11/28 | -28.5% |

| 11/28 | -37.9% |

This suggests no improvement over the last few months.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week last year of .

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week last year of .At one point, gasoline supplied was off almost 50% YoY.

As of December 4th, gasoline supplied was off about 14.4% YoY (about 85.6% of last year).

Note: People driving instead of flying might have boosted gasoline consumption over the summer.

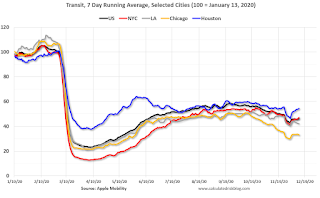

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through December 12th for the United States and several selected cities.

This data is through December 12th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 46% of the January level. It is at 33% in Chicago, and 54% in Houston - and mostly up slightly over the last couple of weeks.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is daily data for this year.

This graph is from Todd W Schneider. This is daily data for this year.This data is through Friday, December 11th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, December 13, 2020

Sunday Night Futures

by Calculated Risk on 12/13/2020 09:29:00 PM

Weekend:

• Schedule for Week of December 13, 2020

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 20 and DOW futures are up 160 (fair value).

Oil prices were up over the last week with WTI futures at $46.76 per barrel and Brent at $50.15 barrel. A year ago, WTI was at $60, and Brent was at $67 - so WTI oil prices are down about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.15 per gallon. A year ago prices were at $2.57 per gallon, so gasoline prices are down $0.42 per gallon year-over-year.

December 13 COVID-19 Test Results; Record 7-Day Cases and Deaths, Record Hospitalizations

by Calculated Risk on 12/13/2020 07:31:00 PM

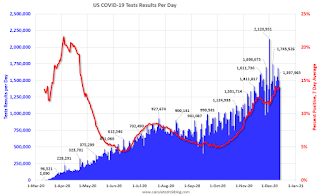

The US is now averaging well over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,397,965 test results reported over the last 24 hours.

There were 186,884 positive tests.

Over 31,000 US deaths have been reported so far in December. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 13.3% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

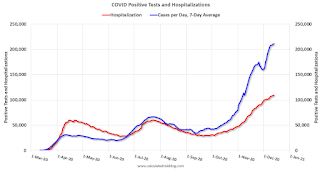

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• Record Hospitalizations (Over 109,000)

• Record 7 Day Average Cases

• Record 7 Day Average Deaths

FOMC Preview

by Calculated Risk on 12/13/2020 10:13:00 AM

Expectations are there will be no change to rate policy when the FOMC meets on Tuesday and Wednesday this week.

Here are some comments from Goldman Sachs economists David Mericle and Laura Nicolae:

"Fed officials are likely to see larger near-term risks but a brighter medium-term outlook as they head into their December meeting next week. The winter virus resurgence has grown much worse since the last meeting, but the vaccine news should inspire more confidence in 2021 recovery prospects than when Fed officials last wrote down projections in September.For review, here are the September FOMC projections.

We expect this brighter outlook to translate to slightly rosier economic projections including a 2021 growth forecast of just over 4% ... We also expect a somewhat lower unemployment rate path, but no changes to the inflation projections beyond this year.

...

Markets will be most focused on possible changes to the Fed’s asset purchase policy next week. The minutes to the November meeting indicate that the FOMC discussed both forward guidance for asset purchases and possible changes to the composition or size of asset purchases.

emphasis added

Note that GDP decreased at a 5.0% annual rate in Q1, decreased at a 31.4% annual rate in Q2, and increased at 33.1% annual rate in Q3. This leaves real GDP down 3.5% from Q4 2019.

Wall Street forecasts are for GDP to increase at a 5% to 6% annual rate in Q4. These forecasts would put the economy down around 2.1% to 2.3% Q4-over-Q4. That would be above the high end of their September forecast.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Sept 2020 | -4.0 to -3.0 | 3.6 to 4.7 | 2.5 to 3.3 | 2.4 to 3.0 |

The unemployment rate was at 6.7% in November, down from 6.9% in October, and might decrease more in December. This will put the unemployment rate for Q4 below the lower end of the September projections.

Note that the unemployment rate doesn't remotely capture the economic damage to the labor market. Not only are there 10.7 million people unemployed, and 4.1 million people have left the labor force since January. And millions more are being supported by various provisions of the CARES Act - that still hasn't been renewed and is schedule to expire on December 26th.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Sept 2020 | 7.0 to 8.0 | 5.0 to 6.2 | 4.0 to 5.0 | 3.5 to 4.4 |

As of October 2020, PCE inflation was up 1.2% from October 2019. This was in the middle of the September projections for Q4.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Sept 2020 | 1.1 to 1.3 | 1.6 to 1.9 | 1.7 to 1.9 | 1.9 to 2.0 |

PCE core inflation was up 1.4% in October year-over-year. This was also in the middle of the September projections for Q4. Note that inflation will not be a concern for the FOMC for the foreseeable future.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Sept 2020 | 1.3 to 1.5 | 1.6 to 1.8 | 1.7 to 1.9 | 1.9 to 2.0 |

Saturday, December 12, 2020

December 12 COVID-19 Test Results; Record 7-Day Cases, Record Hospitalizations

by Calculated Risk on 12/12/2020 07:55:00 PM

I'm looking forward to not posting this data in a few months. Please stay healthy!

The US is now averaging well over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,497,861 test results reported over the last 24 hours.

There were 223,365 positive tests.

Almost 30,000 US deaths have been reported so far in December. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 14.9% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• Record Hospitalizations (Over 108,000)

• Record 7 Day Average Cases

• Tied Yesterday for record 7 Day Average Deaths

Schedule for Week of December 13, 2020

by Calculated Risk on 12/12/2020 08:11:00 AM

The key economic reports this week are November Retail Sales and Housing Starts.

For manufacturing, November Industrial Production, and the December New York, Philly and Kansas City Fed surveys, will be released this week.

The FOMC meets this week, and no change to rate policy is expected.

No major economic releases scheduled.

8:30 AM: The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of 6.8, up from 6.3.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 72.9%.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Retail sales for November will be released. The consensus is for a 0.3% decrease in retail sales.

8:30 AM ET: Retail sales for November will be released. The consensus is for a 0.3% decrease in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 7.1% on a YoY basis.

10:00 AM: The December NAHB homebuilder survey. The consensus is for a reading of 88, down from 90. Any number above 50 indicates that more builders view sales conditions as good than poor.

During the day: The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. No change to rate policy is expected at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 815,000 initial claims, down from 853,000 last week.

8:30 AM: Housing Starts for November.

8:30 AM: Housing Starts for November. This graph shows single and total housing starts since 1968.

The consensus is for 1.530 million SAAR, unchanged from 1.530 million SAAR.

8:30 AM: the Philly Fed manufacturing survey for December. The consensus is for a reading of 19.0, down from 26.3.

11:00 AM: the Kansas City Fed manufacturing survey for December.

10:00 AM: State Employment and Unemployment (Monthly) for November

4:30 PM: the Federal Reserve is expected to release the Bank Stress Test Results

Friday, December 11, 2020

December 11 COVID-19 Test Results; Record 7-Day Cases and Deaths, Record Hospitalizations

by Calculated Risk on 12/11/2020 07:08:00 PM

I'm looking forward to not posting this data in a few months. Please stay healthy!

The US is now averaging well over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,682,010 test results reported over the last 24 hours.

There were 232,105 positive tests.

Over 27,000 US deaths have been reported so far in December. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 13.8% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• Record Hospitalizations (Over 108,000)

• Record 7 Day Average Cases

• Record 7 Day Average Deaths

Sacramento Housing in November: Sales increase 22% YoY, Active Inventory down 47% YoY

by Calculated Risk on 12/11/2020 03:30:00 PM

Note that November sales are for contracts typically signed in September and October.

From SacRealtor.org: November sales volume up 21% over 2019, demand remains

November ended with 1,511 sales, down 9.8% from the 1,676 sales in October. Compared to one year ago (1,242), the current figure is up 21.7%.

...

The Active Listing Inventory decreased 9.8% from October to November, from 1,253 units to 959 units. Compared with November 2019 (2,803), inventory is down 46.8%. The Months of Inventory dropped from .7 Months to .6 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory.

...

The Median DOM (days on market) increased from 6 to 7 and the Average DOM increased from 15 to 16. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.” Of the 1,511 sales this month, 86.2% (1,302) were on the market for 30 days or less and 95.1% (1,436) were on the market for 60 days or less.

emphasis added

Houston Real Estate in November: Sales Up 28% YoY, Inventory Down 27% YoY

by Calculated Risk on 12/11/2020 01:15:00 PM

From the HAR: Houston Housing Blazes its Way Through November

Homes across the greater Houston area continued selling at a record pace despite historically low inventory, the start of the holiday season and the lingering coronavirus pandemic. A low supply of homes for sale and strong demand from homebuyers combined to push the average price to record territory. Once again, the high end of the market generated the strongest increase in consumer activity with mid-range homes also selling briskly.Inventory declined 27.0% year-over-year from 41,022 in November 2019 to 29,948 in November 2020.

According to the latest Houston Association of Realtors (HAR) Market Update, 7,990 single-family homes sold in November compared to 6,359 a year earlier. That translates to a 25.6 percent increase and marks the sixth straight month of positive sales.

...

Sales of all property types totaled 9,660 – up 28.1 percent from November 2019. Total dollar volume for the month rose 43.9 percent to $3.1 billion. The lease market recorded an 11.1 percent decline in single-family housing while townhouse/condo leases fell 4.0 percent.

“In my 50 years in the real estate business, I have never seen a market defy supply and seasonality the way Houston has – amid a pandemic, no less,” said HAR Chairman John Nugent with RE/MAX Space Center. “It’s quite extraordinary to watch consumers take advantage of historically low interest rates and be able to choose their dream homes from among the tightest housing inventory this market has ever experienced.”

emphasis added

Note that the closed sales in November were for contracts that were mostly signed in September and October.

Q4 GDP Forecasts

by Calculated Risk on 12/11/2020 11:34:00 AM

Economic activity in the fourth quarter is dependent on the impact of the pandemic. With the number of new cases per day of COVID over 200,000, hospitalizations at record levels (over 100,000), and deaths per day at new record highs (over 3,000 the last two days), it is clear that economic activity will slow in December. Most of the slowdown will be related to individuals being more cautious, and some will be related to government actions.

However, economic activity was solid in October, and that would suggest PCE growth of close to 6% in Q4, even if November and December see no month-over-month growth. No one expects a lockdown like at the end of March and in April, but it is possible that activity slowed in November and will decline in December.

From Goldman Sachs:

We left our Q4 GDP tracking estimate unchanged at +5.0% (qoq ar) [Dec 9 estimate]From Merrill Lynch:

We continue to track 33.1% for 3Q GDP and 6.0% for 4Q GDP. [Dec 11 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.5% for 2020:Q4 and 5.9% for 2021:Q1. [Dec 11 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2020 is 11.2 percent on December 9, unchanged from December 4 after rounding. [Dec 9 estimate]