by Calculated Risk on 12/09/2020 07:44:00 PM

Wednesday, December 09, 2020

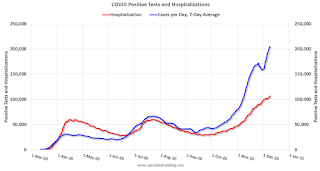

December 9 COVID-19 Test Results; Record 7-Day Cases, Hospitalizations, Over 3,000 Deaths

I'm looking forward to not posting this data in a few months. Please stay healthy!

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,454,192 test results reported over the last 24 hours.

There were 209,822 positive tests.

Over 21,000 US deaths have been reported so far in December. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 14.4% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• Record Hospitalizations (Over 106,000)

• Record 7 Day Average Cases

• Record 7 Day Average Deaths

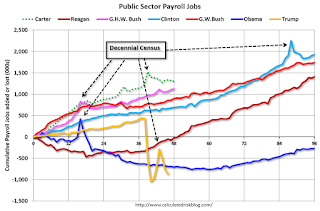

By Request: Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 12/09/2020 01:11:00 PM

Note: I usually post this monthly, but I hesitated recently due to the COVID-19 pandemic. But I've received a number of requests lately - the recent numbers are ugly.

Here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr. Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (46 months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 824,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 387,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 20,970,000 under President Clinton (light blue), by 14,714,000 under President Reagan (dark red), 9,039,000 under President Carter (dashed green), 1,511,000 under President G.H.W. Bush (light purple), and 11,849,000 under President Obama (dark blue).

During the 46 months of Mr. Trump's term, the economy has lost 2,128,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 277,000 jobs).

During the 46 months of Mr. Trump's term, the economy has lost 870,000 public sector jobs.

After 46 months of Mr. Trump's presidency, the economy has lost 2,998,000 jobs, about 12,581,000 behind the projection.

BLS: Job Openings "Little Changed" at 6.7 Million in October

by Calculated Risk on 12/09/2020 10:05:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 6.7 million on the last business day of October, the U.S. Bureau of Labor Statistics reported today. Hires were little changed at 5.8 million while total separations increased to 5.1 million. Within separations, the quits rate was unchanged at 2.2 percent while the layoffs and discharges rate increased to 1.2 percent.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for October, the most recent employment report was for November.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The huge spikes in layoffs and discharges in March and April 2020 are labeled, but off the chart to better show the usual data.

Jobs openings increased in October to 6.652 million from 6.494 million in September.

The number of job openings (yellow) were down 9.0% year-over-year.

Quits were down 10% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings were little changed in September, and are down YoY - and quits are down sharply YoY.

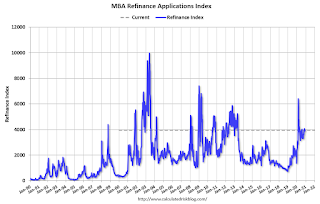

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 12/09/2020 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

— Mortgage applications decreased 1.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 4, 2020. The previous week’s results included an adjustment for the Thanksgiving holiday.

... The Refinance Index increased 2 percent from the previous week and was 89 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. The unadjusted Purchase Index increased 29 percentcompared with the previous week and was 22 percent higher than the same week one year ago.

“Refinance activity increased last week in response to mortgage rates for 30-year, 15-year, and FHA loans hitting their lowest levels in MBA’s survey. The increase in refinance applications was driven by FHA and VA refinances, while conventional activity fell slightly. The ongoing refinance wave has continued through the fall, with activity last week up 89 percent from a year ago,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The purchase market is also poised to finish 2020 on a strong note. Applications fell slightly last week but were around 3 percent higher than the two weeks leading up to Thanksgiving. Reversing the recent trend, there was also a shift in the composition of purchase applications, with an increase in government loans pushing the average loan balance lower.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to a survey low of 2.90 percent from 2.92 percent, with points increasing to 0.35 from 0.31 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index remains up significantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 22% year-over-year unadjusted.

Note: Red is a four-week average (blue is weekly).

Tuesday, December 08, 2020

Wednesday: Job Openings

by Calculated Risk on 12/08/2020 09:53:00 PM

From Matthew Graham at Mortgage News Daily: Refi Rates Are Finally Back to All-Time Lows

For some lenders, it was last week. For others, it was today. After months of waiting and multiple successive reports of all-time lows from other sources, the average lender is now finally back in line with the actual all-time lows seen on August 4th, 2020. [Top Tier Scenarios 30YR FIXED: 2.80%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Job Openings and Labor Turnover Survey for October from the BLS.

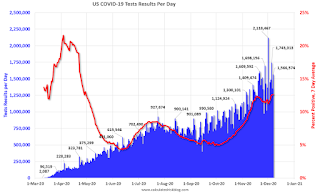

December 8 COVID-19 Test Results; Record 7-Day Cases, Deaths, Hospitalizations

by Calculated Risk on 12/08/2020 07:50:00 PM

I'm looking forward to not posting this data in a few months. Please stay healthy!

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,398,336 test results reported over the last 24 hours.

There were 213,498 positive tests.

Over 18,000 US deaths have been reported so far in December. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 15.3% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• Record Hospitalizations (Over 104,000)

• Record 7 Day Average Cases

• Record 7 Day Average Deaths

Seattle Real Estate in November: Sales up 22% YoY, Inventory UP 27% YoY

by Calculated Risk on 12/08/2020 01:52:00 PM

Note: Inventory is down sharply in the Northwest almost everywhere except Seattle. And inventory is low in Seattle too.

The Northwest Multiple Listing Service reported Northwest MLS brokers say real estate activity across Washington remains strong

The Northwest MLS report summarizing November activity shows strong year-over-year (YOY) increases in closed sales (up about 23%) and prices (up 13.8%). Pending sales (mutually accepted offers) rose 7.9% from a year ago, and the year’s saga of depleted inventory continued last month with the number of total listings down nearly 43%.The press release is for the Northwest MLS area. There were 8,875 closed sales in November 2020, up 23.0% from 7,216 sales in November 2019.

...

Windermere Chief Economist Matthew Gardner said even though the housing market has started to show some signs of its traditional winter slowdown “activity remains higher than we would normally see at this time of year. This isn’t too surprising given the fact that the spring selling season was essentially cancelled due to COVID-19.”

emphasis added

In King County, sales were up 23% year-over-year, and active inventory was down 18% year-over-year.

In Seattle, sales were up 22.2% year-over-year, and inventory was up 27% year-over-year.. This puts the months-of-supply in Seattle at just 1.7 months.

NMHC: Rent Payment Tracker Shows Households Paying Rent Decreased 7.8% YoY in Early December

by Calculated Risk on 12/08/2020 11:52:00 AM

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 75.4 percent of apartment households made a full or partial rent payment by December 6 in its survey of 11.5 million units of professionally managed apartment units across the country.

This is a 7.8 percentage point, or 894,864 household decrease from the share who paid rent through December 6, 2019 and compares to 80.4 percent that had paid by November 6, 2020. It should be noted that December 5th and 6th fell on a weekend in 2020 and therefore may not be a direct comparison to last year’s figures. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

"While the initial rent collection figures for the first week of December are concerning, only a full month's results will paint a complete picture. However, it should not come as a surprise that a rising number of households are struggling to make ends meet. As the nation enters a winter with increasing COVID-19 case levels and even greater economic distress – as indicated by last week’s disquieting employment report - it is only a matter of time before both renters and housing providers reach the end of their resources,” said Doug Bibby, NMHC President.

emphasis added

This graph from the NMHC Rent Payment Tracker shows the percent of household making full or partial rent payments by the 6th of the month.

This is mostly for large, professionally managed properties.

The second graph shows full month payments through November.

Las Vegas Real Estate in November: Sales up 28% YoY, Inventory down 54% YoY

by Calculated Risk on 12/08/2020 08:26:00 AM

This report is for closed sales in November; sales are counted at the close of escrow, so the contracts for these homes were mostly signed in September and October.

The Las Vegas Realtors reported Southern Nevada home prices set record for sixth straight month amid pandemic; LVR housing statistics for November 2020

LVR reported a total of 3,761 existing local homes, condos and townhomes were sold during November. Compared to the same time last year, November sales were up 26.1% for homes and up 34.7% for condos and townhomes.1) Overall sales were up 27.7% year-over-year to 3,761 in November 2020 from 2,946 in November 2019.

“Like other places around the country, we’re seeing multiple offers on properties listed for sale,” said 2020 LVR President Tom Blanchard, a longtime local REALTOR®. “The supply of available homes is very low, and demand is high. I hope the new year will bring some additional inventory as local homeowners start to feel more comfortable moving. We can easily absorb three or four times the current available inventory without tilting the scales of meeting our current demand for housing here in Southern Nevada.”

He said the number of local homes available for sale remains well below the six-month supply considered to be a balanced market. In fact, the sales pace in November equates to just over a one-month supply of homes available for sale, creating what Blanchard said is a local housing shortage.

By the end of November, LVR reported 3,756 single-family homes listed for sale without any sort of offer. That’s down 42.5% from one year ago. For condos and townhomes, the 1,288 properties listed without offers in November represent a 24.7% drop from one year ago.

…

Despite the coronavirus crisis and economic downturn, the number of so-called distressed sales remains near historically low levels. LVR reported that short sales and foreclosures combined accounted for just 0.8% of all existing local property sales in November. That compares to 2.0% of all sales one year ago, 2.6% two years ago and just under 5% three years ago.

emphasis added

2) Active inventory (single-family and condos) is down from a year ago, from a total of 8,242 in 2019 to 3,756 in November 2020. Note: Total inventory was down 54.4% year-over-year. And months of inventory is low.

3) Low level of distressed sales.

Monday, December 07, 2020

December 7 COVID-19 Test Results; Record 7-Day Deaths, Record Hospitalizations

by Calculated Risk on 12/07/2020 07:22:00 PM

I'm looking forward to not posting this data in a few months. Please stay healthy!

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,566,574 test results reported over the last 24 hours.

There were 180,193 positive tests.

Over 15,000 US deaths have been reported so far in December. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 11.5% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• Record Hospitalizations (Over 102,000)

• Record 7 Day Average Cases

• Record 7 Day Average Deaths