by Calculated Risk on 12/06/2020 06:50:00 PM

Sunday, December 06, 2020

December 6 COVID-19 Test Results; Record 7-Day Deaths, Record Hospitalizations

I'm looking forward to not posting this data in a few months. Please stay healthy!

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,349,361 test results reported over the last 24 hours.

There were 176,771 positive tests.

Over 14,000 US deaths have been reported so far in December. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 13.1% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• Record Hospitalizations (Over 101,000)

• Record 7 Day Average Cases

• Record 7 Day Average Deaths

Q4 GDP Forecasts: Uncertainty

by Calculated Risk on 12/06/2020 09:34:00 AM

Economic activity in the fourth quarter is dependent on the impact of the pandemic. With the number of new cases per day of COVID approaching 200,000, hospitalizations at record levels (over 100,000), and deaths per day at new record highs, it is likely that economic activity will slow in December.

Most of the slowdown will be related to individuals being more cautious, and some will be related to government actions. For example, from the AP: Most of California to enter sweeping new virus lockdown

Economic activity was solid in October, and that would suggest PCE growth of close to 6% in Q4, even if November and December see no month-over-month growth. No one expects a lockdown like at the end of March and in April, but it is possible that activity slowed in November and will decline in December.

The high level of uncertainty over the next few months makes forecasting extremely difficult. The automated approaches (below) do not capture this uncertainty.

From Goldman Sachs:

We left our Q4 GDP tracking estimate unchanged at +3.2% (qoq ar) [Dec 2 estimate]From Merrill Lynch:

We continue to track 33.1% for 3Q GDP and 6.0% for 4Q GDP. [Dec 4 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.5% for 2020:Q4 and 5.9% for 2021:Q1. [Dec 4 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2020 is 11.2 percent on December 4, up from 11.1 percent on December 1. [Dec 4 estimate]It is also important to note that GDP is reported at a seasonally adjusted annual rate (SAAR). A 3.3% annualized increase in Q4 GDP (close to Goldman's forecast), is about 0.8% QoQ, and would leave real GDP down about 2.7% from Q4 2019.

The following graph illustrates this decline.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent decline in real GDP from the previous peak (currently the previous peak was in Q4 2019).

This graph is through Q3 2020, and real GDP is currently off 3.5% from the previous peak. For comparison, at the depth of the Great Recession, real GDP was down 4.0% from the previous peak.

The black arrow shows what a 3.3% annualized increase in real GDP would look like in Q4.

Saturday, December 05, 2020

December 5 COVID-19 Test Results; Record 7-Day Deaths

by Calculated Risk on 12/05/2020 07:21:00 PM

I'm looking forward to not posting this data in a few months. Please stay healthy!

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,738,068 test results reported over the last 24 hours.

There were 211,073 positive tests.

Almost 13,000 US deaths have been reported so far in December. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 12.1% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• Near Record Hospitalizations (Over 101,000)

• Record 7 Day Average Cases

• Highest 7 Day Average Deaths

Schedule for Week of December 6, 2020

by Calculated Risk on 12/05/2020 08:11:00 AM

The key economic report this week is November CPI .

3:00 PM: Consumer Credit from the Federal Reserve.

6:00 AM: NFIB Small Business Optimism Index for November.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in September to 6.436 million from 6.352 million in August.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 700,000 initial claims, down from 712,000 last week.

8:30 AM: The Consumer Price Index for November from the BLS. The consensus is for a 0.1% increase in CPI, and a 0.2% increase in core CPI.

12:00 PM: Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

8:30 AM: The Producer Price Index for November from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for December).

Friday, December 04, 2020

December 4 COVID-19 Test Results; Record Cases, Hospitalizations

by Calculated Risk on 12/04/2020 07:22:00 PM

I'm looking forward to not posting this data in a few months. Please stay healthy!

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,443,932 test results reported over the last 24 hours.

There were 224,831 positive tests.

Almost 10,500 US deaths have been reported so far in December. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 15.6% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• Record Hospitalizations (Over 101,000)

• Record 7 Day Average Cases

• Highest 7 Day Average Deaths since April

AAR: November Rail Carloads down 5.8% YoY, Intermodal Up 11.5% YoY

by Calculated Risk on 12/04/2020 04:00:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

Total U.S. carloads in November 2020 were down 5.8% from November 2019, their smallest year over-year percentage decline since August 2019. (The peak recent decline was 27.7% in May 2020.) In November, 9 of the 20 carload categories the AAR tracks had year-over-year carload gains. Grain and chemicals led the way. In November, U.S. grain carloads were the most since October 2007, while carloads of chemicals were the second most for any November on record. Meanwhile, November 2020 was the sixth-best month ever (in terms of weekly average originations) for U.S. intermodal. It might have been the best month ever if Thanksgiving week hadn’t pulled down November’s weekly average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six week average of U.S. Carloads in 2018, 2019 and 2020:

Total U.S. carloads (not including intermodal) were 900,194 in November 2020, down 5.8% from November 2019. That’s the smallest year-over-year percentage decline for total carloads since August 2019. The peak decline was 27.7% in May 2020. That said, total carloads averaged 225,049 per week in November 2020, the smallest weekly average for November in our records which begin in 1988.

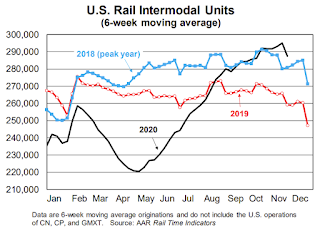

The second graph shows the six week average of U.S. intermodal in 2018, 2019 and 2020: (using intermodal or shipping containers):

The second graph shows the six week average of U.S. intermodal in 2018, 2019 and 2020: (using intermodal or shipping containers):U.S. railroads originated an average of 284,174 intermodal containers and trailers per week in November 2020 — the most ever for November and the sixth best month overall. Thanksgiving week (246,504 units) pulled down November’s average — the second week of November (295,316 units) and the third week of November (301,129 units) were the fifth-best and thirdbest weeks, respectively, in history for U.S. intermodal.Note that rail traffic was weak prior to the pandemic, and intermodal has come back strong.

U.S. intermodal volume in November 2020 was up 11.5% over November 2019. That’s intermodal’s fourth straight year-over-year monthly gain and the biggest year-over-year percentage gain since February 2016.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased Slightly

by Calculated Risk on 12/04/2020 01:36:00 PM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of December 1st.

From Black Knight: Forbearances Resume Trend of Improvement

After a two week stretch of – not unexpected – slight increases in the number of active forbearance plans, our weekly snapshot of daily tracking data showed a partial reversal through Tuesday, December 1, continuing the “stairstep” nature of the recovery we’ve come to expect over the last several months.

Over the past seven days, the number of active forbearances saw a modest decline of 39,000, countering more than two thirds of the 57,000 increase over the two weeks prior. The decline was likely driven by a portion of the roughly 200,000 expirations that were scheduled for the end of November.

...

Click on graph for larger image.

Overall, forbearances are now down by 91,000 (-3.2%) month-over-month. While November saw comparatively limited forbearance expiration activity, more than 1 million forbearance plans are scheduled to expire in December, representing nearly 40% of all active forbearance cases.

In total, as of December 1, 2.76 million homeowners remain in active forbearance plans. Together, representing approximately 5.2% of all active mortgages – down from 5.3% from last week – they account for approximately $561 billion in unpaid principal.

...

Of course, COVID-19 cases continue to spike nationwide, and unemployment claims have risen in recent weeks. As such, we will keep a close eye on the possibility of increasing forbearance starts over the coming weeks. Black Knight will continue to monitor the situation and report our findings on this blog.

emphasis added

Trade Deficit Increased to $63.1 Billion in October

by Calculated Risk on 12/04/2020 11:08:00 AM

From the Department of Commerce reported:

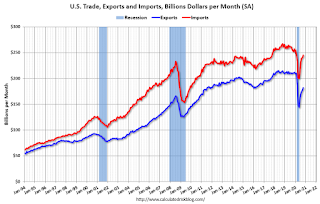

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $63.1 billion in October, up $1.0 billion from $62.1 billion in September, revised.

October exports were $182.0 billion, $4.0 billion more than September exports. October imports were $245.1 billion, $5.0 billion more than September imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in October.

Exports are down 13.5% compared to October 2019; imports are down 3.3% compared to October 2019.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports more than exports),

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that the U.S. exported a slight net positive petroleum products in recent months.

Oil imports averaged $36.23 per barrel in October, down from $37.59 per barrel in September, and down from $52.02 in October 2019.

The trade deficit with China decreased to $30.1 billion in October, from $31.3 billion in October 2019.

Comments on November Employment Report

by Calculated Risk on 12/04/2020 09:18:00 AM

The headline jobs number in the November employment report was well below expectations, however employment for the previous two months were revised up slightly, combined.

Leisure and hospitality added another 31 thousand jobs in November, following 4.84 million jobs added in May through October. Leisure and hospitality lost 8.3 million jobs in March and April, so about 59% of those jobs were added back in the May through November period.

Earlier: November Employment Report: 245 Thousand Jobs Added, 6.7% Unemployment Rate

In November, the year-over-year employment change was minus 9.19 million jobs.

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the November report. (ht Joe Weisenthal at Bloomberg)

This data is only available back to 1994, so there is only data for three recessions.

In November, the number of permanent job losers increased to 3.743 million from 3.684 million in October.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The prime working age will be key in the eventual recovery.

The 25 to 54 participation rate decreased in November to 80.9% from 81.2% in October, and the 25 to 54 employment population ratio was unchanged at 76.0% from 76.0% in October.

Seasonal Retail Hiring

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring had increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring had increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.Retailers hired 302 thousand workers (NSA) net in November. Note: this is NSA (Not Seasonally Adjusted). This was a loss of 35 thousand jobs, seasonally adjusted, in November.

This might be distorted this year by a combination of seasonal hiring - and some bounce back in employment from the shutdowns earlier this year.

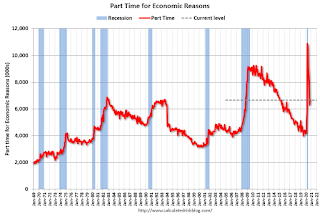

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons was about unchanged over the month at 6.7 million but remains 2.3 million higher than the February level. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased slightly in November to 6.660 million from 6.684 million in October.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 12.0% in November. This is down from the record high in April 22.8% for this measure since 1994.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 3.941 million workers who have been unemployed for more than 26 weeks and still want a job.

This has increased sharply - since the largest number of layoffs were around April - and this will be a key measure to follow during the recovery.

Summary:

The headline monthly jobs number was well below expectations, however the previous two months were revised up 11,000 combined. The headline unemployment rate decreased to 6.7%, but this was due to a decline in the participation rate. Overall this was a disappointing report.

November Employment Report: 245 Thousand Jobs Added, 6.7% Unemployment Rate

by Calculated Risk on 12/04/2020 08:41:00 AM

From the BLS:

Total nonfarm payroll employment rose by 245,000 in November, and the unemployment rate edged down to 6.7 percent, the U.S. Bureau of Labor Statistics reported today. These improvements in the labor market reflect the continued resumption of economic activity that had been curtailed due to the coronavirus (COVID-19) pandemic and efforts to contain it. However, the pace of improvement in the labor market has moderated in recent months. In November, notable job gains occurred in transportation and warehousing, professional and business services, and health care. Employment declined in government and retail trade.

...

In November, the unemployment rate edged down to 6.7 percent. The rate is down by 8.0 percentage points from its recent high in April but is 3.2 percentage points higher than it was in February. The number of unemployed persons, at 10.7 million, continued to trend down in November but is 4.9 million higher than in February.

...

The change in total nonfarm payroll employment for September was revised up by 39,000, from +672,000 to +711,000, and the change for October was revised down by 28,000, from +638,000 to +610,000. With these revisions, employment in September and October combined was 11,000 more than previously reported.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the year-over-year change in total non-farm employment since 1968.

In November, the year-over-year change was negative 9.19 million jobs.

Total payrolls increased by 245 thousand in November. Private payrolls increased by 344 thousand.

Payrolls for September and October were revised up 11 thousand combined.

The second graph shows the job losses from the start of the employment recession, in percentage terms.

The second graph shows the job losses from the start of the employment recession, in percentage terms.The current employment recession is by far the worst recession since WWII in percentage terms, and is still worse than the worst of the "Great Recession".

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased to 61.5% in November. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate decreased to 61.5% in November. This is the percentage of the working age population in the labor force. The Employment-Population ratio decreased to 57.3% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in November to 6.7%.

This was well below consensus expectations, however September and October were revised up by 11,000 combined.

I'll have much more later …