by Calculated Risk on 12/03/2020 09:35:00 PM

Thursday, December 03, 2020

Friday: Employment Report, Trade Deficit

My November Employment Preview

Goldman November Payrolls Preview

Friday:

• At 8:30 AM ET.Employment Report for November. The consensus is for 500 thousand jobs added, and for the unemployment rate to decrease to 6.7%.

This graph shows the job losses from the start of the employment recession, in percentage terms through October.

The current employment recession was by far the worst recession since WWII in percentage terms, and the worst in terms of the unemployment rate.

• Also at 8:30 AM: Trade Balance report for October from the Census Bureau. The consensus is the trade deficit to be $64.7 billion. The U.S. trade deficit was at $63.9 billion in September.

December 3 COVID-19 Test Results; Record Cases, Hospitalizations

by Calculated Risk on 12/03/2020 07:34:00 PM

Note: The data was distorted over the holiday weekend.

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,428,058 test results reported over the last 24 hours.

There were 210,161 positive tests.

Almost 8,000 US deaths have been reported so far in December. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 14.7% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• Record Hospitalizations (Over 100,000)

• Record 7 Day Average Cases

Goldman November Payrolls Preview

by Calculated Risk on 12/03/2020 03:33:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose 450k in November ... The breadth and severity of the virus resurgence suggests a larger labor market impact than during in the second wave ...CR Note: The consensus is for 500 thousand jobs added, and for the unemployment rate to decrease to 6.7%.

We estimate the unemployment rate declined a tenth to 6.8% ... reflecting an increase in household employment and a pause in the labor force participation rebound.

emphasis added

November Employment Preview

by Calculated Risk on 12/03/2020 12:15:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for November. The consensus is for 500 thousand jobs added, and for the unemployment rate to decrease to 6.7%.

First, there are a wide range of estimates. For example, from Merrill Lynch economists:

"We look for November jobs report to show nonfarm payroll growth pulled back to 150k following a gain of 638k in October. Private payrolls should add 300k. Lackluster job growth should keep the U-rate unchanged at 6.9%, breaking a 6-mo streak of declines."• Decennial Census: The decennial Census will subtract 93,026 temporary government jobs.

• ADP Report: The ADP employment report showed a gain of 307,000 private sector jobs, below the consensus estimate of 420 thousand jobs. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be weaker than expected.

• ISM Surveys: The ISM manufacturing employment index decreased in November to 48.4%, down from 53.2% in October. This would suggest essentially approximately 30,000 manufacturing jobs lost in November - although ADP showed 8,000 manufacturing jobs added.

The ISM Services employment index increased in November for 51.5% from 50.1% October, and is just above 50. This would suggest around 125,000 service jobs added in November. Combined, the ISM surveys suggest around 75,000 private sector jobs added in November. The ISM surveys haven't been as useful as usual during the pandemic, but this does suggest the report could be weaker than expected.

• Unemployment Claims: The weekly claims report showed a high number of total continuing unemployment claims during the reference week, although this might not be very useful right now. If we did a "Rip Van Winkle", and saw the weekly claims report this morning, we'd think the economy was in a deep recession!

• Homebase, Kronos/UKG: There are other indicators that analysts are looking at - like Homebase hours worked and Kronos (see Ernie Tedeschi comments):

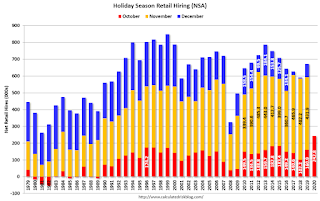

"A slew of recent data is consistent with slow or even negative jobs growth in November. A quick thread."• Seasonal Retail Hiring: Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

Click on graph for larger image.

Click on graph for larger image.In 2019, retailers hired 432,000 seasonal employees (NSA) in November. That translated to a loss of 14,000 SA. Brick and Mortar retailers could be more cautious this year, and retail might decline SA in November.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers have been increasing (small decrease in October).

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers have been increasing (small decrease in October).This graph shows permanent job losers as a percent of the pre-recession peak in employment through the October report.

This data is only available back to 1994, so there is only data for three recessions. In October, the number of permanent job losers decreased to 3.684 million from 3.756 million in September.

• Conclusion: The employment related data has been all over the place, but most of the indicators suggest a weaker report in November than October. My guess is the report will be lower than the consensus.

Hotels: Occupancy Rate Declined 28.5% Year-over-year

by Calculated Risk on 12/03/2020 10:59:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 28 November

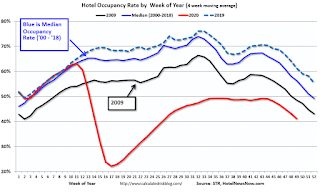

U.S. weekly hotel occupancy fell to its lowest level since late May, according to the latest data from STR through 28 November.Since there is a seasonal pattern to the occupancy rate - see graph below - we can track the year-over-year change in occupancy to look for any improvement. This table shows the year-over-year change since the week ending Sept 19, 2020:

22-28 November 2020 (percentage change from comparable week in 2019):

• Occupancy: 36.2% (-28.5%)

• Average daily rate (ADR): US$92.49 (-17.8%)

• Revenue per available room (RevPAR): US$33.49 (-41.2%)

TSA checkpoint counts increased sharply with more than 6 million passengers during both the week before and of Thanksgiving. However, that increased air travel volume did not translate to more hotel rooms sold as weekly demand (13.2 million) and occupancy fell to their lowest levels since late May. This would indicate that a bulk of travelers opted to stay with family during the holiday. emphasis added

| Week Ending | YoY Change, Occupancy Rate |

|---|---|

| 9/19 | -31.9% |

| 9/26 | -31.5% |

| 10/3 | -29.6% |

| 10/10 | -29.2% |

| 10/17 | -30.7% |

| 10/24 | -31.7% |

| 10/31 | -29.0% |

| 11/7 | -35.9% |

| 11/14 | -32.7% |

| 11/21 | -32.6% |

| 11/28 | -28.5% |

This suggests little improvement over the last 11 weeks.

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels - before 2020).

Seasonally we'd expect the occupancy rate to decline into the new year.

Note: Y-axis doesn't start at zero to better show the seasonal change.

ISM Services Index Decreased to 55.9% in November

by Calculated Risk on 12/03/2020 10:07:00 AM

The November ISM Services index was at 55.9%, down from 56.6% last month. The employment index increased to 51.5%, from 50.1%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: Services PMI™ at 55.9%; November 2020 Services ISM® Report On Business®

Economic activity in the services sector grew in November for the sixth month in a row, say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: "The Services PMI™ registered 55.9 percent, 0.7 percentage point lower than the October reading of 56.6 percent. This reading represents a sixth straight month of growth for the services sector, which has expanded for all but two of the last 130 months.

emphasis added

Weekly Initial Unemployment Claims decreased to 712,000

by Calculated Risk on 12/03/2020 08:38:00 AM

The DOL reported:

In the week ending November 28, the advance figure for seasonally adjusted initial claims was 712,000, a decrease of 75,000 from the previous week's revised level. The previous week's level was revised up by 9,000 from 778,000 to 787,000. The 4-week moving average was 739,500, a decrease of 11,250 from the previous week's revised average. The previous week's average was revised up by 2,250 from 748,500 to 750,750.This does not include the 288,701 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 318,855 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 739,500.

The previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims decreased to 5,520,000 (SA) from 6,089,000 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 8,869,502 receiving Pandemic Unemployment Assistance (PUA) that decreased from 9,208,570 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

This was lower than expected.

Wednesday, December 02, 2020

Thursday: Unemployment Claims, ISM Services

by Calculated Risk on 12/02/2020 09:15:00 PM

From Matthew Graham at MortgageNewsDaily: Mortgage Rates Continue Defying Bond Market Weakness

Although it was the focus of yesterday's discussion, the ability of the mortgage market to hold steady in the face of bond market weakness continues to impress. ... Regardless of the movement, the average lender remains very close to all-time lows and well under 3% for most top tier conventional scenarios.Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 825,000 initial claims, up from 778,000 last week.

• At 10:00 AM, the ISM Services Index for November.

December 2 COVID-19 Test Results; Over 100,000 Hospitalizations

by Calculated Risk on 12/02/2020 07:16:00 PM

Note: The data was distorted over the holiday weekend.

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,163,137 test results reported over the last 24 hours.

There were 195,695 positive tests.

Over 5,200 US deaths have been reported so far in December. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 16.8% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• Record Hospitalizations (Over 100,000)

Fed's Beige Book: "modest or moderate" Growth in Economic Activity, Some Districts see "No growth"

by Calculated Risk on 12/02/2020 02:07:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Philadelphia based on information collected on or before November 20, 2020."

Most Federal Reserve Districts have characterized economic expansion as modest or moderate since the prior Beige Book period. However, four Districts described little or no growth, and five narratives noted that activity remained below pre-pandemic levels for at least some sectors. Moreover, Philadelphia and three of the four Midwestern Districts observed that activity began to slow in early November as COVID-19 cases surged. Reports tended to indicate higher-than-average growth of manufacturing, distribution and logistics, homebuilding, and existing home sales, although not without disruptions. Banking contacts in numerous Districts reported some deterioration of loan portfolios, particularly for commercial lending into the retail and leisure and hospitality sectors. An increase in delinquencies in 2021 is more widely anticipated. Most Districts reported that firms' outlooks remained positive; however, optimism has waned--many contacts cited concerns over the recent pandemic wave, mandated restrictions (recent and prospective), and the looming expiration dates for unemployment benefits and for moratoriums on evictions and foreclosures.CR Note: The pandemic is depressing activity again. Also note the concern about some commercial lending.

...

Nearly all Districts reported that employment rose, but for most, the pace was slow, at best, and the recovery remained incomplete. Firms that were hiring continued to report difficulties in attracting and retaining workers. Many contacts noted that the sharp rise in COVID-19 cases had precipitated more school and plant closings and renewed fears of infection, which have further aggravated labor supply problems, including absenteeism and attrition. Providing for childcare and virtual schooling needs was widely cited as a significant and growing issue for the workforce, especially for women—prompting some firms to extend greater accommodations for flexible work schedules. In several Districts, firms feared that employment levels would fall over the winter before recovering further. Despite hiring difficulties, firms in most Districts reported that wages grew at a slight or modest pace overall. However, many noted greater pressure to raise rates for low-skilled workers, especially in outlying areas. Staffing firms described greater placement success with competitive rates, and one firm instituted a minimum wage rate for its industrial clients.

emphasis added