by Calculated Risk on 11/18/2020 01:59:00 PM

Wednesday, November 18, 2020

LA Area Port Traffic: Strong Imports, Weak Exports in October

Note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 2.2% in October compared to the rolling 12 months ending in September. Outbound traffic was down 0.4% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were up 25% YoY in October, and exports were down 5% YoY.

AIA: "Architecture billings remained stalled in October"

by Calculated Risk on 11/18/2020 10:37:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture billings remained stalled in October

While architectural billings failed to show much progress during October, signs of improving business conditions at firms have emerged, according to a new report from the American Institute of Architects (AIA).

The pace of decline during October remained at about the same level as in September, posting an ABI score of 47.5 (any score below 50 indicates a decline in firm billings). Meanwhile, firms reported a modest increase in new project inquiries—growing from 57.2 in September to 59.1 in October—and newly signed design contracts jumped into positive territory for the first time since the pandemic began, with a score of 51.7.

“Though still in negative territory, the moderating billings score along with the rebound in design contracts and inquiries provide some guarded optimism,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “The pace of recovery will continue to vary across regions and sectors.”

...

• Regional averages: West (50.4); Midwest (49.4); South (45.8); Northeast (44.9)

• Sector index breakdown: multi-family residential (55.1); mixed practice (52.7); commercial/industrial (48.0); institutional (42.2)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 47.5 in October, up from 47.0 in September. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index has been below 50 for eight consecutive months. This represents a significant decrease in design services, and suggests a decline in CRE investment through the first half of 2021 (This usually leads CRE investment by 9 to 12 months).

This weakness is not surprising since certain segments of CRE are struggling, especially offices and retail.

Comments on October Housing Starts

by Calculated Risk on 11/18/2020 09:32:00 AM

Earlier: Housing Starts increased to 1.530 Million Annual Rate in October

Total housing starts in October were above expectations, and starts in August and September were revised up, combined. The single family sectors has increased sharply, but the volatile multi-family sector is down year-over-year (apartments are under pressure from COVID).

The housing starts report showed starts were up 4.9% in October compared to September, and starts were up 14.2% year-over-year compared to October 2019.

Single family starts were up 29% year-over-year. Low mortgage rates and limited existing home inventory have given a boost to single family housing starts.

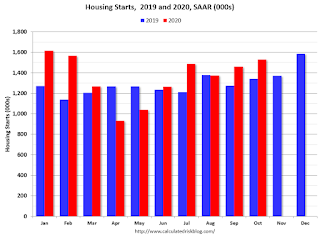

The first graph shows the month to month comparison for total starts between 2019 (blue) and 2020 (red).

Starts were up 14.2% in October compared to October 2019.

Last year, in 2019, starts picked up towards the end of the year, so the comparisons were earlier this year.

Starts, year-to-date, are up 6.7% compared to the same period in 2019. This is close to my forecast for 2020, although I didn't expect a pandemic!

I expect starts to remain solid, but the growth rate will slow.

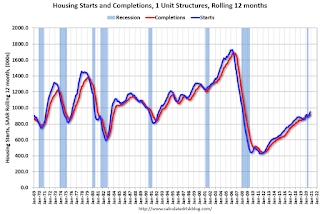

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - then mostly moved sideways. Completions (red line) had lagged behind - then completions caught up with starts- then starts picked up a little again late last year, but have fallen off the pandemic.

Single family starts are getting back to more normal levels, and I expect some further increases in single family starts and completions on rolling 12 month basis.

Housing Starts increased to 1.530 Million Annual Rate in October

by Calculated Risk on 11/18/2020 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in October were at a seasonally adjusted annual rate of 1,530,000. This is 4.9 percent above the revised September estimate of 1,459,000 and is 14.2 percent above the October 2019 rate of 1,340,000. Single-family housing starts in October were at a rate of 1,179,000; this is 6.4 percent above the revised September figure of 1,108,000. The October rate for units in buildings with five units or more was 334,000.

Building Permits:

Privately-owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 1,545,000. This is virtually unchanged (±1.3 percent)* from the revised September rate of 1,545,000, but is 2.8 percent above the October 2019 rate of 1,503,000. Single-family authorizations in October were at a rate of 1,120,000; this is 0.6 percent above the revised September figure of 1,113,000. Authorizations of units in buildings with five units or more were at a rate of 365,000 in October.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) were unchanged in October compared to September. Multi-family starts were down 18% year-over-year in October.

Single-family starts (blue) increased in October, and were up 29% year-over-year. This is the highest level for single family starts since 2007.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then eventual recovery (but still historically low).

Total housing starts in October were above expectations, and starts in August and September were revised up, combined.

I'll have more later …

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 11/18/2020 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 0.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 13, 2020. This week’s results do not include an adjustment for the Veterans’ Day holiday.

... The Refinance Index decreased 2 percent from the previous week and was 98 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 4 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 26 percent higher than the same week one year ago.

“Mortgage market activity was mixed last week, despite the 30-year fixed rate mortgage staying below 3 percent. The purchase market recovered from its recent weekly slump, with activity increasing 3 percent and climbing above year-ago levels for the 26th straight week. Housing demand remains supported by the ongoing recovery in the job market, and an increased appetite from households seeking more space because of the pandemic,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The refinance index decreased last week – driven by sharp declines in FHA and VA applications – but remained a robust 98 percent above a year ago. The average refinance loan balance of $291,000 last week was the lowest since January. Many borrowers with higher loan balances may have acted earlier on in the current refinance wave.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased to 2.99 percent from 2.98 percent, with points increasing to 0.37 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index remains up significantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 26% year-over-year unadjusted.

Note: Red is a four-week average (blue is weekly).

Tuesday, November 17, 2020

Wednesday: Housing Starts

by Calculated Risk on 11/17/2020 09:15:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for October. The consensus is for 1.460 million SAAR, up from 1.415 million SAAR.

• During the day, The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

November 17 COVID-19 Test Results; Record Hospitalizations

by Calculated Risk on 11/17/2020 07:57:00 PM

The end of the pandemic is coming, possibly by Q2 2021!

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,243,225 test results reported over the last 24 hours.

There were 155,201 positive tests.

Almost 17,500 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

Click on graph for larger image.

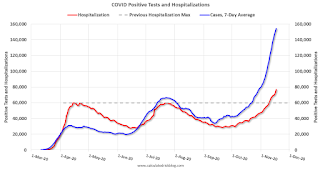

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 12.5% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• 7-day average cases are at a new record.

• 7-day average deaths at highest since May.

• Record Hospitalizations.

Lawler: Early Read on Existing Home Sales in October

by Calculated Risk on 11/17/2020 05:09:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 6.63 million in October, up 1.4% from September’s preliminary pace and up 22.6% from last October’s seasonally adjusted pace. I should note that several state and local realtor reports that would normally be available at this time of the month have not yet been released, and as a result my sample size is smaller than normal.

Local realtor reports, as well as reports from national inventory trackers, suggest that the YOY decline in the inventory of existing homes for sale was about the same in October as it was in September, though what that means for the NAR inventory estimate is unclear. As I’ve noted before, the inventory measure in most publicly-released local realtor/MLS reports excludes listings with pending contracts, but that is not the case for many of the reports sent to the NAR (referred to as the “NAR Report!”), Since the middle of last Spring inventory measures excluding pending listings have fallen much more sharply than inventory measures including such listings, and this latter inventory measure understates the decline in the effective inventory of homes for sale over the last several months.

Finally, local realtor/MLS reports suggest the median existing single-family home sales price last month was up by 14% from last October.

CR Note: The National Association of Realtors (NAR) is scheduled to release October existing home sales on Thursday, November 19, 2020 at 10:00 AM ET. The consensus is for 6.45 million SAAR.

Phoenix Real Estate in October: Sales Up 23.5% YoY, Active Inventory Down 42% YoY

by Calculated Risk on 11/17/2020 04:32:00 PM

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales were at 9,690 in October, up from 9,305 in September, and up from 7,850 in October 2019. Sales were up 4.1% from September 2020 (last month), and up 23.5% from October 2019.

2) Active inventory was at 8,343, down from 14,427 in October 2019. That is down 42% year-over-year.

3) Months of supply decreased to 1.41 in October from 1.48 in September. This is very low.

Sales are reported at the close of escrow, so these sales were mostly signed in August and September.

NY Fed Q3 Report: "Total Household Debt Increased in Q3 2020, Led by Surge in New Credit Extensions"

by Calculated Risk on 11/17/2020 11:09:00 AM

From the NY Fed: Total Household Debt Increased in Q3 2020, Led by Surge in New Credit Extensions; Mortgage Originations, Including Refinances, Continue to Soar

The Federal Reserve Bank of New York's Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit, which shows that total household debt increased by $87 billion (0.6%) to $14.35 trillion in the third quarter of 2020. The increase more than offset the decline seen in the second quarter of 2020 as total household debt has surpassed its 2020Q1 reading. The Report is based on data from the New York Fed's Consumer Credit Panel, a nationally representative sample of individual- and household-level debt and credit records drawn from anonymized Equifax credit data. This latest report reflects consumer credit data as of September 30, 2020.

Mortgage balances—the largest component of household debt—rose by $85 billion in the third quarter, and sat at $9.86 trillion on September 30. Mortgage originations, which include refinances, were at $1.05 trillion, the second highest volume in the history of the series and second only to the historic refinance boom in 2003Q3. Balances on home equity lines of credit saw a $13 billion decline, their 15th consecutive decrease since 2016Q4, bringing the outstanding balance to $362 billion.

...

Aggregate delinquency rates across all debt products fell again in the third quarter, indicating the ongoing effect of forbearances provided by the CARES Act or voluntarily offered by lenders. New transitions into early delinquency have also fallen across product type. The various forbearance offerings and uptake have largely protected borrowers' credit files from being marked delinquent from missed payments. As of September 30, 3.4% of outstanding debt was in some stage of delinquency, a 0.2 percentage point decrease from the second quarter, and 1.4 percentage points lower than the rate observed in 2019Q4. About 132,000 consumers had a bankruptcy notation added to their credit reports in 2020Q3, a decline from the previous quarter and a new historical low.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt decreased in Q3. Household debt previously peaked in 2008, and bottomed in Q3 2013.

From the NY Fed:

Aggregate household debt balances increased by $87 billion in the third quarter of 2020, a 0.6% rise from 2020Q2, and now stand at $14.35 trillion. The increase offsets the decline seen in the second quarter of 2020. Balances are $1.68 trillion higher, in nominal terms, than the 2008Q3 peak of $12.68 trillion and 28.7% above the 2013Q2 trough.

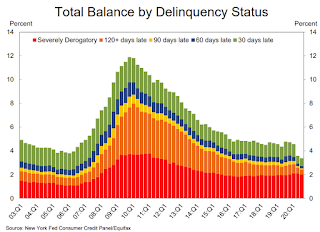

The second graph shows the percent of debt in delinquency.

The second graph shows the percent of debt in delinquency.The overall delinquency rate decreased in Q3. From the NY Fed:

Aggregate delinquency rates have dropped markedly in the second and third quarter, reflecting an uptake in forbearances (provided by both the CARES Act and voluntarily offered by lenders), which protect borrowers’ credit records from the reporting of skipped or deferred payments. Note that accounts in forbearance might be categorized as delinquent on the lender’s book, but typically as current on the credit reports. As of September 30, 3.4% of outstanding debt was in some stage of delinquency, a 0.2 percentage point decrease from the second quarter, and 1.4 percentage points lower than the rate observed in the fourth quarter of 2019 and before the Covid pandemic hit the United States. Of the $485 billion of debt that is delinquent, $363 billion is seriously delinquent (at least 90 days late or “severely derogatory”, which includes some debts that have been removed from lenders books but upon which they continue to attempt collection).There is much more in the report.

The uptake in forbearances continues to be visible in the delinquency transition rates for mortgages. The share of mortgages that transitioned to early delinquency remained at a very low 0.5%, as the option to enter forbearance remained. Meanwhile, 47% of loans in early delinquency transitioned to current. There were only 16,000 new foreclosure starts; given that homeowners with federally backed mortgages are currently protected from foreclosure through a moratorium in the CARES Act.