by Calculated Risk on 11/10/2020 07:12:00 PM

Tuesday, November 10, 2020

November 10 COVID-19 Test Results; Record Cases, Record Hospitalizations

The end of the pandemic is coming, possibly by Q2 2021! Please be careful, especially over the holidays. Thanksgiving, Christmas and New Years will be tough this year, but keep your guard up - plan now to have safe holidays.

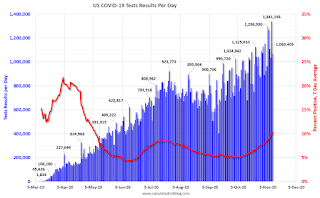

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,069,405 test results reported over the last 24 hours.

There were 130,989 positive tests. This is a new record.

Over 9,000 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 12.2% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

This is a new record 7-day average cases for the USA.

NMHC: Rent Payment Tracker Shows Households Paying Rent Decreased 1.1% YoY in November

by Calculated Risk on 11/10/2020 12:21:00 PM

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 80.4 percent of apartment households made a full or partial rent payment by November 6 in its survey of 11.5 million units of professionally managed apartment units across the country.

This is a 1.1 percentage point, or 131,712 household decrease from the share who paid rent through November 6, 2019 and compares to 79.4 percent that had paid by October 6, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

“November’s opening rent payment figures show that the additional support apartment residents received over the summer, coupled with generous, innovative approaches put into place by property owners and managers, continue to provide renters with some degree of security against the economic distress facing communities throughout the country,” said Doug Bibby, NMHC President.

emphasis added

This graph from the NMHC Rent Payment Tracker shows the percent of household making full or partial rent payments by the 6th of the month.

CR Note: This is mostly for large, professionally managed properties. There are some timing issues month to month, but rent payments are mostly holding steady - and not falling off a cliff.

MBA: "Mortgage Delinquencies Decrease in the Third Quarter of 2020"

by Calculated Risk on 11/10/2020 10:21:00 AM

From the MBA: Mortgage Delinquencies Decrease in the Third Quarter of 2020

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 7.65 percent of all loans outstanding at the end of the third quarter of 2020, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate was down 57 basis points from the second quarter of 2020 and up 368 basis points from one year ago. For the purposes of the survey, MBA asks servicers to report loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage.

“Consistent with the improving labor market and the overall economic rebound, homeowners’ ability to make their mortgage payments improved in the third quarter,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “The decrease in the mortgage delinquency rate was driven by a sharp decline in newer 30-day delinquencies and 60-day delinquencies. Particularly encouraging was the 30-day delinquency rate, which reached its lowest level since MBA’s survey began in 1979.”

Added Walsh, “Nonetheless, the 90-day and over delinquency rate continued to grow and reached its highest level since the second quarter of 2010. With forbearance plans still active and foreclosure moratoriums in place until at least the end of the year, many borrowers experiencing longer-term distress will remain in this delinquency category until a loss mitigation resolution is available.”

emphasis added

Click on graph for larger image.

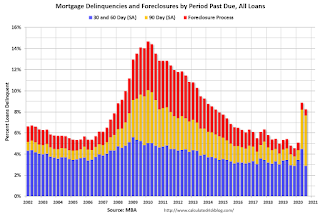

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. Overall delinquencies decreased in Q3.

The decrease was in the 30 day and 60 and day buckets.

This sharp increase in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

The percent of loans in the foreclosure process declined further, and was at the lowest level since 1982.

BLS: Job Openings "Little Changed" at 6.4 Million in September

by Calculated Risk on 11/10/2020 10:06:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 6.4 million on the last business day of September, the U.S. Bureau of Labor Statistics reported today. Hires and total separations were little changed at 5.9 million and 4.7 million, respectively. Within separations, the quits rate was little changed at 2.1 percent while the layoffs and discharges rate decreased to a series low of 0.9 percent.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for September, the most recent employment report was for October.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The huge spikes in layoffs and discharges in March and April 2020 are labeled, but off the chart to better show the usual data.

Jobs openings increased in September to 6.436 million from 6.352 million in August.

The number of job openings (yellow) were down 8.7% year-over-year.

Quits were down 12% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings were little changed in September, and are down YoY - and quits are down sharply YoY.

Small Business Optimism Unchanged in October

by Calculated Risk on 11/10/2020 08:31:00 AM

Most of this survey is noise, but sometimes there is some information, especially on the labor market.

From the National Federation of Independent Business (NFIB): May 2020 Report

The NFIB Optimism Index remained at 104.0 in October, unchanged from September and a historically high reading.

.

As reported in NFIB’s monthly jobs report, small business owners are looking to hire, reporting a historically high level of job openings in October. Overall, 55% of owners reported hiring or trying to hire in October, down 1 point from September. Thirty-three percent (seasonally adjusted) of all owners reported job openings they could not fill in the current period, down 3 points from September’s report.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index was unchanged in October.

Monday, November 09, 2020

Tuesday: Job Openings

by Calculated Risk on 11/09/2020 09:27:00 PM

Tuesday:

• At 6:00 AM ET, NFIB Small Business Optimism Index for October.

• At 10:00 AM, Job Openings and Labor Turnover Survey for September from the BLS.

November 9 COVID-19 Test Results; Hospitalizations almost 60,000

by Calculated Risk on 11/09/2020 07:05:00 PM

Great news today on on the likely Pfizer vaccine. This probably means most Americans will be vaccinated by Q2 2021, but we all need to be careful throughout the Winter!

The US is now averaging close to 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,304,873 test results reported over the last 24 hours.

There were 118,497 positive tests. This is a Monday reporting record.

Almost 8,000 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 9.1% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

This is a new record 7-day average cases for the USA.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 5.67%"

by Calculated Risk on 11/09/2020 04:00:00 PM

Note: This is as of November 1st.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 5.67%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 16 basis points from 5.83% of servicers’ portfolio volume in the prior week to 5.67% as of November 1, 2020. According to MBA’s estimate, 2.8 million homeowners are in forbearance plans.

...

“With declines in the share of loans in forbearance across the board, the data this week align well with the positive news from October’s jobs report, which showed a gain of more than 900,000 private sector jobs, and a 1 percentage point decrease in the unemployment rate,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “A recovering job market, coupled with a strong housing market, is providing the support needed for many homeowners to get back on their feet.”

Added Fratantoni, “However, the data continue to show that servicers are still having difficulties reaching borrowers who have reached the six-month point of their forbearance period. Servicers are required to get borrowers’ consent to extend forbearance beyond six months. Homeowners who continue to be impacted by hardships related to the pandemic should contact their servicer.”

...

By stage, 22.25% of total loans in forbearance are in the initial forbearance plan stage, while 75.99% are in a forbearance extension. The remaining 1.76% are forbearance re-entries.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has been trending down for the last few months.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) remainedunchanged relative to the prior week at 0.10%."

There hasn't been a pickup in forbearance activity related to the end of the extra unemployment benefits.

Leading Index for Commercial Real Estate Decreased in October

by Calculated Risk on 11/09/2020 02:14:00 PM

From Dodge Data Analytics: Dodge Momentum Index Loses Ground in June

The Dodge Momentum Index fell 1.8% in October to 127.5 (2000=100) from the revised September reading of 129.8. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The commercial component of the Momentum Index lost 4.4% over the month, but the institutional component gained 3.3%.

The Momentum Index has struggled to make consistent gains since passing its post-pandemic low in June. Economic growth has slowed over the past few months, creating weaker demand for commercial projects. The fear about a new wave of COVID-19 infections may also be impeding planning activity in consumer-focused projects such as hotels and retail, although planning for warehouse projects continues to impress. Even with this month’s gain, the institutional component of the Momentum Index remains well below levels seen prior to the pandemic as state and local entities come to grips with the widening budget chasm.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 127.5 in October, down from 129.8 in September.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests a decline in Commercial Real Estate construction through early 2021.

The Projected Improvement in Life Expectancy

by Calculated Risk on 11/09/2020 11:07:00 AM

As we celebrate the awesome vaccine news, Pfizer’s Early Data Shows Vaccine Is More Than 90% Effective, here is the most recent life expectancy data from the CDC. This is well prior to the pandemic, but it is still interesting and is important when looking at demographics ...

The following data is from the CDC United States Life Tables, 2017 by Elizabeth Arias, Ph.D., and Jiaquan Xu, M.D.

In 2017, the overall expectation of life at birth was 78.6 years, decreasing from 78.7 in 2016. Between 2016 and 2017, life expectancy at birth decreased by 0.1 year for males (76.2 to 76.1) and did not change for females (81.1). Life expectancy at birth decreased by 0.1 year for the white population (78.9 to 78.8) and the non-Hispanic white population (78.6 to 78.5) between 2016 and 2017. Life expectancy at birth did not change from 2016 for the black population (75.3), the non-Hispanic black population (74.9), and the Hispanic population (81.8).Instead of look at life expectancy, here is a graph of survivors out of 100,000 born alive, by age for three groups: those born in 1900-1902, born in 1949-1951 (baby boomers), and born in 2017.

...

[The following] summarizes the number of survivors by age, race, Hispanic origin, and sex. To illustrate, 57,839 persons out of the original 2017 hypothetical life table cohort of 100,000 (or 57.8%) were alive at exact age 80. In other words, the probability that a person will survive from birth to age 80, given 2017 age-specific mortality rates, is 57.8%. ... In 2017, 99.4% of all infants born in the United States survived the first year of life. In contrast, only 87.6% of infants born in 1900 survived the first year. Of the 2017 period life table cohort, 57.8% survived to age 80 and 1.9% survived to age 100. In 1900, 13.5% of the life table cohort survived to age 80 and only 0.03% survived to age 100

emphasis added

Click on graph for larger image.

Click on graph for larger image.There was a dramatic change between those born in 1900 (blue) and those born mid-century (orange). The risk of infant and early childhood deaths dropped sharply, and the risk of death in the prime working years also declined significantly.

The CDC is projecting further improvement for childhood and prime working age for those born in 2017, but they are also projecting that people will live longer.

The second graph uses the same data but looks at the number of people who die before a certain age, but after the previous age. As an example, for those born in 1900 (blue), 12,448 of the 100,000 born alive died before age 1, and another 5,748 died between age 1 and age 5.

The second graph uses the same data but looks at the number of people who die before a certain age, but after the previous age. As an example, for those born in 1900 (blue), 12,448 of the 100,000 born alive died before age 1, and another 5,748 died between age 1 and age 5.The peak age for deaths didn't change much for those born in 1900 and 1950 (between 76 and 80, but many more people born in 1950 will make it).

Now the CDC is projection the peak age for deaths - for those born in 2017 - will increase to 86 to 90! Using these stats - for those born this year (in 2020) - almost 60% will make it to the next century.

Also the number of deaths for those younger than 20 will be very small (down to mostly accidents, guns, and drugs). Self-driving cars might reduce the accident components of young deaths.

An amazing statistic: for those born in 1900, about 31 out of 100,000 made it to 100. For those born in 1950, 199 are projected to make to 100 - a significant increase. Now the CDC is projecting that 1,894 out of 100,000 born in 2017 will make it to 100. Stunning!

Some people look at this data and worry about supporting all these old people. To me, this is all great news - the vast majority of people can look forward to a long life - with fewer people dying in childhood or during their prime working years.