by Calculated Risk on 10/09/2020 06:32:00 PM

Friday, October 09, 2020

October 9 COVID-19 Test Results; Most Cases in Over 2 Months

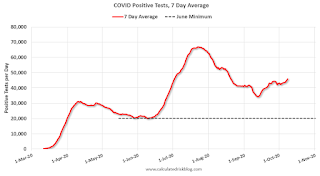

The US is now mostly reporting 700 thousand to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,013,588 test results reported over the last 24 hours.

There were 57,542 positive tests.

Over 6,500 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.7% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people would stay vigilant, the number of cases might drop to the June low in November - but that is looking unlikely.

U.S. Heavy Truck Sales down 26% Year-over-year in September

by Calculated Risk on 10/09/2020 02:08:00 PM

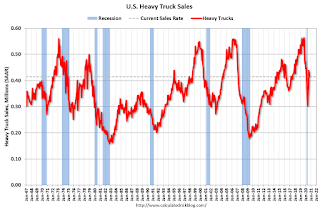

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the September 2020 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all time high of 575 thousand SAAR in September 2019.

However heavy truck sales started declining late last year due to lower oil prices.

Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Click on graph for larger image.

Heavy truck sales really declined towards the end of March due to COVID-19 and the collapse in oil prices.

Heavy truck sales are now back to March 2020 levels, but still below February 2020 (pre-COVID).

Heavy truck sales were at 415 thousand SAAR in September, down from 438 thousand SAAR in August, and down 26% from 563 thousand SAAR in September 2019.

Year-to-date heavy truck sales are down 28% compared to the same period in 2019 (288.5 thousand in 2020 compared to 399.4 thousand in 2019 through September).

Q3 GDP Forecasts

by Calculated Risk on 10/09/2020 12:23:00 PM

From Merrill Lynch:

We are tracking 33% qoq saar for 3Q GDP growth. [Oct 9 estimate]From Goldman Sachs:

emphasis added

We left our Q3 GDP tracking estimate unchanged at +35% (qoq ar).. [Oct 9 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 14.1% for 2020:Q3 and 4.8% for 2020:Q4. [Oct 9 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2020 is 35.2 percent on October 9, slightly down from 35.3 percent on October 6. [Oct 9 estimate]It is important to note that GDP is reported at a seasonally adjusted annual rate (SAAR). A 30% annualized increase in Q3 GDP, is about 6.8% QoQ, and would leave real GDP down about 4.2% from Q4 2019.

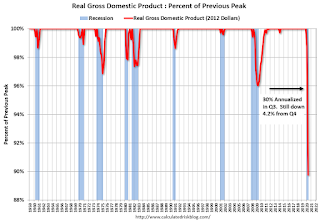

The following graph illustrates this decline.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent decline in real GDP from the previous peak (currently the previous peak was in Q4 2019).

This graph is through Q2 2020, and real GDP is currently off 10.2% from the previous peak. For comparison, at the depth of the Great Recession, real GDP was down 4.0% from the previous peak.

The black arrow shows what a 30% annualized increase in real GDP would look like in Q3.

Even with a 30% annualized increase (about 6.8% QoQ), real GDP will be down about 4.2% from Q4 2019; a larger decline in real GDP than at the depth of the Great Recession.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Declined Sharply

by Calculated Risk on 10/09/2020 08:22:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of October 6th.

From Forbearances See Largest Single Week Decline Yet

After a slight uptick last week, active forbearance volumes plummeted over the past seven days, falling by 649K from the week prior. An 18% reduction in the number of active forbearances, this represents the largest single-week decline since the beginning of the pandemic and its related fallout in the U.S. housing market.

New data from Black Knight’s McDash Flash Forbearance Tracker shows that as the first wave of forbearances from April are hitting the end of their initial six-month term, the national forbearance rate has decreased to 5.6%. This figure is down from 6.8% last week, with active forbearances falling below 3 million for the first time since mid-April.

Click on graph for larger image.

This decline noticeably outpaced the 435K weekly reduction we saw when the first wave of cases hit the three-month point back in July.

As of October 6, 2.97 million homeowners remain in COVID-19-related forbearance plans, representing $614 billion in unpaid principal.

...

Though the market continues to adjust to historic and unprecedented conditions, these are clear signs of long-term improvement. We hope to see a continuation of the promising trend of forbearance reduction in the coming weeks, as an additional 800K forbearance plans are slated to reach the end of their initial six-month term in the next 30 days.

Thursday, October 08, 2020

October 8 COVID-19 Test Results

by Calculated Risk on 10/08/2020 06:46:00 PM

The US is now mostly reporting 700 thousand to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 930,355 test results reported over the last 24 hours.

There were 54,870 positive tests.

Over 5,600 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.9% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people would stay vigilant, the number of cases might drop to the June low in November - but that is looking unlikely.

AAR: September Rail Carloads down 9.7% YoY, Intermodal Up 7.1% YoY

by Calculated Risk on 10/08/2020 03:32:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

U.S. rail volumes in September ranged from “generally getting better” to “already pretty good.”

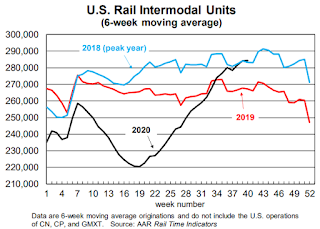

On the “already pretty good” side, average weekly U.S. intermodal originations in September were 284,777 units. That’s the fourth most for any month in history and up 7.1% over September 2019 ...

U.S. rail carloads are in the “generally getting better” category. Total carloads in September were down 9.7% from last year. That’s still a sizable decline, to be sure, but it’s the smallest since March 2020.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six week average of U.S. Carloads in 2018, 2019 and 2020:

On the carload side, volumes are still down, but by less than they were. U.S. railroads originated an average of 223,909 total carloads per week in September 2020. That’s their lowest weekly average for September since sometime before 1988 (when our data begin). That said, total carloads in September 2020 were down 9.7% from September 2019 — their smallest monthly year-over-year percentage decline since March 2020, when the lockdowns began.

The second graph shows the six week average of U.S. intermodal in 2018, 2019 and 2020: (using intermodal or shipping containers):

The second graph shows the six week average of U.S. intermodal in 2018, 2019 and 2020: (using intermodal or shipping containers):Like nearly every other rail category, intermodal fell sharply in the spring — it was down 12.6% in Q2 2020, including a 17.2% decline in April.Note that rail traffic was weak prior to the pandemic.

A few months later, things are very different. U.S. railroads originated 1.31 million containers and trailers in September 2020, up 7.1% over September 2019 — the biggest year-over-year percentage gain for intermodal since December 2016.

...

Why the change? U.S. imports of consumer goods are surging — they set an all-time monthly record in August 2020, with China supplying a huge share of them. After stalling in the spring, China’s export machine has come roaring back.

Seattle Real Estate in September: Sales up 59% YoY, Inventory UP 8% YoY

by Calculated Risk on 10/08/2020 02:24:00 PM

The Northwest Multiple Listing Service reported Northwest MLS brokers say September’s home sales reached highest level since June 2018

Northwest Multiple Listing Service brokers completed 10,175 sales transactions during September – the highest monthly volume since June 2018 when MLS members reported 10,072 closed sales. September’s closings also marked a jump of nearly 28% from the same month a year ago, according to the latest statistical summary from the MLS.There were 10,175 sales in September 2020, up 27.8% from 7,962 sales in September 2019.

“I believe this significant increase speaks to sellers becoming much more confident and buyers competing more effectively, most likely due to low interest rates,” remarked Mike Grady, president and COO at Coldwell Banker Bain. “It’s as if we just completed our typical ‘spring’ market,” he added.

emphasis added

The press release is for the Northwest. In King County, sales were up 41% year-over-year, and active inventory was down 27% year-over-year.

In Seattle, sales were up 58.5% year-over-year, and inventory was up 8.4% year-over-year.. This puts the months-of-supply in Seattle at just 1.8 months.

Hotels: Occupancy Rate Declined 29.6% Year-over-year

by Calculated Risk on 10/08/2020 12:16:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 3 October

U.S. hotel occupancy decreased slightly from the previous week, according to the latest data from STR through 3 October.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

27 September through 3 October 2020 (percentage change from comparable week in 2019):

• Occupancy: 47.9% (-29.6%)

• AAverage daily rate (ADR): US$95.63 (-26.3%)

• Revenue per available room (RevPAR): US$45.80 (-48.1%)

Year-over-year declines were less pronounced compared with previous weeks due to the Rosh Hashanah impact on the hotel calendar in 2019. Most of the markets with the highest occupancy levels were once again those in areas with displaced residents from natural disasters. Amid continued wildfires, California South/Central saw the highest occupancy level at 78.4%. In the aftermath of Hurricane Sally, Mobile, Alabama, reported the next highest occupancy level (73.6%).

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels - before 2020).

There was some recent boost from natural disasters - perhaps 1 or 2 percentage points total based on previous disasters - but so far there has been little business travel pickup that usually happens in the Fall.

Note: Y-axis doesn't start at zero to better show the seasonal change.

NMHC: Rent Payment Tracker Shows Households Paying Rent Unchanged in October

by Calculated Risk on 10/08/2020 10:08:00 AM

From the NMHC: NMHC Rent Payment Tracker Finds 79.4 Percent of Apartment Households Paid Rent as of October 6

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 79.4 percent of apartment households made a full or partial rent payment by October 6 in its survey of 11.4 million units of professionally managed apartment units across the country.

This is unchanged from the share who paid rent through October 6, 2019 and compares to 76.4 percent that had paid by September 6, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

“Our initial findings for October show that despite ongoing efforts by apartment community owners and operators to help residents facing financial distress through creative and nuanced payment plans, rent relief and other approaches, renters and the broader multifamily industry are confronting growing challenges,” said Doug Bibby, NMHC President.

emphasis added

This graph from the NMHC Rent Payment Tracker shows the percent of household making full or partial rent payments by the 6th of the month.

CR Note: This is mostly for large, professionally managed properties. There could be some timing issues, but rent payments are not falling off a cliff.

Weekly Initial Unemployment Claims at 840,000

by Calculated Risk on 10/08/2020 08:38:00 AM

Special technical note on California (two week pause).

The DOL reported:

In the week ending October 3, the advance figure for seasonally adjusted initial claims was 840,000, a decrease of 9,000 from the previous week's revised level. The previous week's level was revised up by 12,000 from 837,000 to 849,000. The 4-week moving average was 857,000, a decrease of 13,250 from the previous week's revised average. The previous week's average was revised up by 3,000 from 867,250 to 870,250.This does not include the 464,437 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 508,707 the previous week. (There are some questions on PUA numbers).

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 857,000.

The previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims decreased to 10,976,000 (SA) from 11,979,000 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 11,394,832 receiving Pandemic Unemployment Assistance (PUA) that decreased from 11,828,338 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.