by Calculated Risk on 10/04/2020 07:08:00 PM

Sunday, October 04, 2020

Sunday Night Futures

Weekend:

• Schedule for Week of October 4, 2020

Monday:

• At 10:30 AM ET, the ISM Services Index for September.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 16 and DOW futures are up 133 (fair value).

Oil prices were down over the last week with WTI futures at $37.18 per barrel and Brent at $39.37 barrel. A year ago, WTI was at $53, and Brent was at $59 - so WTI oil prices are down about 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.17 per gallon. A year ago prices were at $2.66 per gallon, so gasoline prices are down $0.49 per gallon year-over-year.

October 4 COVID-19 Test Results

by Calculated Risk on 10/04/2020 06:44:00 PM

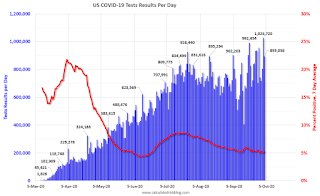

The US is now mostly reporting 700 thousand to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 861,282 test results reported over the last 24 hours.

There were 38,267 positive tests.

Almost 2,800 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 4.4% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people stay vigilant, the number of cases might drop to the June low in November (that would still be a large number of new cases, but progress).

Unofficial Problem Bank list Decreased to 65 Institutions

by Calculated Risk on 10/04/2020 09:43:00 AM

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

DISCLAIMER: This is an unofficial list, the information is from public sources only, and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here is the unofficial problem bank list for September 2020.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for September 2020. During the month, the list declined by one to 65 banks after one removal. Aggregate assets dropped to $56.8 billion. A year ago, the list held 74 institutions with assets of $55.7 billion. Thanks from a reader for letting us know that the action against CFG Community Bank, Lutherville, MD ($1.6 billion) [was terminated].

With the conclusion of the third quarter, we bring an updated transition matrix to detail how banks are transitioning off the Unofficial Problem Bank List. Since we first published the Unofficial Problem Bank List on August 7, 2009 with 389 institutions, 1,767 institutions have appeared on a weekly or monthly list since then. Only 3.7 percent of the banks that have appeared on a list remain today as 1,702 institutions have transitioned through the list. Departure methods include 1,003 action terminations, 410 failures, 270 mergers, and 19 voluntary liquidations. Of the 389 institutions on the first published list, only 3 or less than 1.0 percent, still have a troubled designation more than ten years later. The 410 failures represent 23.2 percent of the 1,767 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

Saturday, October 03, 2020

October 3 COVID-19 Test Results

by Calculated Risk on 10/03/2020 06:22:00 PM

The US is now mostly reporting 700 thousand to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 895,058 test results reported over the last 24 hours.

There were 51,203 positive tests.

Over 2,400 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.7% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people stay vigilant, the number of cases might drop to the June low towards the end of October (that would still be a large number of new cases, but progress).

Schedule for Week of October 4, 2020

by Calculated Risk on 10/03/2020 08:28:00 AM

The key indicators this week include the September ISM Services index, August Job Openings, and the August trade deficit.

Fed Chair Jerome Powell speaks on the Economic Outlook.

10:00 AM: the ISM Services Index for September.

8:30 AM: Trade Balance report for August from the Census Bureau. The consensus is for the deficit to be $66.2 billion in August, from $63.6 billion in July.

8:30 AM: Trade Balance report for August from the Census Bureau. The consensus is for the deficit to be $66.2 billion in August, from $63.6 billion in July.This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

8:00 AM ET: Corelogic House Price index for August

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in July to 6.618 million from 6.001 million in June.

The number of job openings (yellow) were down 8.5% year-over-year, and Quits were down 18% year-over-year.

10:40 AM: Speech by Fed Chair Jerome Powell, Economic Outlook, At the National Association for Business Economics Annual Meeting

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: FOMC Minutes, Meeting of September 15-16, 2020

6:00 AM: NFIB Small Business Optimism Index for September.

8:30 AM: The initial weekly unemployment claims report will be released. Initial claims were 837 thousand the previous week.

No major economic releases scheduled.

Friday, October 02, 2020

September Vehicles Sales increased to 16.3 Million SAAR

by Calculated Risk on 10/02/2020 08:15:00 PM

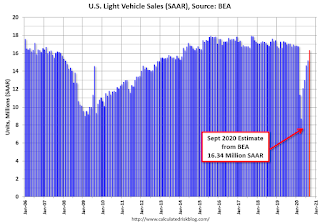

The BEA released their estimate of light vehicle sales for September this morning. The BEA estimates sales of 16.34 million SAAR in September 2020 (Seasonally Adjusted Annual Rate), up 7.6% from the August sales rate, and down 4.3% from September 2019.

This graph shows light vehicle sales since 2006 from the BEA (blue) and the BEA's estimate for September (red).

The impact of COVID-19 was significant, and April was the worst month.

Since April, sales have increased, but are still down 4.3% from last year.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Sales-to-date are down 18.8% in 2020 compared to the same period in 2019.

In 2019, there were 12.70 million light vehicle sales through September. In 2020, there have been 10.31 million sales.

October 2 COVID-19 Test Results

by Calculated Risk on 10/02/2020 07:08:00 PM

The US is now mostly reporting 700 thousand to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,026,720 test results reported over the last 24 hours.

There were 49,534 positive tests.

Almost 1,700 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 4.8% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people stay vigilant, the number of cases might drop to the June low towards the end of October (that would still be a large number of new cases, but progress).

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Increased Slightly

by Calculated Risk on 10/02/2020 12:29:00 PM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of September 29th.

From Forbearances up Slightly, First Rise in 6 Weeks

According to the latest weekly snapshot of Black Knight’s McDash Flash daily forbearance tracking data, the number of mortgages in active forbearance increased for the first time in six weeks, as plans rose by 21,000 over the last seven days.

The increase was driven primarily by an uptick among portfolio-held and private labeled security loans which rose by 28,000 for the week. FHA/VA loans also saw a slight increase of 2,000. Those increases were partially offset by a 9,000 decline in GSE forbearances.

Click on graph for larger image.

As of September 29, 3.6 million homeowners remain in COVID-19-related forbearance plans, or 6.8% of all active mortgages, unchanged from last week. Together, they represent $751 billion in unpaid principal.

Over the past month, active forbearance volumes are now down by 305,000 (-8%), with the strongest monthly declines seen among GSE and Portfolio/Private loans which have each fallen by 10%, with a more modest 4% decline among FHA/VA loans.

...

Of the 3.6 million loans still in active forbearance, more than 75% have had their terms extended at some point since March.

With more than a million forbearance plans for which September’s mortgage payment was the last payment covered under forbearance plan – and another million set to expire in October – significant removal/extension activity is still likely over the next few weeks.

The ongoing COVID-19 pandemic continues to represent significant uncertainty for the weeks ahead. Black Knight will continue to monitor the situation and report our findings on this blog.

emphasis added

Q3 GDP Forecasts

by Calculated Risk on 10/02/2020 12:20:00 PM

From Merrill Lynch:

Growth in 3Q could be 24.6% qoq saar, posing some downside risk for our forecast for a 27.0% qoq annualized growth rate [Sept 30 estimate]From Goldman Sachs:

emphasis added

We left our Q3 GDP tracking estimate unchanged at +35% (qoq ar). [Oct 2 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 14.0% for 2020:Q3 and 4.8% for 2020:Q4. [Oct 2 estimate]And from the Altanta Fed: GDPNow

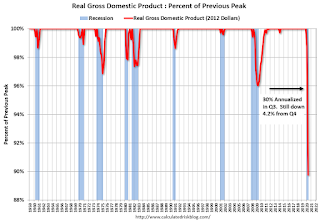

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2020 is 34.6 percent on October 1, up from 32.0 percent on September 25. [Oct 1 estimate]It is important to note that GDP is reported at a seasonally adjusted annual rate (SAAR). A 30% annualized increase in Q3 GDP, is about 6.8% QoQ, and would leave real GDP down about 4.2% from Q4 2019.

The following graph illustrates this decline.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent decline in real GDP from the previous peak (currently the previous peak was in Q4 2019).

This graph is through Q2 2020, and real GDP is currently off 10.2% from the previous peak. For comparison, at the depth of the Great Recession, real GDP was down 4.0% from the previous peak.

The black arrow shows what a 30% annualized increase in real GDP would look like in Q3.

Even with a 30% annualized increase (about 6.8% QoQ), real GDP will be down about 4.2% from Q4 2019; a larger decline in real GDP than at the depth of the Great Recession.

Comments on September Employment Report

by Calculated Risk on 10/02/2020 10:58:00 AM

The September employment report was below expectations, although employment for the previous two months were revised up.

Leisure and hospitality added another 318 thousand jobs in September, following 4.16 million jobs added in May through August. Leisure and hospitality lost 8.3 million jobs in March and April, so about 54% of those jobs were added back in the May through September period.

Earlier: September Employment Report: 661 Thousand Jobs Added, 7.9% Unemployment Rate

In August, the year-over-year employment change was minus 9.65 million jobs.

Permanent Job Losers

This graph shows permanent job losers as a percent of the pre-recession peak in employment through the September report. (ht Joe Weisenthal at Bloomberg)

This data is only available back to 1994, so there is only data for three recessions.

In September, the number of permanent job losers increased to 3.756 million from 3.411 million in August.

Prime (25 to 54 Years Old) Participation

The prime working age will be key in the eventual recovery.

The 25 to 54 participation rate decreased in September to 80.9% from 81.4% in August, and the 25 to 54 employment population ratio decreased to 75.0% from 75.3%.

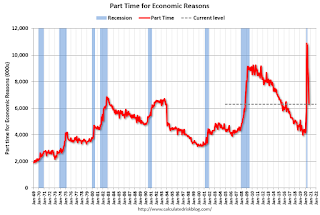

Part Time for Economic Reasons

"In September, the number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) declined by 1.3 million to 6.3 million, reflecting a decrease in the number of persons whose hours were cut due to slack work or business conditions."The number of persons working part time for economic reasons decreased in September to 6.300 million from 7.572 million in August.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 12.8% in September. This is down from the record high in April 22.8% for this measure since 1994.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.405 million workers who have been unemployed for more than 26 weeks and still want a job.

This will increase sharply in October - since the largest number of layoffs were in April - and will be a key measure to follow during the recovery.

Summary:

The headline monthly jobs number was below expectations, however the previous two months were revised up 145,000 combined. The headline unemployment rate decreased to 7.9%, however this was somewhat due to the wrong reasons (decline in participation).