by Calculated Risk on 9/30/2020 08:34:00 AM

Wednesday, September 30, 2020

Q2 GDP Revised up to -31.4% Annual Rate

From the BEA: Gross Domestic Product (Third Estimate), Corporate Profits (Revised), and GDP by Industry (Annual Update), Second Quarter 2020

Real gross domestic product (GDP) decreased at an annual rate of 31.4 percent in the second quarter of 2020, according to the "third" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP decreased 5.0 percent.From the BEA revision information, here is a Comparison of Third and Second Estimates. PCE growth was revised up to -33.2% from -34.6%. Residential investment was revised up from -37.9% to -35.6%. This was close to the consensus forecast.

The “third” estimate of GDP released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the decrease in real GDP was 31.7 percent. The upward revision with the third estimate primarily reflected an upward revision to personal consumption expenditures (PCE) that was partly offset by downward revisions to exports and to nonresidential fixed investment.

emphasis added

ADP: Private Employment increased 749,000 in September

by Calculated Risk on 9/30/2020 08:19:00 AM

Private sector employment increased by 749,000 jobs from August to September according to the September ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 605 thousand private sector jobs added in the ADP report.

“The labor market continues to recover gradually,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “In September, the majority of sectors and company sizes experienced gains with trade, transportation and utilities; and manufacturing leading the way. However, small businesses continued to demonstrate slower growth.

emphasis added

The BLS report will be released Friday, and the consensus is for 850 thousand non-farm payroll jobs added in September. Of course the ADP report has not been very useful in predicting the BLS report.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 9/30/2020 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 4.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 25, 2020.

... The Refinance Index decreased 7 percent from the previous week and was 52 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 22 percent higher than the same week one year ago.

“Mortgage rates decreased last week, with the 30-year fixed rate mortgage declining 5 basis points to 3.05 percent – the lowest in MBA’s survey. Despite the decline in rates, refinances fell over 6 percent, driven by a 9 percent drop in conventional refinance applications,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “There are indications that refinance rates are not decreasing to the same extent as rates for home purchase loans, and that could explain last week’s decline in refinances. Many lenders are still operating at full capacity and working through operational challenges, ultimately limiting the number of applications they are able to accept.”

Added Kan, “Purchase applications also decreased last week, but activity was still at a strong year-overyear growth rate of 22 percent. Even as pent-up demand from earlier in the year wanes, there continues to be action in the higher price tiers, with the average loan balance remaining close to an all-time survey high.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.05 percent from 3.10 percent, with points increasing to 0.52 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

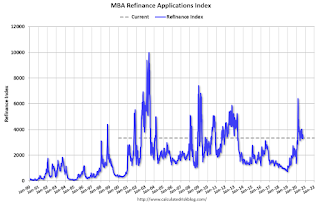

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index is up significantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 22% year-over-year unadjusted.

Note: Red is a four-week average (blue is weekly).

Tuesday, September 29, 2020

Wednesday: ADP Employment, Q2 GDP, Chicago PMI, Pending Home Sales

by Calculated Risk on 9/29/2020 09:24:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 605,000 jobs added, up from 428,000 in August.

• At 8:30 AM, Gross Domestic Product, 2nd quarter 2020 (Third estimate). The consensus is that real GDP decreased 31.7% annualized in Q2, unchanged from the second estimate of -31.7%.

• At 9:45 AM, Chicago Purchasing Managers Index for September. The consensus is for a reading of 52.0, up from 51.2 in August.

• At 10:00 AM, Pending Home Sales Index for August. The consensus is 3.2% increase in the index.

September 29 COVID-19 Test Results

by Calculated Risk on 9/29/2020 07:14:00 PM

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 744,476 test results reported over the last 24 hours.

There were 36,947 positive tests.

Over 22,000 Americans have died from COVID so far in September. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.0% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people stay vigilant, the number of cases might drop to the June low some time in October (that would still be a large number of new cases, but progress).

Real House Prices and Price-to-Rent Ratio in July

by Calculated Risk on 9/29/2020 02:23:00 PM

Here is the post earlier on Case-Shiller: Case-Shiller: National House Price Index increased 4.8% year-over-year in July

It has been over fourteen years since the bubble peak. In the Case-Shiller release today, the seasonally adjusted National Index (SA), was reported as being 18.6% above the previous bubble peak. However, in real terms, the National index (SA) is still about 4% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 12% below the bubble peak.

The year-over-year growth in prices increased to 4.8% nationally.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $289,000 today adjusted for inflation (45%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

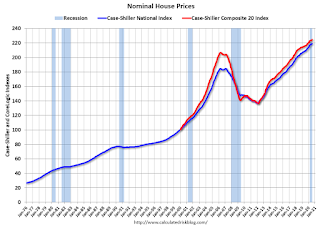

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to June 2005 levels, and the Composite 20 index is back to November 2004.

In real terms, house prices are at 2004/2005 levels.

Note that inflation was negative for a few months earlier this year, and that boosted real prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0). The price-to-rent ratio has been moving sideways recently.

On a price-to-rent basis, the Case-Shiller National index is back to March 2004 levels, and the Composite 20 index is back to November 2003 levels.

In real terms, prices are back to late 2004/2005 levels, and the price-to-rent ratio is back to late 2003, early 2004.

"Chemical Activity Barometer Rises in September"

by Calculated Risk on 9/29/2020 11:12:00 AM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Rises in September

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), rose 1.6 percent in September on a three-month moving average (3MMA) basis following a 2.7 percent gain in August. On a year-over-year (Y/Y) basis, the barometer was down 4.3 percent in September.

The unadjusted data show a 0.7 percent gain in September following a 2.2 percent gain in August and a 1.9 percent gain in July. The diffusion index rose from 35 percent to 65 percent in September. The diffusion index marks the number of positive contributors relative to the total number of indicators monitored. The CAB reading for August was revised upward by 0.89 points and that for July was revised upward by 0.42 points.

“With five consecutive months of gains, the September CAB reading is consistent with recovery in the U.S. economy,” said Kevin Swift, chief economist at ACC.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to 14 months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer (CAB) compared to Industrial Production.

Although the CAB (red) generally leads Industrial Production (blue), they both collapsed together with the sudden stop of the economy in March. The increases in the CAB suggest further increases in Industrial Production, but still a large year-over-year decline.

Case-Shiller: National House Price Index increased 4.8% year-over-year in July

by Calculated Risk on 9/29/2020 09:21:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for July ("July" is a 3 month average of May, June and July prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P CoreLogic Case-Shiller Index Reports 4.8% Annual Home Price Gain in July

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 4.8% annual gain in July, up from 4.3% in the previous month. The 10-City Composite annual increase came in at 3.3%, up from 2.8% in the previous month. The 20-City Composite posted a 3.9% year-over-year gain, up from 3.5% in the previous month.

Phoenix, Seattle and Charlotte reported the highest year-over-year gains among the 19 cities (excluding Detroit) in July. Phoenix led the way with a 9.2% year-over-year price increase, followed by Seattle with a 7.0% increase and Charlotte with a 6.0% increase. Sixteen of the 19 cities reported higher price increases in the year ending July 2020 versus the year ending June 2020.

...

The National Index posted a 0.8% month-over-month increase, while the 10-City and 20-City Composites both posted increases of 0.6% before seasonal adjustment in July. After seasonal adjustment, the National Index posted a month-over-month increase of 0.4%, while the 10-City and 20- City Composites posted increases of 0.5% and 0.6%, respectively. In July, 18 of 19 cities (excluding Detroit) reported increases before seasonal adjustment, while 18 of the 19 cities reported increases after seasonal adjustment.

“Housing prices rose in July,” says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices. “The National Composite Index gained 4.8% relative to its level a year ago, slightly ahead of June’s 4.3% increase. The 10- and 20-City Composites (up 3.3% and 3.9%, respectively) also rose at an accelerating pace in July compared to June. The strength of the housing market was consistent nationally – all 19 cities for which we have July data rose, with 16 of them outpacing their June gains.

“In previous months, we’ve noted that a trend of accelerating increases in the National Composite Index began in August 2019. That trend was interrupted in May and June, as price gains decelerated modestly, but now may have resumed. Obviously more data will be required before we can say with confidence that any COVID-related deceleration is behind us.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 4.3% from the bubble peak, and up 0.5% in July (SA) from June.

The Composite 20 index is 8.7% above the bubble peak, and up 0.6% (SA) in July.

The National index is 18.6% above the bubble peak (SA), and up 0.4% (SA) in July. The National index is up 60% from the post-bubble low set in December 2011 (SA).

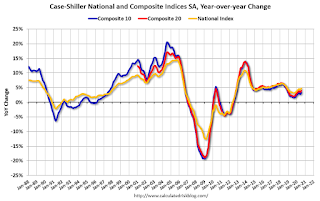

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 3.3% compared to July 2019. The Composite 20 SA is up 4.0% year-over-year.

The National index SA is up 4.8% year-over-year.

Note: According to the data, prices increased in 18 cities month-over-month seasonally adjusted.

Price increases were slightly above expectations. I'll have more later.

Monday, September 28, 2020

Tuesday: Case-Shiller House Prices

by Calculated Risk on 9/28/2020 08:50:00 PM

Tuesday:

• At 9:00 AM ET: S&P/Case-Shiller House Price Index for July. The consensus is for a 3.8% year-over-year increase in the Comp 20 index for July.

September 28 COVID-19 Test Results

by Calculated Risk on 9/28/2020 07:11:00 PM

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 960,631 test results reported over the last 24 hours.

There were 36,741 positive tests.

Over 21,000 Americans have died from COVID so far in September. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 3.8% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people stay vigilant, the number of cases might drop to the June low some time in October (that would still be a large number of new cases, but progress).