by Calculated Risk on 9/23/2020 11:21:00 AM

Wednesday, September 23, 2020

AIA: "Architectural billings in August still show little sign of improvement"

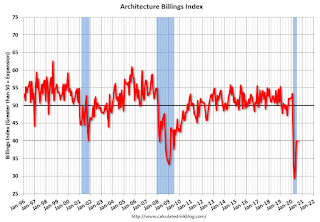

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architectural billings in August still show little sign of improvement

Business conditions remained stalled at architecture firms during August as demand for design services continued to decline, according to a new report from the American Institute of Architects (AIA).

The pace of decline during August remained at about the same level as in July and June, posting an Architecture Billings Index (ABI) score of 40.0 (any score below 50 indicates a decline in firm billings). Inquiries into new projects during August grew for the first time since February, and the value of new design contracts increased to a score of 46.0. As a result, fewer firms reported a decline in August, despite the fact that they remained negative overall.

“Unfortunately, since the start of the COVID-19 pandemic, many architecture firms are finding fewer inquiries that convert to billable projects,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “While fewer firms reported declining billings in August than during the early months of the COVID-19 pandemic, the fact that the score has been unchanged for the last three months shows that the recovery from this downturn is not progressing at the pace we had hoped to see.”

...

• Regional averages: Midwest (41.7); South (41.6); West (41.3); Northeast (33.9)

• Sector index breakdown: multi-family residential (49.4); mixed practice (41.9); institutional (40.2); commercial/industrial (35.5)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 40.0 in August, unchanged from 40.0 in July. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index has been below 50 for six consecutive months. This represents a significant decrease in design services, and suggests a decline in CRE investment through the first half of 2021 (This usually leads CRE investment by 9 to 12 months).

This weakness is not surprising since certain segments of CRE are struggling, especially offices and retail.

FHFA: House Prices up 6.5% YoY in July

by Calculated Risk on 9/23/2020 09:30:00 AM

From the FHFA: FHFA House Price Index Up 1.0 Percent in July; Up 6.5 Percent from Last Year

House prices rose nationwide in July, up 1.0 percent from the previous month, according to the latest Federal Housing Finance Agency House Price Index (FHFA HPI). House prices rose 6.5 percent from July 2019 to July 2020. FHFA also revised its previously reported 0.9 percent price change for June 2020 to 1.0 percent.This is a sharp increase in house prices.

For the nine census divisions, seasonally adjusted monthly house price changes from June 2020 to July 2020 ranged from +0.6 percent in the West North Central division to +2.0 percent in the New England division. The 12-month changes ranged from +5.4 percent in the West South Central division to +7.7 percent in both the Mountain and the East South Central divisions.

“U.S. house prices posted a strong increase in July," said Dr. Lynn Fisher, FHFA's Deputy Director of the Division of Research and Statistics. “Between May and July 2020, national prices increased by over 2 percent, which represents the largest two-month price increase observed since the start of the index in 1991. The dramatic increase in prices this summer can be attributed to the historically low interest rate environment and rebounding housing demand even as the supply of homes for sale remains constrained."

emphasis added

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 9/23/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 6.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 18, 2020. The previous week’s results included an adjustment for the Labor Day holiday.

... The Refinance Index increased 9 percent from the previous week and was 86 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 13 percent compared with the previous week and was 25 percent higher than the same week one year ago.

“Mortgage applications activity remained strong last week, even as the 30-year fixed-rate mortgage and 15-year fixed-rate mortgage increased to their highest levels since late August. Purchase applications were up over 25 percent from a year ago, and the demand for higher-balance loans pushed the average purchase loan size to another record high. The strong interest in homebuying observed this summer has carried over to the fall,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Despite the uptick in rates, refinance applications increased around 9 percent and were almost 86 percent higher than last year. Both conventional and government refinance activity, and in particular FHA refinances, picked up last week.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased to 3.10 percent from 3.07 percent, with points increasing to 0.46 from 0.32 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index is up significantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 25% year-over-year unadjusted.

Note: Red is a four-week average (blue is weekly).

Tuesday, September 22, 2020

Wednesday: MBA Purchase Index, Fed Chair Powell

by Calculated Risk on 9/22/2020 09:00:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:00 AM, FHFA House Price Index for July. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Testimony, Fed Chair Jerome Powell, Coronavirus Response, Before the Select Subcommittee on Coronavirus Crisis, U.S. House of Representatives

• During the day, The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

September 22 COVID-19 Test Results

by Calculated Risk on 9/22/2020 06:54:00 PM

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 717,737 test results reported over the last 24 hours.

There were 48,794 positive tests.

Over 17,000 Americans have died from COVID so far in September. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.8% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people stay vigilant, the number of cases might drop to the June low some time in October (that would still be a large number of new cases, but progress).

September Employment Report Will Show a Decrease of 41,403 Temporary Census Workers

by Calculated Risk on 9/22/2020 02:20:00 PM

The Census Bureau released an update today on 2020 Census Paid Temporary Workers. The release today was for the BLS reference week for the September employment report.

As of the August reference week, there were 288,204 decennial Census temporary workers. As of the September reference week, there were 246,801 temporary Census workers.

This means the September employment report will show a decrease of 41,403 temporary Census workers. This will decrease the headline number.

Richmond Fed: "Manufacturing Activity Improved in September"

by Calculated Risk on 9/22/2020 02:14:00 PM

Earlier from the Richmond Fed: Manufacturing Activity Improved in September

Manufacturing activity in the Fifth District improved in September, according to the most recent survey from the Richmond Fed. The composite index climbed from 18 in August to 21 in September, buoyed by increases in the indicators for new orders and employment. The third component index—shipments—decreased but remained positive, suggesting continued expansion. Survey results also reflected improvement in local business conditions and increased capital spending. Overall, respondents were optimistic that conditions would continue to improve in the next six months.This was above consensus expectations.

Results reflected higher employment among many survey participants in September and suggested several manufacturers raised wages over the month.

emphasis added

Comments on August Existing Home Sales

by Calculated Risk on 9/22/2020 10:29:00 AM

Earlier: NAR: Existing-Home Sales Increased to 6.00 million in August

A few key points:

1) This was the highest sales rate since 2006. Existing home sales are counted at the close of escrow, so the August report was mostly for contracts signed in June and July - when the economy was much more open than in March and April. Some of the increase over the last three months was probably related to pent up demand from the shutdowns in March and April. However, with the high unemployment rate and the high rate of COVID infections, housing might be under some pressure later this year or in 2021. That is difficult to predict and depends on the course of the pandemic.

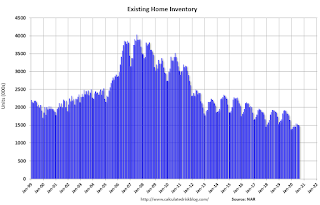

2) Inventory is very low, and was down 18.6% year-over-year (YoY) in August. This is the lowest level of inventory for August since at least the early 1990s.

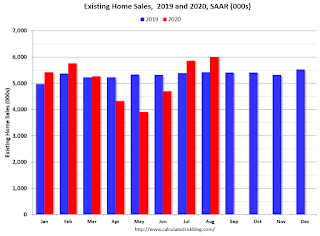

This graph shows existing home sales by month for 2019 and 2020.

Note that existing home sales picked up somewhat in the second half of 2019 as interest rates declined.

Even with weak sales in April, May, and June, sales to date are only down about 3.2% compared to the same period in 2019.

Sales NSA in August (561,000) were 5.5% above sales last year in August (532,000).

Fed Chair Powell Testimony: "Coronavirus Aid, Relief, and Economic Security Act" at 10:30 AM ET

by Calculated Risk on 9/22/2020 10:16:00 AM

Here is Fed Chair Powell's prepared testimony: Coronavirus Aid, Relief, and Economic Security Act

NAR: Existing-Home Sales Increased to 6.00 million in August

by Calculated Risk on 9/22/2020 10:10:00 AM

From the NAR: Existing-Home Sales Hit Highest Level Since December 2006

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 2.4% from July to a seasonally-adjusted annual rate of 6.00 million in August. Sales as a whole rose year-over-year, up 10.5% from a year ago (5.43 million in August 2019).

...

Total housing inventory at the end of August totaled 1.49 million units, down 0.7% from July and down 18.6% from one year ago (1.83 million). Unsold inventory sits at a 3.0-month supply at the current sales pace, down from 3.1 months in July and down from the 4.0-month figure recorded in August 2019.

emphasis added

Click on graph for larger image.

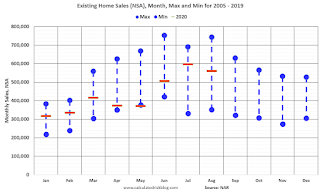

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in August (6.00 million SAAR) were up 2.4% from last month, and were 10.5% above the August 2019 sales rate.

This was the highest sales rate since 2006.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.49 million in August from 1.50 million in July. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

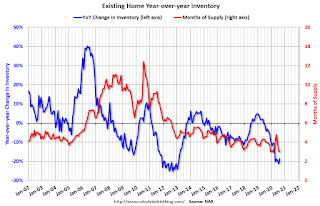

According to the NAR, inventory decreased to 1.49 million in August from 1.50 million in July. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 18.6% year-over-year in August compared to August 2019.

Inventory was down 18.6% year-over-year in August compared to August 2019. Months of supply decreased to 3.0 months in August.

This was at the consensus forecast. I'll have more later.