by Calculated Risk on 9/17/2020 12:21:00 PM

Thursday, September 17, 2020

CAR on California August Housing: Sales up 15% YoY, Active Listings down 50% YoY, Sales-to-date Down 7% Compared to 2019

The CAR reported: California housing market continues recovery as median home price breaks $700,000 mark, C.A.R. reports

California’s housing market continued to improve in August as home sales climbed to their highest level in more than a decade as the median home price broke last month’s record and hit another high, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.CR Note: Existing home sales are reported when the transaction closes, so this was mostly for contracts signed in June and July. Sales-to-date, through August, are down 6.8% compared to the same period in 2019.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 465,400 units in August, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2020 if sales maintained the August pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

August’s sales total climbed above the 400,000 level for the second straight month since the COVID-19 crisis depressed the housing market earlier this year, marking the first time since the summer of 2016 that sales increased from the previous month three months in a row. August sales rose 6.3 percent from 437,890 in July and were up 14.6 percent from a year ago, when 406,100 homes were sold on an annualized basis.

...

With fewer for-sale properties being added to the market, housing supply remained significantly below last year’s level. The 50.3 percent drop from a year ago was the biggest decline in active listings since at least January 2008. It was also the ninth consecutive month with active listings falling more than 25 percent from the prior year.

emphasis added

Comments on August Housing Starts

by Calculated Risk on 9/17/2020 11:31:00 AM

Earlier: Housing Starts decreased to 1.416 Million Annual Rate in August

Total housing starts in August were below expectations, however starts in June and July were revised up, combined. The slight weakness in August was due to volatile multi-family sector.

Low mortgage rates and limited existing home inventory have given a boost to housing starts.

The housing starts report showed starts were down 5.1% in August compared to July, and starts were up 2.8% year-over-year compared to August 2019.

Single family starts were up 12.1% year-over-year.

The first graph shows the month to month comparison for total starts between 2019 (blue) and 2020 (red).

Starts were up 2.8% in August compared to August 2019.

Last year, in 2019, starts picked up towards the end of the year, so the comparisons were easy in the first seven months of the year..

Starts, year-to-date, are up 5.2% compared to the same period in 2019. This is below my forecast for 2020, but I didn't expect a pandemic!

I expect starts to remain solid, but the growth rate will slow.

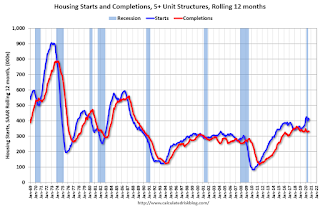

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - then mostly moved sideways. Completions (red line) had lagged behind - then completions caught up with starts- although starts picked up a little again lately.

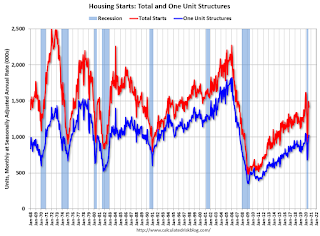

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions as the crisis abates.

Weekly Initial Unemployment Claims decreased to 860,000

by Calculated Risk on 9/17/2020 08:48:00 AM

The DOL reported:

In the week ending September 12, the advance figure for seasonally adjusted initial claims was 860,000, a decrease of 33,000 from the previous week's revised level. The previous week's level was revised up by 9,000 from 884,000 to 893,000. The 4-week moving average was 912,000, a decrease of 61,000 from the previous week's revised average. The previous week's average was revised up by 2,250 from 970,750 to 973,000.The previous week was revised up.

emphasis added

This does not include the 658,737 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 868,314 the previous week. (There are some questions on PUA numbers).

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 912,000.

The previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims decreased to 12,628,000 (SA) from 13,544,000 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 14,467,064 receiving Pandemic Unemployment Assistance (PUA) that decreased from 14,656,297 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

Housing Starts decreased to 1.416 Million Annual Rate in August

by Calculated Risk on 9/17/2020 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in August were at a seasonally adjusted annual rate of 1,416,000. This is 5.1 percent below the revised July estimate of 1,492,000, but is 2.8 percent above the August 2019 rate of 1,377,000. Single-family housing starts in August were at a rate of 1,021,000; this is 4.1 percent above the revised July figure of 981,000. The August rate for units in buildings with five units or more was 375,000.

Building Permits:

Privately-owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 1,470,000. This is 0.9 percent below the revised July rate of 1,483,000 and is 0.1 percent below the August 2019 rate of 1,471,000. Single-family authorizations in August were at a rate of 1,036,000; this is 6.0 percent above the revised July figure of 977,000. Authorizations of units in buildings with five units or more were at a rate of 381,000 in August.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) were up downAugust compared to July. Multi-family starts were down 15% year-over-year in August.

Single-family starts (blue) increased in August, and were up 12% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then eventual recovery (but still historically low).

Total housing starts in August were below expectations, however starts in June and July were revised up, combined.

I'll have more later …

Wednesday, September 16, 2020

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 9/16/2020 09:00:00 PM

Thursday:

• At 8:30 AM ET, Housing Starts for August. The consensus is for 1.470 million SAAR, down from 1.496 million SAAR.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The early consensus is for a 900 thousand initial claims, up from 884 thousand the previous week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for September. The consensus is for a reading of 15.5, down from 17.2.

September 16 COVID-19 Test Results

by Calculated Risk on 9/16/2020 07:07:00 PM

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 665,622 test results reported over the last 24 hours.

There were 40,021 positive tests.

Over 13,000 people have died from COVID in the first half of September. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.0% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people stay vigilant, the number of cases might drop to the June low by the end of September - although this seems unlikely now (that would still be a large number of new cases, but progress).

FOMC Projections and Press Conference

by Calculated Risk on 9/16/2020 02:09:00 PM

Statement here.

Fed Chair Powell press conference video here starting at 2:30 PM ET.

Here are the projections.

Note that GDP decreased at a 5.0% annual rate in Q1, and decreased at a 31.7% annual rate in Q2.

Most forecasts are for GDP to increase at a 25% to 35% annual rate in Q3.

It is important to note that GDP is reported at a seasonally adjusted annual rate (SAAR). A 30% annualized increase in Q3 GDP, is about 6.8% QoQ, and would leave real GDP down about 4.2% from Q4 2019.

The course of the economy will depend on the course of the pandemic, so the FOMC has to factor in their expectations of when the pandemic will subside and end (and no one knows at this time).

This FOMC revised up their GDP projections for 2020, and revised down their projections for the following years.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Sept 2020 | -4.0 to -3.0 | 3.6 to 4.7 | 2.5 to 3.3 | 2.4 to 3.0 |

| June 2020 | -7.6 to -5.5 | 4.5 to 6.0 | 3.0 to 4.5 | NA |

The unemployment rate was at 8.4% in August. The unemployment rate declined faster than most expectations.

Note that the unemployment rate doesn't remotely capture the economic damage to the labor market. Not only are there almost 14 million people unemployed, close to 4 million people have left the labor force since January. And millions more are being supported by various provisions for the CARES Act - that hasn't been renewed

The unemployment rate was revised down for all three years.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Sept 2020 | 7.0 to 8.0 | 5.0 to 6.2 | 4.0 to 5.0 | 3.5 to 4.4 |

| June 2020 | 9.0 to 10.0 | 5.9 to 7.5 | 4.8 to 6.1 | NA |

As of July 2020, PCE inflation was up 1.0% from July 2019. The projections for inflation were revised up this month.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Sept 2020 | 1.1 to 1.3 | 1.6 to 1.9 | 1.7 to 1.9 | 1.9 to 2.0 |

| June 2020 | 0.6 to 1.0 | 1.4 to 1.7 | 1.6 to 1.8 | NA |

PCE core inflation was up 1.3% in July year-over-year. Projections for core inflation were revised up.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Sept 2020 | 1.3 to 1.5 | 1.6 to 1.8 | 1.7 to 1.9 | 1.9 to 2.0 |

| June 2020 | 0.9 to 1.1 | 1.4 to 1.7 | 1.6 to 1.8 | NA |

FOMC Statement: "The Committee will aim to achieve inflation moderately above 2 percent for some time"

by Calculated Risk on 9/16/2020 02:02:00 PM

Fed Chair Powell press conference video here starting at 2:30 PM ET.

FOMC Statement:

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

The COVID-19 pandemic is causing tremendous human and economic hardship across the United States and around the world. Economic activity and employment have picked up in recent months but remain well below their levels at the beginning of the year. Weaker demand and significantly lower oil prices are holding down consumer price inflation. Overall financial conditions have improved in recent months, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy will depend significantly on the course of the virus. The ongoing public health crisis will continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer-term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In addition, over coming months the Federal Reserve will increase its holdings of Treasury securities and agency mortgage-backed securities at least at the current pace to sustain smooth market functioning and help foster accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Patrick Harker; Loretta J. Mester; and Randal K. Quarles.

Voting against the action were Robert S. Kaplan, who expects that it will be appropriate to maintain the current target range until the Committee is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals as articulated in its new policy strategy statement, but prefers that the Committee retain greater policy rate flexibility beyond that point; and Neel Kashkari, who prefers that the Committee to indicate that it expects to maintain the current target range until core inflation has reached 2 percent on a sustained basis.

emphasis added

Phoenix Real Estate in August: Sales Up 1.7% YoY, Active Inventory Down 38% YoY

by Calculated Risk on 9/16/2020 11:49:00 AM

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales were at 8,878 in August, dowm from 10,303 in July, and up from 8,726 in August 2019. Sales were down 13.8% from July 2020 (last month), and up 1.7% from August 2019.

2) Active inventory was at 8,328, down from 13,350 in August 2019. That is down 38% year-over-year.

3) Months of supply increased to 1.52 in August, up from 1.26 in July. This is very low.

Sales are reported at the close of escrow, so these sales were mostly signed in June and July.

NMHC: Rent Payment Tracker Shows Decline in Households Paying Rent in September

by Calculated Risk on 9/16/2020 10:44:00 AM

From the NMHC: NMHC Rent Payment Tracker Finds 86.2 Percent of Apartment Households Paid Rent as of September 13

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 86.2 percent of apartment households made a full or partial rent payment by September 13 in its survey of 11.4 million units of professionally managed apartment units across the country.

This is a 2.4-percentage point, or 279,457-household decrease from the share who paid rent through September 13, 2019 and compares to 86.9 percent that had paid by August 13, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

“While it remains clear that many apartment residents continue to prioritize their housing obligations and that apartment owners and operators remain committed to meeting them halfway with creative and nuanced approaches, the reality is that the second week of September figures shows ongoing deterioration of rent payment figures - representing hundreds of thousands of households who are increasingly at risk,” said Doug Bibby, NMHC President.

“This sadly comes as little surprise given that Congress and the Administration have failed to come back to the table and extend the critical protections that supported apartment residents and the nation’s consumer base during the initial months of the pandemic.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the NMHC Rent Payment Tracker shows the percent of household making full or partial rent payments by the 6th of the month.

CR Note: This is mostly for large, professionally managed properties. It appears fewer people are paying their rent this year compared to last year - down 2.4 percentage points from a year ago - and also down 0.7 percentage points compared to last month at the same point (August 2020).

Declining, but not falling off a cliff.