by Calculated Risk on 9/02/2020 07:00:00 AM

Wednesday, September 02, 2020

MBA: Mortgage Applications Decrease in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

— Mortgage applications decreased 2.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 28, 2020.

... The Refinance Index decreased 3 percent from the previous week and was 40 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 0.2 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 28 percent higher than the same week one year ago.

“Both conventional and government refinancing activity decreased last week, despite 30-year fixed and 15-year fixed mortgage rates declining to near historical lows. Mortgage rates have remained below 3.5 percent for five months now, and it’s possible that refinance demand may be slowing and will not significantly increase again without another notable drop in rates,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications were essentially unchanged over the week and were 28 percent higher than a year ago – the 15th straight week of year-over-year increases. Lenders are reporting that the strong demand for homebuying is coming from delayed activity from the spring, as well as households seeking more space in less densely populated areas.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.08 percent from 3.11 percent, with points decreasing to 0.36 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

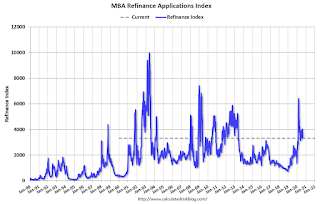

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index is up significantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 28% year-over-year.

Note: Red is a four-week average (blue is weekly).

Tuesday, September 01, 2020

Wednesday: ADP Employment

by Calculated Risk on 9/01/2020 08:45:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for August. This report is for private payrolls only (no government). The consensus is for 900,000 payroll jobs added in August, up from 167,000 added in July.

September 1 COVID-19 Test Results

by Calculated Risk on 9/01/2020 07:43:00 PM

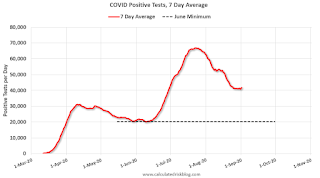

The US is now mostly reporting over 700,000 tests per day (fewer recently). Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 698,161 test results reported over the last 24 hours.

There were 42,401 positive tests.

TSee the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.1% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph).

By June, the percent positive had dropped below 5% (lower than today). If people stay vigilant, the number of cases might drop to the June low by the end of September (that would still be a large number of new cases, but progress).

August Vehicles Sales increased to 15.2 Million SAAR

by Calculated Risk on 9/01/2020 06:35:00 PM

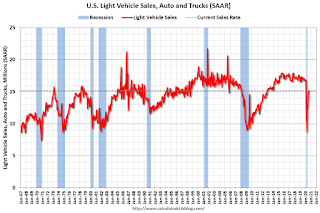

Wards estimated light vehicle sales of 15.19 million SAAR in August 2020 (Seasonally Adjusted Annual Rate), up 4.6% from the July sales rate, and down 11.0% from August 2019.

This graph shows light vehicle sales since 2006 from the BEA (blue) and an estimate for August from Wards 2020 (red).

The impact of COVID-19 was significant, and April was the worst month.

Since April, sales have increased, but are still down 11.0% from last year.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

I'll have more when the BEA releases their August estimate tomorrow.

Update: Framing Lumber Prices Up 150% Year-over-year

by Calculated Risk on 9/01/2020 12:00:00 PM

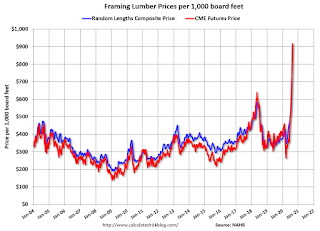

Here is another monthly update on framing lumber prices. Lumber prices are up 150% year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through August 28, 2020, and 2) CME framing futures.

Right now Random Lengths prices are up 156% from a year ago, and CME futures are up 144% year-over-year.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

Clearly there has been a surge in demand for lumber and the mills are struggling to meet demand.

This is the highest price for both Random Lengths lumber and futures.

Construction Spending Increased Slightly in July

by Calculated Risk on 9/01/2020 10:20:00 AM

From the Census Bureau reported that overall construction spending decreased in June:

Construction spending during July 2020 was estimated at a seasonally adjusted annual rate of $1,364.6 billion, 0.1 percent above the revised June estimate of $1,362.8 billion. The July figure is 0.1 percent below the July 2019 estimate of $1,366.0 billion.Private spending increased and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,013.5 billion, 0.6 percent above the revised June estimate of $1,007.2 billion. ...

In July, the estimated seasonally adjusted annual rate of public construction spending was $351.1 billion, 1.3 percent below the revised June estimate of $355.6 billion.

Click on graph for larger image.

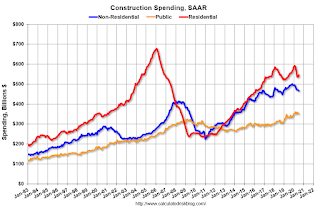

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 19% below the previous peak.

Non-residential spending is 12% above the previous peak in January 2008 (nominal dollars).

Public construction spending is 8% above the previous peak in March 2009, and 34% above the austerity low in February 2014.

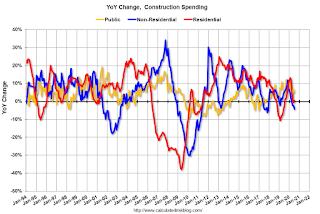

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is mostly unchanged. Non-residential spending is down 4.3% year-over-year. Public spending is up 5.1% year-over-year.

This was below consensus expectations of a 1.0% increase in spending, however construction spending for the previous two months was revised up slightly.

Construction was considered an essential service in most areas and did not decline sharply like many other sectors, but it seems likely that non-residential and public spending will be under pressure.

ISM Manufacturing index Increased to 56.0 in August

by Calculated Risk on 9/01/2020 10:04:00 AM

The ISM manufacturing index indicated expansion in August. The PMI was at 56.0% in August, up from 54.2% in July. The employment index was at 46.3%, up from 44.3% last month, and the new orders index was at 67.6%, up from 61.5%.

From ISM: PMI® at 56.0%; August 2020 Manufacturing ISM® Report On Business®

This was above expectations of 54.5%, but the employment index indicated further contraction.

This suggests manufacturing expanded at a faster pace in August than in July.

CoreLogic: House Prices up 5.5% Year-over-year in July

by Calculated Risk on 9/01/2020 08:14:00 AM

Notes: This CoreLogic House Price Index report is for July. The recent Case-Shiller index release was for June. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: Strong and Resilient: CoreLogic Reports July U.S. Home Price Appreciation Reached its Highest Level Since 2018

Nationally, home prices increased 5.5% in July 2020, compared with July 2019, and were up 1.2% compared to last month, when home prices increased 4.3%.CR Note: The overall impact on house prices will depend on the duration of the crisis.

In July, annual home price growth accelerated to its fastest rate in nearly two years. The one-two punch of strong purchase demand — bolstered by falling mortgage rates, which dipped below 3% for the first time ever in July — and further constriction of for-sale inventory has driven upward pressure on home price appreciation. The national HPI Forecast shows annual home price growth slowing through July 2021, reflecting the anticipated elevated unemployment rates during the next year. This could lead to an increase of distressed-sale inventory as continued financial pressures leave some homeowners unable to make mortgage payments, especially as forbearance periods come to a close.

“Lower-priced homes are sought after and have had faster annual price growth than luxury homes,” said Dr. Frank Nothaft, chief economist at CoreLogic. “First-time buyers and investors are actively seeking lower-priced homes, and that segment of the housing market is in particularly short supply.”

“On an aggregated level, the housing economy remains rock solid despite the shock and awe of the pandemic. A long period of record-low mortgage rates has opened the flood gates for a refinancing boom that is likely to last for several years," said Frank Martell, president and CEO of CoreLogic. "In addition, after a momentary COVID-19-induced blip, purchase demand has picked up, driven by low rates and enthusiastic millennial and investor buyers. Spurred on by strong demand and record-low mortgage rates, we expect to see more home building in 2021 and beyond, which should help support a healthy housing market for years to come.”

emphasis added

Monday, August 31, 2020

Tuesday: ISM Mfg, Construction Spending, Vehicle Sales

by Calculated Risk on 8/31/2020 08:37:00 PM

From Matthew Graham at Mortgage News Daily: Lowest Mortgage Rates in 3 Weeks

Mortgage rates improved nicely today with the average lender more convincingly back under the 3.0% threshold for conventional 30yr fixed scenarios. In general, that refers to 740+ credit and 20% equity/down-payment on an owner-occupied single family home with a loan amount at or under the conforming loan limit. Stray very far from that path and rates can increase rather quickly. [Top Tier Scenarios 30YR FIXED: 2.88%]Tuesday:

emphasis added

• At 10:00 AM, ISM Manufacturing Index for August. The consensus is for the ISM to be at 54.5, up from 54.2 in July.

• Also at 10:00 AM, Construction Spending for July. The consensus is for a 1.0% increase in construction spending.

• Also at 10:00 AM, The BLS is scheduled to release Labor Force projections through 2029.

• All day, Light vehicle sales for August. The consensus is for light vehicle sales to be 15.2 million SAAR in August, up from 14.5 million in July (Seasonally Adjusted Annual Rate).

August 31 COVID-19 Test Results

by Calculated Risk on 8/31/2020 06:25:00 PM

The US is now mostly reporting over 700,000 tests per day (fewer recently). Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 680,405 test results reported over the last 24 hours.

There were 31,406 positive tests.

TSee the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 4.6% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph).

By June, the percent positive had dropped below 5% (lower than today). If people stay vigilant, the number of cases might drop to the June low by the end of September (that would still be a large number of new cases, but progress).