by Calculated Risk on 8/25/2020 06:32:00 PM

Tuesday, August 25, 2020

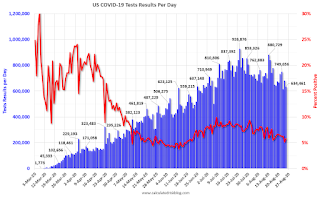

August 25 COVID-19 Test Results

The US is now mostly reporting over 700,000 tests per day (fewer recently). Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 634,461 test results reported over the last 24 hours.

There were 36,679 positive tests.

There have been 24,953 COVID reported deaths in the first 25 days of August. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.8% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

Freddie Mac: Mortgage Serious Delinquency Rate increased in July, Highest Since Feb 2013

by Calculated Risk on 8/25/2020 05:00:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in July was 3.12%, up from 2.48% in June. Freddie's rate is up from 0.61% in July 2019.

This is the highest serious delinquency rate since February 2013.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once they are employed.

Note: Fannie Mae will report for July soon.

August Vehicle Sales Forecast: 11% Year-over-year Decline

by Calculated Risk on 8/25/2020 03:37:00 PM

From Wards: U.S. Light Vehicle Sales & Inventory Forecast, August 2020 (pay content)

This graph shows actual sales from the BEA (Blue), and Wards forecast for August (Red).

Sales have bounced back from the April low, but are still down sharply year-over-year.

The Wards forecast of 15.2 million SAAR, would be up 4.7% from July, and down 11% from August 2019.

This would put sales in 2020, through August, down about 20% compared to the same period in 2019.

Real House Prices and Price-to-Rent Ratio in June

by Calculated Risk on 8/25/2020 03:28:00 PM

Here is the post earlier on Case-Shiller: Case-Shiller: National House Price Index increased 4.3% year-over-year in June

It has been over fourteen years since the bubble peak. In the Case-Shiller release today, the seasonally adjusted National Index (SA), was reported as being 18.1% above the previous bubble peak. However, in real terms, the National index (SA) is still about 4% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 12% below the bubble peak.

The year-over-year growth in prices decreased slightly to 4.3% nationally.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $289,000 today adjusted for inflation (45%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

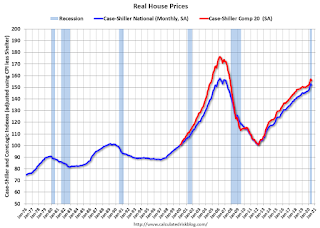

Real House Prices

In real terms, the National index is back to August 2005 levels, and the Composite 20 index is back to November 2004.

In real terms, house prices are at 2004/2005 levels.

Note that inflation was negative for a few months earlier this year, and that boosted real prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0). The price-to-rent ratio has been moving sideways recently.

On a price-to-rent basis, the Case-Shiller National index is back to March 2004 levels, and the Composite 20 index is back to November 2003 levels.

In real terms, prices are back to late 2004/2005 levels, and the price-to-rent ratio is back to late 2003, early 2004.

A few Comments on July New Home Sales

by Calculated Risk on 8/25/2020 12:03:00 PM

New home sales for July were reported at 901,000 on a seasonally adjusted annual rate basis (SAAR). Sales for the previous three months were revised up, combined.

This was well above consensus expectations, and this was the highest sales rate since 2007. Clearly low mortgages rates, and low sales in March and April (due to the pandemic) have led to a bounce back in sales in May, June and July. Favorable demographics (something I wrote about many times over the last decade) and a surging stock market have probably helped new home sales too.

Note that sales are reported on a seasonally adjusted annual rate basis (SAAR). Sales in July NSA were up 3 thousand from June, but this translates into an increase from 791,000 SAAR in June to 901,000 SAAR in July.

Earlier: New Home Sales increased to 901,000 Annual Rate in July.

This graph shows new home sales for 2019 and 2020 by month (Seasonally Adjusted Annual Rate).

New home sales were up 36.3% year-over-year (YoY) in July. Year-to-date (YTD) sales are up 8.2%.

And on inventory: since new home sales are reported when the contract is signed - even if the home hasn't been started - new home sales are not limited by inventory. Inventory for new home sales is important in that it means there will be more housing starts if inventory is low - and fewer starts if inventory is too high (not now).

Important: No one should get too excited. Many years ago, I wrote several articles about how new home sales and housing starts (especially single family starts) were some of the best leading indicators for the economy. However, I've noted that there are times when this isn't true. NOW is one of those times.

Currently the course of the economy will be determined by the course of the virus, and New Home Sales tell us nothing about the future of the pandemic. Without the pandemic, I'd be very positive about this report.

August Employment Report Will Show an Increase of 237,800 Temporary Census Workers

by Calculated Risk on 8/25/2020 10:17:00 AM

The Census Bureau released an update today on 2020 Census Paid Temporary Workers

As of the July BLS employment report reference week, there were 50,404 decennial Census temporary workers. As of August reference week there were 288,204 temp workers.

This means the August employment report will show an increase of 237,800 in temporary Census hiring under Federal employment.

This is the 2020 Census Paid Temporary Workers report released today.

The temporary employment for the July and August reference weeks are circled in red.

Since these are temporary, and only happen every ten years with the decennial Census, it makes sense to adjust the headline monthly Current Employment Statistics (CES) by Census hiring to determine the underlying employment trend.

The correct adjustment method is to take the headline number and subtract the change in the number of Census 2020 temporary and intermittent workers. For more, see: How to Report the Monthly Employment Number excluding Temporary Census Hiring

New Home Sales increased to 901,000 Annual Rate in July

by Calculated Risk on 8/25/2020 10:11:00 AM

The Census Bureau reports New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 901 thousand.

The previous three months were revised up, combined.

Sales of new single-family houses in July 2020 were at a seasonally adjusted annual rate of 901,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 13.9 percent above the revised June rate of 791,000 and is 36.3 percent above the July 2019 estimate of 661,000.

emphasis added

Click on graph for larger image.

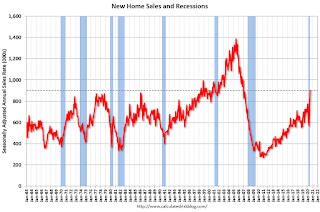

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

This is the highest sales rate since 2007.

The second graph shows New Home Months of Supply.

The months of supply decreased in July to 4.0 months from 5.5 months in June.

The months of supply decreased in July to 4.0 months from 5.5 months in June. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of July was 299,000. This represents a supply of 4.0 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is close to normal.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In July 2020 (red column), 78 thousand new homes were sold (NSA). Last year, 55 thousand homes were sold in July.

The all time high for July was 117 thousand in 2005, and the all time low for July was 26 thousand in 2010.

This was above expectations of 786 thousand sales SAAR, and sales in the three previous months were revised up, combined. I'll have more later today.

Case-Shiller: National House Price Index increased 4.3% year-over-year in June

by Calculated Risk on 8/25/2020 09:14:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for June ("June" is a 3 month average of April, May and June prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P CoreLogic Case-Shiller Index Reports 4.3% Annual Home Price Gain in June

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 4.3% annual gain in June, no change from the previous month. The 10-City Composite annual increase came in at 2.8%, down from 3.0% in the previous month. The 20-City Composite posted a 3.5% year-over-year gain, down from 3.6% in the previous month.

Phoenix, Seattle and Tampa continued to report the highest year-over-year gains among the 19 cities (excluding Detroit) in June. Phoenix led the way with a 9.0% year-over-year price increase, followed by Seattle with a 6.5% increase and Tampa with a 5.9% increase. Five of the 19 cities reported higher price increases in the year ending June 2020 versus the year ending May 2020.

...

The National Index posted a 0.6% month-over-month increase, while the 10-City and 20-City Composites posted increases of 0.1% and 0.2% respectively before seasonal adjustment in June. After seasonal adjustment, the National Index posted a month-over-month increase of 0.2%, while the 10- City Composite posted a decrease of 0.1% and the 20-City Composite did not post any gains. In June, 16 of 19 cities (excluding Detroit) reported increases before seasonal adjustment, while 12 of the 19 cities reported increases after seasonal adjustment.

“Housing prices were stable in June,” says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices. “The National Composite Index rose by 4.3% in June 2020, as it had also done in May (June’s growth was slightly lower in the 10- and 20-City Composites, which were up 2.8% and 3.5%, respectively). More data will be required to understand whether the market resumes its previous path of accelerating prices, continues to decelerate, or remains stable. That said, it’s important to bear in mind that deceleration is quite different from an environment in which prices actually fall.

“June’s gains were quite broad-based. Prices increased in all 19 cities for which we have data, accelerating in five of them. Phoenix retains the top spot for the 13th consecutive month, with a gain of 9.0% for June. Home prices in Seattle rose by 6.5%, followed by Tampa at 5.9% and Charlotte at 5.7%. As has been the case for the last several months, prices were particularly strong in the Southeast and West, and comparatively weak in the Midwest and (especially) Northeast.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 4.1% from the bubble peak, and declined 0.1% in June (SA) from May.

The Composite 20 index is 8.3% above the bubble peak, and unchanged (SA) in June.

The National index is 18.1% above the bubble peak (SA), and up 0.2% (SA) in June. The National index is up 60% from the post-bubble low set in December 2011 (SA).

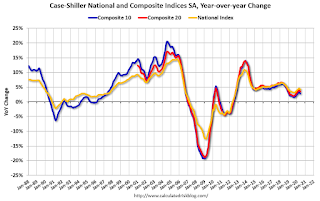

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 2.8% compared to June 2019. The Composite 20 SA is up 3.5% year-over-year.

The National index SA is up 4.3% year-over-year.

Note: According to the data, prices increased in 12 of 20 cities month-over-month seasonally adjusted.

Price increases were slightly below expectations. I'll have more later.

Monday, August 24, 2020

Tuesday: New Home Sales, Case-Shiller House Prices

by Calculated Risk on 8/24/2020 08:51:00 PM

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for June. The consensus is for a 3.6% year-over-year increase in the Comp 20 index for June.

• Also at 9:00 AM, FHFA House Price Index for June 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, New Home Sales for July from the Census Bureau. The consensus is for 786 thousand SAAR, down from 776 thousand in June.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for August

August 24 COVID-19 Test Results

by Calculated Risk on 8/24/2020 07:17:00 PM

The US is now mostly reporting over 700,000 tests per day (fewer recently). Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 682,054 test results reported over the last 24 hours.

There were 35,036 positive tests.

There have been 23,806 COVID reported deaths in the first 24 days of August. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.1% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.