by Calculated Risk on 8/19/2020 09:28:00 PM

Wednesday, August 19, 2020

Thursday: Unemployment Claims, Philly Fed Mfg

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The early consensus is for a 900 thousand initial claims, down from 963 thousand the previous week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for August. The consensus is for a reading of 20.5, down from 24.1.

August 19 COVID-19 Test Results

by Calculated Risk on 8/19/2020 06:34:00 PM

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 680,934 test results reported over the last 24 hours.

There were 45,103 positive tests.

There have been 19,600 COVID deaths in the first 19 days of August. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.6% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

FOMC Minutes: "Uncertainty surrounding the economic outlook remained very elevated"

by Calculated Risk on 8/19/2020 02:26:00 PM

From the Fed: Minutes of the Federal Open Market Committee July 28-29, 2020. A few excerpts:

Participants observed that uncertainty surrounding the economic outlook remained very elevated, with the path of the economy highly dependent on the course of the virus and the public sector's response to it. Several risks to the outlook were noted, including the possibility that additional waves of virus outbreaks could result in extended economic disruptions and a protracted period of reduced economic activity. In such scenarios, banks and other lenders could tighten conditions in credit markets appreciably and restrain the availability of credit to households and businesses. Other risks cited included the possibility that fiscal support for households, businesses, and state and local governments might not provide sufficient relief of financial strains in these sectors and that some foreign economies could come under greater pressure than anticipated as a result of the spread of the pandemic abroad. Several participants noted potential longer-run effects of the pandemic associated with possible restructuring in some sectors of the economy that could slow the growth of the economy's productive capacity for some time.

A number of participants commented on various potential risks to financial stability. Banks and other financial institutions could come under significant stress, particularly if one of the more adverse scenarios regarding the spread of the virus and its effects on economic activity was realized. Nonfinancial corporations had carried high levels of indebtedness into the pandemic, increasing their risk of insolvency. There were also concerns that the anticipated increase in Treasury debt over the next few years could have implications for market functioning. There was general agreement that these institutions, activities, and markets should be monitored closely, and a few participants noted that improved data would be helpful for doing so. Several participants observed that the Federal Reserve had recently taken steps to help ensure that banks remain resilient through the pandemic, including by conducting additional sensitivity analysis in conjunction with the most recent bank stress tests and imposing temporary restrictions on shareholder payouts to preserve banks' capital. A couple of participants noted that they believed that restrictions on shareholder payouts should be extended, while another judged that such a step would be premature.

emphasis added

AIA: "July architectural billings remained stalled"

by Calculated Risk on 8/19/2020 12:27:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: July architectural billings remained stalled

Architectural billings failed to show any progress during July, and business conditions continued to be soft at firms, according to a new report from the American Institute of Architects (AIA).

The pace of decline during July remained at about the same level as in June with both months posting an ABI score of 40.0 (any score below 50 indicates a decline in firm billings). While firms reported a modest decline for inquiries into new projects—slipping from 49.3 in June to 49.1 in July— newly signed design contracts declined more critically, falling from a June level of 44.0 to 41.7 in July.

“It’s clear the pandemic continued to contribute to uncertainty in business conditions, especially as cases spiked in states across the country,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “While clients expressed interest in exploring new projects, many are hesitant to sign onto new contracts with the exception of the multifamily residential sector, which came close to seeing billings growth in July.”

...

• Regional averages: West (40.9); South (40.7); Midwest (40.1); Northeast (36.8)

• Sector index breakdown: multi-family residential (47.5); mixed practice (44.0); institutional (39.5); commercial/industrial (35.4)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 40.0 in July, unchanged from 40.0 in June.. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index has been below 50 for five consecutive months. This represents a significant decrease in design services, and suggests a decline in CRE investment in the first half of 2021 (This usually leads CRE investment by 9 to 12 months).

This weakness is not surprising since certain segments of CRE are struggling, especially offices and retail.

Employment: Preliminary annual benchmark revision shows downward adjustment of 173,000 jobs

by Calculated Risk on 8/19/2020 10:36:00 AM

Note: This is mostly before the sharp decline in employment due to COVID.

The BLS released the preliminary annual benchmark revision showing 173,000 fewer payroll jobs as of March 2020. The final revision will be published when the January 2021 employment report is released in February 2021. Usually the preliminary estimate is pretty close to the final benchmark estimate.

The annual revision is benchmarked to state tax records. From the BLS:

In accordance with usual practice, the Bureau of Labor Statistics (BLS) is announcing the preliminary estimate of the upcoming annual benchmark revision to the establishment survey employment series. The final benchmark revision will be issued in February 2021 with the publication of the January 2021 Employment Situation news release.Using the preliminary benchmark estimate, this means that payroll employment in March 2020 was 173,000 lower than originally estimated. In February 2021, the payroll numbers will be revised down to reflect the final estimate. The number is then "wedged back" to the previous revision (March 2019).

Each year, the Current Employment Statistics (CES) survey employment estimates are benchmarked to comprehensive counts of employment for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. For National CES employment series, the annual benchmark revisions over the last 10 years have averaged plus or minus two-tenths of one percent of total nonfarm employment. The preliminary estimate of the benchmark revision indicates a downward adjustment to March 2020 total nonfarm employment of -173,000 (-0.1 percent).

emphasis added

Construction was revised up by 6,000 jobs, and manufacturing revised down by 70,000 jobs.

This preliminary estimate showed 229,000 fewer private sector jobs, and 56,000 more government jobs (as of March 2020).

Phoenix Real Estate in July: Sales up 12% YoY, Active Inventory Down 42% YoY

by Calculated Risk on 8/19/2020 10:09:00 AM

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales were at 10,303 in July, up from 9,508 in June, and up from 9,192 in July 2019. Sales were up 8.4% from June 2020 (last month), and up 12.1% from July 2019.

2) Active inventory was at 8,010, down from 13,737 in July 2019. That is down 42% year-over-year.

3) Months of supply decreased to 1.26 in July, down from 1.51 in June. This is very low.

Sales are reported at the close of escrow, so these sales were mostly signed in May and June. As expected, sales rebounded further in July.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 8/19/2020 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 14, 2020.

... The Refinance Index decreased 5 percent from the previous week and was 38 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 27 percent higher than the same week one year ago.

“Positive economic data reported last week on retail sales, as well as a large U.S. Treasury auction, drove mortgage rates to their highest level in two weeks. The rise in rates dampened refinance activity, but purchase applications continued their strong run and were 27 percent higher than a year ago – the third straight month of year-over-year increases,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Conventional purchase applications drove last week’s increase, while applications for government loans decreased. The housing market remains a bright spot in the current economic recovery and these results, combined with July data on housing starts and homebuilder optimism, suggest that housing supply could be increasing to better meet the strong demand for buying a home.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased to 3.13 percent from 3.06 percent, with points increasing to 0.36 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans

emphasis added

Click on graph for larger image.

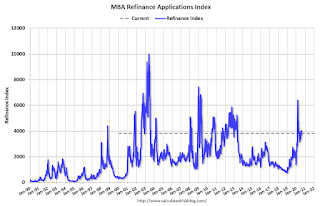

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index is up significantly from last year.

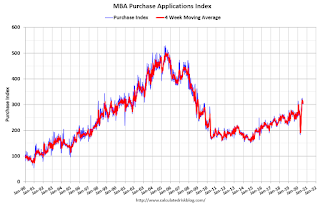

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 27% year-over-year.

Note: Red is a four-week average (blue is weekly).

Tuesday, August 18, 2020

Wednesday: Preliminary Employment Benchmark, FOMC Minutes

by Calculated Risk on 8/18/2020 08:49:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, the Bureau of Labor Statistics (BLS) will release the preliminary estimate of the upcoming annual benchmark revision.

• Also at 10:00 AM, Advance Services Report, Second Quarter 2020

• During the day, The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Minutes, Meeting of July 28-29, 2020

August 18 COVID-19 Test Results

by Calculated Risk on 8/18/2020 06:04:00 PM

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 642,814 test results reported over the last 24 hours.

There were 40,458 positive tests.

There have been 18,184 COVID deaths in the first 18 days of August. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.3% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

Lawler: Early Read on Existing Home Sales in July

by Calculated Risk on 8/18/2020 04:21:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.85 million in July, up 23.9% from June’s preliminary pace and up 8.5% from last July’s seasonally adjusted pace.

Local realtor/MLS data suggest that the median US existing single-family home sales price last month was up by about 8.4% from last July, a sharp YOY acceleration from June.

While not all realtor reports include data on new pending sales – and some that do often revise those data significantly – the limited data available suggest that the YOY increase in pending sales again exceeded the YOY gain in closed sales last month.

Projecting the NAR’s inventory estimate for July is tricky. Local realtor/MLS reports suggest that the “inventory” of homes for sale last month was down by about 30% nationwide in July. However, those same local reports for June would have suggested a much sharply YOY drop in inventories than the NAR reported.

Most of these local realtor/MLS reports utilize third-party software, and most exclude all pending contracts from the inventory number. These reports also differ from the reports sent to the NAR, and it is my understanding is that not all local realtors/MLS exclude all pending contracts from the inventory number in the NAR report.

...

The data do suggest, however, that the YOY decline in inventories in July was larger than it was in June.

Here are a few more observations: First, for local realtor/MLS reports which break sales out by type, single-family detached home sales continued to show stronger growth than condo/coop sales, and inventories of SFD homes were down MUCH more sharply YOY than condo/coop inventories (in fact, in some reports SFD inventories were down sharply while condo/coop sales were up a bit.

Second, home sales in counties with beach resorts were up extremely sharply from a year ago, at least on the East Coast.

Finally, I have heard anecdotally that “many” urban dwellers have been buying SFD homes in the suburbs without (at least yet) listing their urban property.

CR Note: The National Association of Realtors (NAR) is scheduled to release July existing home sales on Friday, August 21, 2020 at 10:00 AM ET. The consensus is for 5.39 million SAAR.