by Calculated Risk on 8/17/2020 08:33:00 AM

Monday, August 17, 2020

NY Fed: Manufacturing "Business activity edged slightly higher in New York State" in August

From the NY Fed: Empire State Manufacturing Survey

Business activity edged slightly higher in New York State, according to firms responding to the August 2020 Empire State Manufacturing Survey. The headline general business conditions index fell fourteen points to 3.7, signaling a slower pace of growth than in July. New orders were little changed, and shipments increased modestly. Unfilled orders were down, and inventories declined. Employment inched higher, while the average workweek declined.This was well below expectations, and showed activity increased slightly in August.

...

The index for number of employees edged up to 2.4, indicating that employment levels inched slightly higher. The average workweek index fell four points to -6.8, pointing to a decline in hours worked.

emphasis added

NAHB: Builder Confidence Increased to 78 in August, Ties Record High

by Calculated Risk on 8/17/2020 08:26:00 AM

Update: The headline number was released early. This update includes the press release.

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 78, up from 72 in July. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Matches All-Time High on Record Traffic

In a sign that housing continues to lead the economy forward, builder confidence in the market for newly-built single-family homes increased six points to 78 in August, according to the latest NAHB/Wells Fargo Housing Market Index (HMI) released today. The HMI now stands at its highest reading in the 35-year history of the series, matching the record that was set in December 1998.

“The demand for new single-family homes continues to be strong, as low interest rates and a focus on the importance of housing has stoked buyer traffic to all-time highs as measured on the HMI,” said NAHB Chairman Chuck Fowke. “However, the V-shaped recovery for housing has produced a staggering increase for lumber prices, which have more than doubled since mid-April. Such cost increases could dampen momentum in the housing market this fall, despite historically low interest rates.”

“Housing has clearly been a bright spot during the pandemic and the sharp rebound in builder confidence over the summer has led NAHB to upgrade its forecast for single-family starts, which are now projected to show only a slight decline for 2020,” said NAHB Chief Economist Robert Dietz. “Single-family construction is benefiting from low interest rates and a noticeable suburban shift in housing demand to suburbs, exurbs and rural markets as renters and buyers seek out more affordable, lower density markets.”

...

All the HMI indices posted gains in August. The HMI index gauging current sales conditions rose six points to 84, the component measuring sales expectations in the next six months increased three points to 78 and the measure charting traffic of prospective buyers posted an eight-point gain to reach its highest level ever at 65.

Looking at the three-month moving averages for regional HMI scores, the Northeast jumped 20 points to 65, the Midwest increased 13 points to 63, the South rose 12 points to 71 and the West increased 15 points to 78.

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast.

Housing and homebuilding have been one of the best performing sectors during the pandemic.

Sunday, August 16, 2020

Monday: Empire State Mfg, Homebuilder Survey

by Calculated Risk on 8/16/2020 07:09:00 PM

Weekend:

• Schedule for Week of August 16, 2020

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for August. The consensus is for a reading of 15.0, down from 17.2.

• At 10:00 AM, The August NAHB homebuilder survey. The consensus is for a reading of 73, up from 72. Any number above 50 indicates that more builders view sales conditions as good than poor.

• At 12:00 PM, MBA Q2 National Delinquency Survey (expected)

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are down slightly (fair value).

Oil prices were up over the last week with WTI futures at $42.30 per barrel and Brent at $45.05 barrel. A year ago, WTI was at $54, and Brent was at $59 - so WTI oil prices are down about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.16 per gallon. A year ago prices were at $2.60 per gallon, so gasoline prices are down $0.44 per gallon year-over-year.

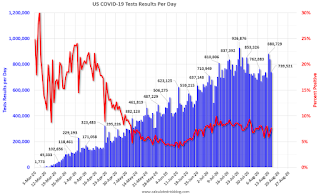

August 16 COVID-19 Test Results

by Calculated Risk on 8/16/2020 05:47:00 PM

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 777,569 test results reported over the last 24 hours.

There were 43,008 positive tests.

There have been 16,567 COVID deaths reported in the first 16 days of August. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.5% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

Earlier Fed Survey: Banks reported Tighter Standards, Weaker Demand for Loans except Residential Real Estate

by Calculated Risk on 8/16/2020 03:14:00 PM

This was released in early August, and is worth a note.

From the Federal Reserve: The July 2020 Senior Loan Officer Opinion Survey on Bank Lending Practices

Regarding loans to businesses, respondents to the July survey indicated that, on balance, they tightened their standards and terms on commercial and industrial (C&I) loans to firms of all sizes. Banks reported weaker demand for C&I loans from firms of all sizes. Meanwhile, banks tightened standards and reported weaker demand across all three major commercial real estate (CRE) loan categories—construction and land development loans, nonfarm nonresidential loans, and multifamily loans—over the second quarter of 2020.

For loans to households, banks tightened standards across all categories of residential real estate (RRE) loans and across all three consumer loan categories—credit card loans, auto loans, and other consumer loans—over the second quarter of 2020 on net. Banks reported stronger demand for all categories of RRE loans and weaker demand for all categories of consumer loans.

Banks also responded to a set of special questions inquiring about the current level of lending standards relative to the midpoint of the range over which banks’ standards have varied since 2005. Banks, on balance, reported that their lending standards across all loan categories are currently at the tighter end of the range of standards between 2005 and the present.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph on Commercial Real Estate lending is from the Senior Loan Officer Survey Charts.

This shows that banks have tightened standards, and that there is weak demand for CRE loans.

Saturday, August 15, 2020

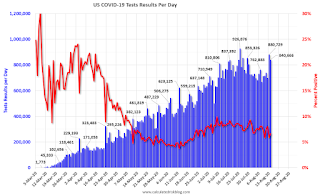

August 15 COVID-19 Test Results

by Calculated Risk on 8/15/2020 05:45:00 PM

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 739,521 test results reported over the last 24 hours.

There were 56,499 positive tests.

There have been 15,948 COVID deaths reported in the first 15 days of August. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.6% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

Schedule for Week of August 16, 2020

by Calculated Risk on 8/15/2020 08:11:00 AM

The key reports this week are July Housing Starts and Existing Home Sales.

The BLS will release the preliminary employment benchmark revision.

8:30 AM: The New York Fed Empire State manufacturing survey for August. The consensus is for a reading of 15.0, down from 17.2.

10:00 AM: The August NAHB homebuilder survey. The consensus is for a reading of 73, up from 72. Any number above 50 indicates that more builders view sales conditions as good than poor.

12:00 PM: MBA Q2 National Delinquency Survey (expected)

8:30 AM ET: Housing Starts for July.

8:30 AM ET: Housing Starts for July. This graph shows single and total housing starts since 1968.

The consensus is for 1.237 million SAAR, up from 1.186 million SAAR in June.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: the Bureau of Labor Statistics (BLS) will release the preliminary estimate of the upcoming annual benchmark revision.

10:00 AM: Advance Services Report, Second Quarter 2020

During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes, Meeting of July 28-29, 2020

8:30 AM: The initial weekly unemployment claims report will be released. The early consensus is for a 900 thousand initial claims, down from 963 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for August. The consensus is for a reading of 20.5, down from 24.1.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 5.39 million SAAR, up from 4.72 million last month.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 5.39 million SAAR, up from 4.72 million last month.The graph shows existing home sales from 1994 through the report last month.

10:00 AM: State Employment and Unemployment (Monthly) for July 2019

Friday, August 14, 2020

LA Area Port Inbound Traffic up Year-over-year in July

by Calculated Risk on 8/14/2020 07:28:00 PM

Note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.5% in July compared to the rolling 12 months ending in June. Outbound traffic was down 0.3% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were up 5% YoY in July, and exports were down 3% YoY.

August 14 COVID-19 Test Results

by Calculated Risk on 8/14/2020 06:13:00 PM

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 840,666 test results reported over the last 24 hours.

There were 55,649 positive tests.

There have been 14,730 COVID deaths reported in the first two weeks of August. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.6% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased

by Calculated Risk on 8/14/2020 04:06:00 PM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of Monday, August 10th.

From Forbearances Below 4 Million for First Time Since April

The overall trend of incremental improvement in the number of mortgages in active forbearance continues. According to the latest data from Black Knight’s McDash Flash Forbearance Tracker, the number of mortgages in active forbearance fell by another 71,000 over the past week, pushing the total under 4 million for the first time since early May.

As of August 10, 3.9 million homeowners were in active forbearance, representing 7.4% of all active mortgages, down from 7.5% the week prior. Together, they represent $852 billion in unpaid principal.

...

Again, the ongoing COVID-19 pandemic around much of the country and the expiration of expanded unemployment benefits last month continue to represent significant uncertainty for the weeks ahead. Black Knight will continue to monitor the situation and provide updates via this blog.

emphasis added

Click on graph for larger image.

Click on graph for larger image.CR Note: There will probably be another disaster relief package soon, but we might see an increase in forbearance activity in the coming weeks as we wait for additional relief.