by Calculated Risk on 8/14/2020 07:28:00 PM

Friday, August 14, 2020

LA Area Port Inbound Traffic up Year-over-year in July

Note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.5% in July compared to the rolling 12 months ending in June. Outbound traffic was down 0.3% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were up 5% YoY in July, and exports were down 3% YoY.

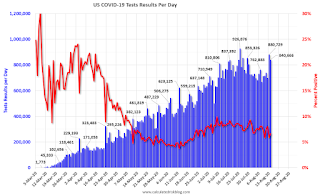

August 14 COVID-19 Test Results

by Calculated Risk on 8/14/2020 06:13:00 PM

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 840,666 test results reported over the last 24 hours.

There were 55,649 positive tests.

There have been 14,730 COVID deaths reported in the first two weeks of August. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.6% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased

by Calculated Risk on 8/14/2020 04:06:00 PM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of Monday, August 10th.

From Forbearances Below 4 Million for First Time Since April

The overall trend of incremental improvement in the number of mortgages in active forbearance continues. According to the latest data from Black Knight’s McDash Flash Forbearance Tracker, the number of mortgages in active forbearance fell by another 71,000 over the past week, pushing the total under 4 million for the first time since early May.

As of August 10, 3.9 million homeowners were in active forbearance, representing 7.4% of all active mortgages, down from 7.5% the week prior. Together, they represent $852 billion in unpaid principal.

...

Again, the ongoing COVID-19 pandemic around much of the country and the expiration of expanded unemployment benefits last month continue to represent significant uncertainty for the weeks ahead. Black Knight will continue to monitor the situation and provide updates via this blog.

emphasis added

Click on graph for larger image.

Click on graph for larger image.CR Note: There will probably be another disaster relief package soon, but we might see an increase in forbearance activity in the coming weeks as we wait for additional relief.

Q3 Preview: Real GDP as a Percent of Previous Peak

by Calculated Risk on 8/14/2020 01:10:00 PM

A key measure of the economy is real GDP. As the NBER committee notes in their business cycle dating procedure:

The committee views real GDP as the single best measure of aggregate economic activity.We are seeing forecasts of a 15% to 25% increase in annualized real GDP in Q3 2020.

It is important to note that GDP is reported at a seasonally adjusted annual rate (SAAR). A 15% annualized increase in GDP is about 3.6% quarter-over-quarter (QoQ). Also, a 15% annualized increase would leave real GDP down about 7.5% from Q4 2019.

A 25% annualized increase in Q3 GDP, is about 5.7% QoQ, and would leave real GDP down about 5.5% from Q4 2019.

The following graph illustrates these declines.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent decline in real GDP from the previous peak (currently the previous peak was in Q4 2019).

This graph is through Q2 2020, and real GDP is currently off 10.6% from the previous peak. For comparison, at the depth of the Great Recession, real GDP was down 4.0% from the previous peak.

The two black arrows show what a 15% or 25% annualized increase in real GDP would look like in Q3.

Even with a 25% annualized increase (about 5.7% QoQ), real GDP will be down about 5.5% from Q4 2019; a larger decline in real GDP than at the depth of the Great Recession.

Q3 GDP Forecasts

by Calculated Risk on 8/14/2020 12:11:00 PM

Important: GDP is reported at a seasonally adjusted annual rate (SAAR). A 15% annualized increase in GDP is about 3.6% quarter-over-quarter (QoQ). Also, a 15% annualized increase would leave real GDP down about 7.5% from Q4 2019. A 25% annualized increase in Q3 GDP, is about 5.7% QoQ, and would leave real GDP down about 5.5% from Q4 2019.

For comparison, at the depth of the Great Recession, real GDP was down 4.0% from the previous high.

Also, even if activity is flat in Q3 compared to June, GDP will show a significant increase in Q3 over Q2 because of the sharp decline in April.

From Merrill Lynch:

2Q GDP tracking remains at -32.6% qoq saar. We expect 3Q GDP growth of +15%. [August 14 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 14.8% for 2020:Q3. [August 14 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2020 is 26.2 percent on August 14, up from 20.5 percent on August 7. [August 14 estimate]

Industrial Production Increased 3.0 Percent in July; Still 8.4% Below Pre-Crisis Level

by Calculated Risk on 8/14/2020 09:23:00 AM

From the Fed: Industrial Production and Capacity Utilization

Total industrial production rose 3.0 percent in July after increasing 5.7 percent in June; even so, the index in July was 8.4 percent below its pre-pandemic February level. Manufacturing output continued to improve in July, rising 3.4 percent. Most major industries posted increases, though they were much smaller in magnitude than the advances recorded in June. The largest gain in July—28.3 percent—was registered by motor vehicles and parts; factory production elsewhere advanced 1.6 percent. Mining production rose 0.8 percent after decreasing for five consecutive months. The output of utilities increased 3.3 percent, as unusually warm temperatures increased the demand for air conditioning. At 100.2 percent of its 2012 average, the level of total industrial production was 8.2 percent lower in July than it was a year earlier. Capacity utilization for the industrial sector increased 2.1 percentage points in July to 70.6 percent, a rate that is 9.2 percentage points below its long-run (1972–2019) average but 6.4 percentage points above its low in April.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up slightly from the record low set last month, and still below the trough of the Great Recession (the series starts in 1967).

Capacity utilization at 70.6% is 9.2% below the average from 1972 to 2017.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in July to 100.2. This is 8.4% below the February 2020 level.

The change in industrial production was at consensus expectations, however industrial production in May and June was revised down.

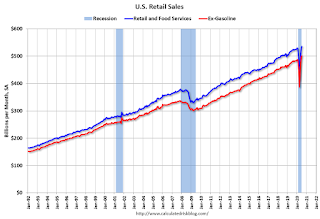

Retail Sales increased 1.2% in July

by Calculated Risk on 8/14/2020 08:40:00 AM

On a monthly basis, retail sales increased 1.2 percent from June to July (seasonally adjusted), and sales were up 2.7 percent from July 2019.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for July 2020, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $536.0 billion, an increase of 1.2 percent from the previous month, and 2.7 percent above July 2019. Total sales for the May 2020 through July 2020 period were down 0.2 percent from the same period a year ago.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.9% in July.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.2% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 4.2% on a YoY basis.The increase in July was below expectations, however sales in May and June were revised up.

Thursday, August 13, 2020

Friday: Retail Sales, Industrial Production

by Calculated Risk on 8/13/2020 07:52:00 PM

Friday:

• At 8:30 AM, Retail sales for July is scheduled to be released. The consensus is for 1.8% increase in retail sales.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for July. The consensus is for a 3.0% increase in Industrial Production, and for Capacity Utilization to increase to 70.2%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for August).

August 13 COVID-19 Test Results

by Calculated Risk on 8/13/2020 06:32:00 PM

SPECIAL NOTE: North Carolina removed 220,000 tests from its cumulative total yesterday (a correction). I've added 220,000 to the total yesterday to make the percent positive correct.

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 880,729 test results reported over the last 24 hours.

There were 51,705 positive tests.

See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.9% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

Hotels: Occupancy Rate Declined 33% Year-over-year

by Calculated Risk on 8/13/2020 11:36:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 8 August

U.S. hotel performance data for the week ending 8 August showed slightly higher occupancy and room rates from the previous week, according to STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

2-8 August 2020 (percentage change from comparable week in 2019):

• Occupancy: 49.9% (-32.6%)

• Average daily rate (ADR): US$100.88 (-24.9%)

• Revenue per available room (RevPAR): US$50.37 (-49.4%)

U.S. occupancy has risen week over week for 16 of the last 17 weeks, although growth in demand (room nights sold) has slowed.

emphasis added

As STR noted, the occupancy rate has increased week-to-week in "16 of the last 17 weeks". The increases in occupancy have slowed and are well below the level for this week last year of 74%.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

According to STR, most of the improvement appears related to leisure travel as opposed to business travel. The leisure travel season usually peaks at the beginning of August (right now), and the occupancy declines sharply in the Fall.

Note: Y-axis doesn't start at zero to better show the seasonal change.