by Calculated Risk on 8/05/2020 08:46:00 PM

Wednesday, August 05, 2020

Thursday: Unemployment Claims, NY Fed Q2 Quarterly Report on Household Debt and Credit

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a 1.415 million initial claims, down from 1.434 million the previous week.

• At 11:00 AM, NY Fed: Q2 Quarterly Report on Household Debt and Credit

August 5 COVID-19 Test Results

by Calculated Risk on 8/05/2020 06:26:00 PM

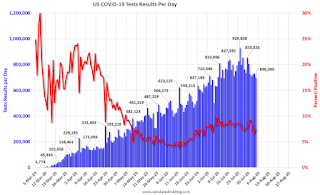

The number of tests per day has been declining. It is not clear if this is a testing problem or a reporting problem.

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 664,219 test results reported over the last 24 hours.

There were 51,825 positive tests.

See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.5% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The Changing Mix of Light Vehicle Sales

by Calculated Risk on 8/05/2020 01:37:00 PM

The relatively low gasoline prices made me take another look at the mix of vehicles being sold.

This graph shows the percent of light vehicle sales between passenger cars and trucks / SUVs through July 2020.

Over time the mix has changed toward more and more towards light trucks and SUVs.

Only when oil prices are high, does the trend slow or reverse.

The percent of light trucks and SUVs was at 76% in July 2020.

ISM Services Index increased to 58.1% in July, Employment Index Declined

by Calculated Risk on 8/05/2020 10:11:00 AM

The July ISM Services index was at 58.1%, up from 57.1% in June. The employment index decreased to 42.1%, from 43.1%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: July 2020 Services ISM Report On Business®

July 2020 Services ISM® Report On Business®; Business Activity Index at 67.2%; New Orders Index at 67.7%; Employment Index at 42.1%; Supplier Deliveries Index at 55.2%The employment index showed ongoing weakness.

Economic activity in the Services sector (formally non-manufacturing sector) grew in July for the second month in a row, say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: "The Services PMI™ registered 58.1 percent, 1 percentage point higher than the June reading of 57.1 percent. This reading represents growth in the services sector for the second straight month after contraction in April and May, preceded by a 122-month period of expansion.

"The Supplier Deliveries Index registered 55.2 percent, down 2.3 percentage points from June's reading of 57.5 percent. Supplier Deliveries is the only ISM® Report On Business® index that is inversed; a reading of above 50 percent indicates slower deliveries, which is typical as the economy improves and customer demand increases. The higher readings for supplier deliveries in the three months prior to June were primarily a product of supply problems related to the coronavirus (COVID-19) pandemic. Supplier deliveries are now more closely correlating to the current supply and demand.

emphasis added

Trade Deficit decreased to $50.7 Billion in June

by Calculated Risk on 8/05/2020 08:40:00 AM

From the Department of Commerce reported:

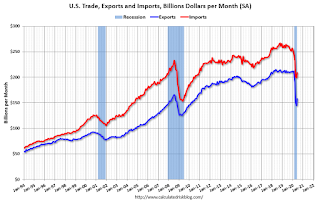

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $50.7 billion in June, down $4.1 billion from $54.8 billion in May, revised.

June exports were $158.3 billion, $13.6 billion more than May exports. June imports were $208.9 billion, $9.5 billion more than May imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in June.

Exports are down 24% compared to June 2019; imports are down 20% compared to June 2019.

Both imports and exports decreased sharply due to COVID-19.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that the U.S. exported a slight net positive petroleum products in recent months.

Oil imports averaged $35.34 per barrel in June, up from $27.55 per barrel in May, and down from $58.72 in June 2019.

The trade deficit with China decreased to $28.4 billion in June, from $29.8 billion in June 2019.

ADP: Private Employment increased 167,000 in July

by Calculated Risk on 8/05/2020 08:19:00 AM

Private sector employment increased by 167,000 jobs from June to July according to the July ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was well below the consensus forecast for 1.25 million private sector jobs added in the ADP report.

“The labor market recovery slowed in the month of July,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “We have seen the slowdown impact businesses across all sizes and sectors.”

The BLS report will be released Friday, and the consensus is for 1.36 million non-farm payroll jobs added in July.

Special Note: The BLS report includes government jobs, and State and Local government will increase sharply due to a Seasonal Adjustment quirk. Also the Census Bureau hired 27.5 thousand temp workers, for the Decennial Census, between the reference week in June and the reference week in July.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 8/05/2020 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 5.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 31, 2020.

... The Refinance Index decreased 7 percent from the previous week and was 84 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 22 percent higher than the same week one year ago.

“Mortgage rates dropped to another record low last week, falling below the previous record set three weeks ago to 3.14 percent. Refinance activity decreased – despite the decline in rates – but the current pace remains more than 80 percent higher than a year ago when rates were over 4 percent. MBA’s forecast calls for rates to remain at these low levels, which will continue to spur strong refinance activity and offer homeowners relief in the form of lower monthly mortgage payments during these uncertain economic times,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications also fell slightly, but were still 20 percent higher than a year ago and have now risen year-over-year for 11 straight weeks. Purchase loan balances continued to climb, which is perhaps a sign that the still-weak job market and tighter credit for government loans are constraining some first time homebuyers.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) remained unchanged at 3.20 percent, with points increasing to 0.37 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index is up significantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 22% year-over-year.

Note: Red is a four-week average (blue is weekly).

Tuesday, August 04, 2020

Wednesday: ADP Employment, Trade Deficit, ISM non-Mfg

by Calculated Risk on 8/04/2020 08:43:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 1.25 million payroll jobs added in July, down from 2.369 million added in June.

• At 8:30 AM, Trade Balance report for June from the Census Bureau. The consensus is the trade deficit to be $50.3 billion. The U.S. trade deficit was at $54.6 Billion the previous month.

• At 10:00 AM, the ISM non-Manufacturing Index for July. The consensus is for a reading of 54.8, down from 57.1.

August 4 COVID-19 Test Results

by Calculated Risk on 8/04/2020 06:19:00 PM

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 696,000 test results reported over the last 24 hours.

There were 52,000 positive tests.

See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.5% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

July 2020: Unofficial Problem Bank list Increased to 65 Institutions

by Calculated Risk on 8/04/2020 01:32:00 PM

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

DISCLAIMER: This is an unofficial list, the information is from public sources only, and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here is the unofficial problem bank list for July 2020.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for July 2020. During the month, the list increased by one to 65 banks after one addition. Aggregate assets were little changed at $52.7 billion. A year ago, the list held 75 institutions with assets of $54.7 billion. Added this month was First National Bank of Muscatine, Muscatine, IA ($311 million). The OCC provided an update on July 16, 2020, it is unclear if the update dates back to May 21, 2020, which is the last preceding press release on the OCC website. Historically, the OCC has provided a monthly update, so a bi-monthly update would be a new development.