by Calculated Risk on 8/03/2020 08:22:00 AM

Monday, August 03, 2020

Black Knight Mortgage Monitor for June

Black Knight released their Mortgage Monitor report for June today. According to Black Knight, 7.59% of mortgages were delinquent in June, down from 7.76% in May, and up from 3.73% in June 2019. Black Knight also reported that 0.36% of mortgages were in the foreclosure process, down from 0.50% a year ago.

This gives a total of 7.95% delinquent or in foreclosure.

Press Release: Black Knight: Falling 30-Year Interest Rates Result in the Highest Level of Home Affordability in 3.5 Years Nationwide

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage performance, housing and public records datasets. As 30-year interest rates hit a record low in recent weeks, Black Knight looked at the impact this has had on refinance incentive, affordability levels, and their broader impact on the mortgage and housing markets.

As Black Knight Data & Analytics President Ben Graboske explained, “Despite eight consecutive years of rising home prices, July’s record-low mortgage rates, which fell below 3% for the first time on July 16, have made purchasing the average-priced home for a median wage earner the most affordable since late 2016. Falling rates and improved affordability have helped to spur home-buying demand, and therefore purchase origination volume, which has provided a much-needed backstop for home prices in the wake of the COVID-19 pandemic.

“As of mid-July, it required 19.8% of the median monthly income to make the mortgage payment on the average-priced home purchase, assuming a 20% down payment and a 30-year mortgage. That was more than 5% below the average of 25% from 1995-2003. This means it currently requires a $1,071 monthly payment to purchase the average-priced home, which is down 6% from the same time last year, despite the average home increasing in value by more than $12,000 during that same time period. In fact, buying power is now up 10% year-over-year, meaning the average home buyer can afford nearly $32,000 more home than they could at the same time last year, while keeping their monthly payment the same.

“A main takeaway from this month’s report is that while record levels of job losses are certainly still weighing on the housing market and broader economy, for those shopping for a home now, buying power has clearly trended up.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows the National Delinquency Rate.

From Black Knight:

• The national delinquency rate fell in June for the first time since January, as initial impacts of COVID-19 on mortgage performance began to crestThere is much more in the mortgage monitor.

• Nearly 7.6% of mortgage holders remain delinquent, up from a record low 3.2% at the beginning of the year

• The number of borrowers 90 or more days past due surged in June to 1.87 million, the largest volume since 2011

• 90-day delinquencies could rise even higher in July given the secondary volume of new delinquencies seen in May and resulting elevated levels of 60-day delinquencies in June

• The number of early-stage delinquencies has mostly normalized, with 30-day delinquencies nearly back to their pre-COVID levels

• Delinquency numbers will be important to watch in August and September, especially if expanded unemployment benefits decline or expire

Sunday, August 02, 2020

Monday: ISM Mfg, Construction Spending

by Calculated Risk on 8/02/2020 07:45:00 PM

Weekend:

• Schedule for Week of August 2, 2020

Monday:

• At 10:00 AM ET, ISM Manufacturing Index for July. The consensus is for the ISM to be at 54.0, up from 52.6 in June.

• Also at 10:00 AM, Construction Spending for June. The consensus is for a 1.3% increase in construction spending

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 5 and DOW futures are down 55 (fair value).

Oil prices were mixed over the last week with WTI futures at $40.06 per barrel and Brent at $43.36 barrel. A year ago, WTI was at $56, and Brent was at $61 - so WTI oil prices are down about 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.18 per gallon. A year ago prices were at $2.72 per gallon, so gasoline prices are down $0.54 per gallon year-over-year.

August 2 COVID-19 Test Results

by Calculated Risk on 8/02/2020 06:28:00 PM

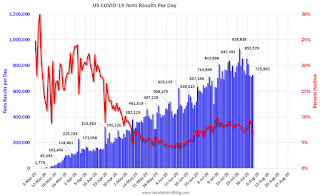

The US is now reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 725,902 test results reported over the last 24 hours.

There were 48,694 positive tests. This is the fewest positive cases in 3 weeks, but it is a weekend report.

See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.7% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

State and Local Government Education Employment will Increase Sharply in July, Seasonally Adjusted

by Calculated Risk on 8/02/2020 03:17:00 PM

Previously I wrote: Will State and Local Governments Hire 1 Million Teachers in June and July? No, but ...

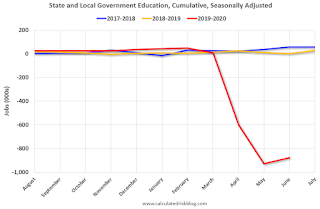

There will be some weird seasonal adjustments this year!Here are a couple of graphs to illustrate what will happen.

Every year, state and local governments let about 2 million teachers go in late Spring, and then hire them back at the end of Summer.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the typical seasonal pattern for state and local government education hiring and layoffs. The graph is Not Seasonally Adjusted (NSA), and cumulative hires since July.

This shows three school years: 2017-2018 (blue), 2018-2019 (orange), and 2019-2020 (red).

The typical pattern is a substantially amount of hiring in September, a dip in January, and then a large number of layoffs in June and July.

In the current school year (red), educators were let go earlier than usual due to the pandemic, with layoffs starting in March. It appears another 350 thousand or more educators will be let go in July NSA.

The second graph shows the same three school years, on a seasonally adjusted basis (cumulative since the previous July). Since there is a regular seasonal pattern, the BLS adjusts the hiring so the typical school year hiring and layoffs, Seasonally Adjusted (SA), is mostly flat.

The second graph shows the same three school years, on a seasonally adjusted basis (cumulative since the previous July). Since there is a regular seasonal pattern, the BLS adjusts the hiring so the typical school year hiring and layoffs, Seasonally Adjusted (SA), is mostly flat.However, in the 2019-2020 school year, layoffs started much earlier. Now, in July, the red line will have to come back close to zero after the seasonal adjustment. This would suggest about 850 thousand jobs added in July SA.

Note: There could be more layoffs than usual, NSA, since state and local budgets are under pressure, which would mean fewer than 850 thousands jobs added SA. But the SA number will still be large.

Just something to remember when looking at the headline employment number.

Saturday, August 01, 2020

August 1 COVID-19 Test Results

by Calculated Risk on 8/01/2020 06:22:00 PM

The US is now reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 713,277 test results reported over the last 24 hours.

There were 60,264 positive tests.

The seven day average of daily deaths has moved higher for the 17th consecutive day to over 1,100 per day. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.4% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

Forecasts for the July Employment Report: A Stall, but Watch State and Local Hiring

by Calculated Risk on 8/01/2020 10:51:00 AM

The July employment report will be released on Friday, August 7th, at 8:30 AM ET. The consensus is for 1.36 million jobs added, and for the unemployment rate to decrease to 10.7%. There were 4.8 million jobs added in June, and the unemployment rate was at 11.1%.

Here are a few forecasts:

From Nomura:

[W]e expect nonfarm payroll employment to increase 550k during the month, down from 4.8mn in June and 2.7mn in May ... , a significant amount of state and local layoffs happened earlier in the year due to COVID-19, pulling forward declines in state and local educational employment that usually take place in July. As a result, seasonally adjusted state and local employment may show an increase during the month. ... we expect the unemployment rate to decline 0.2pp to 10.9%Note the comment on state and local employment. I discussed this seasonal adjustment issue here: Will State and Local Governments Hire 1 Million Teachers in June and July? No, but ... Every July, there is a large decline in state and local education employment. But this year, many of those people were let go earlier in the year - so the seasonal adjustment might show a large increase in state and local education hiring.

emphasis added

From Goldman Sachs:

High frequency data suggest that the labor market recovery is stalling due to the worsening virus situation. ... Our trackers suggest that current household employment has fallen by roughly one million since the June survey week, and that as of July 15 the unemployment rate had risen back up to 11.5% after falling to 10.5% in late June (vs. 11.1% in the June survey).From Merrill Lynch:

The July jobs report is likely to reveal a pullback in the pace of hiring to +1.0mn after the record 4.8mn increase in June. Real-time data sources point to slowing momentum as new virus hotspots emerged since the last jobs report. There is a large error band around this forecast with even a risk of a negative print. We look for the unemployment rate to head lower to 10.7%.

Schedule for Week of August 2, 2020

by Calculated Risk on 8/01/2020 08:11:00 AM

The key report this week is the July employment report.

Other key reports include ISM manufacturing and non-manufacturing indexes, July vehicel sales, and the Trade deficit for June.

10:00 AM: ISM Manufacturing Index for July. The consensus is for the ISM to be at 54.0, up from 52.6 in June.

10:00 AM: ISM Manufacturing Index for July. The consensus is for the ISM to be at 54.0, up from 52.6 in June.Here is a long term graph of the ISM manufacturing index.

The employment index was at 42.1% in June, and the new orders index was at 56.4%.

10:00 AM: Construction Spending for June. The consensus is for a 1.3% increase in construction spending.

Early: Light vehicle sales for July from the BEA. The consensus is for light vehicle sales to be 13.1 million SAAR in July, up from 13.0 million in June (Seasonally Adjusted Annual Rate).

Early: Light vehicle sales for July from the BEA. The consensus is for light vehicle sales to be 13.1 million SAAR in July, up from 13.0 million in June (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the sales rate for last month.

8:00 AM ET: Corelogic House Price index for June

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 1.25 million payroll jobs added in July, up from 2.369 million added in June.

8:30 AM: Trade Balance report for June from the Census Bureau.

8:30 AM: Trade Balance report for June from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $50.3 billion. The U.S. trade deficit was at $54.6 Billion the previous month.

10:00 AM: the ISM non-Manufacturing Index for July. The consensus is for a reading of 54.8, down from 57.1.

8:30 AM: The initial weekly unemployment claims report will be released. The early consensus is for a 1.400 million initial claims, down from 1.434 million the previous week.

11:00 AM: NY Fed: Q2 Quarterly Report on Household Debt and Credit

8:30 AM: Employment Report for July. The consensus is for 1.36 million jobs added, and for the unemployment rate to decrease to 10.7%.

8:30 AM: Employment Report for July. The consensus is for 1.36 million jobs added, and for the unemployment rate to decrease to 10.7%.There were 4.8 million jobs added in June, and the unemployment rate was at 11.1%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession is by far the worst recession since WWII in percentage terms, and the worst in terms of the unemployment rate.

Friday, July 31, 2020

July 31 COVID-19 Test Results

by Calculated Risk on 7/31/2020 06:07:00 PM

The US is now reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 718,956 test results reported over the last 24 hours.

There were 67,503 positive tests.

The seven day average of daily deaths has moved higher for the 16th consecutive day to over 1,100 per day. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 9.4% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

Fannie Mae: Mortgage Serious Delinquency Rate Increased Sharply in June

by Calculated Risk on 7/31/2020 04:14:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency increased to 2.65% in June, from 0.89% in May. The serious delinquency rate is up from 0.70% in June 2019.

This is the highest serious delinquency rate since July 2013.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (2% of portfolio), 5.00% are seriously delinquent (up from 3.09% in May). For loans made in 2005 through 2008 (3% of portfolio), 8.37% are seriously delinquent (up from 5.22%), For recent loans, originated in 2009 through 2018 (95% of portfolio), only 2.21% are seriously delinquent (up from 0.53%). So Fannie is still working through a few poor performing loans from the bubble years.

With COVID-19, this rate will increase further in July (it takes time since these are mortgages three months or more past due).

Mortgages in forbearance are counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once they are employed.

Note: Freddie Mac reported earlier.

Comparing US, EU and China GDP

by Calculated Risk on 7/31/2020 01:58:00 PM

With the sharp GDP decline in Q2, there have been several comparisons of US numbers to other regions of the world.

First, it is important to understand:

The US reports GDP on a quarter-over-quarter (QoQ) annualized basis.

The EU reports GDP on a QoQ basis (not annualized).

China reports GDP on a year-over-year (YoY) basis.

So the US reported that GDP declined 32.9% in Q2 annualized, the EU reported GDP declined 11.9% in Q2, and China reported GDP increased 3.2% YoY in Q2 (China's big hit was in Q1).

This is just how the data is reported. There is no conspiracy to make the US look bad in Q2, or look good in Q3.

If we want to compare the US to the EU, we need to convert one of the numbers. For example, a 32.9% annualized decline is a 9.5% decline QoQ (not annualized).

So we would compare a -9.5% in the US to -11.9% in the EU. Both were terrible, but also necessary to "bend the curve" and suppress the virus, and the EU decline in GDP was worse.

However, the EU did a much better job of suppressing the virus, and the economic recovery in the EU will probably be better. As Dr. Fauci noted today (from CNN):

"If you look at what happened in Europe, when they shut down or locked down or went to shelter in place — however you want to describe it — they really did it to the tune of about 95% plus of the country did that," Fauci said.It will be interesting in Q3 to compare the bounce back. My guess is the EU will do better in Q3 since they did a better job of controlling the virus.

However, "when you actually look at what we did, even though we shut down, even though it created a great deal of difficulty, we really functionally shut down only about 50% in the sense of the totality of the country," Fauci added.

Click on graph for larger image.

Click on graph for larger image.There will be a sharp increase in GDP in Q3 in both the US and the EU.

This graph shows monthly real personal consumption expenditures (PCE) in the US (not GDP), and the dashed red lines are the quarterly levels for real PCE. PCE collapsed at a 6.9% annual rate in Q1, and at a 34.6% annual rate in Q2.

Note the red line for Q2 (the quarterly level of PCE). Even if PCE stayed at the June level in Q3, there would be 27% increase in Q3!