by Calculated Risk on 7/22/2020 12:41:00 PM

Wednesday, July 22, 2020

Comments on June Existing Home Sales

Earlier: NAR: Existing-Home Sales Increased to 4.72 million in June

A few key points:

1) Existing home sales are counted at the close of escrow, so the June report was mostly for contracts signed in April and May. Some of the increase this month was probably related to pent up demand from the shutdowns in March and April. I expect a further increase in sales in July (July will be mostly contracts signed in May and June when the economy was much more open). However, with the high unemployment rate - and the recent surge in COVID infections, housing might be under some pressure later this year. That is difficult to predict and depends on the course of the pandemic.

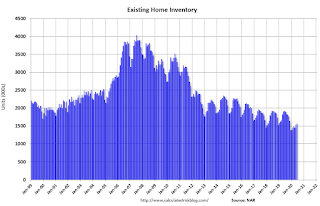

2) Inventory is very low, and was down 18.2% year-over-year (YoY) in June. This is the lowest level of inventory for June since at least the early 1990s.

3) As usual, housing economist Tom Lawler was closer to the actual NAR report than the consensus forecast.

This graph shows existing home sales by month for 2019 and 2020.

Note that existing home sales picked up somewhat in the second half of 2019 as interest rates declined.

Even with weak sales in April, May, and June, sales to date are only down about 8% compared to the same period in 2019.

Sales NSA in June (510,000) were 3.4% below sales last year in June (528,000).

Census: Household Pulse Survey shows 26.4% Missed or Expect to Miss Rent or Mortgage Payment

by Calculated Risk on 7/22/2020 10:41:00 AM

First, from @ernietedeschi

Employment in the @uscensusbureau Household Pulse Survey fell by -4.1 million last week alone.This graph is from Ernie Tedeschi (former US Treasury economist).

That's a cumulative loss of -6.7 million jobs between the reference weeks used for the June & July monthly jobs report.

Seasonality and survey noise may be factors here -- the HPS is a new, experimental survey with limited history.

However it also did an admirable job of predicting the strong employment growth in June.

CR Note on above graph: The Pulse Survey doesn't align exactly with the BLS reference week. The release today is for July 9th - July 14th, and the release next week will be for the period July 16th - July 21th. The BLS reference week is the 12th - 18th.

Also note on the question below on lost income is always since March 13, 2020 - so this percentage will not decline - but might increase.

From the Census Bureau: Measuring Household Experiences during the Coronavirus (COVID-19) Pandemic

The U.S. Census Bureau, in collaboration with five federal agencies, is in a unique position to produce data on the social and economic effects of COVID-19 on American households. The Household Pulse Survey is designed to deploy quickly and efficiently, collecting data to measure household experiences during the Coronavirus (COVID-19) pandemic. Data will be disseminated in near real-time to inform federal and state response and recovery planning.This will be updated weekly, and the Census Bureau released the recent survey results today. This survey asks about Loss in Employment Income, Expected Loss in Employment Income, Food Scarcity, Delayed Medical Care, Housing Insecurity and K-12 Educational Changes.

…

Data collection for the Household Pulse Survey began on April 23, 2020. The Census Bureau will collect data for 90 days, and release data on a weekly basis.

Click on graph for larger image.

Click on graph for larger image.The data was collected between July 9 and July 14, 2020.

Definitions:

Loss in employment income: "Percentage of adults in households where someone had a loss in employment income since March 13, 2020."

This number is since March 13, and has increased to 50.1% from 47% in the initial survey.

Expected Loss in Employment Income: "Percentage of adults who expect someone in their household to have a loss in employment income in the next 4 weeks."

35.1% of households expect a loss in income over the next 4 weeks. This is down from 38.8% in late April, but up from 31% four weeks ago. This might suggest the job gains stalled after the data was collected for the June employment report.

Food Scarcity: Percentage of adults in households where there was either sometimes or often not enough to eat in the last 7 days.

10.8% of households report food scarcity. This has increased slightly since March.

Delayed Medical Care: "Percentage of adults who delayed getting medical care because of the COVID-19 pandemic in the last 4 weeks."

40.6% of households report they delayed medical care over the last 4 weeks. This increased slightly from last week.

Housing Insecurity: "Percentage of adults who missed last month’s rent or mortgage payment, or who have slight or no confidence that their household can pay next month’s rent or mortgage on time."

26.4% of households reported they missed last month's rent or mortgage payment (or little confidence in making this month's payment). This has increased from a low of 22.1% in the survey of June 4th - June 9th.

Without an extension of the extra unemployment benefits, we will likely see a significant increase in housing stress.

K-12 Educational Changes: "Percentage of adults in households with children in public or private school, where classes were taught in a distance learning format, or changed in some other way."

Essentially all households with children are reporting were not being taught in a normal format.

NAR: Existing-Home Sales Increased to 4.72 million in June

by Calculated Risk on 7/22/2020 10:11:00 AM

From the NAR: Existing-Home Sales Climb Record 20.7% in June

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, jumped 20.7% from May to a seasonally-adjusted annual rate of 4.72 million in June. Sales overall, however, dipped year-over-year, down 11.3% from a year ago (5.32 million in June 2019).

...

Total housing inventory at the end of June totaled 1.57 million units, up 1.3% from May, but still down 18.2% from one year ago (1.92 million). Unsold inventory sits at a 4.0-month supply at the current sales pace, down from both 4.8 months in May and from the 4.3-month figure recorded in June 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June (4.72 million SAAR) were up 20.7% from last month, and were 11.3% below the June 2019 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.57 million in June from 1.55 million in May. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 1.57 million in June from 1.55 million in May. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 18.2% year-over-year in June compared to June 2019.

Inventory was down 18.2% year-over-year in June compared to June 2019. Months of supply decreased to 4.0 months in June.

This was below the consensus forecast. I'll have more later … as expected, sales rebounded in June.

Black Knight: National Mortgage Delinquency Rate Decreased in June, "Serious Delinquencies Surge to 9-Year High"

by Calculated Risk on 7/22/2020 09:47:00 AM

Note: Loans in forbearance are counted as delinquent in this survey, but these loans are not reported as delinquent to the credit bureaus.

From Black Knight: Mortgage Delinquencies Improve for the First Time Since January, While Serious Delinquencies Surge to 9-Year High

• After rising from 3.2% in January to 7.8% in May, the national delinquency rate improved for the first time in five months, falling to 7.6% in June as the overall number of past-due mortgages declined by 98,000According to Black Knight's First Look report for March, the percent of loans delinquent decreased 2.3% in June compared to May, and increased 104% year-over-year.

• Serious delinquencies – those 90 or more days past due – rose by more than 1.2 million as the initial wave of borrowers financially impacted by COVID-19 missed their third mortgage payment

• At 1.87 million, the number of seriously delinquent mortgages is now at its highest level since early 2011

• With federal foreclosure moratoriums still in place, active foreclosure inventory continues to dwindle; June’s 192,000 active foreclosures were the fewest on record, dating back to 2000

• Prepayment activity hit its highest level in 16 years in June, fueled by record-low 30-year interest rates and surging refinance incentive

emphasis added

The percent of loans in the foreclosure process decreased 4.2% in June and were down 27.1% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 7.59% in June, down from 7.76% in May.

The percent of loans in the foreclosure process decreased in June to 0.36% from 0.38% in May.

The number of delinquent properties, but not in foreclosure, is up 2,084,000 properties year-over-year, and the number of properties in the foreclosure process is down 67,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| June 2020 | May 2020 | June 2019 | June 2018 | |

| Delinquent | 7.59% | 7.76% | 3.73% | 3.74% |

| In Foreclosure | 0.36% | 0.38% | 0.50% | 0.56% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 4,034,000 | 4,123,000 | 1,950,000 | 1,925,000 |

| Number of properties in foreclosure pre-sale inventory: | 192,000 | 200,000 | 259,000 | 291,000 |

| Total Properties | 4,226,000 | 4.324,000 | 2,209,000 | 2,216,000 |

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 7/22/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 17, 2020.

... The Refinance Index increased 5 percent from the previous week and was 122 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 19 percent higher than the same week one year ago.

“Mortgage applications increased last week despite mixed results from the various rates tracked in MBA’s survey. The average 30-year fixed rate mortgage rose slightly to 3.20 percent, but some creditworthy borrowers are being offered rates even below 3 percent. As a result, these low rates drove a 5 percent weekly gain in refinances and a robust 122 percent increase from a year ago,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “There continues to be strong homebuyer demand this summer, as home shoppers have returned to the market in many states. Purchase activity increased again last week and was up 19 percent compared to last year – the ninth straight week of year-over-year increases.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased to 3.20 percent from 3.19 percent, with points increasing to 0.35 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But the index is up significantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 19% year-over-year.

Note: Red is a four-week average (blue is weekly).

Tuesday, July 21, 2020

Wednesday: Existing Home Sales

by Calculated Risk on 7/21/2020 08:16:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:00 AM, FHFA House Price Index for May 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 4.86 million SAAR, up from 3.91 million last month. Housing economist Tom Lawler expects the NAR to report 4.65 million SAAR.

• During the day, The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

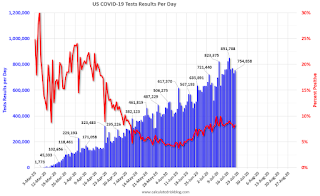

July 21 COVID-19 Test Results

by Calculated Risk on 7/21/2020 05:36:00 PM

The US is now reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 754,858 test results reported over the last 24 hours.

There were 62,749 positive tests.

Sadly, over 1,000 deaths reported today.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.3% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

New York City Subway Usage

by Calculated Risk on 7/21/2020 03:19:00 PM

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

He has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings"

Thoughts on CARES II: Additional Disaster Relief

by Calculated Risk on 7/21/2020 10:10:00 AM

A month ago I outlined a few key items for additional disaster relief. Time is running short.

This morning, the WaPo had an article on some proposals: GOP coronavirus bill likely to include payroll tax cut and tie school money to reopening plans

The emerging GOP coronavirus relief bill appears likely to embrace some of President Trump’s key priorities, despite opposition from within his own party, including a payroll tax cut, very little aid to state and local governments, and measures tying school funding to the reopening of classrooms.The proposed payroll tax deferral is inane (using a "deferral" as opposed to a cut is an accounting gimmick). This proposal targets money for people with a low marginal propensity to consume (MPC).

Compare that to the current Federal Pandemic Unemployment Compensation (FPUC) that targets unemployed people with a high MPC, and helps them pay their bills (grocery, rent, mortgage, etc).

Other people's spending is our income, so during this crisis, we want to provide disaster relief to the people that are most impacted by the crisis (the unemployed), and those with a high MPC.

A few suggestions:

First, we need to address the health crisis.

This means additional money for hospitals, testing, trace-and-isolate programs, and personal protection equipment (PPE). Test results are taking far too long, and that isn't useful. We need to significantly improve our testing (and turnaround). Also, it appears PPE is running low again for our healthcare workers. This puts these frontline workers at risk.

Addressing the healthcare crisis remains the first priority.

Second, we need to provide additional disaster relief to the unemployed.

I discussed this last month, and this includes an extension of the Extension of Federal Pandemic Unemployment Compensation (FPUC), even if the amount is reduced. This is critical, or we will see a significant slump in spending in August, and a sharp increase in delinquencies (rents, mortgages, credit cards, etc).

We will also need to extend the term of the Paycheck Protection Program (PPP). This program has kept many small businesses alive, and millions of employees employed. There will have to be additional disaster relief for these companies, or millions of people will be let go soon.

Third, we need to provide State government relief.

It is time for a substantial state relief package. Without relief, the states and local governments will have to start laying off a significant number of employees.

These are some key areas, and it seems very likely there will be a "CARES II" act. But it has to be sized and structured appropriately.

Chicago Fed National Activity "Index Suggests Economic Growth Increased Further in June"

by Calculated Risk on 7/21/2020 08:37:00 AM

Note: This is a composite index of other data.

From the Chicago Fed: Index Suggests Economic Growth Increased Further in June

Led by improvements in production- and employment-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to +4.11 in June from +3.50 in May. Three of the four broad categories of indicators used to construct the index made positive contributions in June, and two of the four categories increased from May. The index’s three-month moving average, CFNAI-MA3, moved up to –3.49 in June from –6.36 in May.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.