by Calculated Risk on 7/22/2020 07:00:00 AM

Wednesday, July 22, 2020

MBA: Mortgage Applications Increase in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 17, 2020.

... The Refinance Index increased 5 percent from the previous week and was 122 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 19 percent higher than the same week one year ago.

“Mortgage applications increased last week despite mixed results from the various rates tracked in MBA’s survey. The average 30-year fixed rate mortgage rose slightly to 3.20 percent, but some creditworthy borrowers are being offered rates even below 3 percent. As a result, these low rates drove a 5 percent weekly gain in refinances and a robust 122 percent increase from a year ago,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “There continues to be strong homebuyer demand this summer, as home shoppers have returned to the market in many states. Purchase activity increased again last week and was up 19 percent compared to last year – the ninth straight week of year-over-year increases.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased to 3.20 percent from 3.19 percent, with points increasing to 0.35 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But the index is up significantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 19% year-over-year.

Note: Red is a four-week average (blue is weekly).

Tuesday, July 21, 2020

Wednesday: Existing Home Sales

by Calculated Risk on 7/21/2020 08:16:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:00 AM, FHFA House Price Index for May 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 4.86 million SAAR, up from 3.91 million last month. Housing economist Tom Lawler expects the NAR to report 4.65 million SAAR.

• During the day, The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

July 21 COVID-19 Test Results

by Calculated Risk on 7/21/2020 05:36:00 PM

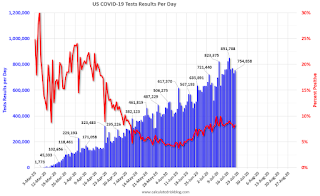

The US is now reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 754,858 test results reported over the last 24 hours.

There were 62,749 positive tests.

Sadly, over 1,000 deaths reported today.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.3% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

New York City Subway Usage

by Calculated Risk on 7/21/2020 03:19:00 PM

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

He has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings"

Thoughts on CARES II: Additional Disaster Relief

by Calculated Risk on 7/21/2020 10:10:00 AM

A month ago I outlined a few key items for additional disaster relief. Time is running short.

This morning, the WaPo had an article on some proposals: GOP coronavirus bill likely to include payroll tax cut and tie school money to reopening plans

The emerging GOP coronavirus relief bill appears likely to embrace some of President Trump’s key priorities, despite opposition from within his own party, including a payroll tax cut, very little aid to state and local governments, and measures tying school funding to the reopening of classrooms.The proposed payroll tax deferral is inane (using a "deferral" as opposed to a cut is an accounting gimmick). This proposal targets money for people with a low marginal propensity to consume (MPC).

Compare that to the current Federal Pandemic Unemployment Compensation (FPUC) that targets unemployed people with a high MPC, and helps them pay their bills (grocery, rent, mortgage, etc).

Other people's spending is our income, so during this crisis, we want to provide disaster relief to the people that are most impacted by the crisis (the unemployed), and those with a high MPC.

A few suggestions:

First, we need to address the health crisis.

This means additional money for hospitals, testing, trace-and-isolate programs, and personal protection equipment (PPE). Test results are taking far too long, and that isn't useful. We need to significantly improve our testing (and turnaround). Also, it appears PPE is running low again for our healthcare workers. This puts these frontline workers at risk.

Addressing the healthcare crisis remains the first priority.

Second, we need to provide additional disaster relief to the unemployed.

I discussed this last month, and this includes an extension of the Extension of Federal Pandemic Unemployment Compensation (FPUC), even if the amount is reduced. This is critical, or we will see a significant slump in spending in August, and a sharp increase in delinquencies (rents, mortgages, credit cards, etc).

We will also need to extend the term of the Paycheck Protection Program (PPP). This program has kept many small businesses alive, and millions of employees employed. There will have to be additional disaster relief for these companies, or millions of people will be let go soon.

Third, we need to provide State government relief.

It is time for a substantial state relief package. Without relief, the states and local governments will have to start laying off a significant number of employees.

These are some key areas, and it seems very likely there will be a "CARES II" act. But it has to be sized and structured appropriately.

Chicago Fed National Activity "Index Suggests Economic Growth Increased Further in June"

by Calculated Risk on 7/21/2020 08:37:00 AM

Note: This is a composite index of other data.

From the Chicago Fed: Index Suggests Economic Growth Increased Further in June

Led by improvements in production- and employment-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to +4.11 in June from +3.50 in May. Three of the four broad categories of indicators used to construct the index made positive contributions in June, and two of the four categories increased from May. The index’s three-month moving average, CFNAI-MA3, moved up to –3.49 in June from –6.36 in May.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Monday, July 20, 2020

July 20 COVID-19 Test Results

by Calculated Risk on 7/20/2020 06:02:00 PM

The US is now reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 735,197 test results reported over the last 24 hours.

There were 57,948 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.9% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases for Fifth Straight Week to 7.80%" of Portfolio Volume

by Calculated Risk on 7/20/2020 04:00:00 PM

Note: To put these numbers in perspective, the MBA notes "For the week of March 2, only 0.25% of all loans were in forbearance."

From the MBA: Share of Mortgage Loans in Forbearance Decreases for Fifth Straight Week to 7.80%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 38 basis points from 8.18% of servicers’ portfolio volume in the prior week to 7.80% as of July 12, 2020. According to MBA’s estimate, 3.9 million homeowners are in forbearance plans.

...

“The share of loans in forbearance dropped to its lowest level in over two months, driven by an increase in the pace of exits as more homeowners have been able to get back to work,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “The decline in the forbearance share was broad based, with decreases for GSE, Ginnie Mae, and portfolio/PLS loans.”

Added Fratantoni, “Almost half of borrowers remaining in forbearance are now in an extension of the original term, while the remainder are in their initial forbearance plan. The pace of new forbearance requests remains quite low compared to earlier in the crisis, but we are watching carefully for any increases due to either the pick-up in COVID-19 cases or the cessation of enhanced unemployment insurance benefits at the end of this month.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has been trending down for the last five weeks.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) remained flat relative to the prior week at 0.13%. "

Lawler: Serious Delinquency Rate on FHA-Insured SF Loans Surged in June

by Calculated Risk on 7/20/2020 03:24:00 PM

CR: Note that Lawler is discussing the sharp increase in serious delinquencies in June according to the Early Warning System. This means people have missed three payments (although many of these people are probably in forbearance programs.)

While the FHA’s “official” monthly loan performance report for June is not yet available on its website, data from the FHA’s Early Warning System indicates that FHA’s Early Warning System indicate that the serious delinquency rate on FHA-insured single-family loans surged in June.

Delinquency rates in the EWS do not match those in the official report, but the two delinquency rates tend to move together over time.

| Delinquency Rate, FHA-Insured SF Loans | ||||

|---|---|---|---|---|

| Official Report | ||||

| Total | 30-day | 60-day | SDQ | |

| 2/29/2020 | 10.85% | 5.16% | 1.65% | 4.04% |

| 3/31/2020 | 11.17% | 5.59% | 1.61% | 3.97% |

| 4/30/2020 | 15.52% | 9.20% | 2.28% | 4.04% |

| 5/31/2020 | 17.27% | 6.37% | 5.99% | 4.91% |

| Early Warning System, Active Servicers | ||||

| 2/29/2020 | 10.63% | 5.16% | 1.66% | 3.81% |

| 3/31/2020 | 10.74% | 5.36% | 1.62% | 3.76% |

| 4/30/2020 | 15.32% | 9.17% | 2.27% | 3.88% |

| 5/31/2020 | 17.15% | 6.37% | 5.99% | 4.80% |

| 6/30/2020 | 17.17% | 4.65% | 3.70% | 8.82% |

Sacramento Housing in June: Sales decline 1% YoY, Active Inventory down 37% YoY

by Calculated Risk on 7/20/2020 12:20:00 PM

Note that June sales are for contracts typically signed in April and May..

From SacRealtor.org: June 2020 Statistics – Sacramento Housing Market – Single Family Homes

June sales rebounded with 1,506 sales for the month, up 45.9% from the 1,032 sales in May. Compared to one year ago (1,527), the current figure is down 1.4%.1) Overall sales decreased to 1,506 in June, down 1.4% from 1,527 in June 2019. Sales were up 45.9% from May 2020 (previous month).

...

The Active Listing Inventory decreased 15.8% from May to June, from 1,775 units to 1,495 units. Compared with June 2019 (2,362), inventory is down 36.7%. The Months of Inventory decreased from 1.7 Months to 1 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory.

...

The Median DOM (days on market) increased from 9 to 10 and the Average DOM decreased from 19 to 23. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.”

emphasis added

2) Active inventory was at 1,495 down from 2,362 in June 2019. That is down 36.7% year-over-year. This is the fourteenth consecutive month with a YoY decline in inventory.