by Calculated Risk on 7/20/2020 06:02:00 PM

Monday, July 20, 2020

July 20 COVID-19 Test Results

The US is now reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 735,197 test results reported over the last 24 hours.

There were 57,948 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.9% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases for Fifth Straight Week to 7.80%" of Portfolio Volume

by Calculated Risk on 7/20/2020 04:00:00 PM

Note: To put these numbers in perspective, the MBA notes "For the week of March 2, only 0.25% of all loans were in forbearance."

From the MBA: Share of Mortgage Loans in Forbearance Decreases for Fifth Straight Week to 7.80%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 38 basis points from 8.18% of servicers’ portfolio volume in the prior week to 7.80% as of July 12, 2020. According to MBA’s estimate, 3.9 million homeowners are in forbearance plans.

...

“The share of loans in forbearance dropped to its lowest level in over two months, driven by an increase in the pace of exits as more homeowners have been able to get back to work,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “The decline in the forbearance share was broad based, with decreases for GSE, Ginnie Mae, and portfolio/PLS loans.”

Added Fratantoni, “Almost half of borrowers remaining in forbearance are now in an extension of the original term, while the remainder are in their initial forbearance plan. The pace of new forbearance requests remains quite low compared to earlier in the crisis, but we are watching carefully for any increases due to either the pick-up in COVID-19 cases or the cessation of enhanced unemployment insurance benefits at the end of this month.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has been trending down for the last five weeks.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) remained flat relative to the prior week at 0.13%. "

Lawler: Serious Delinquency Rate on FHA-Insured SF Loans Surged in June

by Calculated Risk on 7/20/2020 03:24:00 PM

CR: Note that Lawler is discussing the sharp increase in serious delinquencies in June according to the Early Warning System. This means people have missed three payments (although many of these people are probably in forbearance programs.)

While the FHA’s “official” monthly loan performance report for June is not yet available on its website, data from the FHA’s Early Warning System indicates that FHA’s Early Warning System indicate that the serious delinquency rate on FHA-insured single-family loans surged in June.

Delinquency rates in the EWS do not match those in the official report, but the two delinquency rates tend to move together over time.

| Delinquency Rate, FHA-Insured SF Loans | ||||

|---|---|---|---|---|

| Official Report | ||||

| Total | 30-day | 60-day | SDQ | |

| 2/29/2020 | 10.85% | 5.16% | 1.65% | 4.04% |

| 3/31/2020 | 11.17% | 5.59% | 1.61% | 3.97% |

| 4/30/2020 | 15.52% | 9.20% | 2.28% | 4.04% |

| 5/31/2020 | 17.27% | 6.37% | 5.99% | 4.91% |

| Early Warning System, Active Servicers | ||||

| 2/29/2020 | 10.63% | 5.16% | 1.66% | 3.81% |

| 3/31/2020 | 10.74% | 5.36% | 1.62% | 3.76% |

| 4/30/2020 | 15.32% | 9.17% | 2.27% | 3.88% |

| 5/31/2020 | 17.15% | 6.37% | 5.99% | 4.80% |

| 6/30/2020 | 17.17% | 4.65% | 3.70% | 8.82% |

Sacramento Housing in June: Sales decline 1% YoY, Active Inventory down 37% YoY

by Calculated Risk on 7/20/2020 12:20:00 PM

Note that June sales are for contracts typically signed in April and May..

From SacRealtor.org: June 2020 Statistics – Sacramento Housing Market – Single Family Homes

June sales rebounded with 1,506 sales for the month, up 45.9% from the 1,032 sales in May. Compared to one year ago (1,527), the current figure is down 1.4%.1) Overall sales decreased to 1,506 in June, down 1.4% from 1,527 in June 2019. Sales were up 45.9% from May 2020 (previous month).

...

The Active Listing Inventory decreased 15.8% from May to June, from 1,775 units to 1,495 units. Compared with June 2019 (2,362), inventory is down 36.7%. The Months of Inventory decreased from 1.7 Months to 1 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory.

...

The Median DOM (days on market) increased from 9 to 10 and the Average DOM decreased from 19 to 23. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.”

emphasis added

2) Active inventory was at 1,495 down from 2,362 in June 2019. That is down 36.7% year-over-year. This is the fourteenth consecutive month with a YoY decline in inventory.

Comments on BLS Reference Week

by Calculated Risk on 7/20/2020 10:05:00 AM

Just a few comments ...

Last week was the reference week for the monthly U.S. Bureau of Labor Statistics (BLS) employment report.

This means analysts will focus on the Department of Labor's initial weekly claims report to be released this coming Thursday (covering the BLS reference week) for clues about the July employment report.

The consensus is for a 1.3 million initial claims, unchanged from the previous week. Some analysts are expecting an increase in claims this week related to bar and indoor dining closings in some states - and possibly also due to the end of some Paycheck Protection Program (PPP) agreements. For example, Merrill Lynch economists are expecting an increase to 1.5 million initial claims in the report this week.

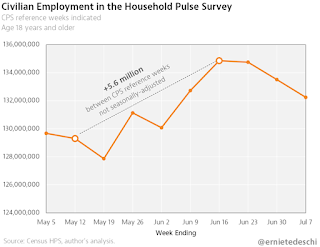

Another interesting data point will be released on Wednesday; the Census Bureau's experimental Household Pulse Survey.

Note: Initially the Pulse Survey was planned for 90 days starting April 23rd. Hopefully this program will be extended!

Ernie Tedeschi (former US Treasury economist) @ernietedeschi has pointed out that his survey was helpful in predicting the June employment report.

Employment in the @uscensusbureau Household Pulse Survey fell another -1.3 million last week alone. It's now fallen -2.6 million cumulatively over the past 3 weeks.The graph is from Ernie Tedeschi.

Seasonality & survey noise may be factors, but the HPS did an excellent job of anticipating the June jobs report.

The Pulse Survey doesn't align exactly with the reference week. The release on Wednesday will be for the period July 9th - July 14th, and the release the following week will be for the period July 16th - July 21th. The reference week is the 12th - 18th.

So we will need to look at two Pulse weekly surveys for hints about the July employment report.

Six High Frequency Indicators for the Economy

by Calculated Risk on 7/20/2020 08:34:00 AM

These indicators are mostly for travel and entertainment - some of the sectors that will recover very slowly.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

On July 19th there were 747,422 travelers compared to 2,727,355 a year ago.

That is a decline of 73%. There had been a slow steady increase from the bottom, but the increase in air travel has slowed.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through July 18, 2020.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market".

The 7 day average for New York is still off 76%.

Florida is down 62% YoY. Note that dining seems to be declining in many areas over the last few weeks (certainly due to the recent surge in COVID cases).

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through July 16th.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through July 16th.Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales have picked up a slightly from the bottom, but are still under $1 million per week (compared to usually around $300 million per week), and ticket sales have essentially been at zero for seventeen weeks.

Most movie theaters are closed all across the country, and will probably reopen slowly (probably with limited seating at first).

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).2020 was off to a solid start, however, COVID-19 crushed hotel occupancy.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

The occupancy rate for the last four weeks was 43.9%, 46.2%, 45.6% and 45.9%. Flattening out well below the median for this week of 75%.

Usually hotel occupancy starts to pick up seasonally in early June. So some of the recent pickup might be seasonal (summer travel). Note that summer occupancy usually peaks at the end of July or in early August.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows the year-over-year change in gasoline consumption.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows the year-over-year change in gasoline consumption.At one point, gasoline consumption was off almost 50% YoY.

As of July 10th, gasoline consumption was only off about 6% YoY (about 94% of normal).

Note: I know several people that have driven to vacation spots - or to visit family - and they usually would have flown. So this might be boosting gasoline consumption over the summer.

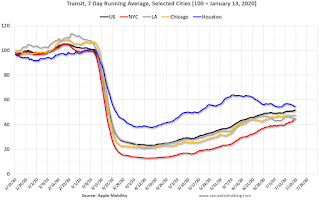

The final graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through July 18th for the United States and several selected cities.

This data is through July 18th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is still only about 52% of the January level. It is at 45% in New York, and 54% in Houston (down over the last few of weeks).

Sunday, July 19, 2020

Sunday Night Futures

by Calculated Risk on 7/19/2020 07:08:00 PM

Weekend:

• Schedule for Week of July 19, 2020

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were up slightly over the last week with WTI futures at $40.58 per barrel and Brent at $43.09 barrel. A year ago, WTI was at $55, and Brent was at $61 - so WTI oil prices are down about 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.18 per gallon. A year ago prices were at $2.77 per gallon, so gasoline prices are down $0.59 per gallon year-over-year.

July 19 COVID-19 Test Results

by Calculated Risk on 7/19/2020 05:41:00 PM

The US is now reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 768,823 test results reported over the last 24 hours.

There were 63,907 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.3% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

Existing Home Sales: Lawler vs. the Consensus

by Calculated Risk on 7/19/2020 10:22:00 AM

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for over 10 years. And he has graciously allowed me to share his predictions with the readers of this blog.

The table below shows the consensus for each month, Lawler's predictions, and the NAR's initially reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

Take last month (May 2020): The consensus was 4.10 million SAAR, and Lawler estimated the NAR would report 3.80 million - and the NAR actually reported 3.91 million.

Note that the initial consensus for May was 4.38 million SAAR, but moved down sharply after Lawler released his projections. This happens frequently - analysts change their outlook based on Lawler's projections.

The NAR is scheduled to release Existing Home Sales for June at 10:00 AM, Wednesday, July 22nd.

The consensus is for 4.86 million SAAR in June, up from 3.91 million in May. Tom Lawler estimates the NAR will report sales of 4.65 million SAAR and that inventory will be down about 26% year-over-year. Based on Lawler's estimate, I expect existing home sales to be below the consensus in June.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last 10 years, the consensus average miss was 139 thousand, and Lawler's average miss was 69 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | 5.60 |

| Apr-18 | 5.60 | 5.48 | 5.46 |

| May-18 | 5.56 | 5.47 | 5.43 |

| Jun-18 | 5.45 | 5.35 | 5.38 |

| Jul-18 | 5.43 | 5.40 | 5.34 |

| Aug-18 | 5.36 | 5.36 | 5.34 |

| Sep-18 | 5.30 | 5.20 | 5.15 |

| Oct-18 | 5.20 | 5.31 | 5.22 |

| Nov-18 | 5.19 | 5.23 | 5.32 |

| Dec-18 | 5.24 | 4.97 | 4.99 |

| Jan-19 | 5.05 | 4.92 | 4.94 |

| Feb-19 | 5.08 | 5.46 | 5.51 |

| Mar-19 | 5.30 | 5.40 | 5.21 |

| Apr-19 | 5.36 | 5.31 | 5.19 |

| May-19 | 5.29 | 5.40 | 5.34 |

| Jun-19 | 5.34 | 5.25 | 5.27 |

| Jul-19 | 5.39 | 5.40 | 5.42 |

| Aug-19 | 5.38 | 5.42 | 5.49 |

| Sep-19 | 5.45 | 5.36 | 5.38 |

| Oct-19 | 5.49 | 5.36 | 5.46 |

| Nov-19 | 5.45 | 5.43 | 5.35 |

| Dec-19 | 5.43 | 5.40 | 5.54 |

| Jan-20 | 5.45 | 5.42 | 5.46 |

| Feb-20 | 5.50 | 5.58 | 5.77 |

| Mar-20 | 5.30 | 5.25 | 5.27 |

| Apr-20 | 4.30 | 4.17 | 4.33 |

| May-20 | 4.10 | 3.80 | 3.91 |

| Jun-20 | 4.86 | 4.65 | NA |

| 1NAR initially reported before revisions. | |||

Phoenix Real Estate in June: Sales up 2% YoY, Active Inventory Down 23% YoY

by Calculated Risk on 7/19/2020 08:11:00 AM

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales were at 9,508 in June, up from 6,860 in May, and up from 9,313 in June 2019. Sales were up 38.6% from May 2020 (last month), and up 2.1% from June 2019.

2) Active inventory was at 8,792 down from 11,418 in June 2019. That is down 23% year-over-year.

3) Months of supply decreased to 1.51 in June, down from 2.46 in May. This remains low.

Sales are reported at the close of escrow, so these sales were mostly signed in April and May. As expected, sales rebounded in June.