by Calculated Risk on 7/19/2020 07:08:00 PM

Sunday, July 19, 2020

Sunday Night Futures

Weekend:

• Schedule for Week of July 19, 2020

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were up slightly over the last week with WTI futures at $40.58 per barrel and Brent at $43.09 barrel. A year ago, WTI was at $55, and Brent was at $61 - so WTI oil prices are down about 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.18 per gallon. A year ago prices were at $2.77 per gallon, so gasoline prices are down $0.59 per gallon year-over-year.

July 19 COVID-19 Test Results

by Calculated Risk on 7/19/2020 05:41:00 PM

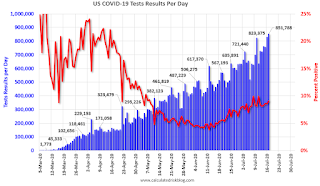

The US is now reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 768,823 test results reported over the last 24 hours.

There were 63,907 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.3% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

Existing Home Sales: Lawler vs. the Consensus

by Calculated Risk on 7/19/2020 10:22:00 AM

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for over 10 years. And he has graciously allowed me to share his predictions with the readers of this blog.

The table below shows the consensus for each month, Lawler's predictions, and the NAR's initially reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

Take last month (May 2020): The consensus was 4.10 million SAAR, and Lawler estimated the NAR would report 3.80 million - and the NAR actually reported 3.91 million.

Note that the initial consensus for May was 4.38 million SAAR, but moved down sharply after Lawler released his projections. This happens frequently - analysts change their outlook based on Lawler's projections.

The NAR is scheduled to release Existing Home Sales for June at 10:00 AM, Wednesday, July 22nd.

The consensus is for 4.86 million SAAR in June, up from 3.91 million in May. Tom Lawler estimates the NAR will report sales of 4.65 million SAAR and that inventory will be down about 26% year-over-year. Based on Lawler's estimate, I expect existing home sales to be below the consensus in June.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last 10 years, the consensus average miss was 139 thousand, and Lawler's average miss was 69 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | 5.60 |

| Apr-18 | 5.60 | 5.48 | 5.46 |

| May-18 | 5.56 | 5.47 | 5.43 |

| Jun-18 | 5.45 | 5.35 | 5.38 |

| Jul-18 | 5.43 | 5.40 | 5.34 |

| Aug-18 | 5.36 | 5.36 | 5.34 |

| Sep-18 | 5.30 | 5.20 | 5.15 |

| Oct-18 | 5.20 | 5.31 | 5.22 |

| Nov-18 | 5.19 | 5.23 | 5.32 |

| Dec-18 | 5.24 | 4.97 | 4.99 |

| Jan-19 | 5.05 | 4.92 | 4.94 |

| Feb-19 | 5.08 | 5.46 | 5.51 |

| Mar-19 | 5.30 | 5.40 | 5.21 |

| Apr-19 | 5.36 | 5.31 | 5.19 |

| May-19 | 5.29 | 5.40 | 5.34 |

| Jun-19 | 5.34 | 5.25 | 5.27 |

| Jul-19 | 5.39 | 5.40 | 5.42 |

| Aug-19 | 5.38 | 5.42 | 5.49 |

| Sep-19 | 5.45 | 5.36 | 5.38 |

| Oct-19 | 5.49 | 5.36 | 5.46 |

| Nov-19 | 5.45 | 5.43 | 5.35 |

| Dec-19 | 5.43 | 5.40 | 5.54 |

| Jan-20 | 5.45 | 5.42 | 5.46 |

| Feb-20 | 5.50 | 5.58 | 5.77 |

| Mar-20 | 5.30 | 5.25 | 5.27 |

| Apr-20 | 4.30 | 4.17 | 4.33 |

| May-20 | 4.10 | 3.80 | 3.91 |

| Jun-20 | 4.86 | 4.65 | NA |

| 1NAR initially reported before revisions. | |||

Phoenix Real Estate in June: Sales up 2% YoY, Active Inventory Down 23% YoY

by Calculated Risk on 7/19/2020 08:11:00 AM

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales were at 9,508 in June, up from 6,860 in May, and up from 9,313 in June 2019. Sales were up 38.6% from May 2020 (last month), and up 2.1% from June 2019.

2) Active inventory was at 8,792 down from 11,418 in June 2019. That is down 23% year-over-year.

3) Months of supply decreased to 1.51 in June, down from 2.46 in May. This remains low.

Sales are reported at the close of escrow, so these sales were mostly signed in April and May. As expected, sales rebounded in June.

Saturday, July 18, 2020

July 18 COVID-19 Test Results

by Calculated Risk on 7/18/2020 05:49:00 PM

The US is now reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 761,771 test results reported over the last 24 hours.

There were 65,180 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.6% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

Schedule for Week of July 19, 2020

by Calculated Risk on 7/18/2020 08:11:00 AM

The key reports this week are June New and Existing Home Sales.

No major economic releases scheduled.

8:30 AM ET: Chicago Fed National Activity Index for June. This is a composite index of other data.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for May 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 4.86 million SAAR, up from 3.91 million last month.

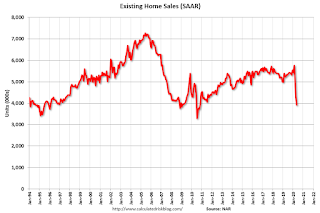

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 4.86 million SAAR, up from 3.91 million last month.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report 4.65 million SAAR.

During the day: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a 1.300 million initial claims, unchanged from 1.300 million the previous week.

10:00 AM: New Home Sales for June from the Census Bureau.

10:00 AM: New Home Sales for June from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 700 thousand SAAR, up from 676 thousand in May.

Friday, July 17, 2020

July 17 COVID-19 Test Results; Record 77,233 Positive Cases

by Calculated Risk on 7/17/2020 05:57:00 PM

The US is now conducting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 851,788 test results reported over the last 24 hours. This is a new record.

There were 77,233 positive tests. This is a new record.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 9.1% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Lawler: Early Read on Existing Home Sales in June

by Calculated Risk on 7/17/2020 04:20:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.65 million in June, up 18.9% from May’s preliminary pace and down 12.6% from last June’s seasonally adjusted pace. Unadjusted sales should show a significantly smaller YOY decline, reflecting this June’s higher business day count than last June’s.

On the inventory front, local realtor/MLS data, as well as data from other inventory trackers, suggest that the inventory of existing homes for sale at the end of June will be down by a whopping 26% from a year earlier.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up by about 3.7% from last June.

While not all realtor reports include data on new pending sales – and some that do often revise those data significantly – the limited data available suggest that pending homes sales in June will be up from May, and will probably be up on a YOY basis as well.

CR Note: The National Association of Realtors (NAR) is scheduled to release June existing home sales on Wednesday, July 22, 2020 at 10:00 AM ET. The consensus is for 4.86 million SAAR.

CAR on California June Housing: Sales down 13% YoY, Listing down 25% YoY

by Calculated Risk on 7/17/2020 01:59:00 PM

The CAR reported: California housing market claws back past two months of losses in June as median home price sets another record high, C.A.R. reports

Existing, single-family home sales totaled 339,910 in June on a seasonally adjusted annualized rate, up 42.4 percent from May and down 12.8 percent from June 2019.CR Note: Existing home sales are reported when the transaction closes, so this was mostly for contracts signed in April and May.

After falling to the lowest level since the Great Recession, California’s housing market rebounded in June with the largest month-to-month sales increase in nearly 40 years, while the median home price set another record high, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 339,910 units in June, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2020 if sales maintained the June pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

Housing supply continued to trend downward on a year-over-year basis, with active listings falling more than 25 percent for the seventh consecutive month. A sizable year-over-year drop in active listings of 43 percent, coupled with a robust gain in closed sales, led to a decline in C.A.R.’s Unsold Inventory Index (UII) in June. The Index dropped to 2.7 months in June from 4.3 months in May and was down from 3.4 months in June 2019. The index indicates the number of months it would take to sell the supply of homes on the market at the current rate of sales.

emphasis added

Comments on June Housing Starts

by Calculated Risk on 7/17/2020 12:44:00 PM

As expected, housing starts bounced back in June.

Earlier: Housing Starts increased to 1.186 Million Annual Rate in June

Total housing starts in June were at expectations, and revisions to prior months were positive.

Low mortgage rates and limited existing home inventory is giving a boost to housing starts.

The housing starts report showed starts were up 17.3% in June compared to May, and starts were down 4.0% year-over-year compared to June 2019.

Single family starts were down 3.9% year-over-year.

This first graph shows the month to month comparison for total starts between 2019 (blue) and 2020 (red).

Starts were down 4.0% in June compared to June 2019.

Last year, in 2019, starts picked up in the 2nd half of the year, so the comparisons were easy early in the year.

Starts, year-to-date, are still up 0.7% compared to the same period in 2019.

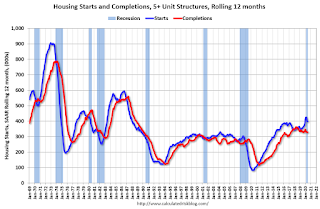

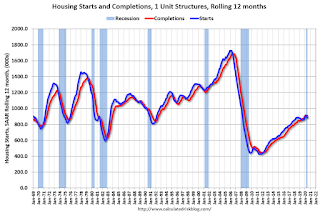

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - then mostly moved sideways. Completions (red line) had lagged behind - then completions caught up with starts- although starts picked up a little again lately.

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions once the crisis abates.