by Calculated Risk on 7/13/2020 05:49:00 PM

Monday, July 13, 2020

July 13 COVID-19 Test Results

The US is now conducting over 600,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

There were 720,700 test results reported over the last 24 hours.

There were 58,357 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.0% (red line).

For the status of contact tracing by state, check out testandtrace.com.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases for Fourth Straight Week to 8.18%" of Portfolio Volume

by Calculated Risk on 7/13/2020 04:00:00 PM

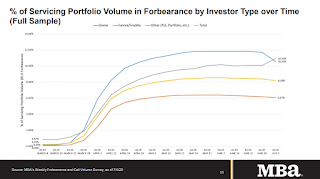

Note: To put these numbers in perspective, the MBA notes "For the week of March 2, only 0.25% of all loans were in forbearance."

From the MBA: Share of Mortgage Loans in Forbearance Decreases for Fourth Straight Week to 8.18%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 21 basis points from 8.39% of servicers’ portfolio volume in the prior week to 8.18% as of July 5, 2020. According to MBA’s estimate, 4.1 million homeowners are in forbearance plans.

...

“The share of loans in forbearance continues to decrease, as more workers are brought back from temporary layoffs. However, our survey reveals a notable shift in the location of many FHA and VA loans, which have been bought out of Ginnie Mae pools – predominantly by bank servicers – and moved onto bank balance sheets,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “As a result, there was a sharp drop in the share of Ginnie Mae loans in forbearance, and an offsetting increase in the share of portfolio loans in forbearance. These buyouts enable servicers to stop advancing principal and interest payments, and to work with borrowers in the hope that they can begin paying again before they are re-securitized into Ginnie Mae pools.”

Added Fratantoni, “Forty-three percent of loans in forbearance are now in an extension following their initial forbearance term, while more than 10 percent of borrowers entered into a deferral plan to exit forbearance – down from 16 percent the week prior. For those exiting forbearance over the next several months, we expect to see many of the borrowers with GSE loans to utilize the deferral option.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April.

The MBA notes: "Weekly forbearance requests as a percent of servicing portfolio volume (#) increased to 0.13 percent from 0.12 percent the previous week."

"Cargo Declines at Port of Long Beach in June"

by Calculated Risk on 7/13/2020 11:05:00 AM

Note: I'll have more on LA area port traffic once the Port of Los Angeles releases June statistics.

From the Port of Long Beach: Cargo Declines at Port of Long Beach in June

The COVID-19 pandemic continued to drive down demand for goods in the second quarter of 2020, leading to an increase in canceled sailings and a decline in cargo containers shipped through the Port of Long Beach in June.

Dockworkers and terminal operators moved 602,180 twenty-foot equivalent units (TEUs) last month, an 11.1% decline compared to June 2019. Imports shrank 9.3% to 300,714 TEUs and exports dropped 12.2% to 117,538 TEUs. Empty containers shipped overseas to Asia were down 13.1% to 183,928 TEUs.

Economic uncertainty brought by decreased consumer spending and ongoing health concerns amid the COVID-19 epidemic contributed to a drop during the first half of 2020, with cargo shipments at 3,433,035 TEUs, 6.9% less than the same period last year.

“Canceled sailings continued to rise at a rapid rate in the second quarter as ocean carriers adjusted their voyages to a decline in demand for imports during the national COVID-19 outbreak,” said Mario Cordero, Executive Director of the Port of Long Beach. “The economic challenges may persist for some time, but the Port of Long Beach continues to invest in infrastructure projects that will meet the needs of our customers.”

The San Pedro Bay ports complex – Long Beach and L.A. combined – had 41 canceled sailings in the first half of 2019. This year it was 104 – 37 of which were destined for the Port of Long Beach.

emphasis added

Six High Frequency Indicators for a Recovery

by Calculated Risk on 7/13/2020 08:13:00 AM

These indicators are mostly for travel and entertainment - some of the sectors that will recover very slowly.

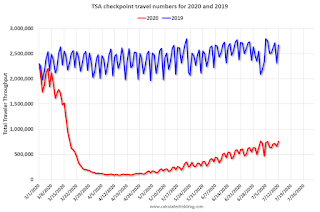

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

On July 12th there were 754,545 travelers compared to 2,669,717 a year ago.

That is a decline of 72%. There has been a slow steady increase from the bottom, but air travel is still down significantly.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through July 11, 2020.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market".

The 7 day average for New York is still off 81%.

Florida is only down 57% YoY. Note that dining seems to be declining in many areas (probably due to the recent surge in COVID cases).

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through July 9th.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through July 9th.Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales have picked up a slightly from the bottom, but are still under $1 million per week (compared to usually around $300 million per week), and ticket sales have essentially been at zero for sixteen weeks.

Most movie theaters are closed all across the country, and will probably reopen slowly (probably with limited seating at first).

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).2020 was off to a solid start, however, COVID-19 crushed hotel occupancy. Hotel occupancy was off 30.2% YoY last week.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Usually hotel occupancy starts to pick up seasonally in early June. So some of the recent pickup might be seasonal (summer travel). Note that summer occupancy usually peaks at the end of July or in early August.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows the year-over-year change in gasoline consumption.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows the year-over-year change in gasoline consumption.At one point, gasoline consumption was off almost 50% YoY.

As of July 3rd, gasoline consumption was only off about 10% YoY (about 90% of normal).

Note: I know several people that have driven to vacation spots - or to visit family - and they usually would have flown. So this might have boosted gasoline consumption.

The final graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through July 11th for the United States and several selected cities.

This data is through July 11th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is still only about 50% of the January level. It is at 39% in New York, and 56% in Houston (down over the last couple of weeks).

Sunday, July 12, 2020

Sunday Night Futures

by Calculated Risk on 7/12/2020 06:39:00 PM

Weekend:

• Schedule for Week of July 12, 2020

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 20 and DOW futures are up 199 (fair value).

Oil prices were down over the last week with WTI futures at $40.25 per barrel and Brent at $42.93 barrel. A year ago, WTI was at $57, and Brent was at $64 - so WTI oil prices are down about 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.19 per gallon. A year ago prices were at $2.79 per gallon, so gasoline prices are down $0.60 per gallon year-over-year.

July 12 COVID-19 Test Results

by Calculated Risk on 7/12/2020 05:10:00 PM

The US is now conducting over 600,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

There were 729,141 test results reported over the last 24 hours.

There were 61,338 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.4% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Saturday, July 11, 2020

July 11 COVID-19 Test Results; Highest Percent Positive Since Early May

by Calculated Risk on 7/11/2020 05:33:00 PM

The US is now conducting over 600,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

There were 633,974 test results reported over the last 24 hours.

There were 63,007 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 9.9% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Hotels: Occupancy Rate Declined 30.2% Year-over-year

by Calculated Risk on 7/11/2020 02:12:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 4 July

U.S. hotel performance data for the week ending 4 July showed a slight decline in occupancy from the previous week, according to STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

28 June through 4 July 2020 (percentage change from comparable week in 2019):

• Occupancy: 45.6% (-30.2%)

• Average daily rate (ADR): US$101.36 (-20.9%)

• Revenue per available room (RevPAR): US$46.21 (-44.8%)

Occupancy had risen in week-to-week comparisons for 11 straight weeks since mid-April.

“Demand came in 67,000 rooms lower than the previous week, and beyond that, July 1 was a reopening day for a lot of hotels, further impacting the occupancy equation,” said Jan Freitag, STR’s senior VP of lodging insights. “A rise in COVID-19 cases has led to states pausing or even rolling back some of their reopenings. Beaches have been a big demand driver for hotels, but with many beaches closed ahead of the July 4 holiday, all but two markets in Florida showed lower occupancy than the previous week. Growing concern around this latest spike in the pandemic has further implications for leisure and business demand alike.” emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Usually hotel occupancy starts to pick up seasonally in early June. So some of the recent pickup might be seasonal (summer travel). Note that summer occupancy usually peaks at the end of July or in early August.

According to STR, the improvement appears related mostly to leisure travel as opposed to business travel.

Note: Y-axis doesn't start at zero to better show the seasonal change.

Schedule for Week of July 12, 2020

by Calculated Risk on 7/11/2020 08:11:00 AM

The key reports this week are June CPI, housing starts and retail sales.

For manufacturing, the June Industrial Production report and the July New York and Philly Fed manufacturing surveys will be released.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for June.

8:30 AM: The Consumer Price Index for June from the BLS. The consensus is for a 0.6% increase in CPI, and a 0.1% increase in core CPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The New York Fed Empire State manufacturing survey for July. The consensus is for a reading of 7.9, up from -0.2.

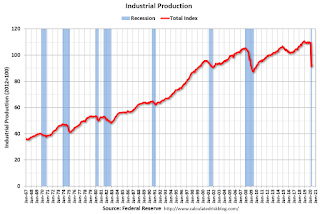

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.This graph shows industrial production since 1967.

The consensus is for a 4.6% increase in Industrial Production, and for Capacity Utilization to increase to 68.1%.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a 1.200 million initial claims, down from 1.314 million the previous week.

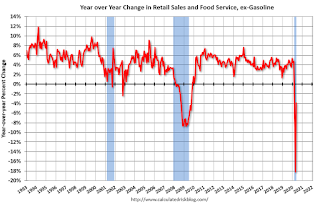

8:30 AM: Retail sales for June is scheduled to be released. The consensus is for 5.5% increase in retail sales.

8:30 AM: Retail sales for June is scheduled to be released. The consensus is for 5.5% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, decreased by 3.9% on a YoY basis in May.

8:30 AM: the Philly Fed manufacturing survey for July. The consensus is for a reading of 20.0, down from 27.5.

10:00 AM: The July NAHB homebuilder survey. The consensus is for a reading of 60, up from 58. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM ET: Housing Starts for June.

8:30 AM ET: Housing Starts for June. This graph shows single and total housing starts since 1968.

The consensus is for 1.180 million SAAR, up from 0.974 million SAAR in May.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for July).

10:00 AM: State Employment and Unemployment (Monthly) for June 2020

Friday, July 10, 2020

July 10 COVID-19 Test Results; Record Tests, Record Positive Tests

by Calculated Risk on 7/10/2020 05:27:00 PM

The US is now conducting over 600,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

There were 825,635 test results reported over the last 24 hours.

There were 66,645 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.0% (red line).

For the status of contact tracing by state, check out testandtrace.com.