by Calculated Risk on 7/08/2020 12:45:00 PM

Wednesday, July 08, 2020

NMHC: Rent Payment Tracker Finds Decline in People Paying Rent in July

Without further disaster relief, there will a significant housing and financial issue.

From the NMHC: NMHC Rent Payment Tracker Finds 77.4 Percent of Apartment Households Paid Rent as of July 6

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 77.4 percent of apartment households made a full or partial rent payment by July 6 in its survey of 11.4 million units of professionally managed apartment units across the country.CR Note: It appears fewer people are paying their rent compared to last year (down 2.3 percentage points from a year ago). In the previous surveys, over the last few months, people were paying their rents at about the same pace as last year. The disaster relief has been key to helping people pay their bills, especially the extra unemployment benefits and the PPP.

This is a 2.3-percentage point decrease from the share who paid rent through July 6, 2019 and compares to 80.8 percent that had paid by June 6, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

“It is clear that state and federal unemployment assistance benefits have served as a lifeline for renters, making it possible for them to pay their rent,” said Doug Bibby, NMHC President. “Unfortunately, there is a looming July 31 deadline when that aid ends. Without an extension or a direct renter assistance program, that NMHC has been calling for since the start of the pandemic, the U.S. could be headed toward historic dislocations of renters and business failures among apartment firms, exacerbating both unemployment and homelessness.”

emphasis added

Census: Household Pulse Survey shows 34.9% of Households Expect Loss in Income; 25.9% Concerned about Housing

by Calculated Risk on 7/08/2020 11:22:00 AM

Note: The details in the pulse survey this week are concerning - especially about loss in income and concern about housing.

First, from @ernietedeschi

The @uscensusbureau Household Pulse Survey, which performed admirably in anticipating the June jobs report, now shows employment has fallen by about 1.3 million cumulatively over the last 2 weeks.This graph is from Ernie Tedeschi (former US Treasury economist).

Some of this may be seasonality or survey error, but it merits pause nonetheless.

Note: The question on lost income is always since March 13, 2020 - so this percentage will not decline.

From the Census Bureau: Measuring Household Experiences during the Coronavirus (COVID-19) Pandemic

The U.S. Census Bureau, in collaboration with five federal agencies, is in a unique position to produce data on the social and economic effects of COVID-19 on American households. The Household Pulse Survey is designed to deploy quickly and efficiently, collecting data to measure household experiences during the Coronavirus (COVID-19) pandemic. Data will be disseminated in near real-time to inform federal and state response and recovery planning.This will be updated weekly, and the Census Bureau released the recent survey results last Wednesday. This survey asks about Loss in Employment Income, Expected Loss in Employment Income, Food Scarcity, Delayed Medical Care, Housing Insecurity and K-12 Educational Changes.

…

Data collection for the Household Pulse Survey began on April 23, 2020. The Census Bureau will collect data for 90 days, and release data on a weekly basis.

Click on graph for larger image.

Click on graph for larger image.The data was collected between June 25 and June 30, 2020.

Definitions:

Loss in employment income: "Percentage of adults in households where someone had a loss in employment income since March 13, 2020."

This number is since March 13, and has increased slightly.

Expected Loss in Employment Income: "Percentage of adults who expect someone in their household to have a loss in employment income in the next 4 weeks."

34.9% of households expect a loss in income over the next 4 weeks. This is down from 38.8% in late April, but up from 32% the previous (the previous week was the reference week for the BLS employment report). This might suggest the job gains stalled after the data was collected for the June employment report.

Food Scarcity: Percentage of adults in households where there was either sometimes or often not enough to eat in the last 7 days.

About 10% of households report food scarcity.

Delayed Medical Care: "Percentage of adults who delayed getting medical care because of the COVID-19 pandemic in the last 4 weeks."

41.5% of households report they delayed medical care over the last 4 weeks. This has not declined.

Housing Insecurity: "Percentage of adults who missed last month’s rent or mortgage payment, or who have slight or no confidence that their household can pay next month’s rent or mortgage on time."

25.9% of households reported they missed last month's rent or mortgage payment (or little confidence in making this month's payment). This has increased from a low of 22.1% in the survey of June 4th - June 9th.

Without an extension of the extra unemployment benefits (expires at the end of July), we will likely see a significant increase in housing stress.

K-12 Educational Changes: "Percentage of adults in households with children in public or private school, where classes were taught in a distance learning format, or changed in some other way."

Essentially all households with children are reporting were not being taught in a normal format.

U.S. Heavy Truck Sales down 42% Year-over-year in June

by Calculated Risk on 7/08/2020 09:38:00 AM

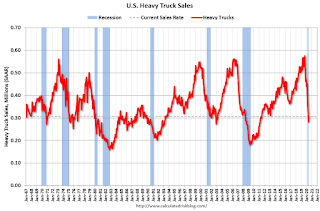

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the June 2020 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all time high of 575 thousand SAAR in September 2019.

However heavy truck sales started declining late last year due to lower oil prices.

Click on graph for larger image.

And then heavy truck sales really declined towards the end of March due to COVID-19 and the collapse in oil prices.

Heavy truck sales were at 305 thousand SAAR in June, up from 282 thousand SAAR in May, and down 42% from 527 thousand SAAR in June 2019.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 7/08/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 3, 2020. This week’s results include an adjustment for the Fourth of July holiday.

... The Refinance Index increased 0.4 percent from the previous week and was 111 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 5 percent from one week earlier. The unadjusted Purchase Index decreased 5 percent compared with the previous week and was 33 percent higher than the same week one year ago.

Mortgage rates declined to another record low as renewed fears of a coronavirus resurgence offset the impacts from a week of mostly positive economic data, such as June factory orders and payroll employment. The 30-year fixed rate slipped to 3.26 percent – down 53 basis points since late March. Borrowers acted in response to these lower rates, after accounting for the July 4th holiday,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications continued their recovery, increasing 5 percent to the highest level in almost a month and 33 percent from a year ago. The average purchase loan size increased to $365,700 – also another high – as borrowers contend with limited supply and higher home prices.”

Added Kan, “Refinance applications increased slightly, driven by a 2 percent rise in conventional refinances. Overall refinance activity was up 111 percent from last year.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.26 percent from 3.29 percent, with points decreasing to 0.35 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But the index is up signficantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 33% year-over-year.

Note: Red is a four-week average (blue is weekly).

Tuesday, July 07, 2020

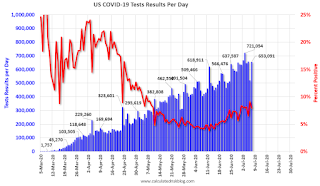

July 7 COVID-19 Test Results

by Calculated Risk on 7/07/2020 05:42:00 PM

The US is now conducting over 600,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day.

There were 653,091 test results reported over the last 24 hours.

There were 51,888 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.9% (red line).

For the status of contact tracing by state, check out testandtrace.com.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases for Third Straight Week to 8.39%" of Portfolio Volume

by Calculated Risk on 7/07/2020 04:00:00 PM

Note: To put these numbers in perspective, the MBA notes "For the week of March 2, only 0.25% of all loans were in forbearance."

From the MBA: Share of Mortgage Loans in Forbearance Decreases for Third Straight Week to 8.39%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 8 basis points from 8.47% of servicers’ portfolio volume in the prior week to 8.39% as of June 28, 2020. According to MBA’s estimate, almost 4.2 million homeowners are in forbearance plans.

...

“We learned last week that the job market improved more than expected in June. With that as background, it is not surprising that the forbearance numbers continue to improve as more people go back to their jobs,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “The improvement in the forbearance data was broad-based, with declines for both GSE and Ginnie Mae loans. The decrease in new forbearance requests indicates that further declines are likely in the weeks ahead.”

Added Fratantoni, “Looking at the mix of loans that are exiting forbearance, we are seeing a higher share exiting into deferral options and modifications, and somewhat fewer simply opting out of a forbearance plan.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April.

The MBA notes: "Weekly forbearance requests as a percent of servicing portfolio volume (#) decreased to 0.12 percent from 0.14 percent the previous week."

Seattle Real Estate in June: Sales down 8% YoY, Inventory down 32% YoY

by Calculated Risk on 7/07/2020 12:54:00 PM

The Northwest Multiple Listing Service reported Northwest MLS brokers report robust activity amid low interest rates, tight inventory, changing lifestyles

Historically low interest rates and lifestyle changes are fueling housing activity around Washington state, according to Dean Rebhuhn, president of Village Homes and Properties in Woodinville. Commenting on just-released June statistics from Northwest Multiple Listing Service, he and other brokers say multiple offers are common “especially in the median price range.”There were 8,312 sales in June 2020, down 12% from 9,474 sales in June 2019.

…

“Multiple offers are back with a vengeance as buyers are handicapped by having only about half the inventory of a year ago,” noted Dick Beeson, managing broker at RE/MAX Northwest in Tacoma-Gig Harbor. “The refrain, ‘Sorry to tell you, but the seller has accepted another offer,’ is heard with regularity,” he stated, adding, “If a buyer finds a home they like, it’s likely 20 other people will be vying for it, and the battle is on.”

emphasis added

The press release is for the Northwest. In King County, sales were down 17.1% year-over-year, and active inventory was down 41.5% year-over-year.

In Seattle, sales were down 8.3% year-over-year, and inventory was down 31.6% year-over-year.. This puts the months-of-supply in Seattle at just 1.6 months.

The closed sales are for contracts mostly signed in April and May. There will likely be some rebound in the July report.

Las Vegas Real Estate in June: Sales down 19% YoY, Inventory down 31% YoY

by Calculated Risk on 7/07/2020 11:06:00 AM

This report is for closed sales in June; sales are counted at the close of escrow, so the contracts for these homes were mostly signed in April and May.

The Las Vegas Realtors reported Southern Nevada home prices holding their ground during crisis, LVR housing statistics for May 2020

LVR reported that a total of 2,934 existing local homes, condos and townhomes were sold during June – the third full month since Nevadans were ordered on March 17 to “stay home for Nevada.” Compared to the same time last year, June sales were down 15.1% for homes and down 35.0% for condos and townhomes. However, sales were up significantly from the previous month.1) Overall sales were down 19.1% year-over-year to 2,934 in June 2020 from 3,626 in June 2019.

...

By the end of June, LVR reported 5,079 single-family homes listed for sale without any sort of offer. That’s down 35.0% from one year ago. For condos and townhomes, the 1,616 properties listed without offers in June represented a 16.6% drop from one year ago.

…

Despite the coronavirus crisis, the number of so-called distressed sales in June remained near historically low levels. The association reported that short sales and foreclosures combined accounted for 2.2% of all existing local property sales in June. That compares to 2.2% of all sales one year ago, 2.6% two years ago and 6.3% three years ago.

emphasis added

2) Active inventory (single-family and condos) is down from a year ago, from a total of 9,752 in June 2019 to 6,695 in June 2020. Note: Total inventory was down 31.3% year-over-year. And months of inventory is still low.

3) Low level of distressed sales.

BLS: Job Openings increased to 5.4 Million in May

by Calculated Risk on 7/07/2020 10:07:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of hires increased by 2.4 million to a series high of 6.5 million in May, the U.S. Bureau of Labor Statistics reported today. This was the largest monthly increase of hires since the series began. Total separations decreased by 5.8 million to 4.1 million, the single largest decrease since the series began. Within separations, the quits rate rose to 1.6 percent while the layoffs and discharges rate fell to 1.4 percent. Job openings increased to 5.4 million on the last business day of May. These improvements in the labor market reflected a limited resumption of economic activity that had been curtailed in March and April due to the coronavirus (COVID-19) pandemic and efforts to contain it.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for May, the most recent employment report was for June.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in May to 5.397 million from 4.996 million in April.

The number of job openings (yellow) were down 26% year-over-year.

Quits were down 41% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings increased in May, but were still down sharply YoY.

CoreLogic: House Prices up 4.8% Year-over-year in May

by Calculated Risk on 7/07/2020 08:00:00 AM

Notes: This CoreLogic House Price Index report is for May. The recent Case-Shiller index release was for April. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: Prepare for a Cooldown: CoreLogic Reports Home Prices Were Up in May, but Could Slump Over the Summer

Nationally, home prices increased by 4.8%, compared with May 2019. Home prices increased 0.7% in May 2020 compared with April of this year.CR Note: The overall impact on house prices will depend on the duration of the crisis.

Strong home purchase demand in the first quarter of 2020, coupled with tightening supply, has helped prop up home prices through the coronavirus (COVID-19) crisis. However, the anticipated impacts of the recession are beginning to appear across the housing market. Despite new contract signings rising year over year in May, home price growth is expected to stall in June and remain that way throughout the summer. CoreLogic HPI Forecast predicts a month-over-month price decrease of 0.1% in June and a year-over-year decline of 6.6% by May 2021.

Unlike the Great Recession, the current economic downturn is not driven by the housing market, which continues to post gains in many parts of the country. While activity up until now suggests the housing market will eventually bounce back, the forecasted decline in home prices will largely be due to elevated unemployment rates. This prediction is exacerbated by the recent spike in COVID-19 cases across the country.

emphasis added