by Calculated Risk on 6/29/2020 01:32:00 PM

Monday, June 29, 2020

Update: Framing Lumber Future Prices Up Year-over-year

Here is another monthly update on framing lumber prices. Lumber prices declined sharply from the record highs in early 2018, and then increased until the COVID-19 crisis.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through June 26, 2020 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 36% from a year ago, and CME futures are up 14% year-over-year.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

Prices fell sharply due to COVID-19, however prices have bounced back (Note: Construction was considered an essential activity in many areas, so construction didn't decline as much as some other sectors).

Dallas Fed: "Manufacturing Regains Footing After Epic Decline"

by Calculated Risk on 6/29/2020 10:39:00 AM

From the Dallas Fed: Manufacturing Regains Footing After Epic Decline

Texas factory activity rebounded strongly in June, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, climbed from -28.0 to 13.6, indicating moderate expansion in output following three months of record or near-record declines.This was the last of the regional Fed surveys for June.

Other measures of manufacturing activity also pointed to a rebound in growth this month. The new orders index advanced 34 points to 2.9, its first positive reading in four months, with nearly a third of manufacturers noting an increase in orders. The growth rate of orders index pushed up 25 points but remained negative at -5.8. The capacity utilization and shipments indexes also returned to positive territory.

Perceptions of broader business conditions were mixed in June. The general business activity index surged 43 points but stayed negative at -6.1. The company outlook index climbed back into positive territory, from -34.6 to 2.7, with 29 percent of manufacturers noting improved outlooks, up from 12 percent last month. The index measuring uncertainty regarding companies’ outlooks retreated notably again to 9.1—its lowest reading since January. The positive reading still indicates increased uncertainty.

Labor market measures indicated virtually flat employment levels and shorter workweeks this month. The employment index remained negative but rose 10 points to -1.5. Fifteen percent of firms noted net hiring, while 17 percent noted net layoffs. The hours worked index rose from -22.8 to -4.3, with the still-negative reading signaling reduced workweek length.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through June), and five Fed surveys are averaged (blue, through June) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through May (right axis).

The ISM manufacturing index for June will be released on Wednesday, July 1st. The consensus is for the ISM to increase to 49.0, up from 43.1 in May. Based on these regional surveys, the ISM manufacturing index might even be above 50 in June.

Note that these are diffusion indexes, so returning to 0 (or 50 for ISM) means activity is not declining further (it does not mean that activity is back to pre-crisis levels).

NAR: Pending Home Sales Increase 44.3% in May

by Calculated Risk on 6/29/2020 10:04:00 AM

From the NAR: Pending Home Sales Notch Record-Setting 44.3% Monthly Increase in May

Pending home sales mounted a record comeback in May, seeing encouraging contract activity after two previous months of declines brought on by the coronavirus pandemic, according to the National Association of Realtors®. Every major region recorded an increase in month-over-month pending home sales transactions, while the South also experienced a year-over-year increase in pending transactions.This was well above expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in June and July.

The Pending Home Sales Index (PHSI),* www.nar.realtor/pending-home-sales, a forward-looking indicator of home sales based on contract signings, rose 44.3% to 99.6 in May, chronicling the highest month-over-month gain in the index since NAR started this series in January 2001. Year-over-year, contract signings fell 5.1%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI grew 44.4% to 61.5 in May, although it was still down 33.2% from a year ago. In the Midwest, the index rose 37.2% to 98.8 last month, down 1.4% from May 2019.

Pending home sales in the South increased 43.3% to an index of 125.5 in May, up 1.9% from May 2019. The index in the West jumped 56.2% in May to 89.2, down 2.5% from a year ago.

emphasis added

Six High Frequency Indicators for a Recovery

by Calculated Risk on 6/29/2020 08:37:00 AM

These indicators are mostly for travel and entertainment - some of the sectors that will probably recover very slowly.

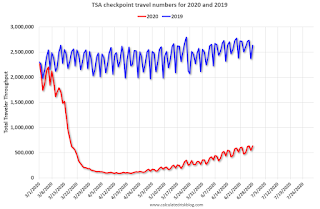

The TSA is providing daily travel numbers.

This data shows the daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

On June 28th there were 633,810 travelers compared to 2,632,030 a year ago.

That is a decline of 76%. There has been a slow steady increase from the bottom, but air travel is still down significantly.

The second graph shows the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

This data is updated through June 27, 2020.

The spike in diners was for Father's Day, June 21st. If there is an increase in cases due to Father's Day dining, they will show up in the data approximately two to weeks after the event (the second week in July).

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market".

New York is still off 82%.

Florida is only down 49% YoY (declining from a week ago, probably due to the recent surge in COVID cases).

Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales have picked up a little, but are still under $1 million per week (compared to usually around $300 million per week), and ticket sales have essentially been at zero for fourteen weeks.

Most movie theaters are closed all across the country, and will probably reopen slowly (probably with limited seating at first).

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

2020 was off to a solid start, however, COVID-19 crushed hotel occupancy.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Usually hotel occupancy starts to pick up seasonally in early June. So even though the occupancy rate was up compared to last week, the year-over-year decline only slightly improved this week compared to the previous three weeks (41.8% decline vs 43.4% last week, 45.3% two weeks ago, and 43.2% decline three weeks ago).

At one point, gasoline consumption was off almost 50% YoY.

As of June 19th, gasoline consumption was only off about 9% YoY (about 91% of normal).

The final graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the US is still only about 46% of the January level. It is at 33% in New York, and 61% in Houston.

Sunday, June 28, 2020

Monday: Pending Home Sales

by Calculated Risk on 6/28/2020 07:54:00 PM

Weekend:

• Schedule for Week of June 28, 2020

Monday:

• At 10:00 AM ET, Pending Home Sales Index for May. The consensus is for a 19.7% increase in the index.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for June. This is the last of the regional surveys for June.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down slightly and DOW futures are down 50 (fair value).

Oil prices were down over the last week with WTI futures at $37.95 per barrel and Brent at $40.41 barrel. A year ago, WTI was at $58, and Brent was at $68 - so WTI oil prices are down about 33% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.18 per gallon. A year ago prices were at $2.70 per gallon, so gasoline prices are down $0.52 per gallon year-over-year.

June 28 COVID-19 Test Results, Highest Percent Positive Since Early May

by Calculated Risk on 6/28/2020 05:26:00 PM

The US is now conducting over 500,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day.

There were 539,333 test results reported over the last 24 hours.

There were 42,161 positive tests. This is the third consecutive day with over 40,000 positive cases.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.8% (red line).

For the status of contact tracing by state, check out testandtrace.com.

June 2020: Unofficial Problem Bank list Decreased to 64 Institutions

by Calculated Risk on 6/28/2020 05:12:00 PM

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

DISCLAIMER: This is an unofficial list, the information is from public sources and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here is the unofficial problem bank list for June 2020.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for June 2020. During the month, the list dropped by one to 64 institutions after three removals and two additions. Assets increased by $3.9 billion to $52.4 billion, with all of the increase centered in updated quarterly financials that added $4.2 billion. A year ago, the list held 73 institutions with assets of $55.0 billion. Added this month was The Fowler State Bank, Fowler, KS ($81 million) and Towanda State Bank, Towanda, KS ($11 million). Removals through merger included KEB Hana Bank USA, National Association, Fort Lee, NJ ($243 million); Ben Franklin Bank of Illinois, Arlington Heights, IL ($97 million); and First Citizens Bank of Polson, National Association, Polson, MT ($17 million), which made its appearance on the first list we published way back in 2009.

This month the OCC did not release a public update on its enforcement action activity. Usually, the OCC releases an update on the first Thursday after the 15th of a month. The last update from the OCC was on May 21st. The FDIC provided first quarter results and an update on the Official Problem Bank List on June 16th. In that release, the FDIC said there were 54 institutions with assets of $44.5 billion on the official list.

With the conclusion of the second quarter, we bring an updated transition matrix to detail how banks are transitioning off the Unofficial Problem Bank List. Since we first published the Unofficial Problem Bank List on August 7, 2009 with 389 institutions, 1,765 institutions have appeared on a weekly or monthly list since then. Only 3.1 percent of the banks that have appeared on a list remain today as 1,701 institutions have transitioned through the list. Departure methods include 1,002 action terminations, 410 failures, 270 mergers, and 19 voluntary liquidations. Of the 389 institutions on the first published list, only 4 or 1.0 percent, still have a troubled designation more than ten years later. The 410 failures represent 23.2 percent of the 1,765 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

Additional Disaster Relief

by Calculated Risk on 6/28/2020 12:49:00 PM

It is time for additional disaster relief.

The key proposals will likely include:

1. Extension of Federal Pandemic Unemployment Compensation (FPUC). The current amount is $600 per week for those receiving unemployment benefits, in addition to the state benefits. This expires at the end of July. This might be reduced to $400 per week (or a percentage of state benefits). This will probably be extended through the election in November (Ideally the extension period would not be calendar based, but determined by the state unemployment rate). This is critical, or we will see a significant slump in spending in August, and a sharp increase in delinquencies (rents, mortgages, credit cards, etc).

2. State government relief: It is time for a substantial state relief package. Without relief, the states and local governments will have to start laying off a significant number of employees (Don't be fooled by state and local government hiring in the June employment report - that will be due to a seasonal adjustment quirk). State governments will have no choice - they have to run a balanced budget.

3. Recent Graduate Program: There are few job opportunities for people graduating from high school or college this year. These people should be immediately eligible for unemployment benefits (or maybe hired as contact tracers!).

4. Expand the Paycheck Protection Program (PPP): This program has kept many small businesses alive, and millions of employees employed. There will have to be additional disaster relief for these companies, or millions of people will be let go soon.

Even with all this disaster relief, there will be significant structural damage to the economy even with an effective treatment and/or vaccine at the end of the year or in early 2021. We need to start thinking about how to put people back to work in 2021 so we don't have an extended period with excessive unemployment.

Saturday, June 27, 2020

June 27 COVID-19 Test Results

by Calculated Risk on 6/27/2020 05:08:00 PM

The US is now conducting over 500,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 590,877 test results reported over the last 24 hours.

There were 43,471 positive tests. This is the second most positive tests ever.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.4% (red line).

For the status of contact tracing by state, check out testandtrace.com.

June Vehicle Sales Forecast: 29% Year-over-year Decline

by Calculated Risk on 6/27/2020 12:45:00 PM

From Edmunds.com: New Vehicle Sales Expected to Drop in June, Closing a Second Down Quarter in 2020, Edmunds Forecasts

The car shopping experts at Edmunds say that June will be another down month for auto sales as the industry continues to combat market challenges posed by the coronavirus (COVID-19) pandemic, forecasting that 1,080,656 new cars and trucks will be sold in the U.S. in June for an estimated seasonally adjusted annual rate (SAAR) of 12.8 million. This reflects a 28.7% decrease in sales from June 2019 and a 3.6% decrease from May 2020.

…

"It comes as no surprise that the second quarter was a disappointing one for the automotive industry, but the good news is that auto sales didn't come to a complete standstill either," said Jessica Caldwell, Edmunds' executive director of insights. "The fact that retail sales — not fleet — are what kept the market propped up speaks volumes to the resilience of the American consumer. And the way that dealers were quick to pivot to online sales also underscores the incredibly responsive and resourceful nature of the industry in the face of adversity."

Although Edmunds data shows a steady growth in sales since the end of March, analysts caution that some of the strains of the pandemic are starting to show as more shoppers return to the market.

"The marketplace is growing less inviting as automakers pull back on incentives and inventory dwindles due to factory shutdowns, particularly when it comes to trucks, which have been the one bright spot for sales during the pandemic," said Caldwell. "Current sales paint an optimistic picture given the circumstances, but between COVID-19 and today's politically charged climate, the industry needs to prepare for uncertainties ahead."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Edmunds forecast for June (Red).

Note that the low in April of 8.73 million SAAR was lower than the lowest sales rate during the great recession of 9.02 million SAAR in February 2009.

Sales have bounced back from the April low, but are still down sharply year-over-year.