by Calculated Risk on 6/24/2020 09:06:00 AM

Wednesday, June 24, 2020

AIA: "Architecture billings downward trajectory moderates"

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture billings downward trajectory moderates

Demand for design services in May saw few signs of rebounding following a record drop in billings the month prior, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score for May was 32.0 compared to 29.5 in April, but still represents a significant decrease in services provided by U.S. architecture firms (any number below 50 indicates a decrease in billings). In May, the decline in new project inquiries and design contract scores moderated from April, posting scores of 38.0 and 33.1 respectively.

“A large portion of the design and construction industry remains mired in steep cutbacks as many businesses and organizations are still trying to figure out what actions make sense in this uncertain economic environment,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “There are growing signs of activity beginning to pick up in some areas, but others are seeing a pause as pandemic concerns continue to grow.”

...

• Regional averages: West (36.0); South (30.6); Midwest (29.7); Northeast (25.1)

• Sector index breakdown: institutional (35.7); multi-family residential (34.8); mixed practice (28.5); commercial/industrial (24.8)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 32.0 in May, up from 29.5 in April. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This represents a significant decrease in design services, and suggests a decline in CRE investment in early 2021 (This usually leads CRE investment by 9 to 12 months).

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 6/24/2020 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 8.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 19, 2020.

... The Refinance Index decreased 12 percent from the previous week and was 76 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 4 percent compared with the previous week and was 18 percent higher than the same week one year ago.

...

“Mortgage applications decreased 9 percent last week, with both refinance and purchase activity falling despite the 30-year fixed rate mortgage staying at 3.30 percent – the record low in MBA’s survey,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Refinance applications dropped to their lowest level in three weeks, but the index remained 76 percent higher than a year ago. Despite the decline last week, MBA still anticipates refinance originations to increase to $1.35 trillion in 2020 – the highest level since 2012.”

Added Kan, “Even with high unemployment and economic uncertainty, the purchase market is strong. Activity has climbed above year-ago levels for five straight weeks and was 18 percent higher than a year ago last week. One factor that may potentially crimp growth in the months ahead is that the release of pent-up demand from earlier this spring is clashing with the tight supply of new and existing homes on the market. Additional housing inventory is needed to give buyers more options and to keep home prices from rising too fast.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) remained unchanged at 3.30 percent, with points increasing to 0.32 from 0.29 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But the index is up signficantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 18% year-over-year.

Note: Red is a four-week average (blue is weekly).

Tuesday, June 23, 2020

Wednesday: Mortgage Purchase Applications, Architecture Billings Index

by Calculated Risk on 6/23/2020 07:06:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:00 AM, FHFA House Price Index for April 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

• During the day, The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

June 23 COVID-19 Test Results, Highest Percent Positive since Mid-May

by Calculated Risk on 6/23/2020 05:52:00 PM

Note: I started posting this graph when the US was doing a few thousand tests per day. Clearly the US was way under testing early in the pandemic. I'll continue posting this graph daily at least until the percent positive is continuously under 3% and the daily positive is significantly lower than today.

The US is now conducting over 500,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 511,484 test results reported over the last 24 hours.

There were 32,984 positive tests. This is the most positive tests since May 1st.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.4% (red line).

For the status of contact tracing by state, check out testandtrace.com.

NMHC: Rent Payment Tracker Finds 92 Percent Paid Rent as of June 20th, Same Pace as in June 2019

by Calculated Risk on 6/23/2020 01:02:00 PM

From the NMHC: NMHC Rent Payment Tracker Finds 92.2 Percent of Apartment Households Paid Rent as of June 20

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 92.2 percent of apartment households made a full or partial rent payment by June 20 in its survey of 11.4 million units of professionally managed apartment units across the country.CR Note: It appears most people are still paying their rent. This was a higher percentage than in May (at the same point in the month), and unchanged from the same date a year ago.

This is unchanged from the share who paid rent through June 20, 2019 and compares to 90.8 percent that had paid by May 20, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

“With the support of expanded unemployment benefits, stimulus funds and significant efforts by apartment community owners and operators to help residents impacted by the outbreak of COVID-19 and resulting financial hardships, it seem most renters were once again able to meet their obligations,” said Doug Bibby, NMHC President. “The early steps taken by lawmakers have proven critical to keeping many safely and securely housed. As we move forward and the economy begins to recover, it will be vitally important that lawmakers continue to support the nation’s renters and forestall even greater economic harm.”

emphasis added

Several disaster relief programs have clearly helped renters pay their bills, such as the extra $600 per week in extra unemployment insurance, the PPP, and the Pandemic Unemployment Assistance (PUA). The PPP has been modified, but will need to be extended. And the $600 per week in extra benefits ends at the end of July (and will need to be extended, perhaps at a lower rate).

The PUA program with 9.3 million participants (mostly self-employed), expires at the end of 2020, but these individuals have also been receiving the extra $600 per week that expires in July.

A few Comments on May New Home Sales

by Calculated Risk on 6/23/2020 11:06:00 AM

New home sales for May were reported at 676,000 on a seasonally adjusted annual rate basis (SAAR). However sales for the previous three months were revised down.

This was above consensus expectations. New home sales are counted when the contract is signed, whereas existing home sales are counted when the transaction closes. So new home sales performed better than existing home sales in May. Based on mortgage applications and regional pending home sales reports, there will be a pickup in existing home sales in June (or July), and builder reports suggest there will probably be a further pickup in new home sales too.

No one should get too excited. I've long argued that new home sales and housing starts (especially single family starts) were some of the best leading indicators for the economy. However, I've noted that there are times when this isn't true. NOW is one of those times. The course of the economy will be determined by the course of the virus, and New Home Sales tell us nothing about the future of the pandemic.

The longer the pandemic lasts, the more long term damage to the economy - and, if the pandemic worsens and persists - that will eventually negatively impact housing. The outlook for housing depends on the outlook for the pandemic.

Earlier: New Home Sales increased to 676,000 Annual Rate in May.

This graph shows new home sales for 2019 and 2020 by month (Seasonally Adjusted Annual Rate).

New home sales were up 12.7% year-over-year (YoY) in May. Year-to-date (YTD) sales are still up 1.9%. (the comparison to May of last year was pretty easy).

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

Now the gap is mostly closed (with help from the sharp decline in existing home sales due to the pandemic).

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increased to 676,000 Annual Rate in May

by Calculated Risk on 6/23/2020 10:12:00 AM

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 676 thousand.

The previous three months were revised down.

Sales of new single-family houses in May 2020 were at a seasonally adjusted annual rate of 676,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 16.6 percent above the revised April rate of 580,000 and is 12.7 percent above the May 2019 estimate of 600,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

The second graph shows New Home Months of Supply.

The months of supply decreased in May to 5.6 months from 6.7 months in April.

The months of supply decreased in May to 5.6 months from 6.7 months in April. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of May was 318,000. This represents a supply of 5.6 months at the current sales rate. "

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is close to normal.

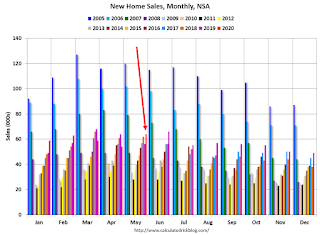

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In May 2020 (red column), 64 thousand new homes were sold (NSA). Last year, 56 thousand homes were sold in May.

The all time high for May was 120 thousand in 2005, and the all time low for May was 30 thousand in 2011.

This was above expectations of 640 thousand sales SAAR, however sales in the three previous months were revised down. I'll have more later today.

Monday, June 22, 2020

Tuesday: New Home Sales

by Calculated Risk on 6/22/2020 07:34:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Hold Ground Near Lows. Can it Continue?

Mortgage rates held their ground today, with the average lender in roughly the same shape as they were on Friday. Incidentally, that's great shape! When it comes to the best-case scenario conventional 30yr fixed quote, rates are still very close to the all-time lows seen two weeks ago. [30YR FIXED - 3.00%]Tuesday:

emphasis added

• At 10:00 AM, New Home Sales for May from the Census Bureau. The consensus is for 640 thousand SAAR, up from 623 thousand in April. Note that new home sales are reported when a contract is signed, so we should see a rebound in sales in May (unlike existing home sales).

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for June.

June 22 COVID-19 Test Results, Highest Percent Positive since Late May

by Calculated Risk on 6/22/2020 05:35:00 PM

Note: I started posting this graph when the US was doing a few thousand tests per day. Clearly the US was way under testing early in the pandemic. I'll continue posting this graph daily at least until the percent positive is continuously under 3% and the daily positive is significantly lower than today.

The US is now conducting over 500,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 474,592 test results reported over the last 24 hours.

There were 27,928 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.9% (red line).

For the status of contact tracing by state, check out testandtrace.com.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases for First Time in Series to 8.48%" of Portfolio Volume

by Calculated Risk on 6/22/2020 04:00:00 PM

Note: To put these numbers in perspective, the MBA notes "For the week of March 2, only 0.25% of all loans were in forbearance."

From the MBA: Share of Mortgage Loans in Forbearance Decreases for First Time in Series to 8.48%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased – for the first time since the survey’s inception in March – from 8.55% of servicers’ portfolio volume in the prior week to 8.48% as of June 14, 2020. According to MBA’s estimate, 4.2 million homeowners are now in forbearance plans – down from almost 4.3 million homeowners the prior week.

...

“The lower share of loans in forbearance was led by declines in GSE and portfolio and PLS loans, as more of those borrowers exited than entered a new forbearance plan,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Fewer homeowners in forbearance underscores the continued improvements in the job market, and provides another sign of the fundamental health of the housing market, which has rebounded considerably over the past several weeks.”

Added Fratantoni, “The big unknown with respect to this positive development is the extent to which it relies upon policy measures put in place to help families through this crisis, particularly the stimulus payments and enhanced unemployment insurance benefits that were key parts of the CARES Act. We expect to see further improvements in the weeks ahead given the drop in forbearance requests this week.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April.

The MBA notes: "Forbearance requests as a percent of servicing portfolio volume (#) increased across all investor types for the first time since the week of March 30-April 5: from 0.17% to 0.19%."