by Calculated Risk on 6/19/2020 10:09:00 AM

Friday, June 19, 2020

BLS: May Unemployment rates down in 38 states; 4 States at New Record Highs

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in May in 38 states and the District of Columbia, higher in 3 states, and stable in 9 states, the U.S. Bureau of Labor Statistics reported today. All 50 states and the District had jobless rate increases from a year earlier. The national unemployment rate declined by 1.4 percentage points over the month to 13.3 percent but was 9.7 points higher than in May 2019.

...

Nevada had the highest unemployment rate in May, 25.3 percent, followed by Hawaii, 22.6 percent, and Michigan, 21.2 percent. The rates in Delaware (15.8 percent), Florida (14.5 percent), Massachusetts (16.3 percent), and Minnesota (9.9 percent) set new series highs. (All state series begin in 1976.) Nebraska had the lowest unemployment rate, 5.2 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

Currently 33 states are above 10% unemployment rate (down from 46 states last month).

Ten states are above 15% (down from 20 states last month).

Three states are above 20% (Hawaii, Michigan, and Nevada).

One state (Nevada) is above 25% unemployment.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Declines Slightly for the third consecutive week

by Calculated Risk on 6/19/2020 08:21:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

From Black Knight:

The number of homeowners in active forbearance fell again this week. Overall, the number of active forbearance plans is down 57K from last week, and 158K from the peak the week of May 22.

Click on graph for larger image.

As of June 16, 4.6 million homeowners remain in forbearance plans, representing 8.7% of all active mortgages, down from 8.8% last week. Together, they represent just over $1 trillion in unpaid principal ($1,012B). Some 6.8% of all GSE-backed loans and 12.1% of all FHA/VA loans are currently in forbearance plans.

emphasis added

Thursday, June 18, 2020

June 18 COVID-19 Test Results; Most Positive Results Since Early May

by Calculated Risk on 6/18/2020 06:22:00 PM

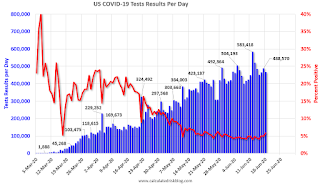

Note: I started posting this graph when the US was doing a few thousand tests per day. Clearly the US was way under testing early in the pandemic. I'll continue posting this graph daily at least until the percent positive is continuously under 3% and the daily positive is significantly lower than today.

The US is now conducting over 400,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 465,621 test results reported over the last 24 hours. There were 26,956 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.8% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Lawler: Early Read on Existing Home Sales in May

by Calculated Risk on 6/18/2020 02:44:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 3.8 million in May, down 12.2% from April’s preliminary pace and down 28.7% from last May’s seasonally adjusted pace. Unadjusted sales should show a larger YOY decline, reflecting this May’s fewer business days relative to last May’s.

On the inventory front, local realtor/MLS data, as well as data from other inventory trackers, suggest that the inventory of existing homes for sale at the end of May will be down about 20% from a year earlier.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up by about 2.6% from last May. This YOY increase reflects a sharp decline from recent months, though it is unclear from the available data whether this reflects weakening home values or a material shift in the mix of hones sold.

Here are a few other observations. First, while not all realtor reports break out sales by type of property (e.g., single-family detached vs. condo/townhomes), almost all that do reported larger YOY decline in condo/townhome sales than in single-family detached sales.

Second, while not all realtor reports include data on new pending sales – and some that do often revise those data significantly – almost all those that do report new pending sales showed either a significantly lower YOY drop in pending sales compared to closed sales or, in quite a few markets, a YOY INCREASE in pending sales last month.

While I do not have enough regional data to produce an accurate estimate of national pending sales in May, I am almost certain that the NAR’s May pending home sales index will show a VERY LARGE monthly increase from April’s PHSI.

CR Note: The National Association of Realtors (NAR) is scheduled to release May existing home sales on Monday, June 22, 2020 at 10:00 AM ET. The consensus is for 4.38 million SAAR.

Hotels: Occupancy Rate Declined 43.4% Year-over-year

by Calculated Risk on 6/18/2020 12:44:00 PM

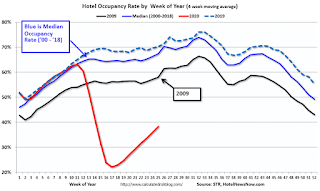

From HotelNewsNow.com: STR: US hotel results for week ending 13 June

U.S. hotel performance data ending with 13 June showed another small rise from previous weeks and less severe year-over-year declines, according to STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

7-13 June 2020 (percentage change from comparable week in 2019):

• Occupancy: 41.7% (-43.4%)

• Average daily rate (ADR): US$89.09 (-33.9%)

• Revenue per available room (RevPAR): US$37.15 (-62.6%)

“Powered by the slow and steady rise in weekly demand, the industry clawed its way above 40% occupancy,” said Alison Hoyt, STR’s senior director, consulting & analytics. “That was still down substantially from the comparable week last year (73.6%) but an obvious improvement from the country’s low point in mid-April. As we have noted, the drive-to destinations with access to beaches, mountains and parks continue to lead the early leisure recovery. With more consistent demand, we’re beginning to see more pricing confidence in those areas as well.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Usually hotel occupancy starts to pick up seasonally in early June. So even though the occupancy rate was up slightly compared to last week, the year-over-year decline was about the same this week as the previous two weeks (43.4% decline vs. 45.3% last week, and 43.2% decline two weeks ago).

Note: Y-axis doesn't start at zero to better show the seasonal change.

Comments on Weekly Unemployment Claims

by Calculated Risk on 6/18/2020 12:31:00 PM

The weekly claims report released this morning was for the June BLS employment report reference week (include the 12th of the month). So it is worth taking a further look at the report.

This morning: Weekly Initial Unemployment Claims decrease to 1,508,000

First, regular initial claims were above expectations, and the previous week was revised up.

Second, including Pandemic Unemployment Assistance (PUA), total initial claims increased from the previous week.

Third, several states have not released PUA claims yet. This includes Florida, Georgia, Oregon and others - so the number of PUA claims is too low. However, there may also be processing delays that are impacting the numbers.

Fourth, continued claims only decreased slightly to 20,544,000 (SA) from 20,606,000 (SA) the previous week. However, continued claims are down over 4 million from a month ago, so a large number of people have probably returned to their jobs (Some of these were included in the employment report for May).

The following graph shows regular initial unemployment claims (blue) and PUA claims (red) since early February.

This is the 13th consecutive week with extraordinarily high initial claims.

It is possible that we are starting to see some layoffs associated with the end of some early Payroll Protection Plan (PPP) participants.

It is too soon to see layoffs associated with the rising COVID cases and hospitalization in some states (like Arizona and Texas). Note that these states don't have to lockdown to see a decline in economic activity. As Merrill Lynch economists noted last month: "Most of the slowdown occurred due to voluntary social distancing rather than lockdown policies."

Overall this was a disappointing initial claims report, but it is difficult to tell from this report what is happening to overall employment.

Philly Fed Manufacturing firms reported "signs of improvement" in June

by Calculated Risk on 6/18/2020 09:32:00 AM

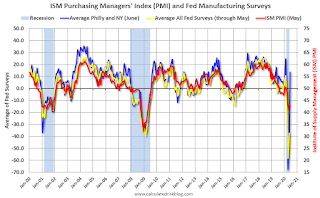

Note: Be careful with diffusion indexes. This shows a rebound off the bottom - some improvement from May to June - but doesn't show the level of activity.

From the Philly Fed: June 2020 Manufacturing Business Outlook Survey

Manufacturing conditions in the region showed signs of improvement this month, according to firms responding to the June Manufacturing Business Outlook Survey. The survey’s current indicators for general activity, new orders, and shipments returned to positive territory, coinciding with the gradual reopening of the economy in our region and the nation more broadly. The employment index remained negative but increased for the second consecutive month. All future indicators improved, suggesting that the firms expect overall growth over the next six months.This was well above to the consensus forecast. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The diffusion index for current general activity increased from -43.1 in May to 27.5 this month, its first positive reading since February (see Chart 1). Forty-six percent of the firms reported increases this month (up from 15 percent last month), while 19 percent reported decreases (down from 58 percent). … The firms continued to report decreases in employment on balance; however, the employment index increased 11 points.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through June), and five Fed surveys are averaged (blue, through May) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through May (right axis).

These early reports suggest the ISM manufacturing index will show a rebound in June.

Weekly Initial Unemployment Claims decrease to 1,508,000

by Calculated Risk on 6/18/2020 08:39:00 AM

The DOL reported:

In the week ending June 13, the advance figure for seasonally adjusted initial claims was 1,508,000, a decrease of 58,000 from the previous week's revised level. The previous week's level was revised up by 24,000 from 1,542,000 to 1,566,000. The 4-week moving average was 1,773,500, a decrease of 234,500 from the previous week's revised average. The previous week's average was revised up by 6,000 from 2,002,000 to 2,008,000.The previous week was revised up.

emphasis added

This does not include the 760,526 initial claims for Pandemic Unemployment Assistance (PUA) - this was an increase from the previous week.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 1,773,500.

This was higher than the consensus forecast of 1.4 million initial claims and the previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims decreased slightly to 20,544,000 (SA) from 20,606,000 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 9,280,644 receiving Pandemic Unemployment Assistance (PUA). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

Wednesday, June 17, 2020

Thursday: Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 6/17/2020 08:33:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a 1.450 million initial claims, down from 1.542 million the previous week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for June. The consensus is for a reading of -25.0, up from -43.1.

June 17 COVID-19 Test Results

by Calculated Risk on 6/17/2020 06:07:00 PM

Note: I started posting this graph when the US was doing a few thousand tests per day. Clearly the US was way under testing early in the pandemic. I'll continue posting this graph daily at least until the percent positive is continuously under 3% and the daily positive is significantly lower than today.

The US is now conducting over 400,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 488,570 test results reported over the last 24 hours. There were 23,498 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 4.9% (red line).

For the status of contact tracing by state, check out testandtrace.com.