by Calculated Risk on 6/03/2020 01:48:00 PM

Wednesday, June 03, 2020

BEA: May Vehicles Sales increased to 12.2 Million SAAR

The BEA released their estimate of May vehicle sales this morning. The BEA estimated light vehicle sales of 12.21 million SAAR in May 2020 (Seasonally Adjusted Annual Rate), up 40.0% from the revised April sales rate, and down 29.8% from May 2019.

Sales in April were revised up from 8.58 million SAAR to 8.73 million SAAR.

This graph shows light vehicle sales since 2006 from the BEA (blue) and an estimate for May 2020 (red).

The impact of COVID-19 is significant, and it appears April was the worst month.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Sales collapsed in the second half of March, and really declined in April. However sales rebounded somewhat in May (but were still down almost 30% YoY).

DOT: Vehicle Miles Driven decreased 18.6% year-over-year in March

by Calculated Risk on 6/03/2020 01:31:00 PM

This will be interesting to track. The most recent release is for March 2020.

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by -18.6% (-50.6 billion vehicle miles) for March 2020 as compared with March 2019. Travel for the month is estimated to be 221.0 billion vehicle miles.

The seasonally adjusted vehicle miles traveled for March 2020 is 221.1 billion miles, a -18.5% (-50.3 billion vehicle miles) decline from March 2019. It also represents -19.3% decline (-52.9 billion vehicle miles) compared with February 2020.

Cumulative Travel for 2020 changed by -5.4% (-40.1 billion vehicle miles). The cumulative estimate for the year is 706.5 billion vehicle miles of travel.

Click on graph for larger image.

Click on graph for larger image.This graph shows the rolling 12 month total vehicle miles driven to remove the seasonal factors.

Miles driven declined during the great recession, and the rolling 12 months stayed below the previous peak for a record 85 months.

Miles driven declined sharply in March, and will really collapse in April. This will be an interesting measure to watch when the economy eventually starts to recover.

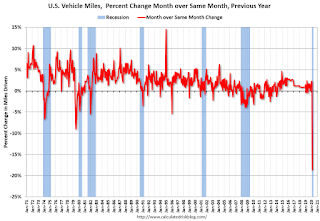

This graph shows the YoY change in vehicle miles driven.

This graph shows the YoY change in vehicle miles driven.Miles driven were down 18.6% year-over-year in March.

ISM Non-Manufacturing Index increased to 45.4% in May

by Calculated Risk on 6/03/2020 10:07:00 AM

The May ISM Non-manufacturing index was at 45.4%, up from 41.8% in April. The employment index increased to 31.8%, from 30.0%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: May 2020 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector contracted in May for the second consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.The headline index understated the weakness in the survey. The Supplier Deliveries index once again boosted the composite NMI, but the employment index was near last month's record low.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: “The NMI® registered 45.4 percent, 3.6 percentage points higher than the April reading of 41.8 percent. This reading represents contraction in the non-manufacturing sector for the second consecutive month, following a 122-month period of expansion. The Business Activity Index increased 15 percentage points from April’s figure, registering 41 percent. The New Orders Index registered 41.9 percent; 9 percentage points higher than the reading of 32.9 percent in April. The Employment Index increased to 31.8 percent; 1.8 percentage points higher than the April reading of 30 percent.

“The Supplier Deliveries Index registered at 67 percent, down 11.3 percentage points from April’s all-time-high reading of 78.3 percent, which elevated the composite NMI®. The Supplier Deliveries Index is one of four equally weighted subindexes that directly factor into the NMI®, along with Business Activity, New Orders and Employment. Supplier Deliveries is the only ISM® Report On Business® index that is inversed; a reading of above 50 percent indicates slower deliveries, which is typical as the economy improves and customer demand increases. The higher readings for supplier deliveries the past three months are primarily a product of supply problems related to the coronavirus (COVID-19) pandemic.

emphasis added

ADP: Private Employment decreased 2,760,000 in May

by Calculated Risk on 6/03/2020 08:20:00 AM

Private sector employment decreased by 2,760,000 jobs from April to May according to the May ADP National Employment Report®. The report utilizes data through the 12th of the month. The NER uses the same time period the Bureau of Labor and Statistics uses for their survey. As such, the May NER does not reflect the full impact of COVID-19 on the overall employment situation.This was well above the consensus forecast for 9,000,000 private sector jobs lost in the ADP report.

Broadly distributed to the public each month, free of charge, the ADP National Employment Report is produced by the ADP Research Institute® in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.

...

“The impact of the COVID-19 crisis continues to weigh on businesses of all sizes,” said Ahu Yildirmaz, cohead of the ADP Research Institute. “While the labor market is still reeling from the effects of the pandemic, job loss likely peaked in April, as many states have begun a phased reopening of businesses.”

The BLS report will be released Friday, and the consensus is for 8,250,000 non-farm payroll jobs lost in May.

MBA: Mortgage Applications Decreased, Purchase Applications up 18% Year over Year

by Calculated Risk on 6/03/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications decreased 3.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 29, 2020. This week’s results included an adjustment for the Memorial Day holiday.

... The Refinance Index decreased 9 percent from the previous week and was 137 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 5 percent from one week earlier. The unadjusted Purchase Index decreased 7 percent compared with the previous week and was 18 percent higher than the same week one year ago.

...

“Purchase applications continued their recent ascent, increasing 5 percent last week and 18 percent compared to a year ago. The pent-up demand from homebuyers returning to the market continues to support a recovery from the weekly declines observed earlier this spring,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “However, there are still many households affected by the widespread job loss and current economic downturn. High unemployment and low housing supply may restrain a more meaningful rebound in purchase applications in the coming months.”

Added Kan, “In contrast to the upswing in purchase activity, refinance applications fell for the seventh consecutive week – even as the 30-year fixed rate hit another MBA survey-low of 3.37 percent. After reaching a peak of 76 percent earlier this year, refinances now account for less than 60 percent of activity, and the index is now at its lowest level since February 21.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.37 percent from 3.42 percent, with points decreasing to 0.30 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But the index is way up from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 18% year-over-year.

Note: Red is a four-week average (blue is weekly).

Tuesday, June 02, 2020

Wednesday: ADP Employment, ISM non-Mfg

by Calculated Risk on 6/02/2020 08:21:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 9,000,000 payroll jobs lost in May, up from 20,236,000 lost in April.

• At 10:00 AM, the ISM non-Manufacturing Index for May. The consensus is for a reading of 44.0, up from 41.8.

June 2 COVID-19 Test Results

by Calculated Risk on 6/02/2020 05:04:00 PM

The US is now conducting around 400,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US might need to double the number of tests per day again.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 400,963 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.4% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Energy expenditures as a percentage of PCE at All Time Low

by Calculated Risk on 6/02/2020 03:40:00 PM

Note: Back in early 2016, I noted that energy expenditures as a percentage of PCE had hit an all time low. Here is an update through the recently released April PCE report.

Below is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through April 2020.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

In April 2020, energy expenditures as a percentage of PCE was at a record low of 3.54% of PCE. This was below the previous low of 3.66% in February 2016.

This new record happened even with a 13.6% annual rate decrease in overall PCE in April (energy expenditures declined more in April than overall PCE).

Update: Real Estate Agent Boom and Bust

by Calculated Risk on 6/02/2020 01:15:00 PM

Way back in 2005, I posted a graph of the Real Estate Agent Boom. Here is another update to the graph.

The graph shows the number of real estate licensees in California.

The number of agents peaked at the end of 2007 (housing activity peaked in 2005, and prices in 2006).

The number of salesperson's licenses is off 26% from the peak, and is increasing again (up 11% from low). The number of salesperson's licenses has increased to December 2004 levels.

Brokers' licenses are off 14.7% from the peak and have fallen to November 2005 levels, and are still slowly declining.

Click on graph for larger image.

We are seeing a pickup in Real Estate licensees in California, although the number of Brokers is still slowly declining.

COVID-19 could lead to more people studying to get their license - and also more people quitting. It is unclear.

Next Tuesday: June 2020 Market & Economic Update

by Calculated Risk on 6/02/2020 11:38:00 AM

On June 9th, at 11:15 AM Pacific Time, UCI Finance Professor Christopher Schwarz and I will be discussing the June 2020 economic outlook.

This is a free event, and you can register at Registration Link for June 2020 Market & Economic Update. The presentation will be about 30 minutes, followed by a Q&A period.

Click on banner for a larger image.

Click on banner for a larger image.