by Calculated Risk on 5/27/2020 02:04:00 PM

Wednesday, May 27, 2020

Fed's Beige Book: "Economic activity declined in all Districts – falling sharply in most"

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Kansas City based on information collected on or before May 18, 2020."

Economic activity declined in all Districts – falling sharply in most – reflecting disruptions associated with the COVID-19 pandemic. Consumer spending fell further as mandated closures of retail establishments remained largely in place during most of the survey period. Declines were especially severe in the leisure and hospitality sector, with very little activity at travel and tourism businesses. Auto sales were substantially lower than a year ago, although several Districts noted recent improvement. A majority of Districts reported sharp drops in manufacturing activity, and production was notably weak in auto, aerospace, and energy-related plants. Residential home sales plunged due in part to fewer new listings and to restrictions on home showings in many areas. Construction activity also fell as new projects failed to materialize in many Districts. Commercial real estate contacts mentioned that a large number of retail tenants had deferred or missed rent payments. Bankers reported strong demand for PPP loans. Agricultural conditions worsened, with several Districts reporting reduced production capacity at meat-processing plants due to closures and social distancing measures. Energy activity plummeted as firms announced oil well closures, which led to historically low levels of active drilling rigs. Although many contacts expressed hope that overall activity would pick-up as businesses reopened, the outlook remained highly uncertain and most contacts were pessimistic about the potential pace of recovery.CR Note: This information was on or before May 18th, and it appears activity has picked up recently.

...

Employment continued to decrease in all Districts, including steep losses in most Districts, as social distancing and business closures affected employment at many firms. Securing PPP loans helped many businesses to limit or avoid layoffs, although employment continued to fall sharply in retail and in leisure and hospitality sectors.

emphasis added

Philly Fed: State Coincident Indexes Decreased in All States in April

by Calculated Risk on 5/27/2020 11:30:00 AM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for April 2020. Over the past three months, the indexes decreased in all 50 states, for a three-month diffusion index of -100. Additionally, in the past month, the indexes decreased in all 50 states, for a one-month diffusion index of -100. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index fell 13.7 percent over the past three months and 12.0 percent in April.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the great recession, and all or mostly green during most of the recent expansion.

The map is all red on a three month basis.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In all, zero states had increasing activity including states with minor increases.

In March, only 9 states had increasing activity.

A number of states had declining activity in January and February - prior to the COVID crisis.

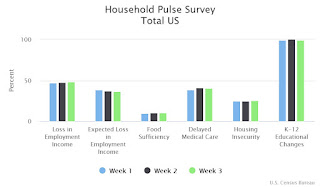

Census: Household Pulse Survey shows 48.5% of Households lost Income

by Calculated Risk on 5/27/2020 11:11:00 AM

Note: The question on lost income is always since March 13, 2020 - so this percentage will not decline.

From the Census Bureau: Measuring Household Experiences during the Coronavirus (COVID-19) Pandemic

The U.S. Census Bureau, in collaboration with five federal agencies, is in a unique position to produce data on the social and economic effects of COVID-19 on American households. The Household Pulse Survey is designed to deploy quickly and efficiently, collecting data to measure household experiences during the Coronavirus (COVID-19) pandemic. Data will be disseminated in near real-time to inform federal and state response and recovery planning.This will be updated weekly, and the Census Bureau released the third week of survey results today. This survey asks about Loss in Employment Income, Expected Loss in Employment Income, Food Scarcity, Delayed Medical Care, Housing Insecurity and K-12 Educational Changes.

…

Data collection for the Household Pulse Survey began on April 23, 2020. The Census Bureau will collect data for 90 days, and release data on a weekly basis. (For the first release, the Census Bureau anticipates it will take two weeks after the first week of data collection to prepare and weight the data; subsequent releases will then be made on a weekly basis.)

Click on graph for larger image.

Click on graph for larger image.This survey will be useful in tracking the "opening" of the economy.

The data was collected between May 14 and May 19, 2020.

48.5% of households report loss in employment income since March 13th.

The data will be updated weekly for 90 days.

Richmond Fed: "Fifth District manufacturing remained soft in May"

by Calculated Risk on 5/27/2020 10:06:00 AM

From the Richmond Fed: Fifth District manufacturing remained soft in May

Fifth District manufacturing remained soft in May, according to the most recent survey from the Richmond Fed. The composite index rose from a record low of −53 in April to −27 in May, remaining at its lowest level since 2009. All three components — shipments, new orders and employment — were above their April readings but still in contractionary territory. The index for local business conditions was also negative, but contacts expected conditions to improve in the next six months.The last of the regional Fed surveys for May will be released tomorrow (Kansas City Fed).

Many survey participants reported decreases in employment and the average workweek in May. However, the indexes for wages and the availability of workers with the necessary skills were both close to 0.

emphasis added

MBA: Mortgage Applications Increased, Purchase Applications up 9% Year over Year

by Calculated Risk on 5/27/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 22, 2020.

... The Refinance Index decreased 0.2 percent from the previous week and was 176 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 9 percent from one week earlier. The unadjusted Purchase Index increased 7 percent compared with the previous week and was 9 percent higher than the same week one year ago.

...

“The home purchase market continued its path to recovery as various states reopen, leading to more buyers resuming their home search. Purchase applications increased 9 percent last week – the sixth consecutive weekly increase and a jump of 54 percent since early April. Additionally, the purchase loan amount has increased steadily in recent weeks and is now at its highest level since mid-March,” said Joel Kan MBA’s Associate Vice President of Economic and Industry Forecasting. “Despite mortgage rates hovering near MBA’s all-time survey low, refinance activity was essentially flat but still 176 percent higher than last year. Conventional refinance applications increased 2 percent, while government refinancing was down almost 7 percent.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased to 3.42 percent from 3.41 percent, with points remaining unchanged at 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But the index is way up from last year (over triple last year).

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 9% year-over-year.

Note: Red is a four-week average (blue is weekly).

Tuesday, May 26, 2020

Wednesday: Beige Book, Richmond Fed Mfg

by Calculated Risk on 5/26/2020 08:38:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for May.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

May 26 COVID-19 Test Results

by Calculated Risk on 5/26/2020 06:18:00 PM

In late April, Dr. Fauci said the US might be able to test 400,000 to 600,000 people per day sometime in May, and testing is now close to that range. This might be enough to allow test-and-trace in some areas. However, the US might need more than 900,000 tests per day according to Dr. Jha of Harvard's Global Health Institute.

There were 302,099 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.4% (red line). The US probably needs enough tests to keep the percentage positive well below 5%. (probably much lower based on testing in New Zealand).

MBA Survey: "Share of Mortgage Loans in Forbearance Increases to 8.36%" of Portfolio Volume

by Calculated Risk on 5/26/2020 04:00:00 PM

Note: To put these numbers in perspective, the MBA notes "For the week of March 2, only 0.25% of all loans were in forbearance."

From the MBA: Share of Mortgage Loans in Forbearance Increases to 8.36%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance increased from 8.16% of servicers’ portfolio volume in the prior week to 8.36% as of May 17, 2020. According to MBA’s estimate, 4.2 million homeowners are now in forbearance plans.

...

“Although job losses continue at extremely high rates, mortgage servicers are reporting only modest increases in the share of loans in forbearance as of May 17,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “The decline in employment and income is hitting FHA and VA borrowers harder, leading to 11.6 percent of Ginnie Mae loans currently in forbearance.”

Added Fratantoni, “Forbearance requests declined relative to the prior week, and while call volume picked up, servicers appear well staffed for this volume, as wait times and abandonment rates dropped.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly forbearance requests as a percent of servicer's portfolio volume.

The requests peaked in the week of March 30th to April 5th.

The MBA notes: "Forbearance requests as a percent of servicing portfolio volume (#) dropped across all investor types for the sixth consecutive week relative to the prior week: from 0.32% to 0.28%."

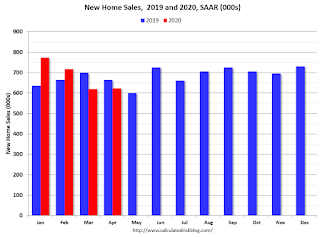

A few Comments on April New Home Sales

by Calculated Risk on 5/26/2020 01:54:00 PM

New home sales for April were reported at 623,000 on a seasonally adjusted annual rate basis (SAAR). Sales for the previous three months were revised down.

This was well above consensus expectations. I've long argued that new home sales and housing starts (especially single family starts) were some of the best leading indicators for the economy. However, I've noted that there are times when this isn't true. NOW is one of those times. The course of the economy will be determined by the course of the virus, and New Home Sales tell us nothing about the future of the pandemic.

Earlier: New Home Sales at 623,000 Annual Rate in April.

This graph shows new home sales for 2019 and 2020 by month (Seasonally Adjusted Annual Rate).

New home sales were down 6.2% year-over-year (YoY) in April. Year-to-date (YTD) sales are still up 1.4%, but sales will be down YTD soon (although the comparison to May of last year is pretty easy).

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

Now the gap is mostly closed. However, this assumes that the builders will offer some smaller, less expensive homes.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Dallas Fed: "Contraction Continues in Texas Manufacturing Sector"

by Calculated Risk on 5/26/2020 10:40:00 AM

From the Dallas Fed: Contraction Continues in Texas Manufacturing Sector, Though Severity Eases

Texas factory activity declined again in May, though at a slower pace than in April, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, remained negative but improved from -55.6 to -28.0, suggesting the contraction in output has eased somewhat since last month.The last of the regional Fed surveys for May will be released later this week (Richmond and Kansas City Fed)

Other measures of manufacturing activity pointed to a less-severe decline in May. The new orders index advanced 38 points to -30.6, its highest reading in three months, with more than 20 percent of manufacturers noting an increase in orders. Similarly, the growth rate of orders index pushed up more than 30 points to -30.8. The capacity utilization and shipments indexes also remained negative at -26.0 and -25.7, respectively, but were up from March and April.

Perceptions of broader business conditions remained negative but were somewhat less pessimistic in May. The general business activity index moved up from -74.0 to -49.2. Similarly, the company outlook index moved up nearly 30 points to -34.6, though only 12 percent of manufacturers noted improved outlooks. The index measuring uncertainty regarding companies’ outlooks retreated notably to 28.3, though the positive reading still indicates increased uncertainty.

Labor market measures indicated further employment declines and shorter workweeks this month. The employment index remained negative but rose from -22.0 to -11.5. Eight percent of firms noted net hiring, while 19 percent noted net layoffs. The hours worked index rose 18 points to -22.8, with the still-negative reading signaling reduced workweek length.

emphasis added