by Calculated Risk on 5/25/2020 10:03:00 AM

Monday, May 25, 2020

Six High Frequency Indicators for the Eventual Recovery

These indicators are mostly for travel and entertainment - some of the sectors that will probably recover very slowly.

The TSA is providing daily travel numbers.

This data shows the daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

On May 24th there were 267,451 travelers compared to 2,070,716 a year ago.

That is a decline of 87.1%. There has been some increase off the bottom, but it is pretty small compared to the normal level of travel.

The second graph shows the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

This data is updated through May 23, 2020.

The US was off 100% YoY as of March 21st.

California and New York are still off 100%.

Some states - like Texas and Georgia - have started to open up. In Texas, diner traffic was only down 63% YoY.

Note that the data is noisy and depends on when blockbusters are released.

Movie ticket sales have been essentially at zero for nine weeks.

Basically movie theaters are closed all across the country, and will probably reopen slowly (probably with limited seating at first).

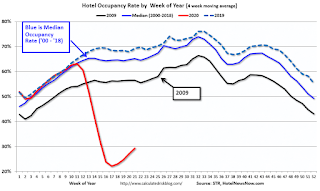

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

2020 was off to a solid start, however, COVID-19 has crushed hotel occupancy.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

STR reported hotel occupancy was off 54.1% year-over-year last week. Occupancy has increased slightly over the last few of weeks.

At one point, gasoline consumption was off almost 50% YoY.

As of May 15th, gasoline consumption was off about 20% YoY (about 72% of normal).

The final graph is from Apple mobility.

According to the Apple data, driving is back to normal, walking is close to normal, but public transit is still off 64% from the pre-crisis level.

Sunday, May 24, 2020

May 24 COVID-19 Test Results

by Calculated Risk on 5/24/2020 05:30:00 PM

In late April, Dr. Fauci said the US might be able to test 400,000 to 600,000 people per day sometime in May, and testing is now close to that range. This might be enough to allow test-and-trace in some areas. However, the US might need more than 900,000 tests per day according to Dr. Jha of Harvard's Global Health Institute.

There were 379,129 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.5% (red line). The US probably needs enough tests to keep the percentage positive well below 5%. (probably much lower based on testing in New Zealand).

Economic Outlook: Not Sanguine

by Calculated Risk on 5/24/2020 11:08:00 AM

On March 31st, I wrote:

This is a healthcare crisis, and the economic outlook is based on presumptions about the course of the pandemic.Unfortunately the course of the pandemic has been worse than I expected. Although social distancing clearly worked in slowing the growth rate of infections, many people have recently relaxed their guard - and COVID-19 cases, hospitalizations and deaths are still rising in many parts of the country.

Stories like this are concerning: Arkansas governor says several people who attended pool party infected with COVID-19

Several people who attended a swim party in Arkansas have contracted coronavirus, Gov. Asa Hutchinson (R) confirmed Saturday.It is possible to open the economy without an increase in infections. For example, in Japan, the economy is mostly open, however 1) everyone wears a mask, 2) there is robust contact tracing, and 3) everyone is urged to follow the 3 C's (avoid Closed spaces, Crowded places, and Close-Contact settings) (Cool graphic!).

"There were positive cases coming out of a high school swim party. A high school swim party that I'm sure everybody thought was harmless. They're young, they're swimming, they're just having activity and positive cases resulted from that," the governor told reporters Saturday.

However, in the US, contact tracing is still ramping up, many people aren't wearing a mask or face covering, and - based on many stories like above - people are not following the 3Cs.

Since the course of the economy will be determined by the course of the virus, I'm not currently sanguine about the economic outlook.

Saturday, May 23, 2020

May 23 COVID-19 Test Results

by Calculated Risk on 5/23/2020 05:54:00 PM

Note: I live in Orange County, CA, and the COVID-19 news has been disappointing. The number of daily deaths has increased recently (12 today), and the number of hospitalizations has been rising steadily. Also the percentage of tests that were positive today was 21% (216 out of 1,033). This is a very high positive rate and indicates testing in the OC is not adequate. The overall number of cases and deaths in the OC is not exceedingly high compared to some areas, but the trend is not favorable.

In late April, Dr. Fauci said the US might be able to test 400,000 to 600,000 people per day sometime in May, and testing is now close to that range. This might be enough to allow test-and-trace in some areas. However, the US might need more than 900,000 tests per day according to Dr. Jha of Harvard's Global Health Institute.

There were 344,384 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.2% (red line). The US probably needs enough tests to keep the percentage positive well below 5%. (probably much lower based on testing in New Zealand).

NOTE: There was something wrong with the Texas numbers today, so this doesn't include Texas tests today.

Schedule for Week of May 24, 2020

by Calculated Risk on 5/23/2020 08:11:00 AM

The key reports this week are the second estimate of Q1 GDP, April New Home Sales, March Case-Shiller house prices, and Personal Income and Outlays for April.

For manufacturing, the May Dallas, Richmond and Kansas City Fed manufacturing surveys will be released.

On Friday, Fed Chair Jerome Powell will participate in a discussion.

All US markets will be closed in observance of Memorial Day.

8:30 AM ET: Chicago Fed National Activity Index for April. This is a composite index of other data.

9:00 AM: S&P/Case-Shiller House Price Index for March.

9:00 AM: S&P/Case-Shiller House Price Index for March.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 3.3% year-over-year increase in the Comp 20 index for March.

9:00 AM: FHFA House Price Index for March 2020. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: New Home Sales for April from the Census Bureau.

10:00 AM: New Home Sales for April from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 490 thousand SAAR, down from 627 thousand in March.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for May.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for a 2.100 million initial claims, down from 2.438 million the previous week.

8:30 AM: Gross Domestic Product, 1st quarter 2020 (Second estimate). The consensus is that real GDP decreased 4.8% annualized in Q1, unchanged from the advance estimate of -4.8%.

8:30 AM: Durable Goods Orders for April from the Census Bureau. The consensus is for a 18.5% decrease in durable goods orders.

10:00 AM: Pending Home Sales Index for April. The consensus is for a 15% decrease in the index.

11:00 AM: the Kansas City Fed manufacturing survey for May. This is the last of regional manufacturing surveys for May.

8:30 AM ET: Personal Income and Outlays, April 2020. The consensus is for a 6.5% decrease in personal income, and for a 12.5% decrease in personal spending. And for the Core PCE price index to decrease 0.3%.

9:45 AM: Chicago Purchasing Managers Index for May.

10:00 AM: University of Michigan's Consumer sentiment index (Final for May). The consensus is for a reading of 73.7.

11:00 AM: Discussion, Fed Chair Jerome Powell, At Griswold Center for Economic Policy Studies Princeton Reunions Talk: A Conversation with Jerome Powell, moderated by Alan Blinder (via webcast)

Friday, May 22, 2020

May 22 COVID-19 Test Results

by Calculated Risk on 5/22/2020 05:42:00 PM

In addition to having enough tests for test-and-trace, we also need people to conduct contact tracing. There is a great new website that tracks the progress of each towards test-and-trace. The website also has resources on how to implement test-and-trace. This includes software, training resources, a calculator for how many people to hire and more. Every state should review this site!

Check it out.

In late April, Dr. Fauci said the US might be able to test 400,000 to 600,000 people per day sometime in May, and testing is now close to that range. This might be enough to allow test-and-trace in some areas. However, the US might need more than 900,000 tests per day according to Dr. Jha of Harvard's Global Health Institute.

There were 343,802 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.0% (red line). The US probably needs enough tests to keep the percentage positive well below 5%. (probably much lower based on testing in New Zealand).

NOTE: A few states - reportedly Virginia, Texas, Georgia, and Vermont - have apparently been including antibody tests with virus tests. The COVID tracking project is working to straighten that out. I think the COVID tracking project was able to back out some these antibody tests!

Seasonal Adjustment Weirdness: Will State and Local Governments Hire 700,000 Teachers in June and July?

by Calculated Risk on 5/22/2020 01:50:00 PM

Every year, state and local governments let about 2 million teachers go in late Spring, and then hire them back at the end of Summer.

Since this happens every year, the BLS adjusts for this seasonal pattern in the monthly employment report.

However, in 2020, state and local governments let almost 700 thousand teachers go in March and April (mostly in April).

What this means is that instead of letting 2 million teachers go in late Spring, state and local governments will only let go about 1.3 million teachers (since 700 thousand were already let go).

This creates a weird seasonal adjustment problem. By the end of July, the normal number of teachers (around 2 million) will probably have been let go.

Since the BLS has already reported almost 700 thousand teaching jobs lost seasonally adjusted, the seasonally adjusted number from the BLS will have to show something like an increase of 700 thousand teacher jobs in June and July!

State and local governments will not hire 700 thousand teachers in June and July, but the BLS seasonally adjusted report will show those hires to make the numbers balance out. Just something to remember in a few months.

Q2 GDP Forecasts: Probably Around 40% Annual Rate Decline

by Calculated Risk on 5/22/2020 11:37:00 AM

Important: GDP is reported at a seasonally adjusted annual rate (SAAR). So a 40% Q2 decline is around 9% decline from Q1 (SA).

From Merrill Lynch:

We are tracking 2Q GDP at -40% qoq saar, down from -30% earlier. [SAAR May 22 estimate]From Goldman Sachs:

emphasis added

We left our Q2 GDP forecast unchanged at -39% (qoq ar) but raised our estimate of the initial vintage by 0.3pp to -31.5% (released on July 30th). [May 22 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at -30.5% for 2020:Q2. [May 22 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2020 is -41.9 percent May 19, up from -42.8 percent on May 15. [May 19 estimate]

NMHC: Rent Payment Tracker Finds 90.8 Percent Paid Rent as of May 20th

by Calculated Risk on 5/22/2020 10:24:00 AM

From the NMHC: NMHC Rent Payment Tracker Finds 90.8 Percent of Apartment Households Paid Rent as of May 20

he National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 90.8 percent of apartment households made a full or partial rent payment by May 20 in its survey of 11.4 million units of professionally managed apartment units across the country.CR Note: It appears most people are still paying their rent. This was a higher percentage than in April (at the same point in the month), and only down 2.2 percentage points from a year ago.

This is a 2.2-percentage point decrease in the share who paid rent through May 20, 2019 and compares to 89.2 percent that had paid by April 20, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

"Each week we see new evidence that Americans are prioritizing rent and that the work apartment firms did to create flexible payment plans is paying dividends,” said Doug Bibby, NMHC President. “However, the hardships caused by the outbreak are not ending anytime soon. Accordingly, it is critical that lawmakers come together to support America’s 43 million renter households with a national rental assistance fund as was included in the House-passed HEROES Act, and to protect our housing providers with expanded mortgage forbearance.”

emphasis added

BLS: April jobless rates up in all 50 states; 43 States at New Record Highs

by Calculated Risk on 5/22/2020 10:12:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were higher in April in all 50 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Similarly, all 50 states and the District had jobless rate increases from a year earlier. The national unemployment rate rose by 10.3 percentage points over the month to 14.7 percent and was 11.1 points higher than in April 2019.

...

Nevada had the highest unemployment rate in April, 28.2 percent, followed by Michigan, 22.7 percent, and Hawaii, 22.3 percent. The rates in 43 states set new series highs. (All state series begin in 1976.) The rates in Hawaii and Nevada exceeded their previous series highs by more than 10.0 percentage points each, while the rates in Michigan, New Hampshire, Rhode Island, and Vermont exceeded their previous highs by more than 5.0 points each. Connecticut had the lowest unemployment rate, 7.9 percent. The next lowest rates were in Minnesota and Nebraska, 8.1 percent and 8.3 percent, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

Currently 43 states are above 10% unemployment rate.

Seventeen states are above 15%.

Three states are above 20% (Hawaii, Michigan, and Nevada).

One state (Nevada) is above 25% unemployment.