by Calculated Risk on 5/22/2020 01:50:00 PM

Friday, May 22, 2020

Seasonal Adjustment Weirdness: Will State and Local Governments Hire 700,000 Teachers in June and July?

Every year, state and local governments let about 2 million teachers go in late Spring, and then hire them back at the end of Summer.

Since this happens every year, the BLS adjusts for this seasonal pattern in the monthly employment report.

However, in 2020, state and local governments let almost 700 thousand teachers go in March and April (mostly in April).

What this means is that instead of letting 2 million teachers go in late Spring, state and local governments will only let go about 1.3 million teachers (since 700 thousand were already let go).

This creates a weird seasonal adjustment problem. By the end of July, the normal number of teachers (around 2 million) will probably have been let go.

Since the BLS has already reported almost 700 thousand teaching jobs lost seasonally adjusted, the seasonally adjusted number from the BLS will have to show something like an increase of 700 thousand teacher jobs in June and July!

State and local governments will not hire 700 thousand teachers in June and July, but the BLS seasonally adjusted report will show those hires to make the numbers balance out. Just something to remember in a few months.

Q2 GDP Forecasts: Probably Around 40% Annual Rate Decline

by Calculated Risk on 5/22/2020 11:37:00 AM

Important: GDP is reported at a seasonally adjusted annual rate (SAAR). So a 40% Q2 decline is around 9% decline from Q1 (SA).

From Merrill Lynch:

We are tracking 2Q GDP at -40% qoq saar, down from -30% earlier. [SAAR May 22 estimate]From Goldman Sachs:

emphasis added

We left our Q2 GDP forecast unchanged at -39% (qoq ar) but raised our estimate of the initial vintage by 0.3pp to -31.5% (released on July 30th). [May 22 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at -30.5% for 2020:Q2. [May 22 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2020 is -41.9 percent May 19, up from -42.8 percent on May 15. [May 19 estimate]

NMHC: Rent Payment Tracker Finds 90.8 Percent Paid Rent as of May 20th

by Calculated Risk on 5/22/2020 10:24:00 AM

From the NMHC: NMHC Rent Payment Tracker Finds 90.8 Percent of Apartment Households Paid Rent as of May 20

he National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 90.8 percent of apartment households made a full or partial rent payment by May 20 in its survey of 11.4 million units of professionally managed apartment units across the country.CR Note: It appears most people are still paying their rent. This was a higher percentage than in April (at the same point in the month), and only down 2.2 percentage points from a year ago.

This is a 2.2-percentage point decrease in the share who paid rent through May 20, 2019 and compares to 89.2 percent that had paid by April 20, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

"Each week we see new evidence that Americans are prioritizing rent and that the work apartment firms did to create flexible payment plans is paying dividends,” said Doug Bibby, NMHC President. “However, the hardships caused by the outbreak are not ending anytime soon. Accordingly, it is critical that lawmakers come together to support America’s 43 million renter households with a national rental assistance fund as was included in the House-passed HEROES Act, and to protect our housing providers with expanded mortgage forbearance.”

emphasis added

BLS: April jobless rates up in all 50 states; 43 States at New Record Highs

by Calculated Risk on 5/22/2020 10:12:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were higher in April in all 50 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Similarly, all 50 states and the District had jobless rate increases from a year earlier. The national unemployment rate rose by 10.3 percentage points over the month to 14.7 percent and was 11.1 points higher than in April 2019.

...

Nevada had the highest unemployment rate in April, 28.2 percent, followed by Michigan, 22.7 percent, and Hawaii, 22.3 percent. The rates in 43 states set new series highs. (All state series begin in 1976.) The rates in Hawaii and Nevada exceeded their previous series highs by more than 10.0 percentage points each, while the rates in Michigan, New Hampshire, Rhode Island, and Vermont exceeded their previous highs by more than 5.0 points each. Connecticut had the lowest unemployment rate, 7.9 percent. The next lowest rates were in Minnesota and Nebraska, 8.1 percent and 8.3 percent, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

Currently 43 states are above 10% unemployment rate.

Seventeen states are above 15%.

Three states are above 20% (Hawaii, Michigan, and Nevada).

One state (Nevada) is above 25% unemployment.

Black Knight: 4.75 Million Homeowners Now in COVID-19-Related Forbearance Plans; Nearly Half Made April Mortgage Payments

by Calculated Risk on 5/22/2020 07:30:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

From Black Knight: Black Knight: 4.75 Million Homeowners Now in COVID-19-Related Forbearance Plans; Nearly Half Made April Mortgage Payments

“Of the 4.25 million homeowners who were in active forbearance as of the end of April, nearly half – 46% – still made their April mortgage payment,” said Jabbour. “The fact that only 54% of borrowers in forbearance actually missed their payments helps explain the disparity between April’s delinquency and forbearance rates. However, just 21% of borrowers in forbearance have made their May payments, which could lead to another sharp increase in the national delinquency rate for May if those payments are not received before the end of the month.”CR Note: The delinquency rate in April increased sharply to 6.45%, but it would have been much higher if so many borrowers in forbearance hadn't made their mortgage payments (loans in forbearance are counted as delinquent in the survey).

The McDash Flash Forbearance tracker shows that the 4.75 million loans in forbearance represent 9% of all active mortgages and account for a little over $1 trillion in unpaid principal. An estimated 7.1% of all GSE-backed loans and 12.6% of FHA/VA mortgages are now in forbearance. Over the past week, active forbearance volumes have increased by just 93,000, a more than 70% decline from the 325,000 in the first week of May.

Thursday, May 21, 2020

May 21 COVID-19 Test Results

by Calculated Risk on 5/21/2020 05:05:00 PM

In addition to having enough tests for test-and-trace, we also need people to conduct contact tracing.

There is a great new website that tracks the progress of each towards test-and-trace. The website also has resources on how to implement test-and-trace. This includes software, training resources, a calculator for how many people to hire and more. Every state should review this site!

Check it out.

In late April, Dr. Fauci said the US might be able to test 400,000 to 600,000 people per day sometime in May, and testing is now close to that range. This might be enough to allow test-and-trace in some areas. However, the US might need more than 900,000 tests per day according to Dr. Jha of Harvard's Global Health Institute.

There were 408,415 test results reported over the last 24 hours.

The percent positive over the last 24 hours was 6.2% (red line). The US probably needs enough tests to keep the percentage positive well below 5%. (probably much lower based on testing in New Zealand).

NOTE: A few states - reportedly Virginia, Texas, Georgia, and Vermont - have apparently been including antibody tests with virus tests. The COVID tracking project is working to straighten that out.

Comments on April Existing Home Sales

by Calculated Risk on 5/21/2020 01:46:00 PM

Earlier: NAR: Existing-Home Sales Decreased to 4.33 million in April

A few key points:

1) Existing home sales are counted at the close of escrow, so this report is mostly for contracts signed in February and March. Some analysts think the April report will be the bottom for existing home sales - since purchase applications have increased recently - but my guess is that few contracts were signed in April, so reported sales in May (and maybe even June) will probably be lower.

2) Inventory is very low, and was down 19.7% year-over-year (YoY) in April. Inventory will probably stay fairly low as people wait to list their homes - and do not want strangers in their house. This is the lowest level of inventory for April since at least the early 1990s.

This graph shows existing home sales by month for 2019 and 2020.

Note that existing home sales picked up somewhat in the second half of 2019 as interest rates declined.

Even with weak sales in April, sales to date are only down about 0.8% compared to the same period in 2019.

Sales NSA in April (373,000) were well below sales last year in April (456,000).

Sales NSA were just above the minimum for April in 2009 (349,000).

It seems likely reported sales in May will be below the post bubble low of 376,000 in May 2009.

Hotels: Occupancy Rate Declined 54.1% Year-over-year, Slight Increase Week-over-week

by Calculated Risk on 5/21/2020 11:51:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 16 May

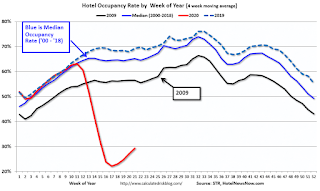

STR data ending with 16 May showed continued modest gains in U.S. hotel performance compared with previous weeks. Year-over-year declines remain significant although not as severe as the levels recorded in April.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

10-16 May 2020 (percentage change from comparable week in 2019):

• Occupancy: 32.4% (-54.1%)

• Average daily rate (ADR): US$77.55 (-42.4%)

• evenue per available room (RevPAR): US$25.12 (-73.6%)

“The trend of ‘less bad’ data continued with occupancy and ADR on a slow climb driven by a fifth consecutive week-to-week increase in demand,” said Jan Freitag, STR’s senior VP of lodging insights. “Last week’s data showed demand of more than 10 million room nights sold for the first time since the end of March, and this past week, the industry inched close to 11 million. All 50 states have at least partially reopened, so slow weekly demand growth should continue with more leisure activity around the country. Weekend occupancies continue to increase at a healthy clip, especially in drive-to destinations with beach access like Florida, or national park access, such as Gatlinburg, Tennessee. The industry will remain largely dependent on the leisure segment as uncertainty remains over when hotels will be ready to accommodate large events and group business.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

During 2009 (black line), many hotels were struggling. At this point in the year, the 4-week average in 2009 was 57%. Now it is half that level at just 29%! (The median is 65%).

COVID-19 has crushed hotel occupancy.

Note: Y-axis doesn't start at zero to better show the seasonal change.

NAR: Existing-Home Sales Decreased to 4.33 million in April

by Calculated Risk on 5/21/2020 10:12:00 AM

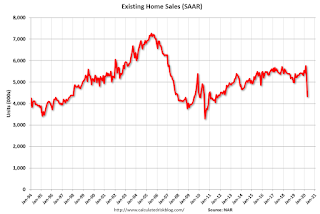

From the NAR: Existing-Home Sales Wane 17.8% in April

Existing-home sales dropped in April, continuing what is now a two-month skid in sales brought on by the coronavirus pandemic, according to the National Association of Realtors®. Each of the four major regions experienced a decline in month-over-month and year-over-year sales, with the West seeing the greatest dip in both categories.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, dropped 17.8% from March to a seasonally-adjusted annual rate of 4.33 million in April. Overall, sales decreased year-over-year, down 17.2% from a year ago (5.23 million in April 2019).

...

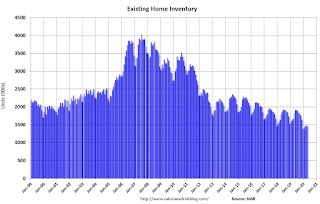

Total housing inventory at the end of April totaled 1.47 million units, down 1.3% from March, and down 19.7% from one year ago (1.83 million). Unsold inventory sits at a 4.1-month supply at the current sales pace, up from 3.4-months in March and down from the 4.2-month figure recorded in April 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in April (4.33 million SAAR) were down 17.8% from last month, and were 17.2% below the April 2019 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.47 million in April from 1.49 million in March. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

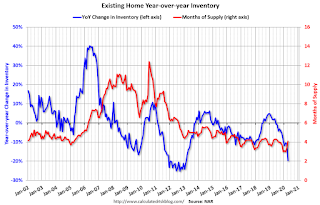

According to the NAR, inventory decreased to 1.47 million in April from 1.49 million in March. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 19.7% year-over-year in April compared to April 2019.

Inventory was down 19.7% year-over-year in April compared to April 2019. Months of supply increased to 4.1 months in April.

This was close to the consensus forecast. I'll have more later …

Philly Fed Manufacturing firms reported "continued weakness" in May

by Calculated Risk on 5/21/2020 08:57:00 AM

From the Philly Fed: May 2020 Manufacturing Business Outlook Survey

Manufacturing firms reported continued weakness in regional manufacturing activity this month, according to results from the Manufacturing Business Outlook Survey. Despite remaining well below zero, the survey’s current indicators for general activity, new orders, shipments, and employment rose this month after reaching long-term low readings in April. The firms expect the current slump in manufacturing activity to last less than six months, as the broadest indicator of future activity strengthened further from last month’s reading; furthermore, the firms continue to expect overall growth in new orders, shipments, and employment over the next six months.This was well close to the consensus forecast. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

After reaching a 40-year low in April, the diffusion index for current general activity rose 13 points to -43.1, its third consecutive negative reading. The percentage of firms reporting decreases this month (58 percent) far exceeded the percentage reporting increases (15 percent). … The firms continued to report overall decreases in manufacturing employment this month, but the current employment index increased 31 points to -15.3.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through May), and five Fed surveys are averaged (blue, through April) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

These early reports suggest the ISM manufacturing index will show significant contraction in May.