by Calculated Risk on 5/21/2020 11:51:00 AM

Thursday, May 21, 2020

Hotels: Occupancy Rate Declined 54.1% Year-over-year, Slight Increase Week-over-week

From HotelNewsNow.com: STR: US hotel results for week ending 16 May

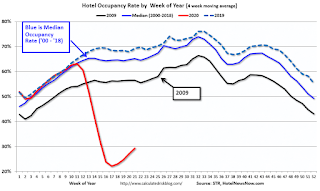

STR data ending with 16 May showed continued modest gains in U.S. hotel performance compared with previous weeks. Year-over-year declines remain significant although not as severe as the levels recorded in April.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

10-16 May 2020 (percentage change from comparable week in 2019):

• Occupancy: 32.4% (-54.1%)

• Average daily rate (ADR): US$77.55 (-42.4%)

• evenue per available room (RevPAR): US$25.12 (-73.6%)

“The trend of ‘less bad’ data continued with occupancy and ADR on a slow climb driven by a fifth consecutive week-to-week increase in demand,” said Jan Freitag, STR’s senior VP of lodging insights. “Last week’s data showed demand of more than 10 million room nights sold for the first time since the end of March, and this past week, the industry inched close to 11 million. All 50 states have at least partially reopened, so slow weekly demand growth should continue with more leisure activity around the country. Weekend occupancies continue to increase at a healthy clip, especially in drive-to destinations with beach access like Florida, or national park access, such as Gatlinburg, Tennessee. The industry will remain largely dependent on the leisure segment as uncertainty remains over when hotels will be ready to accommodate large events and group business.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

During 2009 (black line), many hotels were struggling. At this point in the year, the 4-week average in 2009 was 57%. Now it is half that level at just 29%! (The median is 65%).

COVID-19 has crushed hotel occupancy.

Note: Y-axis doesn't start at zero to better show the seasonal change.

NAR: Existing-Home Sales Decreased to 4.33 million in April

by Calculated Risk on 5/21/2020 10:12:00 AM

From the NAR: Existing-Home Sales Wane 17.8% in April

Existing-home sales dropped in April, continuing what is now a two-month skid in sales brought on by the coronavirus pandemic, according to the National Association of Realtors®. Each of the four major regions experienced a decline in month-over-month and year-over-year sales, with the West seeing the greatest dip in both categories.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, dropped 17.8% from March to a seasonally-adjusted annual rate of 4.33 million in April. Overall, sales decreased year-over-year, down 17.2% from a year ago (5.23 million in April 2019).

...

Total housing inventory at the end of April totaled 1.47 million units, down 1.3% from March, and down 19.7% from one year ago (1.83 million). Unsold inventory sits at a 4.1-month supply at the current sales pace, up from 3.4-months in March and down from the 4.2-month figure recorded in April 2019.

emphasis added

Click on graph for larger image.

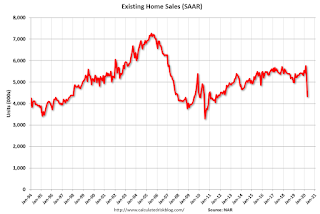

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in April (4.33 million SAAR) were down 17.8% from last month, and were 17.2% below the April 2019 sales rate.

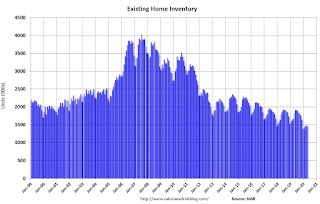

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.47 million in April from 1.49 million in March. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

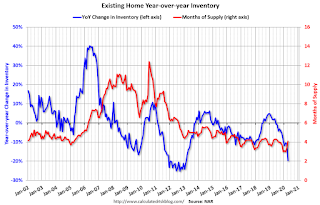

According to the NAR, inventory decreased to 1.47 million in April from 1.49 million in March. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 19.7% year-over-year in April compared to April 2019.

Inventory was down 19.7% year-over-year in April compared to April 2019. Months of supply increased to 4.1 months in April.

This was close to the consensus forecast. I'll have more later …

Philly Fed Manufacturing firms reported "continued weakness" in May

by Calculated Risk on 5/21/2020 08:57:00 AM

From the Philly Fed: May 2020 Manufacturing Business Outlook Survey

Manufacturing firms reported continued weakness in regional manufacturing activity this month, according to results from the Manufacturing Business Outlook Survey. Despite remaining well below zero, the survey’s current indicators for general activity, new orders, shipments, and employment rose this month after reaching long-term low readings in April. The firms expect the current slump in manufacturing activity to last less than six months, as the broadest indicator of future activity strengthened further from last month’s reading; furthermore, the firms continue to expect overall growth in new orders, shipments, and employment over the next six months.This was well close to the consensus forecast. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

After reaching a 40-year low in April, the diffusion index for current general activity rose 13 points to -43.1, its third consecutive negative reading. The percentage of firms reporting decreases this month (58 percent) far exceeded the percentage reporting increases (15 percent). … The firms continued to report overall decreases in manufacturing employment this month, but the current employment index increased 31 points to -15.3.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through May), and five Fed surveys are averaged (blue, through April) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

These early reports suggest the ISM manufacturing index will show significant contraction in May.

Weekly Initial Unemployment Claims decrease to 2,438,000

by Calculated Risk on 5/21/2020 08:37:00 AM

Update Another error this week: "In Massachusetts, PUA initial claims for the week ending May 16 were 115,952." With MA correction, total PUA claims is 1,158,081.

The DOL reported:

In the week ending May 16, the advance figure for seasonally adjusted initial claims was 2,438,000, a decrease of 249,000 from the previous week's revised level. The previous week's level was revised down by 294,000 from 2,981,000 to 2,687,000. The 4-week moving average was 3,042,000, a decrease of 501,000 from the previous week's revised average. The previous week's average was revised down by 73,500 from 3,616,500 to 3,543,000.The previous week was revised down.

emphasis added

This does not include the 2,226,921 initial claims for Pandemic Unemployment Assistance (PUA).

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 3,042,000.

This was close to the consensus forecast of 2.5 million.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week while increasing sharply).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims have already increased to a new record high of 25,073,000 (SA) and will increase further over the next couple of weeks - and likely stay at a high level until the crisis abates.

Note: There are an additional 6,121,221 receiving Pandemic Unemployment Assistance (PUA). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

Black Knight: National Mortgage Delinquency Rate Increased Sharply in April, "Largest Single-Month Increase Ever Recorded"

by Calculated Risk on 5/21/2020 07:00:00 AM

Note: Loans in forbearance are counted as delinquent in this survey, so the delinquency rate jumped in April.

From Black Knight: Black Knight’s First Look: Past-Due Mortgages Increase by 1.6 Million in April, Largest Single-Month Increase Ever Recorded;

Delinquency Rate Nearly Doubles

• 3.6 million homeowners were past due on their mortgages as of the end of April, the largest number since January 2015According to Black Knight's First Look report for March, the percent of loans delinquent increased 90.2% in April compared to March, and increased 85.8% year-over-year.

• The number includes both homeowners past due on mortgage payments who are not in forbearance, as well as those in forbearance plans who did not make an April mortgage payment

• At 6.45%, the national delinquency rate nearly doubled (+3.06%) from March, the largest single-month increase ever recorded, and nearly three times the previous single-month record set back in late 2008

• There were declines in cure activity among later-stage delinquencies as well, with the number of seriously delinquent mortgages (90+ days) increasing by 56,000 (+14%) from March

• Both foreclosure starts and foreclosure sales hit record lows in April as moratoriums halted foreclosure activity across the country

emphasis added

The percent of loans in the foreclosure process decreased 3.8% in April and were down 19.3% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 6.45% in April, up from 3.39% in March.

The percent of loans in the foreclosure process decreased in April to 0.40% from 0.42% in March.

The number of delinquent properties, but not in foreclosure, is up 1,558,000 properties year-over-year, and the number of properties in the foreclosure process is down 48,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Apr 2020 | Mar 2020 | Apr 2019 | Apr 2018 | |

| Delinquent | 6.45% | 3.39% | 3.47% | 3.67% |

| In Foreclosure | 0.40% | 0.42% | 0.50% | 0.61% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 3,400,000 | 1,792,000 | 1,812,000 | 1,885,000 |

| Number of properties in foreclosure pre-sale inventory: | 211,000 | 220,000 | 259,000 | 314,000 |

| Total Properties | 3,611,000 | 2,013,000 | 2,072,000 | 2,199,000 |

Wednesday, May 20, 2020

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 5/20/2020 09:36:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a 2.500 million initial claims, down from 2.981 million the previous week.

• At 8:30 AM, the Philly Fed manufacturing survey for May. The consensus is for a reading of -45.0, up from -56.6.

• At 10:00 AM, Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 4.30 million SAAR, down from 5.27 million.

• At 2:30 PM, Speech, Fed Chair Jerome Powell, Opening Remarks, At Fed Listens: How is COVID-19 Affecting Your Community?

Phoenix Real Estate in April: Sales down 27% YoY, Active Inventory Down 22% YoY

by Calculated Risk on 5/20/2020 06:33:00 PM

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales were at 6,925 in April, down from 8,626 in March, and down from 9,493 in April 2019. Sales were down 19.7% from March 2020 (last month), and down 27.1% from April 2019.

2) Active inventory was at 13,889, down from 17,804 in April 2019. That is down 22% year-over-year.

3) Months of supply increased to 2.59 in April from 2.11 in March. This remains low.

Sales are reported at the close of escrow, so these sales were mostly signed in February and March. Sales for May will be negatively impacted by COVID since few contracts were likely signed in April.

May 20 COVID-19 Test Results, AND Great News on the Next Step

by Calculated Risk on 5/20/2020 05:03:00 PM

In addition to having enough tests for test-and-trace, we also need people to conduct the tests.

There is a great new website that tracks the progress of each towards test-and-trace. The website also has resources on how to implement test-and-trace. This includes software, training resources, a calculator for how many people to hire and more. Every state should review this site!

This graph is from the test-and-trace website. The graph is interactive, and shows the percent positive tests by state, and the number of contract traces hired and more.

Check it out.

In late April, Dr. Fauci said the US might be able to test 400,000 to 600,000 people per day sometime in May, and testing is now close to that range. This might be enough to allow test-and-trace in some areas. However, the US might need more than 900,000 tests per day according to Dr. Jha of Harvard's Global Health Institute.

There were 413,804 test results reported over the last 24 hours.

The percent positive over the last 24 hours was 5.2% (red line). The US probably needs enough tests to keep the percentage positive well below 5%. (probably much lower based on testing in New Zealand).

NOTE: A few states are apparently including antibody tests with virus tests. The COVID tracking project is working to straighten that out.

FOMC Minutes: "Considerable risks to the economic outlook over the medium term"

by Calculated Risk on 5/20/2020 02:08:00 PM

From the Fed: Minutes of the Federal Open Market Committee, April 28–29, 2020. A few excerpts:

Participants noted that the coronavirus outbreak was causing tremendous human and economic hardship across the United States and around the world. The virus and the measures taken to protect public health were inducing sharp declines in economic activity and a surge in job losses. Weaker demand and significantly lower oil prices were holding down consumer price inflation. The disruptions to economic activity here and abroad had significantly affected financial conditions and had impaired the flow of credit to U.S. households and businesses.

Participants judged that the effects of the coronavirus outbreak and the ongoing public health crisis would continue to weigh heavily on economic activity, employment, and inflation in the near term and would pose considerable risks to the economic outlook over the medium term. Participants assessed that the second quarter would likely see overall economic activity decline at an unprecedented rate. Participants relayed information from their Districts that the burdens of the present crisis would fall disproportionately on the most vulnerable and financially constrained households in the economy.

...

Participants noted that recently enacted fiscal programs were crucial for limiting the severity of the economic downturn. In particular, the Cares Act and other legislation, which represented more than $2 trillion in federal spending in total, had provided direct help to households, businesses, and communities. For example, the PPP was providing a financial lifeline to small businesses, the expansion of unemployment benefits was helping restore lost income for laid-off workers, and the Treasury had provided a necessary financial backstop to many Federal Reserve lending facilities. Participants acknowledged that even greater fiscal support may be necessary if the economic downturn persists.

…

A number of participants commented on potential risks to financial stability. Participants were concerned that banks could come under greater stress, particularly if adverse scenarios for the spread of the pandemic and economic activity were realized, and so this sector should be monitored carefully. Participants saw risks to banks and some other financial institutions as exacerbated by high levels of indebtedness among nonfinancial corporations that prevailed before the pandemic; this indebtedness increased these firms' risk of insolvency. The upcoming financial stress tests for banks were seen as important for measuring the ability of large banks to withstand future downside scenarios. A number of participants emphasized that regulators should encourage banks to prepare for possible downside scenarios by further limiting payouts to shareholders, thereby preserving loss-absorbing capital. Indeed, historical loss models might understate losses in this context. A few participants stressed that the activities of some nonbank financial institutions presented vulnerabilities to the financial system that could worsen in the event of a protracted economic downturn and that these institutions and activities should be monitored closely.

…

Members further concurred that the ongoing public health crisis would weigh heavily on economic activity, employment, and inflation in the near term, and posed considerable downside risks to the economic outlook over the medium term. In light of these developments, members decided to maintain the target range for the federal funds rate at 0 to 1/4 percent. Members noted that they expected to maintain this target range until they were confident that the economy had weathered recent events and was on track to achieve the Committee's maximum employment and price stability goals.

emphasis added

Census: Household Pulse Survey shows 47.5% of Households lost Income

by Calculated Risk on 5/20/2020 11:46:00 AM

From the Census Bureau: Measuring Household Experiences during the Coronavirus (COVID-19) Pandemic

The U.S. Census Bureau, in collaboration with five federal agencies, is in a unique position to produce data on the social and economic effects of COVID-19 on American households. The Household Pulse Survey is designed to deploy quickly and efficiently, collecting data to measure household experiences during the Coronavirus (COVID-19) pandemic. Data will be disseminated in near real-time to inform federal and state response and recovery planning.This will be updated weekly, and the Census Bureau released the first survey results today. This survey asks about Loss in Employment Income, Expected Loss in Employment Income, Food Scarcity, Delayed Medical Care, Housing Insecurity and K-12 Educational Changes.

…

Data collection for the Household Pulse Survey began on April 23, 2020. The Census Bureau will collect data for 90 days, and release data on a weekly basis. (For the first release, the Census Bureau anticipates it will take two weeks after the first week of data collection to prepare and weight the data; subsequent releases will then be made on a weekly basis.)

Click on graph for larger image.

Click on graph for larger image.This survey will be useful in tracking the "opening" of the economy.

This is the first release. The data was collected between April 23 and May 12, 2020.

The data will be updated weekly for the next 90 days.