by Calculated Risk on 5/16/2020 08:11:00 AM

Saturday, May 16, 2020

Schedule for Week of May 17, 2020

The key reports this week are April Housing Starts and Existing Home Sales.

For manufacturing, the May Philly Fed manufacturing survey will be released.

Fed Chair Jerome Powell testifies before the Senate Banking Committee on Tuesday.

10:00 AM: The May NAHB homebuilder survey. The consensus is for an increase to 33 from 30 last month . Any number below 50 indicates that more builders view sales conditions as poor than good.

8:30 AM ET: Housing Starts for April.

8:30 AM ET: Housing Starts for April. This graph shows single and total housing starts since 1968.

The consensus is for 0.950 million SAAR, down from 1.216 million SAAR in March.

10:00 AM, Testimony, Fed Chair Jerome Powell, Coronavirus Aid, Relief, and Economic Security Act, Before the Senate Banking, Housing, and Urban Affairs Committee, U.S. Senate

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes, Meeting of April 28-29, 2020

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for a 2.500 million initial claims, down from 2.981 million the previous week.

8:30 AM: the Philly Fed manufacturing survey for May. The consensus is for a reading of -45.0, up from -56.6.

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 4.30 million SAAR, down from 5.27 million.

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 4.30 million SAAR, down from 5.27 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 4.17 million SAAR for April.

2:30 PM, Speech, Fed Chair Jerome Powell, Opening Remarks, At Fed Listens: How is COVID-19 Affecting Your Community?

10:00 AM: State Employment and Unemployment (Monthly) for April 2020

Friday, May 15, 2020

May 15 Update: US COVID-19 Test Results

by Calculated Risk on 5/15/2020 05:50:00 PM

The COVID Tracking Project put out an important statement today: Position Statement on Antibody Data Reporting

Earlier this week, we learned that for several weeks, the Commonwealth of Virginia has been combining viral test data with antibody test data in their public reporting on COVID-19. Virginia officials suggested that other states were pooling these two types of results so that, in essence, Virginia was forced to combine them to keep up.This means the number of tests being reported is too high, and the percent positive is probably higher than being reported. Hopefully the states will separate the tests in all reporting.

On May 13, 2020, we contacted 44 states and territories without clear statements about their antibody test reporting policy. As of May 15, we have confirmed that at least two states besides Virginia have been combining antibody and viral test results, though only Virginia's health department is on the record about combining their testing datasets. If more states are, in fact, combining viral and antibody results, we understand that they are making a choice that appears to increase their test totals. But we think it comes at much too high a price.

As antibody tests become more widely available across the United States, every state and territory will have to choose how to report this data to the public. We encourage all states and territories to standardize on reporting antibody and viral test results separately and fully, allowing government departments, journalists, and members of the public to maintain access to the most meaningful numbers throughout the COVID-19 outbreak in the United States.

emphasis added

The US might be able to test 400,000 to 600,000 people per day sometime in May according to Dr. Fauci - and that might be enough for test and trace.

However, the US might need more than 900,000 tests per day according to Dr. Jha of Harvard's Global Health Institute.

There were 378,410 test results reported over the last 24 hours.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.9% (red line). The US probably needs enough tests to keep the percentage positive well below 5%. (probably much lower based on testing in New Zealand).

Lawler: Early Read on Existing Home Sales in April

by Calculated Risk on 5/15/2020 04:50:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.17 million in April, down 20.6% from March’s preliminary pace and down 20.1% from last April’s seasonally adjusted pace.

I should note that this “earlier than normal” estimate is based on a smaller sample than my normal “early read.” In addition, there are huge differences in sales figures not just across states but within states, with much of the differences reflecting how states were affected by and how state governments responded to the pandemic. As such, this estimate is subject to greater than normal “sampling error.”

On the inventory front, local realtor/MLS data, as well as data from other inventory trackers, suggest that the inventory of existing homes for sale at the end of April will be 7down about 15.0% from a year earlier. Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up by about 8.3% from last April.

Here are a few other observations: first, while not all realtor reports break out sales by type of property (e.g., single-family detached vs. condo/townhomes), almost all that do reported a significantly larger YOY decline in condo/townhome sales than in single-family detached sales.

Second, while not all realtor reports include data on new pending sales – and some that do often revise those data significantly – it is worth nothing that almost all realtor reports with new pending sales data showed a significantly larger YOY drop in pending sales than in closed sales. E.g., of the realtor reports than included new pending sales, the combined closed sales in those reports were down 20% YOY while combined pending sales were down 34% YOY.

CR Note: The National Association of Realtors (NAR) is scheduled to release April existing home sales on Thursday, May 21, 2020 at 10:00 AM ET. The consensus is for 4.30 million SAAR.

NMHC: Rent Payment Tracker Finds 87.7 Percent Paid Rent as of May 13th

by Calculated Risk on 5/15/2020 01:57:00 PM

From the NMHC: NMHC Rent Payment Tracker Finds 87.7 Percent of Apartment Households Paid Rent as of May 13

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 87.7 percent of apartment households made a full or partial rent payment by May 13 in its survey of 11.4 million units of professionally managed apartment units across the country.CR Note: It appears most people are still paying their rent. This was a higher percentage than in April (at the same point in the month), and only down 2.1 percentage points from a year ago. (Commercial is a different story).

This is a 2.1-percentage point decrease in the share who paid rent through May 13, 2019 and compares to 85.0 percent that had paid by April 13, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

“Once again, despite the economic and health challenges facing so many, we have found that apartment residents who live in professionally managed properties are meeting their obligations,” said Doug Bibby, NMHC President. “But it’s important to understand that our metric does not capture rent payments for smaller landlords or for affordable and subsidized properties. These excluded properties are the ones more likely to house residents experiencing financial stress. In addition, as current federal support programs begin to reach their limit, it will be even more critical for Congress to enact a meaningful renter assistance program. It’s the only way to avoid adding a housing crisis to our health and economic crisis.”

emphasis added

Q2 GDP Forecasts: Probably Around 30% Annual Rate Decline

by Calculated Risk on 5/15/2020 12:42:00 PM

Important: GDP is reported at a seasonally adjusted annual rate (SAAR). So a 30% Q2 decline is around 7% decline from Q1 (SA).

From Merrill Lynch:

We are tracking -5.2% qoq saar for 1Q GDP and expect a -30% qoq saar plunge in 2Q. [SAAR May 15 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at -31.1% for 2020:Q2. [May 15 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2020 is -42.8 percent on May 15, down from -34.9 percent on May 8. [May 15 estimate]

NY Fed: Manufacturing "Business activity continued to deteriorate significantly in New York State"

by Calculated Risk on 5/15/2020 12:35:00 PM

Earlier from the NY Fed: Empire State Manufacturing Survey

Business activity continued to deteriorate significantly in New York State, according to firms responding to the May 2020 Empire State Manufacturing Survey. The headline general business conditions index climbed thirty points, but remained well below zero at -48.5.This was another weak report and suggests activity continued to "deteriorate significantly" in May.

...

After plunging last month, the index for number of employees increased nearly 50 points to -6.1, suggesting that after declining sharply last month, employment levels fell somewhat further in May. The average workweek index also increased, but at -21.6, the index pointed to ongoing declines in hours worked.

emphasis added

Black Knight: 4.7 Million Homeowners Now in COVID-19-Related Forbearance Plans, 8.8% of Mortgages

by Calculated Risk on 5/15/2020 10:18:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

From Black Knight: 4.7M Homeowners Now in Forbearance, But Pace is Slowing Considerably

• As of May 12, approximately 4.7 million homeowners are in forbearance plans, up from a revised 4.5 million one week prior.

• The pace of new forbearance plans has slowed considerably – there was an average net increase of just under 26K per day over the past week. That’s a reduction of more than 85% of the rate we saw back in early April.

• Using a momentum-based approach based on the one-week average and assuming an optimistic 10% daily decline moving forward, we would see 4.9 million loans in forbearance by the end of May (9.2% of active mortgages) and just under 5 million (9.4%) by the end of June.

• A more pessimistic scenario, in which the two-week average rolls forward and the 10% daily decline doesn’t manifest until June 15th, could result in as many as 5.4 million loans (10.1%) in forbearance by the end of the month, and nearly 6.3 million (11.8%) by the end of June.

• Together, the 4.66M represent 8.8% of all active mortgages and more than $1 trillion in unpaid principal.

BLS: Job Openings decreased to 6.2 Million in March

by Calculated Risk on 5/15/2020 10:08:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of total separations increased by 8.9 million to a series high of 14.5 million in March, the U.S. Bureau of Labor Statistics reported today. Within separations, the quits rate fell to 1.8 percent and the layoffs and discharges rate increased to 7.5 percent. Job openings decreased to 6.2 million on the last business day of March. Over the month, hires declined to 5.2 million. The changes in these measures reflect the effects of the coronavirus (COVID-19) pandemic and efforts to contain it. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

In March, the number and rate of quits decreased to 2.8 million (-654,000) and 1.8 percent, respectively. Total private quits fell to 2.6 million (-640,000), while government edged down to 177,000 (-14,000).

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for March, the most recent employment report was for April.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in March to 6.191 million from 7.004 million in February.

The number of job openings (yellow) were down 16% year-over-year.

Quits were down 21% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings declined sharply, and will decline further in the April report.

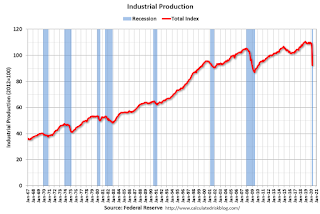

Industrial Production Decreased 11.2 Percent in April, Capacity utilization at Record Low

by Calculated Risk on 5/15/2020 09:23:00 AM

From the Fed: Industrial Production and Capacity Utilization

Total industrial production fell 11.2 percent in April for its largest monthly drop in the 101-year history of the index, as the COVID-19 (coronavirus disease 2019) pandemic led many factories to slow or suspend operations throughout the month. Manufacturing output dropped 13.7 percent, its largest decline on record, as all major industries posted decreases. The output of motor vehicles and parts fell more than 70 percent; production elsewhere in manufacturing dropped 10.3 percent. The indexes for utilities and mining decreased 0.9 percent and 6.1 percent, respectively. At 92.6 percent of its 2012 average, the level of total industrial production was 15.0 percent lower in April than it was a year earlier. Capacity utilization for the industrial sector decreased 8.3 percentage points to 64.9 percent in April, a rate that is 14.9 percentage points below its long-run (1972–2019) average and 1.8 percentage points below its all-time (since 1967) low set in 2009.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is down 1.8 percentage points from the previous record low set in June 2009 (the series starts in 1967).

Capacity utilization at 64.9% is 14.9% below the average from 1972 to 2017.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in April to 92.6. This is 6.3% above the Great Recession low.

The change in industrial production was at consensus expectations.

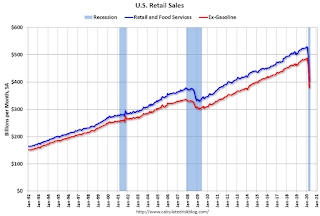

Retail Sales decreased 16.4% in April

by Calculated Risk on 5/15/2020 08:43:00 AM

On a monthly basis, retail sales decreased 16.4 percent from March to April (seasonally adjusted), and sales were down 21.6 percent from April 2019.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for April 2020, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $403.9 billion, a decrease of 16.4 percent from the previous month, and 21.6 percent below April 2019. Total sales for the February 2020 through April 2020 period were down 7.7 percent from the same period a year ago. The February 2020 to March 2020 percent change was revised from down 8.4 percent to down 8.3 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 15.5% in March.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, decreased by 19.7% on a YoY basis.

Retail and Food service sales, ex-gasoline, decreased by 19.7% on a YoY basis.The decrease in April was well below expectations, and sales in February and March were revised down, combined.