by Calculated Risk on 5/13/2020 09:05:00 AM

Wednesday, May 13, 2020

Fed Chair Powell: Current Economic Issues "May require additional policy measures"

Note: You can watch the speech here.

From Fed Chair Jerome Powell: Current Economic Issues

The coronavirus has left a devastating human and economic toll in its wake as it has spread around the globe. This is a worldwide public health crisis, and health-care workers have been the first responders, showing courage and determination and earning our lasting gratitude. So have the legions of other essential workers who put themselves at risk every day on our behalf.

As a nation, we have temporarily withdrawn from many kinds of economic and social activity to help slow the spread of the virus. Some sectors of the economy have been effectively closed since mid-March. People have put their lives and livelihoods on hold, making enormous sacrifices to protect not just their own health and that of their loved ones, but also their neighbors and the broader community. While we are all affected, the burden has fallen most heavily on those least able to bear it.

The scope and speed of this downturn are without modern precedent, significantly worse than any recession since World War II. We are seeing a severe decline in economic activity and in employment, and already the job gains of the past decade have been erased. Since the pandemic arrived in force just two months ago, more than 20 million people have lost their jobs. A Fed survey being released tomorrow reflects findings similar to many others: Among people who were working in February, almost 40 percent of those in households making less than $40,000 a year had lost a job in March.1 This reversal of economic fortune has caused a level of pain that is hard to capture in words, as lives are upended amid great uncertainty about the future.

This downturn is different from those that came before it. Earlier in the post– World War II period, recessions were sometimes linked to a cycle of high inflation followed by Fed tightening. The lower inflation levels of recent decades have brought a series of long expansions, often accompanied by the buildup of imbalances over time—asset prices that reached unsupportable levels, for instance, or important sectors of the economy, such as housing, that boomed unsustainably. The current downturn is unique in that it is attributable to the virus and the steps taken to limit its fallout. This time, high inflation was not a problem. There was no economy-threatening bubble to pop and no unsustainable boom to bust. The virus is the cause, not the usual suspects—something worth keeping in mind as we respond.

Today I will briefly discuss the measures taken so far to offset the economic effects of the virus, and the path ahead. Governments around the world have responded quickly with measures to support workers who have lost income and businesses that have either closed or seen a sharp drop in activity. The response here in the United States has been particularly swift and forceful.

To date, Congress has provided roughly $2.9 trillion in fiscal support for households, businesses, health-care providers, and state and local governments—about 14 percent of gross domestic product. While the coronavirus economic shock appears to be the largest on record, the fiscal response has also been the fastest and largest response for any postwar downturn.

At the Fed, we have also acted with unprecedented speed and force. After rapidly cutting the federal funds rate to close to zero, we took a wide array of additional measures to facilitate the flow of credit in the economy, which can be grouped into four areas. First, outright purchases of Treasuries and agency mortgage-backed securities to restore functionality in these critical markets. Second, liquidity and funding measures, including discount window measures, expanded swap lines with foreign central banks, and several facilities with Treasury backing to support smooth functioning in money markets. Third, with additional backing from the Treasury, facilities to more directly support the flow of credit to households, businesses, and state and local governments. And fourth, temporary regulatory adjustments to encourage and allow banks to expand their balance sheets to support their household and business customers.

The Fed takes actions such as these only in extraordinary circumstances, like those we face today. For example, our authority to extend credit directly to private nonfinancial businesses and state and local governments exists only in "unusual and exigent circumstances" and with the consent of the Secretary of the Treasury. When this crisis is behind us, we will put these emergency tools away.

While the economic response has been both timely and appropriately large, it may not be the final chapter, given that the path ahead is both highly uncertain and subject to significant downside risks. Economic forecasts are uncertain in the best of times, and today the virus raises a new set of questions: How quickly and sustainably will it be brought under control? Can new outbreaks be avoided as social-distancing measures lapse? How long will it take for confidence to return and normal spending to resume? And what will be the scope and timing of new therapies, testing, or a vaccine? The answers to these questions will go a long way toward setting the timing and pace of the economic recovery. Since the answers are currently unknowable, policies will need to be ready to address a range of possible outcomes.

The overall policy response to date has provided a measure of relief and stability, and will provide some support to the recovery when it comes. But the coronavirus crisis raises longer-term concerns as well. The record shows that deeper and longer recessions can leave behind lasting damage to the productive capacity of the economy.3 Avoidable household and business insolvencies can weigh on growth for years to come. Long stretches of unemployment can damage or end workers' careers as their skills lose value and professional networks dry up, and leave families in greater debt.4 The loss of thousands of small- and medium-sized businesses across the country would destroy the life's work and family legacy of many business and community leaders and limit the strength of the recovery when it comes. These businesses are a principal source of job creation—something we will sorely need as people seek to return to work. A prolonged recession and weak recovery could also discourage business investment and expansion, further limiting the resurgence of jobs as well as the growth of capital stock and the pace of technological advancement. The result could be an extended period of low productivity growth and stagnant incomes.

We ought to do what we can to avoid these outcomes, and that may require additional policy measures. At the Fed, we will continue to use our tools to their fullest until the crisis has passed and the economic recovery is well under way. Recall that the Fed has lending powers, not spending powers. A loan from a Fed facility can provide a bridge across temporary interruptions to liquidity, and those loans will help many borrowers get through the current crisis. But the recovery may take some time to gather momentum, and the passage of time can turn liquidity problems into solvency problems. Additional fiscal support could be costly, but worth it if it helps avoid long-term economic damage and leaves us with a stronger recovery. This tradeoff is one for our elected representatives, who wield powers of taxation and spending.

emphasis added

MBA: Mortgage Applications Increased Slightly, Purchase Applications up 11% Week over Week

by Calculated Risk on 5/13/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 8, 2020.

... The Refinance Index decreased 3 percent from the previous week and was 201 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 11 percent from one week earlier. The unadjusted Purchase Index increased 11 percent compared with the previous week and was 10 percent lower than the same week one year ago.

...

“There continues to be a stark recovery in purchase applications, as most large states saw increases in activity last week. In the ten largest states in MBA’s survey, New York – after a 9 percent gain two weeks ago – led the increases with a 14 percent jump. Illinois, Florida, Georgia, California and North Carolina also had double-digit increases last week,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “We expect this positive purchase trend to continue – at varying rates across the country – as states gradually loosen social distancing measures, and some of the pent-up demand for housing returns in what is typically the final weeks of the spring home buying season.”

Added Kan, “Mortgage rates stayed close to record-lows, but refinance applications decreased for the fourth consecutive week, driven by a 5 percent drop in conventional refinances. Despite the downward trend over the last month, mortgage lenders remain busy. Refinance activity was up 200 percent from a year ago.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased to 3.43 percent from 3.40 percent, with points decreasing to 0.29 from 0.30 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But the index is way up from last year (over triple last year).

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is down 10% year-over-year.

Purchase activity has fallen, but was up 11% week over week.

Note: Red is a four-week average (blue is weekly).

Tuesday, May 12, 2020

May 12 Update: US COVID-19 Test Results: Step Backwards

by Calculated Risk on 5/12/2020 05:39:00 PM

The US might be able to test 400,000 to 600,000 people per day sometime in May according to Dr. Fauci - and that might be enough for test and trace.

However, the US might need more than 900,000 tests per day according to Dr. Jha of Harvard's Global Health Institute.

There were 306,581 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.6% (red line). The US probably needs enough tests to keep the percentage positive well below 5%. (probably much lower based on testing in New Zealand).

A step backward from yesterday, but still above 300,000 tests.

LA area Port Traffic Down Sharply Year-over-year in April

by Calculated Risk on 5/12/2020 03:35:00 PM

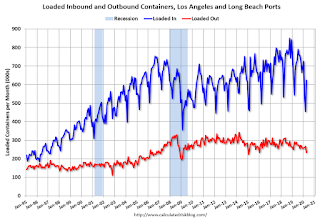

Note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.7% in April compared to the rolling 12 months ending in March. Outbound traffic was down 1.4% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Because of the timing of the New Year, we would have expected traffic to decline in February without an impact from COVID-19, but bounce back in March and April.

In general imports both imports and exports have turned down recently - and will probably be negatively impacted by COVID-19 over the next several months.

Bloomberg Interview on Housing and COVID-19

by Calculated Risk on 5/12/2020 01:32:00 PM

From Timothy O'Brien at Bloomberg: A leading real-estate data junkie is now focused on the impact of the coronavirus

My last quote in the article (something I've also written on this blog):

“The course of the economy will be determined by the course of the virus. If it doesn’t last a long time we’ll be fine. If we’re not out of this in just a few months we’ll have a real problem,” he tells me. “I’m the wrong guy in the wrong field to ask where housing will go. Infectious disease specialists will know.”

Cleveland Fed: Key Measures Show Inflation Slowed in April

by Calculated Risk on 5/12/2020 11:18:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.8% annualized rate) in April. The 16% trimmed-mean Consumer Price Index was unchanged (0.3% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for April here. Motor fuel decreased at a 93.5% annualized rate in April!

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.8% (-9.1% annualized rate) in April. The CPI less food and energy fell 0.4% (-5.2% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.7%, the trimmed-mean CPI rose 2.2%, and the CPI less food and energy rose 1.4%. Core PCE is for March and increased 1.7% year-over-year.

On a monthly basis, median CPI was at 1.8% annualized and trimmed-mean CPI was at 0.3% annualized.

Inflation will not be a concern during the crisis.

MBA: "Mortgage Delinquencies Rise in First Quarter of 2020"

by Calculated Risk on 5/12/2020 10:19:00 AM

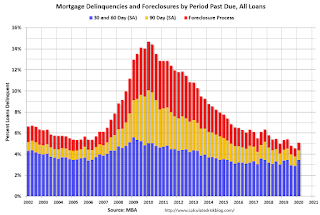

This is mostly pre-COVID. The second quarter will see a large increase in delinquencies (forbearance will be included as delinquent in Q2).

From the MBA: Mortgage Delinquencies Rise in First Quarter of 2020

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 4.36 percent of all loans outstanding at the end of the first quarter of 2020, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate was up 59 basis points from the fourth quarter of 2019 and down 6 basis points from one year ago. The percentage of loans on which foreclosure actions were started in the first quarter fell by 2 basis points to 0.19 percent.

“The mortgage delinquency rate in the fourth quarter of 2019 was at its lowest rate since MBA’s survey began in 1979. Fast-forward to the end of March, and it is clear the COVID-19 pandemic is impacting homeowners. Mortgage delinquencies jumped by 59 basis points – which is reminiscent of the hurricane-related, 64-basis-point increase seen in the third quarter of 2017,” said Marina Walsh, MBA’s Vice President of Industry Analysis. “The major variances from the fourth quarter of 2019 to this year’s first quarter are tied to the increase in early-stage delinquencies for all loan types. For example, the 30-day FHA delinquency rate rose by 113 basis points, the second-highest quarterly ramp-up in the survey series. The 30-day VA delinquency rate rose by 78 basis points – the highest quarterly increase.”

The seriously delinquent rate in the first quarter decreased by 9 basis points and was down 29 basis points from a year ago. The foreclosure inventory rate – the percentage of loans in the foreclosure process – was at its lowest level last quarter since 1984. Foreclosure starts were down 2 basis points from the previous quarter.

“Mortgage delinquencies track closely with the U.S. job market. With unemployment rising from historical lows in early 2020 to a record 14.7 percent in April, it is inevitable that mortgage delinquencies would increase as well. 33.5 million U.S. workers applied for unemployment benefits in the past seven weeks, and with signs of economic distress continuing into the second quarter, mortgage delinquencies will likely further increase,” said Walsh.

According to Walsh, there may be a flattening in foreclosure starts in future quarterly surveys due to COVID-19-related foreclosure moratoria and borrower forbearance guidelines under the CARES Act. Almost 4 million homeowners are on forbearance plans as of May 3, but MBA’s survey asks servicers to report these loans as delinquent if the payment was not made based on the original terms of the mortgage – in the same manner that delinquency data is collected during natural disasters.

“Once foreclosure moratoria are lifted and forbearance periods end, borrower repayment and modification options, combined with year-over-year equity accumulation and home-price gains, may present alternatives to foreclosure for the millions of distressed homeowners affected by this unfortunate pandemic and economic crisis,” added Walsh.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. Delinquencies increased in Q1.

The increase was mostly in the 30 day bucket that increased from 2.17% in Q4 to 2.67% in Q1. There will be a huge spike in delinquencies in Q2.

The percent of loans in the foreclosure process declined further, and was at the lowest level since at least 1985.

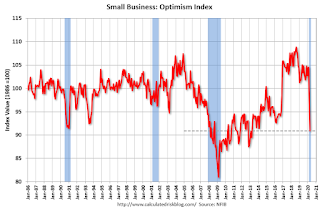

Small Business Optimism Decreased Sharply in April

by Calculated Risk on 5/12/2020 09:43:00 AM

Most of this survey is noise, but there is some information, especially on the labor market.

From the National Federation of Independent Business (NFIB): April 2020 Report

Small business optimism took another dive in April, falling 5.5 points to 90.9, with owners expressing certainty the economy will weaken in the near-term, but expecting it to improve over the next six months. The Optimism Index has fallen 13.6 points over the last two months, with nine of 10 Index components declining in April and one improving.

.

[J]ob creation plans fell eight points to a net one percent, the lowest level since December 2012.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 90.9 in April.

BLS: CPI decreased 0.8% in April, Core CPI decreased 0.4%

by Calculated Risk on 5/12/2020 08:34:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.8 percent in April on a seasonally adjusted basis, the largest monthly decline since December 2008, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 0.3 percent before seasonal adjustment.Overall inflation was below expectations in April. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

A 20.6-percent decline in the gasoline index was the largest contributor to the monthly decrease in the seasonally adjusted all items index, but the indexes for apparel, motor vehicle insurance, airline fares, and lodging away from home all fell sharply as well. In contrast, food indexes rose in April, with the index for food at home posting its largest monthly increase since February 1974. The energy index declined mostly due to the decrease in the gasoline index, though some energy component indexes rose.

The index for all items less food and energy fell 0.4 percent in April, the largest monthly decline in the history of the series, which dates to 1957. Along with the indexes mentioned above, the indexes for used cars and trucks and recreation also declined. The indexes for rent, owners’ equivalent rent, medical care, and household furnishings and operations all increased in April.

The all items index increased 0.3 percent for the 12 months ending April, the smallest 12-month increase since October 2015. The index for all items less food and energy increased 1.4 percent over the last 12 months, its smallest increase since April 2011.

emphasis added

Monday, May 11, 2020

Tuesday: CPI

by Calculated Risk on 5/11/2020 08:05:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Start Strong But End Day Higher

Mortgage rates began the day slightly lower compared to last Friday, but that didn't last long. Underlying bond markets were under pressure from the outset. When bond prices fall, rates move higher, all other things being equal.Tuesday:

The bond market has a few concerns at the moment--many of them "relative." In fact, it's hard to complain too much about mortgage rates "moving higher" when this afternoon's final destination was still in the low 3% range for top tier 30yr fixed rate quotes. [30YR FIXED 3.20%]

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for April.

• At 8:30 AM, The Consumer Price Index for April from the BLS. The consensus is for 0.7% decrease in CPI, and a 0.2% decrease in core CPI.