by Calculated Risk on 5/08/2020 08:43:00 AM

Friday, May 08, 2020

April Employment Report: 20,500,000 Jobs Lost, 14.7% Unemployment Rate

From the BLS:

Total nonfarm payroll employment fell by 20.5 million in April, and the unemployment rate rose to 14.7 percent, the U.S. Bureau of Labor Statistics reported today. The changes in these measures reflect the effects of the coronavirus (COVID-19) pandemic and efforts to contain it. Employment fell sharply in all major industry sectors, with particularly heavy job losses in leisure and hospitality.

...

The change in total nonfarm payroll employment for February was revised down by 45,000 from +275,000 to +230,000, and the change for March was revised down by 169,000 from -701,000 to -870,000. With these revisions, employment changes in February and March combined were 214,000 lower than previously reported.

emphasis added

Click on graph for larger image.

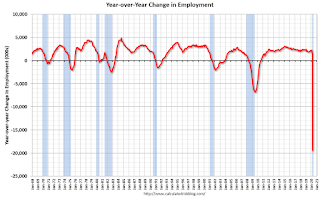

Click on graph for larger image.The first graph shows the year-over-year change in total non-farm employment since 1968.

In April, the year-over-year change was -19.420 million jobs.

Total payrolls decreased by 20.5 million in April.

Payrolls for February and March were revised down 214 thousand combined.

The second graph shows the job losses from the start of the employment recession, in percentage terms.

The second graph shows the job losses from the start of the employment recession, in percentage terms.The current employment recession is by far the worst recession since WWII in percentage terms, and the worst in terms of the unemployment rate.

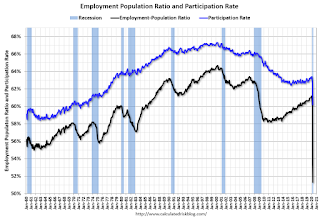

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased to 60.2% in April. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate decreased to 60.2% in April. This is the percentage of the working age population in the labor force. The Employment-Population ratio decreased to 51.3% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

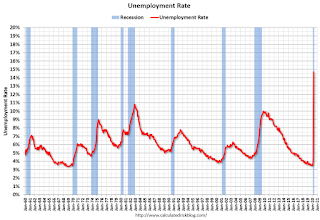

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate increased in April to 14.7%.

This was close to consensus expectations of 21,000,000 jobs lost, and February and March were revised down by 214,000 combined.

This was the worst employment report ever, and the report for May will also be horrible. I'll have much more later ...

Black Knight: Nearly 4.1 Million Homeowners Now in COVID-19-Related Forbearance Plans, 7.7% of Mortgages

by Calculated Risk on 5/08/2020 08:11:00 AM

From Black Knight: Nearly 4.1 million homeowners are in forbearance plans

• As of May 7, nearly 4.1 million homeowners are in forbearance plans, representing 7.7% of all active mortgages.

• Together, they account for $890 billion in unpaid principal and includes 6.4% of all GSE-backed loans and 11% of all FHA/VA loans.

• At today’s level, mortgage servicers need to advance a combined $4.5 billion/month to holders of government-backed mortgage securities on COVID-19-related forbearances. Another $2.1 billion in lost funds will be faced each month by those with portfolio-held or privately securitized mortgages (some 7.2% of these loans are in forbearance as well).

Thursday, May 07, 2020

Friday: Employment Report

by Calculated Risk on 5/07/2020 06:51:00 PM

Friday:

My April Employment Preview.

Goldman's April Payrolls preview.

Friday:

• At 8:30 AM ET, Employment Report for April. The consensus is for 21,000,000 jobs lost, and for the unemployment rate to increase to 16.0%.

Goldman April Payrolls Review

by Calculated Risk on 5/07/2020 05:23:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls declined by 24 million in April.

...

We estimate the unemployment rate rose from 4.4% to 14.0%.

…

In interpreting tomorrow’s report, we will pay special attention to the number and share of workers on furlough or temporary layoff.

emphasis added

May 7 Update: US COVID-19 Test Results: Progress, More Needed

by Calculated Risk on 5/07/2020 04:57:00 PM

From NPR: U.S. Coronavirus Testing Still Falls Short. How's Your State Doing?

One prominent research group, Harvard's Global Health Institute, proposes that the U.S. should be doing more than 900,000 tests per day as a country. This projection, released Thursday, is a big jump from its earlier projection of testing need, which had been between 500,000 and 600,000 daily.The US might be able to test 400,000 to 600,000 people per day sometime in May according to Dr. Fauci - and that might be enough. But the US might need even more tests according to Dr. Jha.

Harvard's testing estimate increased, says Ashish Jha, director of the Global Health Institute, because the latest modeling shows that the outbreak in the United States is worse than projected earlier.

"Just in the last few weeks, all of the models have converged on many more people getting infected and many more people [dying]," he says.

There were 318,720 test results reported over the last 24 hours (the number of tests yesterday were revised up).

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.7% (red line). The US probably needs enough tests to push the percentage positive below 5%. (probably much lower based on testing in New Zealand).

April Employment Preview

by Calculated Risk on 5/07/2020 12:48:00 PM

Important Notes:

1. Watch for Special Notes in the release. There are many questions this month (the BLS will do a great job explaining how they handled a number of issues).

2. The 2020 Decennial Census was expected to increase hiring in April. Most of this hiring has been delayed.

3. Ignore wage growth. Since many low paid employees have been let go, average wages will increase significantly. This is meaningless.

On Friday at 8:30 AM ET, the BLS will release the employment report for April. The consensus is for a decrease of 21,000,000 non-farm payroll jobs, and for the unemployment rate to increase to 16.0%.

Last month, the BLS reported 701,000 jobs lost in March and the unemployment rate at 4.4%.

The job losses in March were the eighth worst on record. The worst was after WWII. There will be a new #1 this month - and losses will be an order of magnitude worse than in Sept 1945.

| Worst Monthly Job Losses Since 1939 | ||

|---|---|---|

| Rank | Date | Jobs Lost (000s) |

| 1 | Sep-45 | -1,959 |

| 2 | Oct-49 | -838 |

| 3 | Mar-09 | -800 |

| 4 | Jan-09 | -784 |

| 5 | Feb-09 | -743 |

| 6 | Nov-08 | -727 |

| 7 | Dec-08 | -706 |

| 8 | Mar-20 | -701 |

| 9 | Apr-09 | -695 |

| 10 | Jul-56 | -631 |

Goldman Sachs economists wrote this morning: "We left our April nonfarm payroll estimate unchanged at -24,000k (mom sa) ahead of tomorrow’s report."

And Merrill Lynch economists wrote: "We forecast 22 million in nonfarm payroll losses and a massive spike in the unemployment rate to 15% from 4.4% in March."

The usual indicators are somewhat useless this month. They are signaling huge jobs losses, but we've never seen anything remotely close to the job losses that happened in April.

• Conclusion: The number of jobs lost in April will be huge. And there will be many more jobs lost in May and June. The Payroll Protection Program in the CARES act only pays for eight weeks - and then many of those employees will lose there jobs if the program isn't extended. So those will be likely job losses in June or July.

Hotels: Occupancy Rate Declined 58.5% Year-over-year, Slight Increase Week-over-week

by Calculated Risk on 5/07/2020 11:16:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 2 May

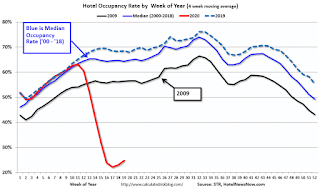

STR data for 26 April through 2 May 2020 showed slightly higher U.S. hotel occupancy compared with previous weeks, but the same significant level of year-over-year decline in the three key performance metrics.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 28 April through 4 May 2019, the industry recorded the following:

• Occupancy: -58.5% to 28.6%

• Average daily rate (ADR): -44.0% to US$74.72

• Revenue per available room (RevPAR): -76.8% to US$21.39

“Week-to-week comparisons showed a third consecutive increase in room demand, which provides further hope that early-April was the performance bottom,” said Jan Freitag, STR’s senior VP of lodging insights. “TSA checkpoint numbers, up for the second week in a row, aligned with this rise in hotel guest activity, which still remains incredibly low in the big picture. Overall, these last few weeks can be filed under the ‘less bad’ category.

“At the same time, this past week was the first to show solid evidence of leisure demand as weekend occupancy grew in states that have significantly eased mitigation efforts. As we have noted throughout the pandemic, the leisure segment will be the first to show a demand bounce back. In weeks prior, the more reasonable conclusion was that hotels were selling mostly to essential worker types.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

2020 was off to a solid start, however, COVID-19 has crushed hotel occupancy.

Note: Y-axis doesn't start at zero to better show the seasonal change.

Seattle Real Estate in April: Sales down 25% YoY, Inventory down 31% YoY

by Calculated Risk on 5/07/2020 10:01:00 AM

The Northwest Multiple Listing Service reported Western Washington housing market adjusting to new ways of operating

Residential real estate activity around Western Washington reflected expected declines during April with the impact of the coronavirus pandemic taking its toll. A new report from Northwest Multiple Listing Service shows year-over-year (YOY) drops system-wide in new listings, pending sales and closed sales, but prices increased nearly 6.4%.There were 5,866 sales in April 2020, down from 7,578 sales in April 2019.

“With the first full month of post-COVID-19 data in hand, it’s clear the Puget Sound housing market has been hit but not knocked out,” stated Windermere Chief Economist Matthew Gardener. “The normally active spring market is significantly slower than normal due to COVID-19, but it has not come to a halt,” he observed, adding, “In my opinion, it is responding to the current circumstances exactly as expected.”

…

The Northwest MLS report for April shows area-wide inventory fell nearly 21% from a year ago, dropping from 12,955 listings to 10,282.

emphasis added

The press release is for the Northwest. In King County, sales were down 22.6% year-over-year, and active inventory was down 20.6% year-over-year.

In Seattle, sales were down 25.3% year-over-year, and inventory was down 30.8% year-over-year.. This puts the months-of-supply in Seattle at just 1.7 months.

The closed sales are for contracts mostly signed in February and March. There will be a significant decline in sales in coming months.

Weekly Initial Unemployment Claims decrease to 3,169,000

by Calculated Risk on 5/07/2020 08:35:00 AM

The DOL reported:

In the week ending May 2, the advance figure for seasonally adjusted initial claims was 3,169,000, a decrease of 677,000 from the previous week's revised level. The previous week's level was revised up by 7,000 from 3,839,000 to 3,846,000. The 4-week moving average was 4,173,500, a decrease of 861,500 from the previous week's revised average. The previous week's average was revised up by 1,750 from 5,033,250 to 5,035,000.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 4,173,500.

This was lower than the consensus forecast.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week while increasing sharply).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims have already increased to a new record high of 22.647 million (SA) and will increase further over the next few weeks - and likely stay at that high level until the crisis abates.

Wednesday, May 06, 2020

Thursday: Unemployment Claims

by Calculated Risk on 5/06/2020 08:42:00 PM

There are still a large number of layoffs every week.

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 3.300 million initial claims, down from 3.839 million the previous week.

• At 3:00 PM, Consumer Credit from the Federal Reserve.