by Calculated Risk on 5/06/2020 07:00:00 AM

Wednesday, May 06, 2020

MBA: Mortgage Applications Increased Slightly, Purchase Applications up 6% Week over Week

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 1, 2020.

... The Refinance Index decreased 2 percent from the previous week and was 210 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 6 percent from one week earlier. The unadjusted Purchase Index increased 7 percent compared with the previous week and was 19 percent lower than the same week one year ago.

...

“Mortgage application volume was unchanged last week, even as the 30-year fixed rate mortgage declined to 3.40 percent – a new record in MBA’s survey,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Despite lower rates, refinance applications dropped, as many lenders are offering higher rates for refinances than for purchase loans, and others are suspending the availability of cash-out refinance loans because of their inability to sell them to Fannie Mae and Freddie Mac.”

Added Fratantoni, “Purchase volume increased for the third week in a row, led by strong growth in Arizona, Texas and California. Although purchase activity remains almost 19 percent below year-ago levels, this annualized deficit has decreased as more states reopen amidst the apparent, pent-up demand for homebuying.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.40 percent from 3.43 percent, with points decreasing to 0.30 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But the index is way up from last year (over triple last year).

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is down 19% year-over-year.

Purchase activity has fallen sharply, but was up 6% week over week.

Note: Red is a four-week average (blue is weekly).

Tuesday, May 05, 2020

Wednesday: ADP Employment

by Calculated Risk on 5/05/2020 08:04:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 20,000,000 payroll jobs lost in April, down from 27,000 lost in March.

May 5 Update: US COVID-19 Test Results: Progress on Percent Positive

by Calculated Risk on 5/05/2020 05:05:00 PM

The US might be able to test 400,000 to 600,000 people per day sometime in May according to Dr. Fauci - and that would probably be sufficient for test and trace.

There were 259,150 test results reported over the last 24 hours (the number of tests yesterday were revised up).

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.6% (red line). The US probably needs enough tests to push the percentage positive below 5%. (probably much lower based on testing in New Zealand).

Las Vegas: "Effectively empty for the second half of March"

by Calculated Risk on 5/05/2020 03:03:00 PM

From the Las Vegas Visitor Authority: March 2020 Las Vegas Visitor Statistics

Reflecting the impacts of travel restrictions imposed in the middle of March in response to the Covid-19 pandemic, all key indicators saw dramatic YoY reductions.Here is the data from the Las Vegas Convention and Visitors Authority.

Las Vegas hosted an estimated 1.5 million visitors (-58.6%) during the month as the destination was effectively empty for the second half of the month. Likewise, convention attendance saw a YoY decrease of -54.8%.

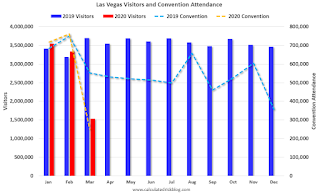

Click on graph for larger image.

Click on graph for larger image. The blue and red bars are monthly visitor traffic (left scale) for 2019 and 2020. The dashed blue and orange lines are convention attendance (right scale).

Convention traffic in March as down 54.8% compared to March 2019. And visitor traffic was down 58.6% YoY.

The numbers for April will be much worse.

ISM Non-Manufacturing Index decreased to 41.8% in April

by Calculated Risk on 5/05/2020 10:18:00 AM

The April ISM Non-manufacturing index was at 41.8%, down from 52.5% in March. The employment index decreased to 30.0%, from 47.0%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: April 2020 Non-Manufacturing ISM Report On Business®

conomic activity in the non-manufacturing sector contracted in April for the first time since December 2009, ending a 122-month period of growth, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.The headline index understated the weakness in the survey. The Supplier Deliveries index boosted the composite NMI, while other indexes hit record lows.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: "The NMI® registered 41.8 percent, 10.7 percentage points lower than the March reading of 52.5 percent. This reading represents contraction in the non-manufacturing sector and is the NMI®'s lowest since March 2009 (40.1 percent). The Business Activity Index fell 22 percentage points from March's figure, registering 26 percent — the lowest reading for that index since the debut of the Non-Manufacturing ISM® Report On Business® in 1997. The New Orders Index registered 32.9 percent, 20 percentage points below the reading of 52.9 percent in March. The Employment Index decreased to 30 percent, 17 percentage points below the March reading of 47 percent.

"The Supplier Deliveries Index registered an all-time high of 78.3 percent, up 16.2 percentage points from the March reading of 62.1 percent, which limited the decrease in the composite NMI®. The Supplier Deliveries Index is one of four equally weighted subindexes that directly factor into the NMI®, along with Business Activity, New Orders and Employment. Supplier Deliveries is the only ISM® Report On Business® index that is inversed; a reading of above 50 percent indicates slower deliveries, which is typical as the economy improves and customer demand increases. However, the combined 25.9-percentage point increase in March and April was primarily a product of supply problems related to the coronavirus (COVID-19) pandemic.

emphasis added

CoreLogic: House Prices up 4.5% Year-over-year in March

by Calculated Risk on 5/05/2020 08:55:00 AM

Notes: This CoreLogic House Price Index report is for March. The recent Case-Shiller index release was for February. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports March Home Prices Increased by 4.5% Year Over Year

CoreLogic® ... oday released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for March 2020. Home prices increased nationally by 4.5% from March 2019. On a month-over-month basis, prices increased by 1.3% in March 2020. CoreLogic HPI Forecast indicates annual price growth of 0.5% from March 2020 to March 2021, with a month-over-month increase of 0.6% between March and April 2020.

Increased homes sales in January and February 2020 accounts for the sustained acceleration of home prices seen in the March HPI. CoreLogic continues to monitor shifts in the housing market and economy in light of COVID-19, and, in the coming weeks, homebuying activity will likely continue to be tempered by unemployment and recommended ongoing social distancing practices. We can expect to see home price growth slow drastically in response to this declining demand, with the HPI Forecast predicting less than 1% annual increase in home prices by March 2021.

“Home prices for March reflect transactions negotiated primarily in the previous two months, prior to the implementation of the shelter-in-place policies. Rapid decline of purchase activity starting in the middle of March can be seen in other CoreLogic data and is consistent with our HPI forecast of slowing price growth in April,” said Dr. Frank Nothaft, chief economist at CoreLogic. “The first quarter GDP results showed that the country entered a recession in March. Unemployment claims have reached record highs and this economic environment will further impact the housing market into the foreseeable future.”

...

“The CoreLogic U.S. Home Price Index is predicted to remain largely unchanged over the next year or so after a long uninterrupted run of appreciation,” said Frank Martell, president and CEO of CoreLogic. “Although the economic fallout from lockdown orders, put in place to fight the spread of COVID-19, will be profound, the basic supports for a rebound in home purchase activity remain in place. Once the shelter-in-place policies are lifted, we expect millennials, who submitted home-purchase applications well into the crisis, to lead the way back to a positive, purchase-driven housing cycle.”

emphasis added

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph from CoreLogic shows the YoY change in the index - and the CoreLogic forecast.

CR Note: The impact of COVID-19 on house prices will probably not show up for several months. The report next month will be for April, and that is mostly for contracts signed in February and March. The overall impact on house prices will depend on the duration of the crisis.

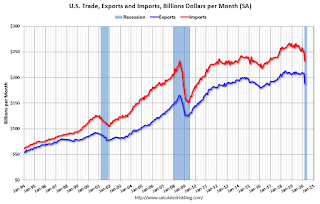

Trade Deficit increased to $44.4 Billion in March

by Calculated Risk on 5/05/2020 08:42:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $44.4 billion in March, up $4.6 billion from $39.8 billion in February, revised.

March exports were $187.7 billion, $20.0 billion less than February exports. March imports were $232.2 billion, $15.4 billion less than February imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports and imports decreased in March.

Exports are down 11% compared to March 2019; imports are down 12% compared to March 2019.

Both imports and exports have decreased sharply due to COVID-19.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that the U.S. exported a slight net positive petroleum products in recent months.

Oil imports averaged $47.09 per barrel in March, down from $57.24 in February, and down from $60.17 in March 2019.

The trade deficit with China decreased to $11.8 billion in March, from $20.7 billion in March 2019.

Monday, May 04, 2020

Tuesday: Trade Deficit, ISM non-Mfg Index

by Calculated Risk on 5/04/2020 07:48:00 PM

CR Note: The ISM non-manufacturing index is for April and will show a large decline.

Tuesday:

• At 8:30 AM, Trade Balance report for March from the Census Bureau. The consensus is the trade deficit to be $44.2 billion. The U.S. trade deficit was at $39.9 Billion in February.

• At 10:00 AM, the ISM non-Manufacturing Index for April. The consensus is for a reading of 44.0, down from 52.5.

• At 10:00 AM, Corelogic House Price index for March.

May 4 Update: US COVID-19 Test Results

by Calculated Risk on 5/04/2020 04:56:00 PM

The US might be able to test 400,000 to 600,000 people per day sometime in May according to Dr. Fauci - and that would probably be sufficient for test and trace.

There were 231,812 test results reported over the last 24 hours (the number of tests yesterday were revised up).

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 9.2% (red line). The US probably needs enough tests to push the percentage positive below 5%. (probably much lower based on testing in New Zealand).

MBA Survey: "Share of Mortgage Loans in Forbearance Increases to 7.54%" of Portfolio Volume

by Calculated Risk on 5/04/2020 04:00:00 PM

Note: To put these numbers in perspective, the MBA notes "For the week of March 2, only 0.25% of all loans were in forbearance."

From the MBA: Share of Mortgage Loans in Forbearance Increases to 7.54%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance increased from 6.99% of servicers’ portfolio volume in the prior week to 7.54% as of April 26, 2020. According to MBA’s estimate, a total of 3.80 million homeowners are now in forbearance plans.

...

“The share of loans in forbearance increased once again in the last full week of April, but the pace of new requests slowed,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “With millions more Americans filing for unemployment over the week, the level of job market distress continues to worsen. That is why we expect that the share of loans in forbearance will continue to grow, particularly as new mortgage payments come due in May.”

Added Fratantoni, “As states across the country begin to re-open their economies, a silver lining we are seeing is indications of increased activity in the housing market, including more purchase applications in some markets. We are hopeful that the housing market can eventually contribute to a broader rebound in economic activity, which would then begin to reverse the unprecedented job losses experienced during this crisis.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly forbearance requests as a percent of servicer's portfolio volume.

The requests peaked in the week of March 30th to April 5th, but might pick up again when May payments are due.

The MBA notes: "Forbearance requests as a percent of servicing portfolio volume (#) dropped across all investor types for the third consecutive week relative to the prior week: from 1.14% to 0.63%."