by Calculated Risk on 4/30/2020 04:10:00 PM

Thursday, April 30, 2020

Fannie Mae: Mortgage Serious Delinquency Rate Increased Slightly in March

Fannie Mae reported that the Single-Family Serious Delinquency increased to 0.66% in March, from 0.65% in February. The serious delinquency rate is down from 0.74% in March 2019.

IMPORTANT: These are mortgage loans that are "three monthly payments or more past due or in foreclosure". So it will take three months for the impact of COVID-19 to show up in this series.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (2% of portfolio), 2.48% are seriously delinquent. For loans made in 2005 through 2008 (3% of portfolio), 4.11% are seriously delinquent, For recent loans, originated in 2009 through 2018 (95% of portfolio), only 0.35% are seriously delinquent. So Fannie is still working through a few poor performing loans from the bubble years.

I expect the serious delinquency rate will increase in a few months due to COVID-19.

Note: Freddie Mac reported earlier.

Hotels: Occupancy Rate Declined 62.2% Year-over-year

by Calculated Risk on 4/30/2020 01:32:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 25 April

Reflecting the continued impact of the COVID-19 pandemic, the U.S. hotel industry reported significant year-over-year declines in the three key performance metrics during the week of 19-25 April 2020, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 21-27 April 2019, the industry recorded the following:

• Occupancy: -62.2% to 26.0%

• Average daily rate (ADR): -42.9% to US$73.61

• Revenue per available room (RevPAR): -78.4% to US$19.13

Year-over-year declines were less steep than previous weeks due to a comparison with the time of Passover in 2019. Additionally, absolute occupancy rose slightly from the levels of the previous two weeks (23.4% and 21.0%).

“Demand has grown slightly across the country during the last two weeks, which could provide some hope that the levels seen in early April were indeed the bottom—especially with some states now moving to ease social distancing guidance,” said Jan Freitag, STR’s senior VP of lodging insights. “The 1.4 million additional room nights sold the last two weeks only represent around 100,000 new rooms occupied per night, but gains even that small are certainly better than further declines.

“Five states—California, Texas, New York, Florida and Georgia—represent 40% of that demand gain from the last two weeks. The list of hotel demand generators is long, but in general, it is not unreasonable to assume that part of the increased business is coming from essential workers, homeless housing initiatives and government-contracted guests.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

2020 was off to a solid start, however, COVID-19 has crushed hotel occupancy.

Note: Y-axis doesn't start at zero to better show the seasonal change.

Zillow Case-Shiller March Forecast: Still Showing Increasing YoY Price Gains, Mostly Pre-Crisis

by Calculated Risk on 4/30/2020 12:09:00 PM

The Case-Shiller house price indexes for February were released Tuesday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: February Case-Shiller Results & March Forecast: Last Look at The World that Was

the Case-Shiller home price index for February – the last before the data begin to show effects of the coronavirus outbreak – offers a final look at a housing market that was primed for a stellar spring selling season. ...

Things were looking up for the housing market in mid-winter, with low interest rates and still-secure job prospects combining to boost demand for housing just as a growing share of millennials were looking to finally take the leap into home ownership. Teamed with record-low levels of for-sale inventory, these demand factors had begun to push home prices upward after the growth rate spent most of 2019 decelerating. The economic carnage that’s occurred since, particularly in the labor markets, has been well documented and the true impact on home prices remains to be seen.

emphasis added

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 4.4% in March, up from 4.2% in February.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 4.4% in March, up from 4.2% in February. The Zillow forecast is for the 20-City index to be up 3.8% YoY in March from 3.5% in February, and for the 10-City index to increase to 3.3% YoY compared to 2.9% YoY in February.

Note that Case-Shiller is a three month average, so the March data will include both January and February. Also, Case-Shiller uses closed transactions, and most of the transactions that closed in March were signed in January and February - so the March price indexes will still be mostly pre-crisis data.

Q1 2020 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 4/30/2020 10:26:00 AM

The BEA has released the underlying details for the Q1 initial GDP report this morning.

The BEA reported that investment in non-residential structures decreased at a 9.7% annual pace in Q1.

Investment in petroleum and natural gas exploration decreased in Q1 compared to Q4, and was down 24% year-over-year. This will probably collapse in Q2.

The first graph shows investment in offices, malls and lodging as a percent of GDP.

Investment in offices decreased in Q1, but was only down slightly year-over-year.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was down about 27% year-over-year in Q1 - and at a record low as a percent of GDP. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment decreased in Q1, and lodging investment was down 8% year-over-year.

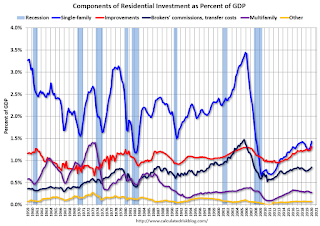

Usually single family investment is the top category, although home improvement was the top category for five consecutive years following the housing bust. Then investment in single family structures was back on top, however it is close between single family and home improvement.

Even though investment in single family structures has increased from the bottom, single family investment is still low, and still below the bottom for previous recessions as a percent of GDP. I expect some further increases - once the healthcare crisis abates.

Investment in single family structures was $308 billion (SAAR) (about 1.4% of GDP)..

Investment in multi-family structures decreased in Q1.

Investment in home improvement was at a $283 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (about 1.3% of GDP). Home improvement spending has been solid and might hold up during the pandemic.

Personal Income decreased 2.0% in March, Spending decreased 7.5%

by Calculated Risk on 4/30/2020 09:24:00 AM

The BEA released the Personal Income and Outlays report for March:

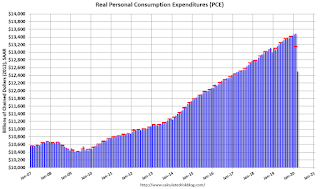

Personal income decreased $382.1 billion (2.0 percent) in March according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) decreased $334.6 billion (2.0 percent) and personal consumption expenditures (PCE) decreased $1,127.3 billion (7.5 percent).The March PCE price index increased 1.3 percent year-over-year and the March PCE price index, excluding food and energy, increased 1.7 percent year-over-year.

Real DPI decreased 1.7 percent in March and Real PCE decreased 7.3 percent. The PCE price index decreased 0.3 percent. Excluding food and energy, the PCE price index decreased 0.1 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through March 2020 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The change in personal income and the change in PCE were below expectations.

PCE collapsed in March, and will collapse further in April.

Weekly Initial Unemployment Claims decrease to 3,839,000

by Calculated Risk on 4/30/2020 08:35:00 AM

The DOL reported:

In the week ending April 25, the advance figure for seasonally adjusted initial claims was 3,839,000, a decrease of 603,000 from the previous week's revised level. The previous week's level was revised up by 15,000 from 4,427,000 to 4,442,000. The 4-week moving average was 5,033,250, a decrease of 757,000 from the previous week's revised average. The previous week's average was revised up by 3,750 from 5,786,500 to 5,790,250.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 5,033,250.

This was lower than the consensus forecast.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week while increasing sharply).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims have already increased to a new record high of 17.992 million (SA) and will increase further over the next few weeks - and likely stay at that high level until the crisis abates.

Wednesday, April 29, 2020

Thursday: Unemployment Claims, Personal Income and Outlays, Chicago PMI

by Calculated Risk on 4/29/2020 09:15:00 PM

Merrill: "We expect initial jobless claims of 4.1mn for the week ending April 25, revising up from our preliminary forecast of 3.5mn."

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a 3.500 million initial claims, down from 4.427 million the previous week.

• Also at 8:30 AM ET, Personal Income and Outlays, March 2020. The consensus is for a 1.4% decrease in personal income, and for a 5.0% decrease in personal spending. And for the Core PCE price index to decrease 0.1%.

• At 9:45 AM, Chicago Purchasing Managers Index for April.

April 29 Update: US COVID-19 Test Results

by Calculated Risk on 4/29/2020 05:18:00 PM

Recommended article by Ed Yong in the Atlantic: Why the Coronavirus Is So Confusing

The US might be able to test 400,000 to 600,000 people per day in several weeks according to Dr. Fauci - and that would probably be sufficient for test and trace.

There were 230,442 test results reported over the last 24 hours (the number of tests yesterday were revised up).

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 12.0% (red line). The US probably needs enough tests to push the percentage positive below 5%. (probably much lower based on testing in New Zealand).

FOMC Statement: "committed to using its full range of tools to support the U.S. economy in this challenging time"

by Calculated Risk on 4/29/2020 02:01:00 PM

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

The coronavirus outbreak is causing tremendous human and economic hardship across the United States and around the world. The virus and the measures taken to protect public health are inducing sharp declines in economic activity and a surge in job losses. Weaker demand and significantly lower oil prices are holding down consumer price inflation. The disruptions to economic activity here and abroad have significantly affected financial conditions and have impaired the flow of credit to U.S. households and businesses.

The ongoing public health crisis will weigh heavily on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term. In light of these developments, the Committee decided to maintain the target range for the federal funds rate at 0 to 1/4 percent. The Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.

The Committee will continue to monitor the implications of incoming information for the economic outlook, including information related to public health, as well as global developments and muted inflation pressures, and will use its tools and act as appropriate to support the economy. In determining the timing and size of future adjustments to the stance of monetary policy, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

To support the flow of credit to households and businesses, the Federal Reserve will continue to purchase Treasury securities and agency residential and commercial mortgage-backed securities in the amounts needed to support smooth market functioning, thereby fostering effective transmission of monetary policy to broader financial conditions. In addition, the Open Market Desk will continue to offer large-scale overnight and term repurchase agreement operations. The Committee will closely monitor market conditions and is prepared to adjust its plans as appropriate.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Patrick Harker; Robert S. Kaplan; Neel Kashkari; Loretta J. Mester; and Randal K. Quarles.

emphasis added

Q1 GDP: Investment

by Calculated Risk on 4/29/2020 11:55:00 AM

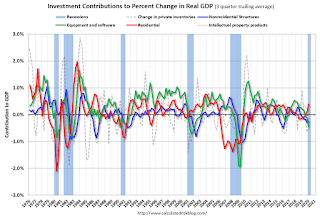

Investment has been weak for some time, and most investment categories were even weaker in Q1 due to COVID-19. However residential investment was very strong in Q1 (increased at 21.0% annual rate in Q1).

The first graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

Of course - with the sudden economic stop due to COVID-19 - the usual pattern doesn't apply.

The dashed gray line is the contribution from the change in private inventories.

Residential investment (RI) increased in Q1 (21.0% annual rate in Q1). Equipment investment decreased at a 15.2% annual rate, and investment in non-residential structures decreased at a 9.7% annual rate.

On a 3 quarter trailing average basis, RI (red) is up solidly, equipment (green) is negative, and nonresidential structures (blue) is also down.

I'll post more on the components of non-residential investment once the supplemental data is released.

Residential Investment as a percent of GDP increased in Q1. RI as a percent of GDP is close to the bottom of the previous recessions - and prior to the pandemic, I expected RI to continue to increase further in this cycle.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.