by Calculated Risk on 4/24/2020 12:59:00 PM

Friday, April 24, 2020

Lawler: Zillow on Trends in Pending Sales

Housing economist Tom Lawler sent me the following:

From Jeff Tucker at Zillow Economic Research Early Data Point to Slight Housing Turnaround After Initial Coronavirus Pullback (March 2020 Market Report)

“Zillow Economic Research is piloting three new daily metrics — daily new active listings, daily new pending listings and daily median list price — in an effort to bolster our usual monthly data and provide more timely signals about the housing market during this unprecedented health and economic crisis.”The charts Zillow shows do not show levels, but show year-over-year % changes. While the data are daily, it would appear as if each data point reflects a “rolling week,” or rolling 7-day average.

The definition of pending sales is “(t)he number of listings on Zillow that switch from active to pending status each day,” I’m not positive, but I do not believe this definition will reflect cancellations.

Assuming the data reflect rolling 7-day averages, here are some data from the chart on pending sales.

| Week Ending: | YOY % Change in Pending Sales (Zillow) |

|---|---|

| 4/19/20 | -32% |

| 4/12/20 | -37% |

| 4/5/20 | -34% |

| 3/29/20 | -23% |

| 3/22/20 | -1% |

| 3/15/20 | 17% |

| 3/8/20 | 18% |

| 3/1/20 | 26% |

Lawler: Excerpts from PulteGroup’s Conference Call

by Calculated Risk on 4/24/2020 11:23:00 AM

From housing economist Tom Lawler:

The edited transcript from the conference call is available here.

“In the first quarter, net new orders were up more than 30% over the prior year for both January and February. It's now old news when I say that, with the virus spreading rapidly and governments implementing shelter-in-place restrictions, homebuying demand slowed dramatically as March progressed. To appreciate the magnitude of the slowdown, in the first full week of March, our net new orders exceeded 800 homes. In the final full week, this number dropped to just 140. As a result, our March 2020 orders in total were down 11% from March of 2019. From orders being up 30-plus percent to being down 11% in just a few weeks is unlike anything we have experienced before.”

“Given how the U.S. economic slowdown intensified as we moved into April, it is no the month, we have sold approximately 920 homes on a gross basis, excluding cancellations. The underlying trend is that buyer traffic to our website, and in turn, our communities has decreased materially. This is obviously a very small sample size, but directionally, we are running a little below 50% of the pace in the first quarter, with the most recent trends generally stable to up slightly.”

“Through the first 3 weeks of April, we've had 360 backlog units canceled, which represents only 3% of homes in backlog.”

Note that if PuleGroup’s gross orders were 920 in the first 3 weeks of April, and cancellations were 360 in the first 3 weeks of April, net orders in the first three weeks of April were just 560, or more than 30% lower than net orders in just the first week of March alone!

While the company didn’t give further information about the weekly pattern of orders or cancellations, it would appear as if net orders in April could be down by about 65% from the monthly average pace of the first quarter.

University of Michigan: Consumer Sentiment at 71.8, Down from 89.1 in March

by Calculated Risk on 4/24/2020 10:02:00 AM

From the University of Michigan: Preliminary Results for April 2020

April's final Sentiment Index reading remained largely unchanged from the mid-month figure (+0.8 points), and households with below median incomes expressed the same level of confidence as those with above median incomes (71.9). This merging reflects somewhat larger April declines among households with above median incomes (-19.8 points) compared with those with below median incomes (-14.0). The seven-day moving average of the Index of Consumer Sentiment indicated a second larger improvement that was quickly reversed (see the featured chart); its cause could not be linked to any direct judgements about the coronavirus. The notable divergence between the two main components of the Sentiment Index remained large. The Current Conditions Index fell by 29.4 points in the past month and by 40.5 points in the past two months, whereas the Expectations Index has posted smaller declines of 9.6 points in the past month and 22.0 points from February. While the decline in both indices indicates an ongoing recession, the gap reflects the anticipated cyclical nature of the coronavirus.

emphasis added

Black Knight: More than 3.4 Million Homeowners Now in COVID-19-Related Forbearance Plans

by Calculated Risk on 4/24/2020 08:34:00 AM

From Black Knight: More than 3.4 Million Homeowners – 6.4% of All Mortgages – Now in COVID-19-Related Forbearance Plans According to Black Knight’s McDash Flash Data Set

• The McDash Flash suite from Black Knight leverages daily, loan-level data to provide market participants with the most current view of the forbearance and mortgage performance landscape

• According to the McDash Flash Forbearance Tracker, as of April 23, 2020, more than 3.4 million homeowners – or 6.4% of all mortgages – have entered into COVID-19 mortgage forbearance plans

• This population represents $754 billion in unpaid principal and includes 5.6% of all GSE-backed loans and 8.9% of all FHA/VA loans

• At today’s level, mortgage servicers are bound to advance $2.8 billion of principal and interest payments per month to holders of government-backed securities on COVID-19-related forbearances

• Another $1.3 billion per month in lost funds is faced by those with portfolio-held or privately-securitized mortgages

• Given FHFA’s recently announced four-month limit on advance obligations, servicers of GSE-backed mortgages could still face more than $7 billion in advances based on the number of forbearance plans thus far

Thursday, April 23, 2020

Friday: Durable Goods, Consumer Sentiment

by Calculated Risk on 4/23/2020 08:08:00 PM

Friday:

• At 8:30 AM ET, Durable Goods Orders for March from the Census Bureau. The consensus is for a 6.0% decrease in durable goods orders.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for April). The consensus is for a reading of 70.0.

April 23 Update: US COVID-19 Test Results

by Calculated Risk on 4/23/2020 05:05:00 PM

NOTE: California reported over 165,000 tests yesterday. Perhaps they were clearing a backlog, but a majority of the tests were negative - pushing down the percent positive rate. I'd take yerserday's numbers with a grain of salt.

Test-and-trace is a key criterion in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: The Financial Times reports that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

This is just test results reported daily.

There were 193,479 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 17% (red line). The US probably needs enough tests to push the percentage below 5% (probably much lower based on testing in New Zealand).

All experts agree: We need many more tests!

Black Knight: National Mortgage Delinquency Rate Increased in March, First Increase in March Ever

by Calculated Risk on 4/23/2020 02:29:00 PM

Note: Loans in forbearance will be counted as delinquent in this survey, so the delinquency rate will jump in April (see Black Knight's on this below)

From Black Knight: Black Knight’s First Look: Mortgage Delinquencies See First-Ever March Increase from Early COVID-19 Impact; Foreclosures, Serious Delinquencies Hit Record Lows

• In what’s typically the strongest month of the year for mortgage performance, delinquencies rose by 3.33%, the first March increase since the turn of the century, an early sign of COVID-19’s impact on the marketAccording to Black Knight's First Look report for March, the percent of loans delinquent increased 3.3% in March compared to February, and decreased 7.3% year-over-year.

• Both the national foreclosure and 90-day delinquency rates set new record lows in March, a lingering reminder of the strength of the mortgage market heading into the pandemic

• At just 27,600 for the month, foreclosure starts also fell to their lowest level on record, as COVID-19-related moratoriums began to impact foreclosure inflows

• Prepayment activity jumped by nearly 40% in March, driven by record-low 30-year mortgage rates

• Note: For the purposes of this report going forward, the millions of homeowners who have since entered into forbearance will be counted as past due, but should not be reported as such to the credit bureaus by their servicers

emphasis added

The percent of loans in the foreclosure process decreased 7.7% in March and were down 18.0% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.39% in March, up from 3.28% in February.

The percent of loans in the foreclosure process decreased in March to 0.42% from 0.45% in February.

The number of delinquent properties, but not in foreclosure, is down 111,000 properties year-over-year, and the number of properties in the foreclosure process is down 44,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Mar 2020 | Feb 2020 | Mar 2019 | Mar 2018 | |

| Delinquent | 3.39% | 3.28% | 3.65% | 3.73% |

| In Foreclosure | 0.42% | 0.45% | 0.51% | 0.63% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,792,000 | 1,737,000 | 1,903,000 | 1,191,000 |

| Number of properties in foreclosure pre-sale inventory: | 220,000 | 239,000 | 264,000 | 321,000 |

| Total Properties | 2,013,000 | 1,976,000 | 2,167,000 | 2,232,000 |

A few Comments on March New Home Sales

by Calculated Risk on 4/23/2020 12:28:00 PM

New home sales for March were reported at 627,000 on a seasonally adjusted annual rate basis (SAAR). Sales for the previous three months were revised down.

New home sales are counted when contracts are signed, so the impact of COVID-19 was probably in the second half of March. I expect sales will decline significantly in the April New Home sales report (to be released in May).

Earlier: New Home Sales Decrease to 627,000 Annual Rate in March.

This graph shows new home sales for 2019 and 2020 by month (Seasonally Adjusted Annual Rate).

New home sales were down 9.5% year-over-year (YoY) in March. Year-to-date (YTD) sales are still up 6.7%, but sales will be down YTD soon.

The comparisons are easy over the first five months of the year, but sales will probably be down YoY for the next several months - at least - due to COVID-19.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

Now the gap is mostly closed. However, this assumes that the builders will offer some smaller, less expensive homes.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Over the next several months, both new and existing home sales will be negatively impacted by COVID-19.

Kansas City Fed: "Tenth District Manufacturing Activity Decreased Further" in April, Lowest Reading on Record

by Calculated Risk on 4/23/2020 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Decreased Further

Tenth District manufacturing activity decreased further to the lowest reading in survey history (since 1994), while expectations for future activity improved but remained slightly negative. Month-over-month price indexes declined again in April, but District firms expected prices to rise slightly in the next six months.All of the regional surveys for April have been very weak.

The month-over-month composite index was -30 in April, the lowest composite reading in survey history, and down considerably from -17 in March and 5 in February. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The decrease in district manufacturing activity was steepest at durable goods factories such as primary and fabricated metals, and activity at non-durable goods plants including food and beverage manufacturing declined as well. All month-over-month indexes dropped further in April except for supplier delivery time which continued to increase. Year-over-year factory indexes also decreased again in April, and the composite index fell from -14 to -30. The future composite index improved from -19 April, but remained slightly negative at -6.

emphasis added

New Home Sales Decrease to 627,000 Annual Rate in March

by Calculated Risk on 4/23/2020 10:14:00 AM

The Census Bureau reports New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 627 thousand.

The previous three months were revised down.

Sales of new single‐family houses in March 2020 were at a seasonally adjusted annual rate of 627,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 15.4 percent below the revised February rate of 741,000 and is 9.5 percent below the March 2019 estimate of 693,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are just at a normal level.

The second graph shows New Home Months of Supply.

The months of supply increased in March to 6.4 months from 5.2 months in February.

The months of supply increased in March to 6.4 months from 5.2 months in February. The all time record was 12.1 months of supply in January 2009.

This is slightly above the normal range (less than 6 months supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of March was 333,000. This represents a supply of 6.4 months at the current sales rate."

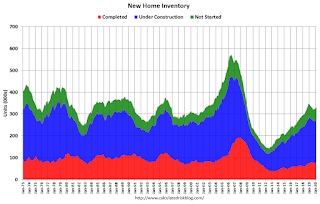

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is close to normal.

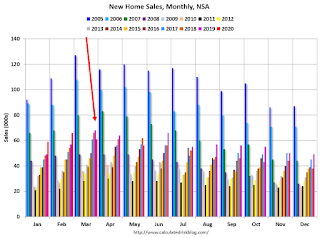

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In March 2020 (red column), 61 thousand new homes were sold (NSA). Last year, 68 thousand homes were sold in March.

The all time high for March was 127 thousand in 2005, and the all time low for March was 28 thousand in 2011.

This was below expectations of 645 thousand sales SAAR, and sales in the three previous months were revised down. I'll have more later today.

The sales in March were only partially impacted by COVID-19 crisis. Sales in April will probably be much lower.